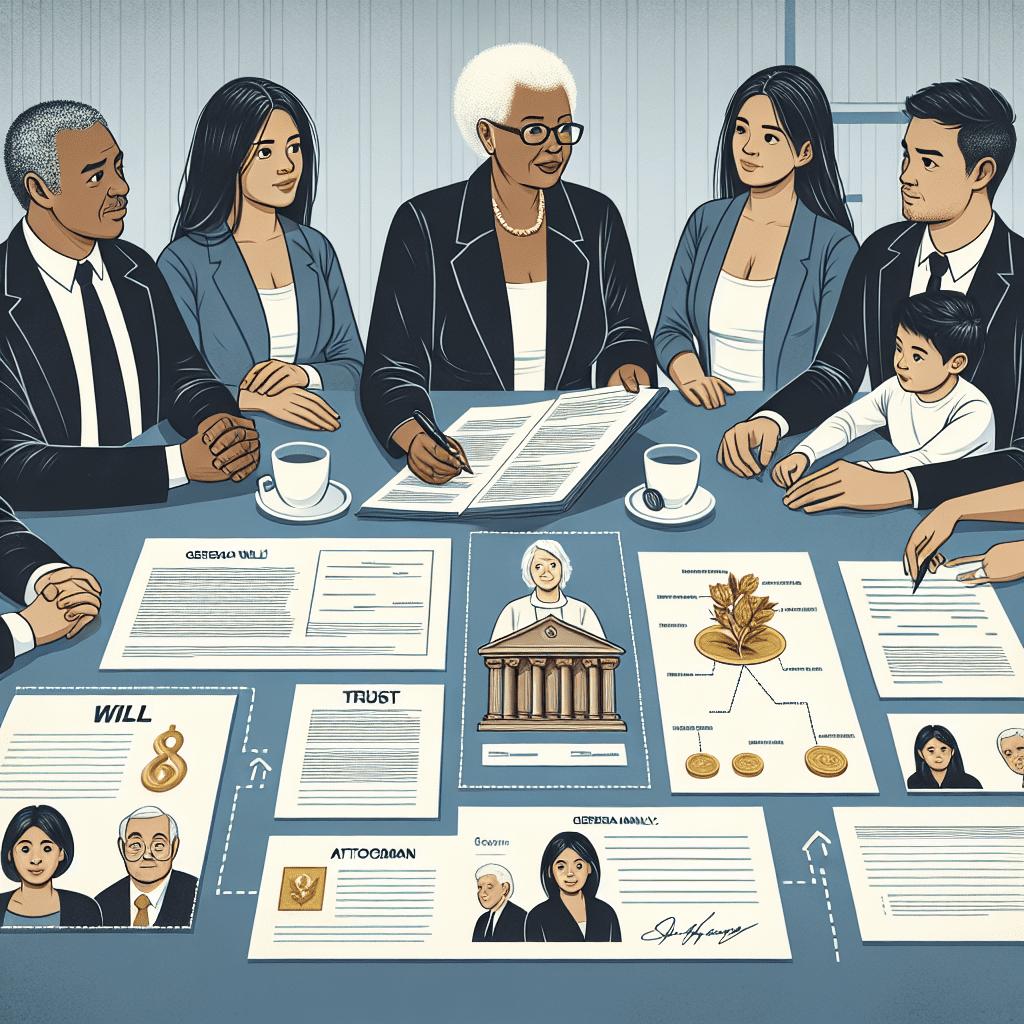

“Secure Your Family’s Future: Protect What Matters with Wills & Trusts.”

Importance Of Wills And Trusts In Protecting Your Family’s Future

Ensuring the financial security and well-being of your family requires careful planning, and one of the most effective ways to achieve this is through the use of wills and trusts. These legal instruments provide a structured approach to managing and distributing assets, ensuring that your loved ones are protected in the event of your passing. Without proper estate planning, families may face unnecessary legal complications, financial burdens, and potential disputes that could have been avoided with clear directives in place.

A will serves as a fundamental document that outlines how your assets should be distributed after your death. It allows you to designate beneficiaries, appoint an executor to manage your estate, and specify guardianship arrangements for minor children. Without a legally valid will, state laws will determine how your assets are distributed, which may not align with your wishes. This can lead to unintended consequences, such as assets being allocated to distant relatives instead of those you intended to benefit. Additionally, the probate process, which is required to validate a will, can be time-consuming and costly, but having a well-drafted will can help streamline this process and minimize potential disputes among heirs.

While a will is essential, it may not always be sufficient to fully protect your family’s financial future. This is where trusts become a valuable tool in estate planning. A trust is a legal arrangement that allows you to transfer assets to a trustee, who then manages and distributes them according to your instructions. Unlike a will, a trust can take effect during your lifetime or upon your death, providing greater flexibility in managing your estate. One of the key advantages of a trust is that it allows assets to bypass the probate process, ensuring a faster and more private distribution to beneficiaries. This can be particularly beneficial for families who wish to avoid the delays and expenses associated with probate court proceedings.

Moreover, trusts offer additional layers of protection that a will alone cannot provide. For instance, a revocable living trust allows you to retain control over your assets while you are alive and ensures a seamless transition of management in the event of incapacity. This can prevent the need for court-appointed guardianship, which can be both costly and emotionally challenging for family members. Additionally, irrevocable trusts can be used to protect assets from creditors, lawsuits, or excessive taxation, ensuring that your wealth is preserved for future generations.

Another important consideration is the protection of minor children or beneficiaries who may not be financially responsible. A trust allows you to set specific conditions for asset distribution, such as releasing funds at certain ages or for specific purposes like education or healthcare. This ensures that your loved ones receive financial support in a controlled manner, reducing the risk of mismanagement or financial hardship.

Ultimately, incorporating wills and trusts into your estate plan provides peace of mind, knowing that your family’s future is secure. By taking proactive steps to establish these legal documents, you can prevent unnecessary legal battles, protect your assets, and ensure that your loved ones are cared for according to your wishes. Consulting with an experienced estate planning attorney can help you navigate the complexities of wills and trusts, ensuring that your plan is tailored to meet your family’s unique needs.

Key Differences Between Wills And Trusts: Which One Is Right For You?

Wills and trusts are essential legal tools that help individuals protect their families and ensure their assets are distributed according to their wishes. While both serve similar purposes, they have distinct differences that can impact how an estate is managed and transferred. Understanding these differences is crucial in determining which option best suits your needs and those of your loved ones.

A will is a legal document that outlines how a person’s assets should be distributed after their death. It allows individuals to name beneficiaries, designate guardians for minor children, and specify final arrangements. One of the primary advantages of a will is its simplicity. It is relatively easy to create and can be modified or revoked at any time before the testator’s passing. However, a will must go through probate, a court-supervised process that validates the document and oversees the distribution of assets. Probate can be time-consuming and costly, potentially delaying the transfer of assets to beneficiaries. Additionally, because probate proceedings are public, the details of the estate become part of the public record, which may not be ideal for those who value privacy.

In contrast, a trust is a legal arrangement in which a person, known as the grantor, transfers assets into a trust to be managed by a trustee for the benefit of designated beneficiaries. One of the most significant advantages of a trust is that it allows assets to bypass probate, enabling a faster and more private distribution of property. Trusts can be either revocable or irrevocable, each serving different purposes. A revocable living trust allows the grantor to retain control over the assets during their lifetime and make changes as needed. Upon the grantor’s death, the assets are distributed according to the trust’s terms without the need for probate. An irrevocable trust, on the other hand, cannot be modified once established, but it offers benefits such as asset protection and potential tax advantages.

Another key difference between wills and trusts is the level of control they provide over asset distribution. A will takes effect only after the testator’s death, meaning assets are distributed in a lump sum unless otherwise specified. This can be problematic if beneficiaries are young or financially inexperienced. A trust, however, allows for more detailed instructions on how and when assets should be distributed. For example, a trust can specify that funds be released in increments or upon reaching certain milestones, such as graduating from college or reaching a specific age. This level of control can help protect beneficiaries from mismanaging their inheritance.

When deciding between a will and a trust, it is important to consider factors such as the size of the estate, the complexity of asset distribution, and the need for privacy. For individuals with modest estates and straightforward wishes, a will may be sufficient. However, those with larger estates, minor children, or concerns about probate may benefit from establishing a trust. In many cases, a comprehensive estate plan includes both a will and a trust to ensure all aspects of asset distribution and family protection are addressed. Consulting with an estate planning attorney can provide valuable guidance in making the best decision for your unique circumstances.

Common Mistakes To Avoid When Creating A Will Or Trust

One of the most important steps in securing your family’s future is creating a comprehensive estate plan, which often includes a will or trust. However, many individuals make critical mistakes during this process, potentially leading to unintended consequences, legal disputes, or financial burdens for their loved ones. Understanding these common pitfalls can help ensure that your estate plan is legally sound and effectively protects your family.

A frequent mistake is failing to update a will or trust regularly. Life circumstances change over time, including marriages, divorces, births, and deaths, all of which can impact an estate plan. If a will or trust does not reflect these changes, it may not distribute assets according to the individual’s current wishes. Regularly reviewing and updating estate planning documents ensures that they remain aligned with evolving family dynamics and financial situations.

Another common error is not clearly specifying beneficiaries. Ambiguous language or vague instructions can lead to confusion and disputes among heirs. It is essential to clearly identify beneficiaries by their full legal names and specify the exact assets they are to receive. Additionally, failing to name contingent beneficiaries can create complications if a primary beneficiary predeceases the testator. By providing precise instructions, individuals can minimize the risk of legal challenges and ensure that their assets are distributed as intended.

Many people also overlook the importance of properly funding a trust. Simply creating a trust document is not enough; assets must be legally transferred into the trust’s name. If this step is neglected, those assets may still be subject to probate, defeating one of the primary purposes of establishing a trust. Ensuring that real estate, bank accounts, and other valuable assets are correctly titled in the trust’s name is crucial for avoiding unnecessary legal complications.

Additionally, some individuals attempt to draft their own wills or trusts without professional guidance. While online templates and do-it-yourself estate planning tools may seem convenient, they often fail to account for state-specific laws and unique family circumstances. A poorly drafted document can lead to unintended tax consequences, legal disputes, or even invalidation of the entire estate plan. Consulting an experienced estate planning attorney helps ensure that all legal requirements are met and that the documents accurately reflect the individual’s wishes.

Another significant mistake is failing to consider potential tax implications. Estate taxes, inheritance taxes, and capital gains taxes can significantly impact the value of an estate if not properly planned for. Without strategic tax planning, beneficiaries may face unnecessary financial burdens. Establishing trusts, gifting assets during one’s lifetime, or utilizing other tax-saving strategies can help minimize the tax impact on heirs. Seeking professional advice from an estate planning attorney or financial advisor can provide valuable insights into tax-efficient strategies.

Finally, many individuals neglect to communicate their estate plan to their family members. While discussing end-of-life planning can be uncomfortable, transparency can help prevent misunderstandings and disputes. Informing key family members about the existence and location of estate planning documents, as well as the reasoning behind certain decisions, can foster clarity and reduce the likelihood of conflicts.

By avoiding these common mistakes, individuals can create a well-structured estate plan that effectively protects their family’s financial future. Taking the time to carefully draft, update, and communicate a will or trust ensures that assets are distributed according to one’s wishes while minimizing legal complications and financial burdens for loved ones.