“Is Pet Insurance Worth It? A Complete Guide to Protecting Your Furry Friend and Your Finances!”

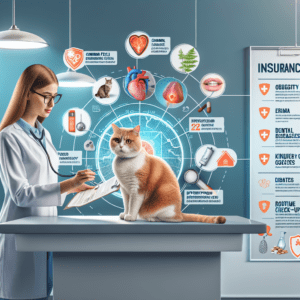

Benefits And Drawbacks Of Pet Insurance

Pet insurance has become an increasingly popular option for pet owners seeking financial protection against unexpected veterinary expenses. While it offers several advantages, it also comes with certain limitations that must be carefully considered. Understanding both the benefits and drawbacks of pet insurance can help pet owners make an informed decision about whether it is the right choice for their specific needs.

One of the most significant benefits of pet insurance is the financial security it provides. Veterinary care can be expensive, particularly in cases of emergencies, chronic illnesses, or specialized treatments. With pet insurance, owners can mitigate the financial burden of costly procedures, ensuring that their pets receive the necessary medical attention without hesitation. This is especially important for those who may not have substantial savings set aside for unexpected veterinary bills. By paying a monthly premium, pet owners can avoid the stress of making difficult financial decisions when their pet requires urgent care.

In addition to financial protection, pet insurance allows for greater access to advanced medical treatments. Veterinary medicine has made significant advancements in recent years, offering treatments such as chemotherapy, physical therapy, and even complex surgeries. However, these procedures can be prohibitively expensive without insurance coverage. With a suitable policy in place, pet owners can explore a wider range of treatment options, improving their pet’s quality of life and increasing the chances of a successful recovery.

Another advantage of pet insurance is the flexibility it provides in choosing a veterinarian. Unlike human health insurance, which often requires policyholders to visit specific healthcare providers, most pet insurance plans allow owners to seek treatment from any licensed veterinarian. This ensures that pets can continue receiving care from a trusted provider without the restrictions of network limitations. Additionally, some policies offer coverage for alternative therapies, such as acupuncture or hydrotherapy, which can be beneficial for pets with chronic conditions or mobility issues.

Despite these benefits, pet insurance also has certain drawbacks that must be taken into account. One of the primary concerns is the cost of premiums, which can vary depending on factors such as the pet’s age, breed, and pre-existing conditions. While some policies offer affordable monthly rates, others can be quite expensive, particularly for older pets or breeds prone to hereditary conditions. Over time, the cumulative cost of premiums may exceed the amount spent on veterinary care, making it essential for pet owners to carefully evaluate whether the investment is worthwhile.

Another potential drawback is the presence of exclusions and limitations within insurance policies. Many providers do not cover pre-existing conditions, meaning that any illness or injury diagnosed before obtaining coverage will not be eligible for reimbursement. Additionally, some policies impose waiting periods before coverage takes effect, which can be problematic if a pet requires immediate medical attention. It is crucial for pet owners to thoroughly review the terms and conditions of a policy to ensure they understand what is and is not covered.

Furthermore, the reimbursement process can sometimes be cumbersome. Unlike human health insurance, where providers often pay healthcare facilities directly, most pet insurance policies require owners to pay for veterinary services upfront and then submit a claim for reimbursement. Depending on the provider, this process can take time, potentially causing financial strain for those who cannot afford to pay large sums out of pocket.

Ultimately, the decision to invest in pet insurance depends on an individual’s financial situation, risk tolerance, and the specific needs of their pet. While it offers valuable financial protection and access to advanced medical care, it also comes with costs and limitations that must be carefully weighed. By thoroughly researching different policies and considering both the benefits and drawbacks, pet owners can make an informed choice that best supports their pet’s health and well-being.

How To Choose The Right Pet Insurance Plan

Selecting the right pet insurance plan requires careful consideration of several factors to ensure that your pet receives the best possible care while also managing costs effectively. With numerous providers offering a variety of coverage options, it is essential to evaluate each plan based on your pet’s specific needs, your financial situation, and the level of protection you desire. Understanding the key elements of pet insurance can help you make an informed decision that benefits both you and your pet in the long run.

One of the first aspects to consider is the type of coverage offered by different insurance providers. Some plans cover only accidents, while others include illnesses, hereditary conditions, and even routine wellness care. Accident-only plans tend to be more affordable but may not provide sufficient coverage if your pet develops a chronic illness or requires specialized treatment. Comprehensive plans, on the other hand, offer broader protection but come with higher premiums. Evaluating your pet’s breed, age, and medical history can help determine which type of coverage is most appropriate.

In addition to coverage type, it is important to examine the policy’s exclusions and limitations. Many pet insurance plans do not cover pre-existing conditions, meaning any illness or injury diagnosed before the policy’s start date will not be eligible for reimbursement. Some policies also have breed-specific exclusions, particularly for conditions that are common in certain breeds. Reviewing these details carefully can prevent unexpected expenses and ensure that the plan aligns with your pet’s potential healthcare needs.

Another crucial factor to assess is the reimbursement structure of the policy. Pet insurance typically operates on a reimbursement basis, where you pay the veterinary bill upfront and then submit a claim for reimbursement. Different plans offer varying reimbursement rates, usually ranging from 70% to 90% of eligible expenses. Additionally, some policies use a benefit schedule, which sets a maximum payout for specific treatments, while others reimburse based on actual veterinary costs. Understanding how reimbursement works can help you choose a plan that minimizes out-of-pocket expenses.

Equally important is the deductible amount, which is the portion of veterinary costs you must pay before the insurance coverage takes effect. Deductibles can be either annual or per-incident, with each structure affecting overall costs differently. A higher deductible generally results in lower monthly premiums, while a lower deductible increases premium costs but reduces the amount you pay when seeking veterinary care. Evaluating your budget and expected veterinary expenses can help determine the most suitable deductible for your situation.

Furthermore, considering the policy’s annual or lifetime coverage limits is essential. Some plans impose a cap on the total amount they will pay per year or over the pet’s lifetime. If your pet requires extensive medical treatment, reaching these limits could mean covering additional costs out of pocket. Opting for a plan with higher or unlimited coverage limits can provide greater financial security, particularly for pets prone to chronic conditions or unexpected emergencies.

Lastly, researching the reputation and customer service of the insurance provider can make a significant difference in your overall experience. Reading customer reviews, checking claim processing times, and understanding the company’s responsiveness to inquiries can help ensure that you choose a reliable provider. A company with a strong track record of customer satisfaction and efficient claims processing can offer peace of mind when dealing with veterinary expenses.

By carefully evaluating these factors, pet owners can select an insurance plan that provides comprehensive coverage, aligns with their financial situation, and ensures their pet receives the necessary medical care. Taking the time to compare different options and understand policy details can lead to a well-informed decision that benefits both the pet and its owner in the long term.

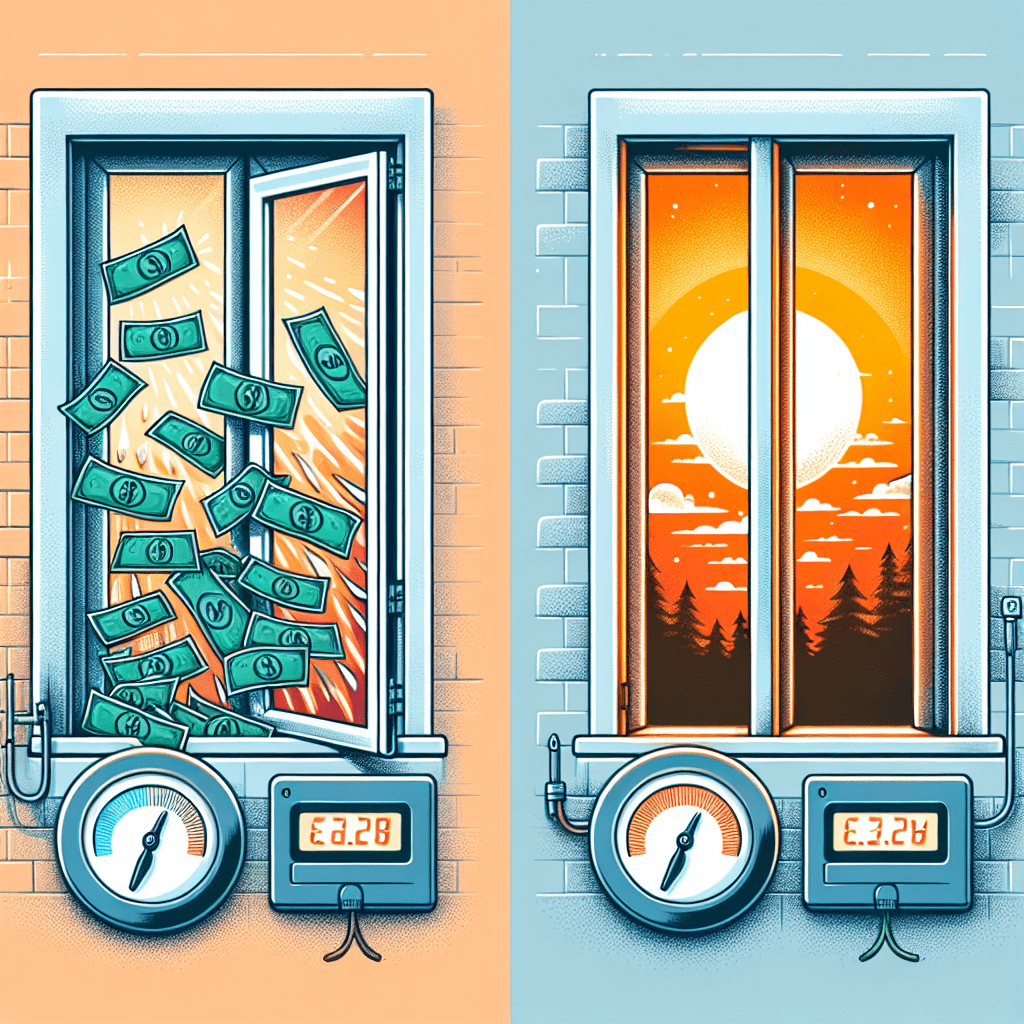

Cost Analysis: Pet Insurance Vs. Out-Of-Pocket Expenses

When considering whether pet insurance is a worthwhile investment, one of the most important factors to evaluate is the cost. Pet owners must weigh the financial implications of purchasing an insurance policy against the potential expenses of paying for veterinary care out of pocket. Understanding the differences between these two approaches can help pet owners make an informed decision that best suits their financial situation and their pet’s healthcare needs.

Pet insurance typically requires a monthly or annual premium, which varies based on factors such as the pet’s age, breed, location, and the level of coverage selected. Basic plans may cover accidents and emergencies, while more comprehensive policies include routine care, vaccinations, and chronic illness management. In addition to premiums, pet owners should also consider deductibles, co-pays, and reimbursement rates, as these factors influence the overall cost of coverage. While some policies offer high reimbursement rates, they may come with higher premiums, making it essential to balance affordability with the level of protection desired.

On the other hand, paying for veterinary expenses out of pocket means covering all medical costs as they arise. This approach eliminates the need for monthly payments but can lead to significant financial strain in the event of an unexpected illness or emergency. Routine check-ups and vaccinations may be relatively affordable, but surgeries, diagnostic tests, and long-term treatments for chronic conditions can quickly add up. For example, emergency surgery for a pet suffering from a severe injury can cost thousands of dollars, while ongoing treatment for conditions such as diabetes or cancer may require continuous financial commitment. Without insurance, pet owners must be prepared to handle these expenses on their own, which can be challenging, especially in cases of sudden or severe health issues.

To determine which option is more cost-effective, pet owners should consider their pet’s health history, breed-specific risks, and their own financial stability. Some breeds are more prone to hereditary conditions, such as hip dysplasia in large dogs or heart disease in certain cat breeds, making insurance a more attractive option for those who want to mitigate potential future costs. Additionally, younger pets generally have lower insurance premiums, making it more affordable to enroll them in a policy early before pre-existing conditions develop.

Another important consideration is the unpredictability of veterinary expenses. While some pets may go years without needing major medical care, others may require frequent visits to the veterinarian due to accidents or illnesses. Pet insurance provides a level of financial security by covering a portion of these costs, reducing the burden of unexpected expenses. However, if a pet remains healthy throughout its life, the total amount paid in premiums may exceed the actual veterinary costs incurred, leading some owners to question whether insurance is a cost-effective choice.

Ultimately, the decision between pet insurance and out-of-pocket expenses depends on an individual’s financial situation and risk tolerance. Those who prefer predictable monthly payments and financial protection against high medical costs may find pet insurance to be a valuable investment. Conversely, pet owners who have sufficient savings and are comfortable handling unexpected expenses may opt to forgo insurance. By carefully analyzing the costs and benefits of each approach, pet owners can make a well-informed decision that ensures their pet receives the best possible care without unnecessary financial strain.