Choosing the right credit card can be challenging, especially when comparing two strong contenders like the Wells Fargo Active Cash® and the Wells Fargo Autograph℠. Both cards offer valuable rewards, but they cater to different spending habits and financial goals. In this guide, we’ll break down their features, benefits, and drawbacks to help you decide which one suits you best.

Overview of Wells Fargo Active Cash®

The Wells Fargo Active Cash® card is a straightforward cash back credit card that offers a flat-rate rewards structure, making it ideal for those who prefer simplicity.

Key Features:

- Unlimited 2% cash rewards on all purchases.

- Introductory bonus: Earn a $200 cash rewards bonus after spending $500 in the first 3 months.

- 0% intro APR for 15 months on purchases and balance transfers, then a variable APR applies.

- No annual fee, making it a cost-effective option.

- Cell phone protection when you pay your phone bill with the card.

Pros and Cons:

- Pros: High flat-rate cash back, no annual fee, simple rewards structure.

- Cons: No bonus categories, lacks travel perks.

Overview of Wells Fargo Autograph℠

The Wells Fargo Autograph℠ card is designed for those who want to maximize rewards in specific spending categories, particularly for travel and dining.

Key Features:

- 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans.

- 1X point on all other purchases.

- Introductory bonus: Earn 20,000 bonus points (worth $200) after spending $1,000 in the first 3 months.

- 0% intro APR for 12 months on purchases, then a variable APR applies.

- No annual fee, making it a great value for rewards seekers.

Pros and Cons:

- Pros: High rewards in multiple categories, no annual fee, travel-friendly benefits.

- Cons: Lower base rewards rate (1X on non-category spending), requires strategic spending.

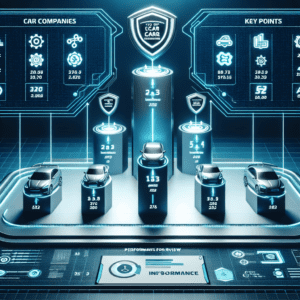

Side-by-Side Comparison

| Feature | Wells Fargo Active Cash® | Wells Fargo Autograph℠ |

|---|---|---|

| Rewards Rate | 2% cash back on all purchases | 3X points on select categories, 1X on others |

| Sign-Up Bonus | $200 after spending $500 in 3 months | 20,000 points ($200 value) after spending $1,000 in 3 months |

| Intro APR | 0% for 15 months | 0% for 12 months |

| Annual Fee | $0 | $0 |

| Best For | Flat-rate cash back on all purchases | Maximizing rewards in specific categories |

Which Card Should You Choose?

The best card for you depends on your spending habits and financial goals. Here’s a quick guide to help you decide:

Choose the Wells Fargo Active Cash® if:

- You prefer a simple, flat-rate cash back structure.

- You don’t want to track bonus categories.

- You want a longer 0% intro APR period for purchases and balance transfers.

Choose the Wells Fargo Autograph℠ if:

- You spend heavily in categories like dining, travel, and gas.

- You want to maximize rewards with strategic spending.

- You prefer earning points that can be redeemed for travel and other perks.

Final Thoughts

Both the Wells Fargo Active Cash® and Wells Fargo Autograph℠ offer excellent value with no annual fee, but they cater to different types of spenders. If you want a hassle-free cash back experience, the Active Cash® is the way to go. However, if you’re looking to maximize rewards in specific categories, the Autograph℠ is a better fit.

Ultimately, the right choice depends on your spending habits and financial goals. Consider how you use your credit card and choose the one that aligns best with your lifestyle.