“Smart Spending: Avoid Costly Credit Card Mistakes and Take Control of Your Finances!”

Overspending: How to Control Your Credit Card Usage and Stay Within Budget

Credit cards can be valuable financial tools when used responsibly, but they also present significant risks if not managed properly. One of the most common mistakes people make with credit cards is overspending, which can lead to mounting debt and financial instability. Many individuals fall into the trap of using credit cards as an extension of their income, rather than as a means of convenience or financial flexibility. This often results in spending beyond their means, making it difficult to pay off balances in full each month. To avoid this pitfall, it is essential to develop disciplined spending habits and implement strategies that help maintain control over credit card usage.

One effective way to prevent overspending is to establish a clear and realistic budget. By tracking income and expenses, individuals can determine how much they can afford to charge to their credit cards without exceeding their financial limits. Setting spending limits based on this budget ensures that credit card usage remains within manageable boundaries. Additionally, using budgeting tools or mobile apps can provide real-time insights into spending patterns, helping individuals stay accountable and make informed financial decisions.

Another crucial strategy is to differentiate between wants and needs. Credit cards make it easy to make impulse purchases, especially when the immediate financial impact is not felt. However, distinguishing between essential expenses and discretionary spending can prevent unnecessary debt accumulation. Before making a purchase, individuals should ask themselves whether the item is a necessity or a luxury. If it is not essential, it may be wise to delay the purchase or save for it instead of relying on credit.

Furthermore, setting up automatic payment reminders or alerts can help individuals stay on top of their credit card usage. Many credit card issuers offer features that notify users when they are approaching their spending limits or when a payment is due. These reminders can serve as a safeguard against excessive spending and ensure that payments are made on time, avoiding late fees and interest charges.

In addition to monitoring spending, it is beneficial to adopt the practice of paying off the full balance each month. Carrying a balance from month to month results in interest charges that can quickly accumulate, making it more challenging to pay off debt. By paying the full statement balance, individuals can avoid interest fees and maintain financial stability. If paying the full balance is not possible, making more than the minimum payment can help reduce the overall debt burden and prevent long-term financial strain.

Another way to control credit card usage is to limit the number of credit cards in use. Having multiple credit cards can increase the temptation to spend more than necessary, leading to higher debt levels. While having a credit card can be beneficial for building credit history, it is important to manage them wisely. Keeping the number of active credit cards to a minimum can simplify financial management and reduce the risk of overspending.

Ultimately, responsible credit card usage requires self-discipline and financial awareness. By setting a budget, distinguishing between needs and wants, using alerts, paying balances in full, and limiting the number of credit cards, individuals can avoid the common mistake of overspending. Developing these habits not only helps maintain financial health but also ensures that credit cards remain a useful tool rather than a source of financial stress.

Missing Payments: The Consequences of Late Payments and How to Stay on Track

Missing credit card payments can have serious financial consequences, yet many people underestimate the impact of a late payment. When a payment is missed, even by a single day, credit card issuers may impose late fees, which can add up over time and make it more difficult to pay off the balance. Additionally, late payments can trigger penalty interest rates, significantly increasing the cost of carrying a balance. These higher rates can make it even more challenging to manage debt, leading to a cycle of financial strain that is difficult to break.

Beyond the immediate financial penalties, late payments can also harm an individual’s credit score. Payment history is one of the most significant factors in determining a credit score, and even one missed payment can cause a noticeable drop. A lower credit score can make it harder to qualify for loans, credit cards with favorable terms, or even rental agreements. In some cases, employers and insurance companies also review credit reports, meaning that a history of late payments could have broader implications beyond borrowing.

To avoid these negative consequences, it is essential to establish habits that ensure payments are made on time. One of the most effective strategies is setting up automatic payments. Most credit card issuers offer this option, allowing cardholders to schedule at least the minimum payment each month. This ensures that even if a due date is forgotten, the payment will still be processed, preventing late fees and potential damage to credit scores. However, it is important to regularly review account statements to ensure that the correct amount is being paid and that there are no unauthorized charges.

For those who prefer more control over their payments, setting up reminders can be a useful alternative. Many banks and credit card companies provide email or text notifications when a payment due date is approaching. Additionally, using a calendar or budgeting app to track due dates can help individuals stay organized and avoid missing payments. By incorporating these reminders into a financial routine, it becomes easier to stay on top of obligations and maintain a positive payment history.

Another important step in preventing late payments is aligning due dates with an individual’s financial schedule. Many credit card issuers allow customers to change their payment due dates, which can be particularly helpful for those who receive paychecks on a specific schedule. By selecting a due date that coincides with a payday, individuals can ensure that funds are available when the payment is due, reducing the risk of missing a deadline due to insufficient funds.

In addition to these proactive measures, it is also crucial to have a plan in place in case a payment is missed. If a late payment does occur, contacting the credit card issuer as soon as possible may help mitigate the consequences. Some issuers may be willing to waive a late fee or prevent a penalty interest rate increase, especially if the cardholder has a history of on-time payments. Taking immediate action can help minimize the impact and prevent further financial difficulties.

Ultimately, staying on track with credit card payments requires diligence and organization. By implementing strategies such as automatic payments, reminders, and aligning due dates with income schedules, individuals can avoid the costly consequences of late payments. Maintaining a consistent payment history not only protects credit scores but also ensures financial stability in the long run.

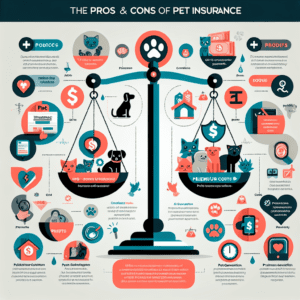

Ignoring Rewards and Fees: Maximizing Benefits While Avoiding Hidden Costs

Many credit card users focus on convenience and purchasing power but often overlook the rewards and fees associated with their cards. This oversight can lead to missed opportunities for savings and unexpected costs that diminish the benefits of using credit. Understanding how to maximize rewards while minimizing fees is essential for making the most of a credit card.

One of the most common mistakes people make is failing to take full advantage of the rewards programs offered by their credit cards. Many cards provide cashback, travel points, or other incentives for specific types of purchases. However, cardholders often do not familiarize themselves with the details of these programs, resulting in lost potential savings. For example, some cards offer higher rewards for dining, groceries, or gas purchases, while others provide additional benefits for travel-related expenses. By not aligning spending habits with the card’s reward structure, users miss out on valuable perks that could significantly reduce their overall expenses.

In addition to overlooking rewards, many people fail to redeem them effectively. Some allow points or cashback to expire, while others redeem them for less valuable options, such as merchandise or gift cards, instead of travel or statement credits that offer better value. To maximize benefits, cardholders should regularly review their rewards balance and redemption options, ensuring they use their points in the most advantageous way possible. Setting reminders to redeem rewards before they expire can prevent unnecessary losses.

While rewards can be beneficial, they should not come at the expense of high fees. Many credit cards charge annual fees, foreign transaction fees, late payment fees, and interest charges that can quickly outweigh any rewards earned. One of the biggest mistakes consumers make is signing up for a rewards card without considering whether the benefits justify the costs. For instance, a card with a high annual fee may not be worthwhile if the user does not spend enough to earn significant rewards. Before applying for a credit card, individuals should carefully evaluate whether the rewards structure aligns with their spending habits and whether the fees are reasonable given the benefits provided.

Another common pitfall is ignoring interest rates and carrying a balance. While rewards cards often offer attractive incentives, they also tend to have higher interest rates than basic credit cards. If a cardholder does not pay off their balance in full each month, the interest charges can quickly erode any rewards earned. To avoid this, it is crucial to use credit cards responsibly by paying off balances on time and in full whenever possible. This practice not only prevents unnecessary interest charges but also helps maintain a strong credit score.

Additionally, many people overlook hidden fees, such as foreign transaction fees, which can add up when traveling or making international purchases. Some credit cards charge a percentage of each transaction made in a foreign currency, which can significantly increase costs. To avoid this, consumers should choose a card that does not impose foreign transaction fees if they frequently travel or shop internationally.

By paying close attention to both rewards and fees, credit card users can maximize their benefits while minimizing unnecessary costs. Understanding the terms and conditions of a credit card, strategically using rewards, and avoiding excessive fees can lead to a more financially sound approach to credit card usage.