“Know Your Rights, Stand Your Ground: Navigate Debt Collection with Confidence.”

Knowing Your Legal Protections Against Debt Collectors

Dealing with debt collectors can be a stressful and overwhelming experience, but understanding your legal protections can help you navigate these interactions with confidence. In many countries, laws are in place to regulate how debt collectors operate, ensuring that consumers are treated fairly and with respect. By familiarizing yourself with these protections, you can safeguard your rights and prevent any potential harassment or unfair treatment.

One of the most important legal protections available to consumers is the right to be free from abusive or deceptive practices. Debt collectors are prohibited from using threats, intimidation, or misleading statements to pressure individuals into making payments. This means they cannot falsely claim that you will be arrested, that legal action has already been taken against you when it has not, or that they have the authority to seize your property without due process. If a debt collector engages in such behavior, you have the right to report them to the appropriate regulatory agencies.

In addition to protection from harassment, consumers also have the right to receive accurate and transparent information about their debts. Debt collectors are required to provide written validation of the debt, including details about the amount owed and the original creditor. If you believe there is an error or that the debt does not belong to you, you have the right to dispute it. Upon receiving a dispute, the collector must cease collection efforts until they have provided verification of the debt. This safeguard ensures that individuals are not unfairly pursued for debts they do not owe.

Another critical protection is the right to control how and when debt collectors contact you. While collectors are permitted to reach out to discuss outstanding debts, they must do so within reasonable hours, typically between 8 a.m. and 9 p.m. They are also prohibited from contacting you at work if you have informed them that your employer does not allow such calls. Furthermore, you have the right to request that all communication be conducted in writing, which can help you keep a clear record of all interactions. If you prefer to stop all contact from a debt collector, you can submit a written request instructing them to cease communication. While this does not eliminate the debt, it does prevent further direct contact, except for notifications regarding legal actions.

Beyond communication restrictions, consumers are also protected from unfair collection practices. Debt collectors cannot add unauthorized fees or interest to the amount owed, nor can they attempt to collect a debt that has passed the statute of limitations. Each jurisdiction has specific time limits for how long a creditor or collector can legally pursue a debt through the courts. If a debt is too old, you may not be legally obligated to pay it, though collectors may still attempt to request payment. Understanding these limitations can help you make informed decisions about how to handle old debts.

If you believe a debt collector has violated your rights, you have options for recourse. You can file a complaint with consumer protection agencies, such as the Federal Trade Commission or the Consumer Financial Protection Bureau in the United States. Additionally, you may have the right to take legal action against a collector who has engaged in unlawful practices. In some cases, consumers may be entitled to damages if they have suffered harm due to a collector’s misconduct.

By knowing your legal protections, you can approach debt collection situations with greater confidence and ensure that your rights are upheld. While managing debt can be challenging, being informed about your rights empowers you to handle these interactions in a way that is fair and legally sound.

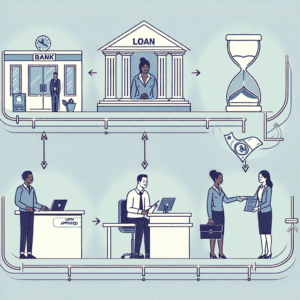

Steps to Take When a Debt Collector Contacts You

When a debt collector contacts you, it is essential to understand your rights and take the appropriate steps to protect yourself. The first step is to remain calm and gather as much information as possible. Debt collection can be stressful, but responding with a clear and informed approach will help you manage the situation effectively. When a collector reaches out, request their name, the name of the collection agency, the original creditor, and the amount they claim you owe. This information will allow you to verify the legitimacy of the debt and ensure that you are dealing with a legitimate collector rather than a scam.

Once you have gathered the necessary details, it is important to request written verification of the debt. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to receive a written notice within five days of initial contact. This notice should include the amount of the debt, the name of the original creditor, and information on how to dispute the debt if you believe it is incorrect. If the collector does not provide this documentation, you should not make any payments or acknowledge the debt until you receive proper verification.

After receiving the written notice, carefully review the details to confirm whether the debt is accurate and whether you are legally responsible for it. Mistakes can occur, and debts may sometimes be assigned to the wrong person. If you believe the debt is incorrect or do not recognize it, you have the right to dispute it in writing within 30 days of receiving the notice. Sending a dispute letter will require the collector to provide further proof of the debt before they can continue collection efforts. Be sure to send this letter via certified mail with a return receipt to have a record of your communication.

If the debt is valid and you acknowledge responsibility, the next step is to assess your financial situation and determine how to proceed. You may be able to negotiate a payment plan or a settlement with the collector. Before agreeing to any terms, ensure that you fully understand the agreement and that it is documented in writing. Never provide payment information over the phone without first receiving a written agreement outlining the terms of repayment. Additionally, be cautious of any pressure tactics used by collectors, as they are legally prohibited from using harassment, threats, or deceptive practices.

It is also important to be aware of your rights under federal and state laws. The FDCPA protects consumers from abusive collection practices, including excessive phone calls, threats of legal action that cannot be taken, and contacting you at inconvenient times. If a collector violates these rights, you have the option to file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office. Keeping records of all communications with debt collectors, including phone calls, letters, and emails, can serve as evidence if you need to take further action.

By taking these steps, you can ensure that you handle debt collection matters in a way that protects your rights and financial well-being. Understanding your legal protections and responding strategically will help you navigate the process with confidence and avoid unnecessary stress.

How to Dispute a Debt and Protect Your Credit

Disputing a debt and protecting your credit are essential steps when dealing with debt collectors. Understanding your rights and taking the appropriate actions can help ensure that inaccurate or unfair claims do not negatively impact your financial standing. The Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA) provide consumers with protections against unfair debt collection practices and inaccurate credit reporting. By following the proper procedures, you can challenge a debt and safeguard your credit score.

When you receive a collection notice, the first step is to verify the accuracy of the debt. Debt collectors are required to provide specific details, including the amount owed, the name of the original creditor, and your right to dispute the debt. If you believe the debt is incorrect or do not recognize it, you have the right to request validation. Within 30 days of receiving the notice, you should send a written request for verification. The collector must then provide documentation proving that the debt is valid. If they fail to do so, they cannot continue collection efforts.

If the debt is inaccurate or does not belong to you, disputing it with both the debt collector and the credit bureaus is crucial. To dispute the debt with the credit bureaus, you must submit a written dispute to the relevant credit reporting agencies—Equifax, Experian, and TransUnion. Your dispute should include your personal information, details about the debt, and any supporting documentation that proves the inaccuracy. The credit bureaus are required to investigate the claim within 30 days and must remove or correct any errors if they find the dispute valid.

While the dispute is under review, it is important to monitor your credit report to ensure that no further negative information is added. You are entitled to a free credit report from each of the three major credit bureaus once a year through AnnualCreditReport.com. Regularly reviewing your credit report allows you to identify any discrepancies and take action before they cause significant damage to your credit score.

In some cases, debt collectors may continue to contact you even after you have disputed the debt. If this happens, you have the right to request that they cease communication. Under the FDCPA, you can send a written request instructing the collector to stop contacting you. Once they receive this request, they can only contact you to confirm that they will no longer pursue the debt or to inform you of legal action. However, it is important to note that stopping communication does not eliminate the debt if it is valid.

If a debt collector reports an inaccurate debt to the credit bureaus, it can have a lasting impact on your credit score. A lower credit score can make it more difficult to obtain loans, secure housing, or even find employment. Therefore, taking immediate action to dispute incorrect debts is essential. If the credit bureaus fail to correct an error, you may need to escalate the matter by filing a complaint with the Consumer Financial Protection Bureau (CFPB) or seeking legal assistance.

Protecting your credit also involves understanding your rights regarding time-barred debts. Each state has a statute of limitations that determines how long a creditor or collector can legally sue you for a debt. If a debt is past the statute of limitations, you are not legally required to pay it, though collectors may still attempt to collect. However, making a payment on an old debt can reset the statute of limitations, potentially reviving the collector’s ability to take legal action. Before making any payments, it is advisable to confirm whether the debt is time-barred.

In addition to disputing inaccurate debts, negotiating with creditors or collectors can sometimes be a viable option. If the debt is valid but unaffordable, you may be able to arrange a settlement or payment plan. When negotiating, always request written confirmation of any agreement before making payments. This ensures that the terms are clear and that the collector upholds their end of the agreement.

Ultimately, disputing a debt and protecting your credit require diligence and knowledge of your rights. By verifying debts, disputing inaccuracies, monitoring your credit report, and understanding legal protections, you can prevent unfair collection practices from harming your financial future. Taking proactive steps can help you maintain a strong credit profile and avoid unnecessary financial stress.