“Break Free from Endless Payments – Discover Debt Settlement Today!”

Understanding Debt Settlement: A Path to Financial Freedom

Debt can be overwhelming, especially when monthly payments seem never-ending and financial relief feels out of reach. For many individuals struggling with high-interest loans and mounting balances, debt settlement offers a potential solution to regain control of their finances. By negotiating with creditors to reduce the total amount owed, debt settlement provides an opportunity to resolve outstanding obligations for less than the full balance. While this approach is not without its challenges, understanding how it works and its potential benefits can help individuals make informed decisions about their financial future.

At its core, debt settlement involves working with creditors to reach an agreement that allows a borrower to pay a reduced amount in exchange for resolving the debt. This process is typically pursued by individuals who are experiencing financial hardship and are unable to keep up with their payments. Rather than continuing to make minimum payments that barely cover interest charges, debt settlement allows borrowers to negotiate a lump-sum payment or structured settlement that satisfies the debt at a lower cost. This can provide significant relief, particularly for those facing high levels of unsecured debt, such as credit card balances, medical bills, or personal loans.

One of the primary advantages of debt settlement is the potential for substantial savings. By negotiating a lower payoff amount, individuals can reduce their overall debt burden and work toward financial stability more quickly. Additionally, settling a debt can prevent further collection efforts, including harassing phone calls and legal action, which can be a source of significant stress. For those who have already fallen behind on payments, debt settlement may offer a viable alternative to bankruptcy, which can have long-term consequences on creditworthiness and financial opportunities.

However, it is important to recognize that debt settlement is not a one-size-fits-all solution. The process can take time, often requiring months or even years to accumulate the necessary funds for a settlement offer. During this period, creditors may continue to report missed payments to credit bureaus, which can negatively impact credit scores. Furthermore, not all creditors are willing to negotiate, and there is no guarantee that a settlement offer will be accepted. As a result, individuals considering this option should carefully evaluate their financial situation and explore all available alternatives before proceeding.

Working with a reputable debt settlement company or financial advisor can help navigate the complexities of the process. Professional negotiators have experience dealing with creditors and can often secure more favorable terms than individuals attempting to settle debts on their own. However, it is essential to research any company before engaging their services, as some may charge high fees or make unrealistic promises. Transparency and a clear understanding of the terms of any agreement are crucial to ensuring a successful outcome.

Ultimately, debt settlement can be an effective strategy for those struggling with unmanageable debt, but it requires careful planning and consideration. By weighing the potential benefits and risks, individuals can determine whether this approach aligns with their financial goals. While the journey to financial freedom may not be easy, taking proactive steps toward debt resolution can provide much-needed relief and a path toward a more stable financial future.

Pros and Cons of Debt Settlement: Is It the Right Choice for You?

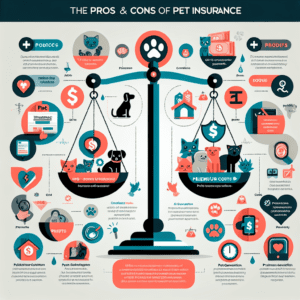

Debt settlement is an option that many individuals consider when they find themselves overwhelmed by financial obligations. It offers a way to reduce the total amount owed by negotiating with creditors, potentially providing relief from mounting payments. However, while this approach can be beneficial in certain situations, it also comes with risks and drawbacks that must be carefully evaluated. Understanding both the advantages and disadvantages of debt settlement is essential in determining whether it is the right choice for your financial situation.

One of the most significant benefits of debt settlement is the potential for substantial savings. By negotiating with creditors, individuals may be able to reduce their total debt balance, sometimes by a considerable percentage. This can make repayment more manageable and allow for a quicker resolution of financial difficulties. Additionally, debt settlement can provide relief from the stress of constant collection calls and overdue notices, offering a sense of financial control that may have previously felt unattainable.

Another advantage is that debt settlement can be a faster alternative to other debt relief options, such as making minimum payments over an extended period. Instead of spending years trying to pay off high-interest balances, individuals who successfully settle their debts may be able to resolve their financial obligations in a shorter timeframe. This can be particularly beneficial for those who are struggling with unsecured debts, such as credit card balances or medical bills, which can accumulate rapidly due to interest and fees.

Despite these benefits, debt settlement also has notable drawbacks that must be considered. One of the primary concerns is the potential impact on credit scores. When individuals choose to settle their debts, they typically stop making payments while negotiations take place. This can lead to late payment marks and a decline in creditworthiness, making it more difficult to obtain loans or credit in the future. Additionally, settled accounts are often reported to credit bureaus as “settled for less than the full amount,” which can be viewed negatively by future lenders.

Another disadvantage is the possibility of fees associated with debt settlement services. Many companies that offer debt settlement charge fees for their assistance, which can reduce the overall savings achieved through the process. It is important to carefully review any agreements and ensure that the potential benefits outweigh the costs. Furthermore, there is no guarantee that creditors will agree to settle, and some may refuse to negotiate, leaving individuals in a difficult financial position.

Tax implications are another factor to consider. In some cases, the amount of debt forgiven through settlement may be considered taxable income by the IRS. This means that individuals who successfully settle their debts could face an unexpected tax bill, which may offset some of the financial relief gained through the process. Consulting with a tax professional can help individuals understand the potential consequences and plan accordingly.

Ultimately, deciding whether debt settlement is the right choice depends on individual circumstances. While it can provide a path to financial relief, it is not without risks. Carefully weighing the pros and cons, seeking professional advice, and exploring alternative options such as debt consolidation or credit counseling can help individuals make an informed decision. By taking a thoughtful approach, those struggling with debt can work toward a more stable financial future.

How Debt Settlement Can Reduce Your Monthly Payments and Relieve Stress

Debt can be overwhelming, especially when monthly payments continue to pile up with no end in sight. Many individuals find themselves struggling to keep up with multiple financial obligations, leading to stress and uncertainty about their future. Fortunately, debt settlement offers a potential solution for those seeking relief from the burden of excessive payments. By negotiating with creditors to reduce the total amount owed, debt settlement can provide a more manageable path toward financial stability.

One of the most significant benefits of debt settlement is the potential reduction in monthly payments. When individuals enroll in a debt settlement program, they typically stop making payments to their creditors and instead contribute to a dedicated account. Over time, these funds accumulate and are used to negotiate settlements with creditors for less than the full balance owed. As a result, individuals may be able to resolve their debts for a fraction of the original amount, ultimately lowering their overall financial obligations.

In addition to reducing the total debt, debt settlement can also alleviate the stress associated with constant creditor calls and collection efforts. Many people struggling with debt experience anxiety due to frequent reminders of their financial difficulties. However, once a debt settlement program is in place, professional negotiators handle communication with creditors, allowing individuals to focus on rebuilding their financial health. This reduction in stress can lead to improved mental well-being and a greater sense of control over one’s financial future.

Another advantage of debt settlement is the potential for a faster resolution compared to making minimum payments on outstanding balances. Traditional repayment methods, such as paying only the minimum amount due each month, can result in years or even decades of financial strain. Interest charges continue to accumulate, making it difficult to make significant progress in reducing the principal balance. In contrast, debt settlement programs are often designed to resolve debts within two to four years, providing a more efficient path to financial freedom.

While debt settlement offers several benefits, it is important to consider potential drawbacks before deciding if it is the right option. For instance, stopping payments to creditors can negatively impact credit scores, as missed payments are reported to credit bureaus. However, for individuals already struggling with delinquent accounts, the impact may be less severe than continuing to accumulate late fees and interest charges. Additionally, forgiven debt may be considered taxable income, which could result in a tax obligation. Consulting with a financial professional can help individuals understand these potential consequences and determine the best course of action.

Despite these considerations, many individuals find that the long-term benefits of debt settlement outweigh the temporary challenges. By reducing overall debt and lowering monthly payments, this approach can provide much-needed relief and a clearer path toward financial recovery. Moreover, once debts are settled, individuals can focus on rebuilding their credit and developing healthier financial habits to prevent future difficulties.

Ultimately, debt settlement can be a valuable tool for those struggling with overwhelming financial obligations. By working with experienced professionals to negotiate reduced balances, individuals can regain control of their finances and move toward a more stable future. While it is essential to weigh the pros and cons carefully, debt settlement remains a viable option for those seeking relief from the stress of endless payments.