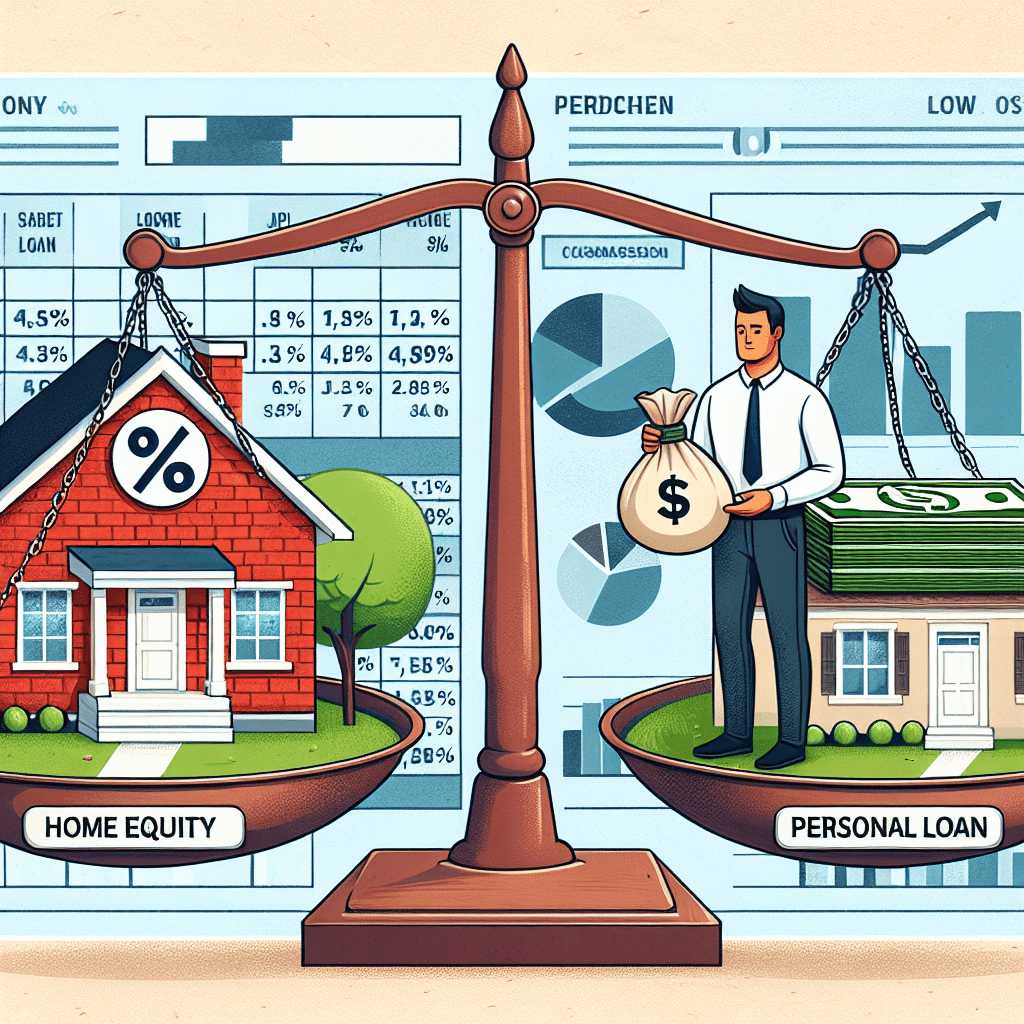

When you need extra funds for a major expense, two common borrowing options are home equity loans and personal loans. Each has its own advantages and drawbacks, making it essential to understand which one best suits your financial situation. In this guide, we’ll compare home equity loans and personal loans to help you make an informed decision.

What Is a Home Equity Loan?

A home equity loan allows homeowners to borrow against the equity they have built in their property. Equity is the difference between the home’s market value and the remaining mortgage balance. These loans typically come with fixed interest rates and structured repayment terms.

What Is a Personal Loan?

A personal loan is an unsecured loan that does not require collateral. Lenders approve personal loans based on creditworthiness, income, and financial history. These loans can be used for various purposes, such as debt consolidation, home improvements, or emergency expenses.

Key Differences Between Home Equity Loans and Personal Loans

- Collateral: Home equity loans require your home as collateral, while personal loans are unsecured.

- Interest Rates: Home equity loans generally have lower interest rates because they are secured, whereas personal loans tend to have higher rates.

- Loan Amount: Home equity loans allow you to borrow larger amounts, depending on your home’s equity, while personal loans have lower borrowing limits.

- Repayment Terms: Home equity loans often have longer repayment periods (10-30 years), while personal loans typically range from 1-7 years.

- Approval Process: Personal loans have a faster approval process, whereas home equity loans require property appraisals and more paperwork.

Pros and Cons of Home Equity Loans

Pros:

- Lower interest rates compared to personal loans.

- Higher borrowing limits based on home equity.

- Fixed monthly payments for predictable budgeting.

- Potential tax benefits if used for home improvements.

Cons:

- Requires homeownership and sufficient equity.

- Longer approval process with additional fees.

- Risk of foreclosure if you fail to repay.

Pros and Cons of Personal Loans

Pros:

- No collateral required, reducing risk to assets.

- Faster approval and funding process.

- Flexible usage for various financial needs.

- Shorter repayment terms to clear debt faster.

Cons:

- Higher interest rates compared to secured loans.

- Lower borrowing limits than home equity loans.

- Strict credit requirements for favorable terms.

Which Loan Is Right for You?

The right loan depends on your financial situation and borrowing needs. Consider the following scenarios:

- Choose a home equity loan if: You need a large loan amount, have significant home equity, and prefer lower interest rates with longer repayment terms.

- Choose a personal loan if: You need quick access to funds, don’t own a home, or prefer an unsecured loan with a shorter repayment period.

Final Thoughts

Both home equity loans and personal loans offer valuable financial solutions, but the best choice depends on your specific needs and financial stability. If you have home equity and can handle a longer repayment term, a home equity loan may be ideal. However, if you need quick funds without risking your home, a personal loan might be the better option.

Before making a decision, compare loan offers, assess your repayment ability, and consult a financial advisor if needed. Choosing the right loan can help you achieve your financial goals while minimizing risks.