“Save Smart: Build Your Emergency Fund Without Changing Your Lifestyle!”

Smart Budgeting: Redirecting Hidden Savings into Your Emergency Fund

Building an emergency fund is essential for financial security, yet many people hesitate to start one due to concerns about altering their lifestyle. However, by identifying hidden savings within your current budget and redirecting them strategically, you can steadily grow your emergency fund without making significant sacrifices. This approach requires a keen awareness of spending habits, a commitment to small adjustments, and a focus on financial efficiency.

One of the most effective ways to uncover hidden savings is by reviewing recurring expenses. Many individuals subscribe to multiple streaming services, gym memberships, or premium apps that they rarely use. By conducting a thorough audit of these subscriptions, you may find opportunities to eliminate or downgrade services without impacting your daily routine. For instance, if you subscribe to multiple entertainment platforms but primarily use only one, canceling the others and redirecting those funds into your emergency savings can make a noticeable difference over time.

Similarly, small daily expenses often go unnoticed but can add up significantly. Consider the cost of buying coffee from a café every morning or frequently dining out for lunch. While these expenditures may seem minor, they accumulate over weeks and months. Instead of eliminating these habits entirely, a simple adjustment—such as preparing coffee at home a few days a week or bringing lunch from home occasionally—can free up extra funds without drastically changing your lifestyle. The money saved from these minor modifications can be automatically transferred into your emergency fund, ensuring consistent growth.

Another effective strategy involves optimizing utility and household expenses. Many people unknowingly overspend on electricity, water, and internet services. Simple changes, such as using energy-efficient appliances, turning off lights when not in use, or negotiating a better rate with your internet provider, can lead to noticeable savings. Additionally, reviewing insurance policies and mobile phone plans may reveal opportunities to switch to more cost-effective options without compromising quality. These savings, when redirected into an emergency fund, contribute to financial stability without requiring major lifestyle changes.

Grocery shopping is another area where hidden savings can be found. Many households spend more than necessary due to impulse purchases, lack of meal planning, or brand loyalty. By creating a shopping list, taking advantage of discounts, and considering generic brands, you can reduce grocery expenses without sacrificing quality. Additionally, using cashback apps or loyalty programs can provide small but consistent savings that can be allocated to your emergency fund.

Automating savings is a crucial step in ensuring that these hidden savings are effectively redirected. Setting up an automatic transfer from your checking account to your emergency fund each month ensures that the money is saved before it is spent elsewhere. Even small, consistent contributions accumulate over time, providing a financial cushion for unexpected expenses.

By making mindful adjustments to existing spending habits, optimizing recurring expenses, and automating savings, you can build an emergency fund without disrupting your lifestyle. These small but strategic changes allow you to achieve financial security while maintaining the comfort and routines you value. Over time, these efforts will result in a well-funded emergency reserve, providing peace of mind and financial resilience.

Maximizing Rewards: Using Cashback and Discounts to Grow Your Savings

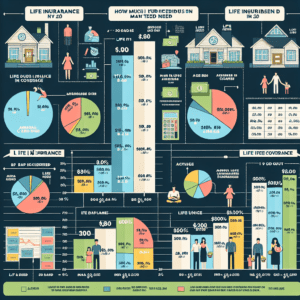

Building an emergency fund is essential for financial security, yet many people hesitate to start saving because they fear it will require significant lifestyle changes. However, by strategically using cashback programs and discounts, it is possible to grow your savings without altering your daily habits. These methods allow you to accumulate extra funds effortlessly while continuing to spend as usual.

One of the most effective ways to maximize savings is by utilizing cashback credit cards. Many financial institutions offer credit cards that provide a percentage of your purchases back in cash. By using these cards for everyday expenses such as groceries, gas, and utility bills, you can accumulate cashback rewards over time. To ensure that this strategy benefits your savings rather than leading to unnecessary spending, it is crucial to pay off the balance in full each month. This approach prevents interest charges from negating the rewards earned. Once the cashback is credited to your account, transferring it directly into your emergency fund ensures that these small amounts contribute to long-term financial security.

In addition to cashback credit cards, many retailers and online platforms offer cashback programs that provide rebates on purchases. Websites and apps such as Rakuten, Honey, and Ibotta allow users to earn a percentage of their spending back when shopping through their platforms. By making purchases through these services, you can accumulate additional savings without any extra effort. Over time, these small amounts add up, providing a steady stream of funds that can be redirected into your emergency savings account.

Another effective way to grow your savings is by taking advantage of discounts and promotional offers. Many retailers provide discounts through loyalty programs, coupons, and seasonal sales. By planning purchases around these opportunities, you can reduce expenses while maintaining your usual spending habits. The money saved from these discounts can then be transferred directly into your emergency fund. For instance, if a grocery store offers a discount on essential items, the amount saved can be set aside rather than spent elsewhere. This disciplined approach ensures that savings accumulate without requiring additional income or lifestyle changes.

Furthermore, subscription services and memberships often provide opportunities for savings. Many companies offer discounts for annual payments instead of monthly billing, and some provide cashback incentives for using specific payment methods. Reviewing existing subscriptions and identifying areas where savings can be maximized allows for additional contributions to an emergency fund. Additionally, some banks and financial institutions offer cashback on bill payments or direct deposits, further enhancing the potential for savings.

To make the most of these strategies, it is beneficial to track savings and set specific goals. Automating transfers of cashback earnings and discount savings into a dedicated emergency fund account ensures that the money is not inadvertently spent. Over time, these small contributions accumulate, creating a financial cushion without requiring major lifestyle adjustments.

By leveraging cashback programs, discounts, and strategic spending habits, it is possible to build an emergency fund without making drastic changes. These methods allow individuals to save effortlessly while continuing their regular spending patterns. With consistency and discipline, small savings can grow into a substantial financial safety net, providing peace of mind and financial stability.

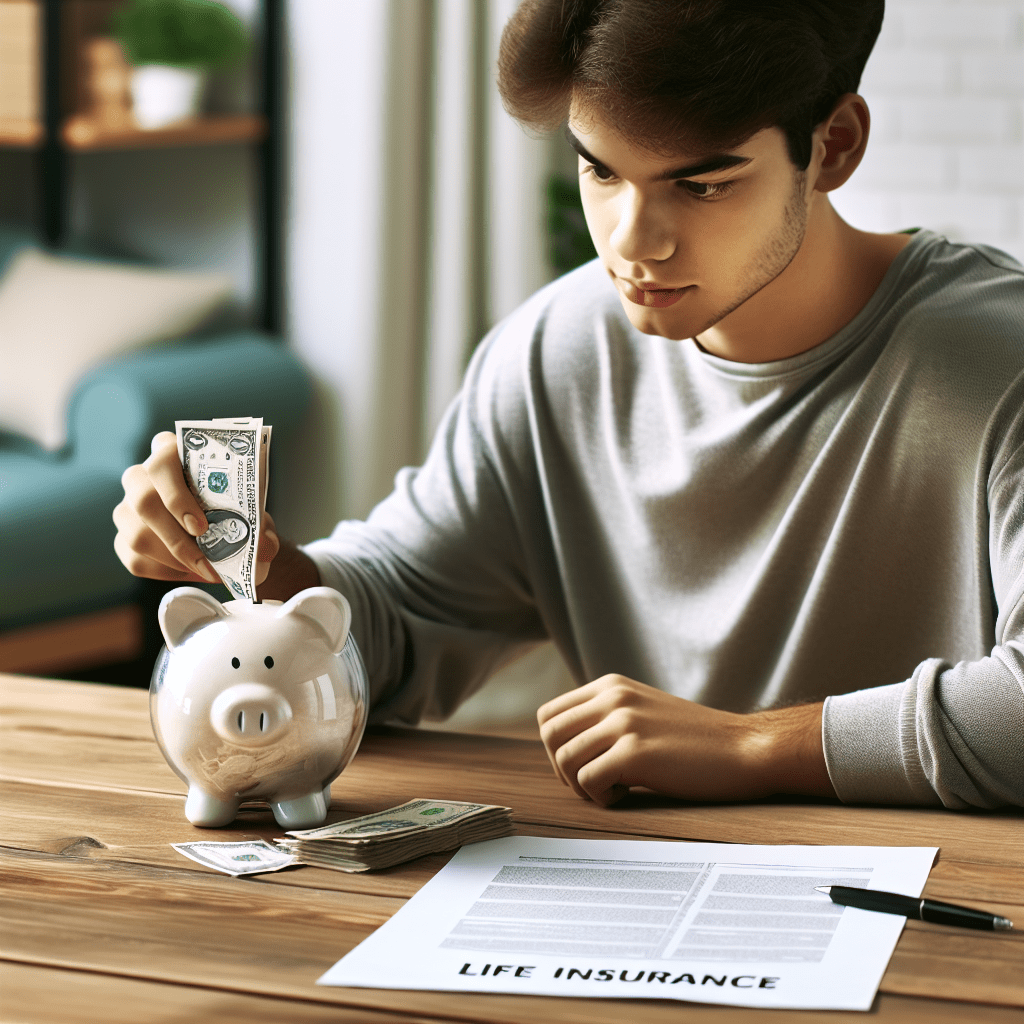

Automating Savings: Effortless Ways to Build an Emergency Fund

Building an emergency fund is essential for financial security, yet many people hesitate to start because they fear it will require significant lifestyle changes. However, by automating savings, individuals can steadily grow their emergency fund without altering their daily routines. This approach ensures consistency and removes the temptation to spend money that should be set aside for future needs.

One of the most effective ways to automate savings is by setting up direct deposits into a separate savings account. Many employers offer the option to split paychecks into multiple accounts, allowing a portion of each paycheck to be automatically transferred to an emergency fund. By doing this, individuals can save without having to make a conscious effort each month. Since the money is never in a primary checking account, there is less temptation to spend it on non-essential expenses.

In addition to direct deposits, automatic transfers from a checking account to a savings account can further simplify the process. Most banks and financial institutions allow customers to schedule recurring transfers, ensuring that a predetermined amount is moved into savings at regular intervals. Setting up these transfers to coincide with payday can be particularly effective, as it prevents individuals from feeling the impact of the deduction. Over time, these small, consistent contributions accumulate into a substantial emergency fund.

Another effortless way to build savings is by using round-up programs offered by many banks and financial apps. These programs automatically round up everyday purchases to the nearest dollar and transfer the difference into a savings account. For example, if a person spends $4.75 on coffee, the program rounds the purchase up to $5.00 and deposits the extra $0.25 into savings. While each individual transaction may seem insignificant, the cumulative effect over weeks and months can lead to meaningful savings without requiring any additional effort.

Cashback rewards and rebates also provide an opportunity to grow an emergency fund without changing spending habits. Many credit cards and shopping apps offer cashback on purchases, which can be automatically deposited into a savings account. Instead of using these rewards for discretionary spending, directing them toward an emergency fund allows individuals to save money they would have otherwise spent. Similarly, rebate programs that provide refunds on everyday purchases can be an easy way to boost savings without making financial sacrifices.

Another strategy involves increasing savings incrementally over time. Some financial institutions offer programs that automatically raise the amount transferred to savings by a small percentage at regular intervals. For instance, an individual might start by saving $10 per week, then increase the amount to $15 after a few months. This gradual approach ensures that savings grow steadily without causing financial strain.

By implementing these automated savings strategies, individuals can build a robust emergency fund without making drastic changes to their lifestyle. The key is to make saving effortless and consistent, allowing small contributions to accumulate over time. With minimal effort, these methods ensure financial preparedness for unexpected expenses while maintaining the same level of comfort in daily life.