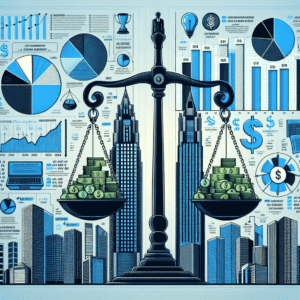

“Envelope Budgeting: A Proven Path to Smarter Spending and Financial Control!”

Understanding The Envelope Budgeting Method: How It Works and Why It’s Effective

The envelope budgeting method is a time-tested approach to managing personal finances that has helped many individuals gain better control over their spending. This system relies on the principle of allocating cash into designated envelopes for specific expense categories, ensuring that money is spent only on what has been planned. By using this method, individuals can develop a more disciplined approach to budgeting, avoid unnecessary debt, and gain a clearer understanding of their financial habits.

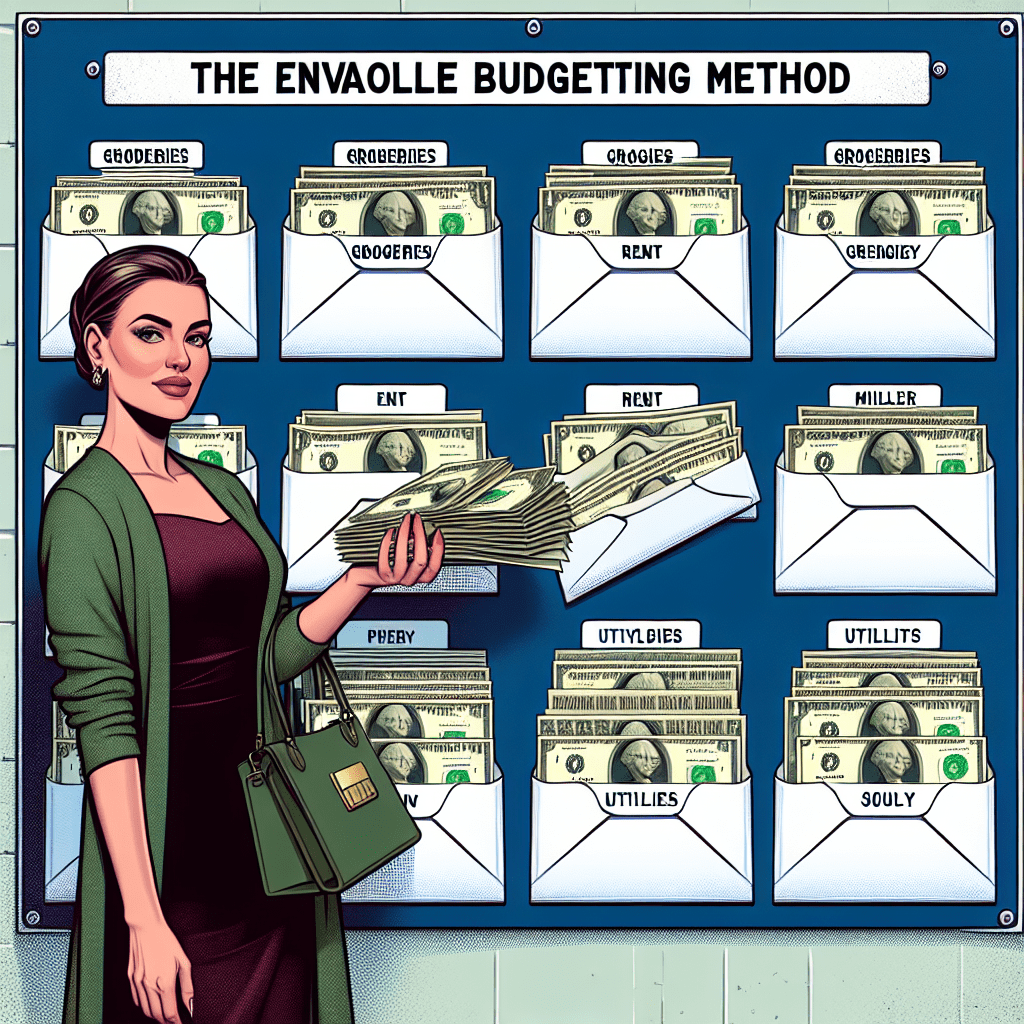

To implement the envelope budgeting method, individuals first determine their monthly income and categorize their expenses accordingly. Common categories include rent or mortgage payments, groceries, transportation, entertainment, and savings. Once these categories are established, cash is withdrawn and placed into separate envelopes labeled for each expense. Throughout the month, money is spent directly from these envelopes, and once an envelope is empty, no further spending is allowed in that category until the next budgeting cycle. This approach ensures that individuals do not exceed their budget and encourages mindful spending.

One of the primary reasons the envelope budgeting method is effective is that it provides a tangible way to track expenses. Unlike digital transactions, which can sometimes feel abstract, physically handling cash makes individuals more aware of their spending habits. When money is visibly depleting from an envelope, it serves as a clear reminder of financial limits, discouraging impulsive purchases. This heightened awareness often leads to more intentional spending decisions, helping individuals prioritize essential expenses over discretionary ones.

Additionally, this method helps prevent overspending by enforcing strict boundaries on each category. Many people struggle with swiping credit or debit cards without fully considering the impact on their overall budget. However, with the envelope system, once the allocated cash is gone, there is no option to spend more unless adjustments are made by reallocating funds from another category. This limitation fosters financial discipline and encourages individuals to live within their means rather than relying on credit or loans to cover shortfalls.

Another advantage of the envelope budgeting method is its ability to reduce reliance on credit cards, which can contribute to debt accumulation if not managed properly. By using cash for everyday expenses, individuals are less likely to incur high-interest debt and can focus on saving rather than paying off credit balances. Furthermore, this method can be particularly beneficial for those who struggle with impulse spending, as it requires careful planning and adherence to a predetermined budget.

Despite its many benefits, the envelope budgeting method does have some limitations. In an increasingly digital world, relying solely on cash can be inconvenient, especially for online purchases or automated bill payments. However, some individuals adapt this method by using digital envelopes or budgeting apps that mimic the cash-based system while allowing for electronic transactions. Additionally, strict adherence to cash-only spending may not be practical for all expenses, requiring some flexibility in implementation.

Overall, the envelope budgeting method remains a highly effective tool for managing personal finances. By promoting financial awareness, enforcing spending limits, and reducing reliance on credit, this approach helps individuals take control of their money and work toward their financial goals. While it may require adjustments to fit modern spending habits, the fundamental principles of this method continue to provide valuable guidance for those seeking a structured and disciplined approach to budgeting.

Pros and Cons of The Envelope Budgeting Method: Does It Really Work for Everyone?

The envelope budgeting method is a time-tested approach to managing personal finances, offering a structured way to allocate income toward specific spending categories. By using physical envelopes or digital equivalents, individuals can set aside predetermined amounts for expenses such as groceries, rent, entertainment, and savings. This method promotes disciplined spending and helps prevent overspending by ensuring that once an envelope is empty, no additional funds can be used for that category until the next budgeting period. While this approach has proven effective for many, it is important to examine both its advantages and limitations to determine whether it is suitable for everyone.

One of the primary benefits of the envelope budgeting method is its ability to provide clear spending boundaries. By allocating cash to specific categories, individuals gain a tangible sense of their financial limits, making it easier to avoid unnecessary purchases. This method also encourages mindful spending, as physically handling money can create a stronger psychological connection to financial decisions compared to using credit or debit cards. Additionally, it fosters accountability by requiring individuals to track their expenses closely, which can lead to better financial habits over time.

Another advantage is that this method can be particularly useful for those who struggle with impulse spending. Since each category has a fixed amount, individuals are less likely to make unplanned purchases that could disrupt their budget. Furthermore, the envelope system can be an effective tool for debt management. By prioritizing essential expenses and allocating funds accordingly, individuals can ensure that they meet their financial obligations while avoiding unnecessary debt accumulation.

Despite these benefits, the envelope budgeting method also has certain drawbacks that may make it less suitable for some individuals. One of the main challenges is the reliance on cash, which can be inconvenient in an increasingly digital economy. Many transactions, such as online purchases and automatic bill payments, require electronic payments, making it difficult to adhere strictly to a cash-based system. While digital envelope budgeting apps exist, they may not provide the same level of psychological reinforcement as handling physical cash.

Additionally, this method requires a high level of discipline and consistency. Individuals must diligently track their spending and ensure that they do not borrow from one envelope to cover expenses in another category. For those who find it difficult to maintain strict financial discipline, this approach may become burdensome or ineffective over time. Moreover, unexpected expenses can pose a challenge, as the rigid structure of the envelope system may not always accommodate sudden financial needs. While some individuals create an emergency fund envelope, it may not always be sufficient to cover unforeseen costs.

Another potential drawback is that the envelope budgeting method may not be ideal for individuals with fluctuating incomes. Those who receive irregular paychecks may find it challenging to allocate fixed amounts to each category, leading to inconsistencies in their budgeting process. In such cases, a more flexible budgeting approach may be necessary to accommodate variations in income.

Ultimately, the effectiveness of the envelope budgeting method depends on an individual’s financial habits, lifestyle, and level of commitment. While it offers a structured and disciplined approach to managing money, it may not be suitable for everyone. Those who prefer a more flexible system or rely heavily on digital transactions may find alternative budgeting methods more practical. However, for individuals seeking a hands-on approach to controlling their spending and improving financial discipline, the envelope budgeting method can be a valuable tool in achieving financial stability.

Real-Life Success Stories: How The Envelope Budgeting Method Transformed Finances

The envelope budgeting method has been a time-tested approach to managing personal finances, helping individuals take control of their spending and achieve financial stability. By allocating cash into designated envelopes for specific expense categories, this method enforces discipline and prevents overspending. While the concept may seem simple, its impact on real-life financial situations has been profound. Many individuals and families have successfully transformed their financial habits using this approach, demonstrating that structured budgeting can lead to long-term financial well-being.

One such success story is that of a young couple who struggled with managing their monthly expenses. Despite earning a stable income, they often found themselves short on cash before the end of the month, relying on credit cards to cover basic necessities. After implementing the envelope budgeting method, they assigned cash to envelopes labeled for groceries, utilities, entertainment, and other essential expenses. By physically seeing how much money remained in each category, they became more mindful of their spending. Over time, they not only eliminated their reliance on credit cards but also managed to save for emergencies and future goals.

Similarly, a single mother facing financial difficulties found relief through this budgeting technique. With a limited income and multiple financial responsibilities, she often struggled to make ends meet. However, by using the envelope system, she gained a clearer understanding of her spending patterns and identified areas where she could cut back. This newfound awareness allowed her to prioritize essential expenses while setting aside small amounts for savings. Within a year, she had built an emergency fund and reduced her financial stress significantly.

Another compelling example is that of an individual burdened with debt who used the envelope budgeting method to regain financial control. With multiple loans and credit card balances, managing payments had become overwhelming. By allocating cash to specific debt repayment envelopes, this individual ensured that payments were made consistently and on time. Additionally, the method helped curb unnecessary spending, allowing for extra funds to be directed toward debt reduction. As a result, within a few years, they successfully paid off a significant portion of their debt and improved their overall financial health.

Beyond personal success stories, families have also benefited from this approach. One family, struggling with unplanned expenses and inconsistent savings, decided to implement the envelope system to bring structure to their finances. By involving every family member in the budgeting process, they created a sense of accountability and teamwork. Each month, they allocated cash for household expenses, children’s activities, and savings goals. Over time, they noticed a significant improvement in their financial stability, allowing them to plan vacations, invest in their children’s education, and build a secure financial future.

These real-life examples highlight the effectiveness of the envelope budgeting method in transforming financial habits. By providing a tangible way to manage money, this approach encourages discipline, reduces reliance on credit, and promotes savings. While it may require adjustments and commitment, those who have embraced this method have experienced lasting financial improvements. Ultimately, the envelope budgeting method proves that with proper planning and consistency, achieving financial stability is within reach.