“Secure Your Future: Top Life Insurance Picks for Millennials in 2025”

Top 5 Life Insurance Companies for Millennials in 2025

When selecting a life insurance provider, millennials must consider factors such as affordability, flexibility, and digital accessibility. As this generation navigates major life milestones, including homeownership, marriage, and parenthood, securing the right life insurance policy becomes increasingly important. In 2025, several companies stand out for their ability to meet the unique needs of millennials, offering competitive rates, user-friendly platforms, and customizable coverage options.

One of the top choices for millennials is Haven Life, a company known for its seamless online experience and affordable term life insurance policies. Backed by MassMutual, Haven Life provides a straightforward application process that allows applicants to receive coverage decisions in minutes. Many millennials appreciate the ability to apply entirely online without the need for a medical exam in some cases. Additionally, Haven Life offers a range of term lengths and coverage amounts, making it easy for policyholders to tailor their plans to their specific financial goals.

Another leading provider is Bestow, which has gained popularity for its fully digital approach to life insurance. Bestow eliminates the need for medical exams, making it an attractive option for young adults seeking a hassle-free application process. With policies underwritten by North American Company for Life and Health Insurance, Bestow offers term life insurance with flexible coverage options. The company’s emphasis on technology and efficiency aligns well with the preferences of millennials who value convenience and speed when making financial decisions.

For those looking for a more traditional yet highly reputable insurer, Northwestern Mutual remains a strong contender. While the company is known for its whole life insurance policies, it also offers competitive term life options that appeal to younger individuals. Northwestern Mutual provides personalized financial planning services, allowing millennials to integrate life insurance into their broader financial strategies. With a strong track record of financial stability and customer satisfaction, this insurer is an excellent choice for those who prioritize long-term security and expert guidance.

Similarly, Prudential continues to be a top choice for millennials due to its diverse range of policy options and flexible underwriting process. Unlike some insurers that rely solely on digital applications, Prudential offers both online and in-person support, catering to individuals who prefer a hybrid approach. The company provides term and permanent life insurance policies, allowing policyholders to transition from one type of coverage to another as their needs evolve. Additionally, Prudential’s wellness programs and policy discounts for healthy lifestyles make it an appealing option for health-conscious millennials.

Finally, Ladder stands out as an innovative life insurance provider that offers a unique approach to coverage adjustments. Millennials often experience significant life changes, such as career advancements, growing families, and new financial responsibilities. Ladder allows policyholders to increase or decrease their coverage as needed, ensuring that they only pay for the protection they require. The company’s online platform simplifies the application process, and its competitive pricing makes it an attractive option for budget-conscious individuals.

As millennials continue to prioritize financial security and digital convenience, these five life insurance companies provide the best options in 2025. Whether seeking affordability, flexibility, or personalized financial planning, each of these insurers offers valuable benefits that align with the needs of a tech-savvy and forward-thinking generation.

How to Choose the Best Life Insurance Company as a Millennial in 2025

When selecting the best life insurance company as a millennial in 2025, it is essential to consider several key factors that can impact both short-term affordability and long-term financial security. With an increasing number of insurers offering policies tailored to younger generations, understanding what to look for can help ensure that you make an informed decision. While price is often a primary concern, other aspects such as policy flexibility, customer service, financial stability, and digital accessibility should also play a significant role in your choice.

One of the first considerations when choosing a life insurance provider is affordability. Millennials often have competing financial priorities, such as student loan payments, homeownership, and retirement savings. Therefore, finding a company that offers competitive premiums without compromising on coverage is crucial. Many insurers now provide term life insurance policies with lower premiums, making them an attractive option for younger individuals who want to secure financial protection without a significant financial burden. Comparing quotes from multiple providers can help identify the most cost-effective option while ensuring that the policy meets your specific needs.

Beyond affordability, policy flexibility is another important factor. Millennials tend to have dynamic lifestyles, with career changes, relocations, and evolving financial goals. As a result, selecting a life insurance company that offers customizable policies can be beneficial. Some insurers provide the option to convert term policies into permanent coverage or adjust coverage amounts as financial circumstances change. This flexibility ensures that your policy remains relevant as your life progresses, preventing the need to purchase a new policy later at potentially higher rates.

In addition to flexibility, the financial strength of an insurance company should not be overlooked. A provider’s ability to pay out claims in the future is a critical consideration, as life insurance is a long-term commitment. Reviewing ratings from independent agencies such as AM Best, Moody’s, or Standard & Poor’s can provide insight into an insurer’s financial stability. Choosing a company with strong ratings ensures that your beneficiaries will receive the intended benefits when needed, offering peace of mind that your investment is secure.

Customer service and claims processing efficiency are also essential aspects to evaluate. A life insurance policy is only valuable if the company provides reliable support when it matters most. Reading customer reviews and researching complaint records can help gauge an insurer’s reputation for service quality. Additionally, some companies offer digital tools that streamline the application process, making it easier for millennials to obtain coverage without extensive paperwork or in-person meetings. Insurers that provide online policy management, mobile apps, and virtual customer support can enhance the overall experience, making it more convenient to maintain and update coverage as needed.

Finally, considering additional benefits and riders can help tailor a policy to your specific needs. Some insurers offer features such as accelerated death benefits, which allow policyholders to access a portion of their benefits in the event of a terminal illness. Others provide options for disability waivers or coverage for critical illnesses. Evaluating these add-ons can help ensure that your policy provides comprehensive protection beyond just a death benefit.

By carefully assessing these factors, millennials can choose a life insurance company that aligns with their financial goals and lifestyle. Taking the time to research and compare options will ultimately lead to a policy that offers both affordability and long-term security, ensuring peace of mind for the future.

Comparing the Best Life Insurance Policies for Millennials in 2025

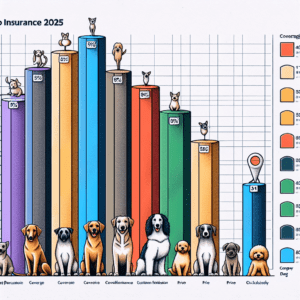

When evaluating the best life insurance policies for millennials in 2025, several factors must be considered, including affordability, coverage options, financial stability, and customer service. Millennials, who are now in their late twenties to early forties, have unique financial priorities that influence their insurance decisions. Many are balancing student loan debt, homeownership, and family planning, making it essential to find policies that offer flexibility and long-term value. As a result, insurers that provide customizable coverage, digital accessibility, and competitive pricing stand out as the best options for this generation.

One of the top contenders in 2025 is Haven Life, a subsidiary of MassMutual. Known for its seamless online application process, Haven Life appeals to tech-savvy millennials who prefer a digital-first experience. The company offers term life insurance policies with competitive rates and a straightforward underwriting process, often allowing applicants to secure coverage without a medical exam. Additionally, Haven Life provides policyholders with access to benefits such as online will creation and fitness discounts, making it an attractive choice for those seeking more than just basic coverage.

Similarly, Bestow has gained popularity among millennials due to its fully digital approach and no-medical-exam policies. Bestow offers term life insurance with coverage amounts ranging from $50,000 to $1.5 million, making it a suitable option for individuals with varying financial needs. The company’s streamlined application process allows for near-instant approval, which is particularly appealing to those who value efficiency. However, because Bestow does not offer permanent life insurance, it may not be the best choice for those looking for lifelong coverage.

For millennials who prefer a more traditional insurer with a strong financial reputation, Northwestern Mutual remains a top choice. Unlike many digital-first insurers, Northwestern Mutual provides both term and permanent life insurance options, including whole and universal life policies. This flexibility allows policyholders to convert term policies into permanent coverage as their financial situations evolve. Additionally, Northwestern Mutual’s policies come with the benefit of dividends, which can be used to reduce premiums or increase cash value over time. While the application process may take longer compared to online-only insurers, the company’s financial strength and personalized service make it a reliable option for long-term coverage.

Another noteworthy provider is Prudential, which offers a wide range of policy options tailored to different financial goals. Prudential’s term life insurance policies are competitively priced, and the company also provides universal and indexed universal life insurance for those seeking investment opportunities within their coverage. One of Prudential’s key advantages is its lenient underwriting for individuals with pre-existing health conditions, making it a viable option for millennials who may have medical concerns. Additionally, Prudential’s policies often include living benefits, allowing policyholders to access a portion of their death benefit in case of a terminal illness diagnosis.

As millennials continue to prioritize financial security, selecting the right life insurance policy requires careful consideration of coverage options, pricing, and long-term benefits. While digital-first insurers like Haven Life and Bestow offer convenience and affordability, traditional providers such as Northwestern Mutual and Prudential provide stability and comprehensive coverage. Ultimately, the best choice depends on individual financial goals and lifestyle preferences, ensuring that millennials can secure the protection they need for the future.