“Secure Your Family’s Future: Protect What Matters with Wills & Trusts.”

Importance Of Wills And Trusts In Protecting Your Family’s Future

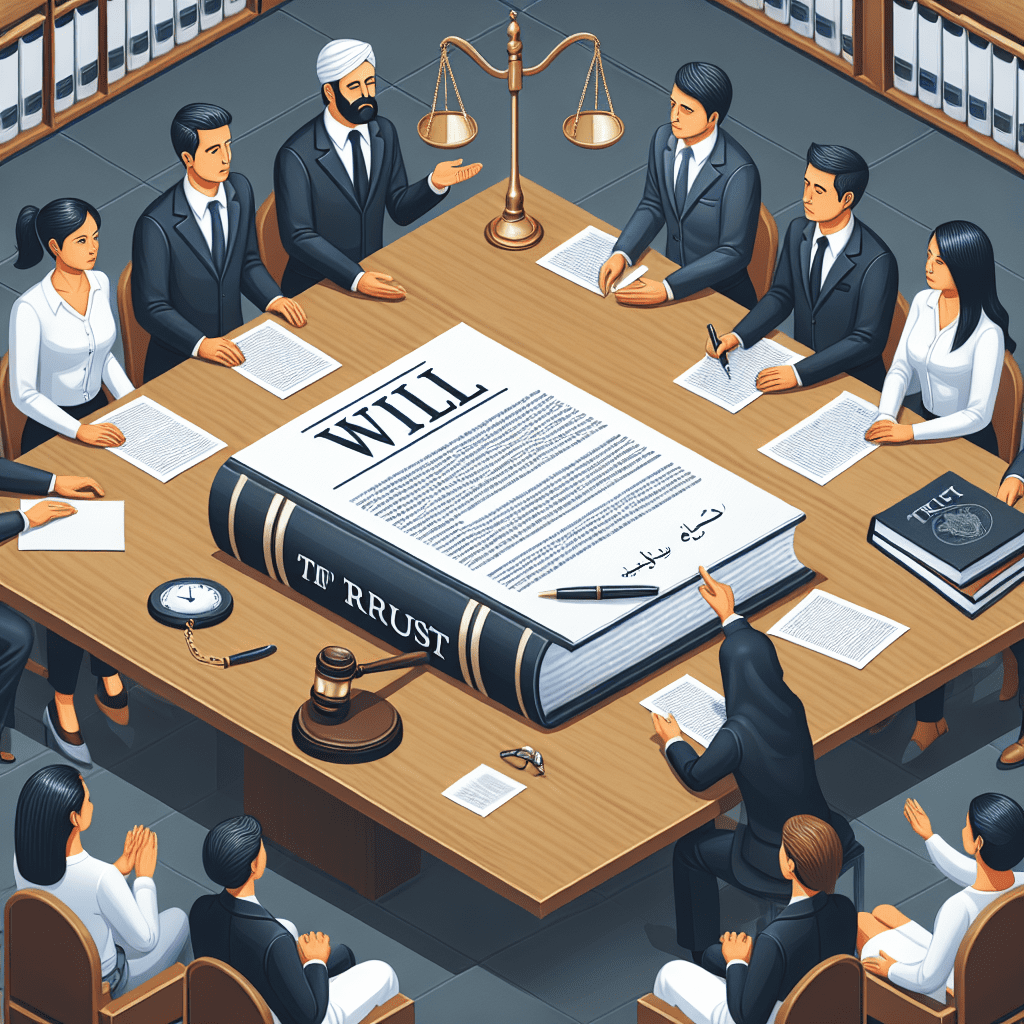

Ensuring the financial security and well-being of your family requires careful planning, and one of the most effective ways to achieve this is through the use of wills and trusts. These legal instruments provide a structured approach to managing and distributing assets, ensuring that your loved ones are protected in the event of your passing. Without proper estate planning, families may face unnecessary legal complications, financial burdens, and potential disputes that could have been avoided with a well-drafted will or trust.

A will serves as a legally binding document that outlines how your assets should be distributed after your death. It allows you to designate beneficiaries, appoint an executor to manage your estate, and specify guardians for minor children. Without a valid will in place, state laws will determine how your assets are distributed, which may not align with your wishes. This can lead to unintended consequences, such as assets being allocated to distant relatives instead of those you intended to benefit. Additionally, the probate process, which is required to validate a will, can be time-consuming and costly. However, having a clear and legally sound will can help streamline this process and minimize potential conflicts among family members.

While a will is an essential component of estate planning, a trust offers additional benefits that can further protect your family’s future. A trust is a legal arrangement in which a trustee holds and manages assets on behalf of beneficiaries according to the terms set by the grantor. One of the primary advantages of a trust is that it allows assets to bypass probate, ensuring a faster and more private distribution of wealth. This can be particularly beneficial for families who wish to avoid the delays and expenses associated with probate court proceedings. Furthermore, trusts provide greater control over how and when assets are distributed, which can be especially useful for individuals with minor children or beneficiaries who may not be financially responsible.

Another significant advantage of trusts is their ability to offer protection against creditors and legal claims. Assets placed in certain types of trusts may be shielded from lawsuits, divorce settlements, or financial mismanagement by beneficiaries. This level of protection ensures that your wealth remains intact and is used for the intended purpose of supporting your family. Additionally, trusts can be structured to provide for individuals with special needs without jeopardizing their eligibility for government assistance programs. By carefully designing a trust, you can ensure that your loved ones receive the financial support they need while preserving their access to essential benefits.

Estate planning is not only about distributing assets but also about minimizing tax liabilities. Both wills and trusts can be used strategically to reduce estate taxes and maximize the inheritance passed on to beneficiaries. Certain types of trusts, such as irrevocable trusts, can remove assets from an individual’s taxable estate, potentially lowering the overall tax burden. Consulting with an experienced estate planning attorney can help you determine the most effective strategies for preserving your wealth and ensuring that your family benefits from your hard-earned assets.

Ultimately, taking the time to establish a comprehensive estate plan that includes wills and trusts is one of the most responsible steps you can take to protect your family’s future. By clearly outlining your wishes and utilizing the appropriate legal tools, you can provide financial security, prevent unnecessary legal disputes, and ensure that your legacy is preserved for generations to come.

Key Differences Between Wills And Trusts: Which One Is Right For You?

Wills and trusts are essential legal tools that help individuals protect their families and ensure their assets are distributed according to their wishes. While both serve similar purposes, they have distinct differences that can impact how an estate is managed and transferred. Understanding these differences is crucial in determining which option best suits your needs.

A will is a legal document that outlines how a person’s assets should be distributed after their death. It allows individuals to name beneficiaries, designate guardians for minor children, and specify final wishes. One of the primary advantages of a will is its simplicity. It is relatively easy to create and can be modified as circumstances change. However, a will must go through probate, a court-supervised process that validates the document and oversees the distribution of assets. Probate can be time-consuming and costly, potentially delaying the transfer of assets to beneficiaries. Additionally, because probate is a public process, the details of the estate become part of the public record, which may not be ideal for those who value privacy.

In contrast, a trust is a legal arrangement in which a person, known as the grantor, transfers assets into a trust to be managed by a trustee for the benefit of designated beneficiaries. One of the most significant advantages of a trust is that it allows assets to bypass probate, enabling a faster and more private distribution. Trusts can be structured in various ways, with revocable and irrevocable trusts being the most common. A revocable trust, also known as a living trust, allows the grantor to retain control over the assets during their lifetime and make changes as needed. Upon the grantor’s death, the assets are distributed according to the trust’s terms without the need for probate. On the other hand, an irrevocable trust cannot be easily modified once established, but it offers benefits such as asset protection and potential tax advantages.

When deciding between a will and a trust, several factors should be considered. For individuals with relatively simple estates and minimal concerns about probate, a will may be sufficient. It provides a straightforward way to outline final wishes and ensure assets are distributed accordingly. However, for those with more complex estates, significant assets, or concerns about privacy, a trust may be the better option. Trusts offer greater control over asset distribution, allowing for specific conditions to be set, such as distributing funds to beneficiaries over time rather than in a lump sum. This can be particularly beneficial for individuals with young children or beneficiaries who may not be financially responsible.

Another important consideration is incapacity planning. While a will only takes effect after death, a trust can provide for the management of assets in the event of incapacity. If the grantor becomes unable to manage their affairs, the designated trustee can step in and handle financial matters without the need for court intervention. This can be a significant advantage in ensuring continuity and avoiding legal complications.

Ultimately, the choice between a will and a trust depends on individual circumstances, financial goals, and family dynamics. Consulting with an estate planning attorney can help determine the most appropriate strategy to protect your family and ensure your wishes are carried out effectively.

Common Mistakes To Avoid When Creating A Will Or Trust

One of the most important steps in securing your family’s future is creating a comprehensive estate plan, which often includes a will or trust. However, many individuals make critical mistakes during this process, potentially leading to legal complications, unintended consequences, or disputes among beneficiaries. Understanding these common pitfalls can help ensure that your estate plan effectively protects your loved ones and honors your final wishes.

A frequent mistake is failing to update a will or trust regularly. Life circumstances change over time, including marriages, divorces, births, and deaths within the family. If an estate plan does not reflect these changes, it may result in unintended beneficiaries receiving assets or important individuals being excluded. Regularly reviewing and updating these documents ensures that they remain aligned with current family dynamics and financial situations.

Another common error is not clearly specifying asset distribution. Vague or ambiguous language in a will or trust can lead to confusion and disputes among heirs. For example, simply stating that assets should be divided “fairly” among children may leave room for interpretation, potentially causing disagreements. Clearly outlining who receives what, along with any conditions or stipulations, helps prevent misunderstandings and ensures that your wishes are carried out as intended.

Additionally, many people overlook the importance of naming contingent beneficiaries. If a primary beneficiary predeceases the testator or is otherwise unable to inherit, the absence of a designated alternate can lead to assets being distributed according to state intestacy laws rather than the individual’s preferences. By naming secondary beneficiaries, you can provide a clear plan for asset distribution in unforeseen circumstances.

Another significant mistake is failing to properly fund a trust. Simply creating a trust document is not enough; assets must be legally transferred into the trust’s name for it to be effective. If assets remain in the individual’s name at the time of death, they may still be subject to probate, defeating one of the primary purposes of establishing a trust. Ensuring that all intended assets are correctly titled in the trust’s name is essential for avoiding unnecessary legal complications.

Furthermore, some individuals attempt to draft their own wills or trusts without professional guidance. While do-it-yourself estate planning tools may seem cost-effective, they often fail to account for complex legal requirements and state-specific regulations. Errors in wording, improper execution, or failure to comply with legal formalities can render a will or trust invalid. Consulting an experienced estate planning attorney helps ensure that documents are legally sound and tailored to your specific needs.

Another oversight is neglecting to consider tax implications. Estate taxes, inheritance taxes, and capital gains taxes can significantly impact the value of assets passed on to beneficiaries. Without proper planning, heirs may face unexpected tax burdens that could have been minimized through strategic estate planning techniques. Working with a financial advisor or estate attorney can help structure your plan in a way that reduces tax liabilities and maximizes the value of your estate for your loved ones.

Finally, failing to communicate your estate plan to key individuals can create confusion and conflict after your passing. While it may be uncomfortable to discuss these matters, informing your executor, trustee, and beneficiaries about your intentions can help prevent disputes and ensure a smoother administration process. Providing clear instructions and discussing your reasoning behind certain decisions can also help manage expectations and reduce the likelihood of legal challenges.

By avoiding these common mistakes, you can create a well-structured estate plan that effectively protects your family’s financial future. Taking the time to carefully draft, update, and communicate your will or trust ensures that your assets are distributed according to your wishes while minimizing potential legal complications. Seeking professional guidance and staying proactive in your estate planning efforts will provide peace of mind, knowing that your loved ones are safeguarded for years to come.