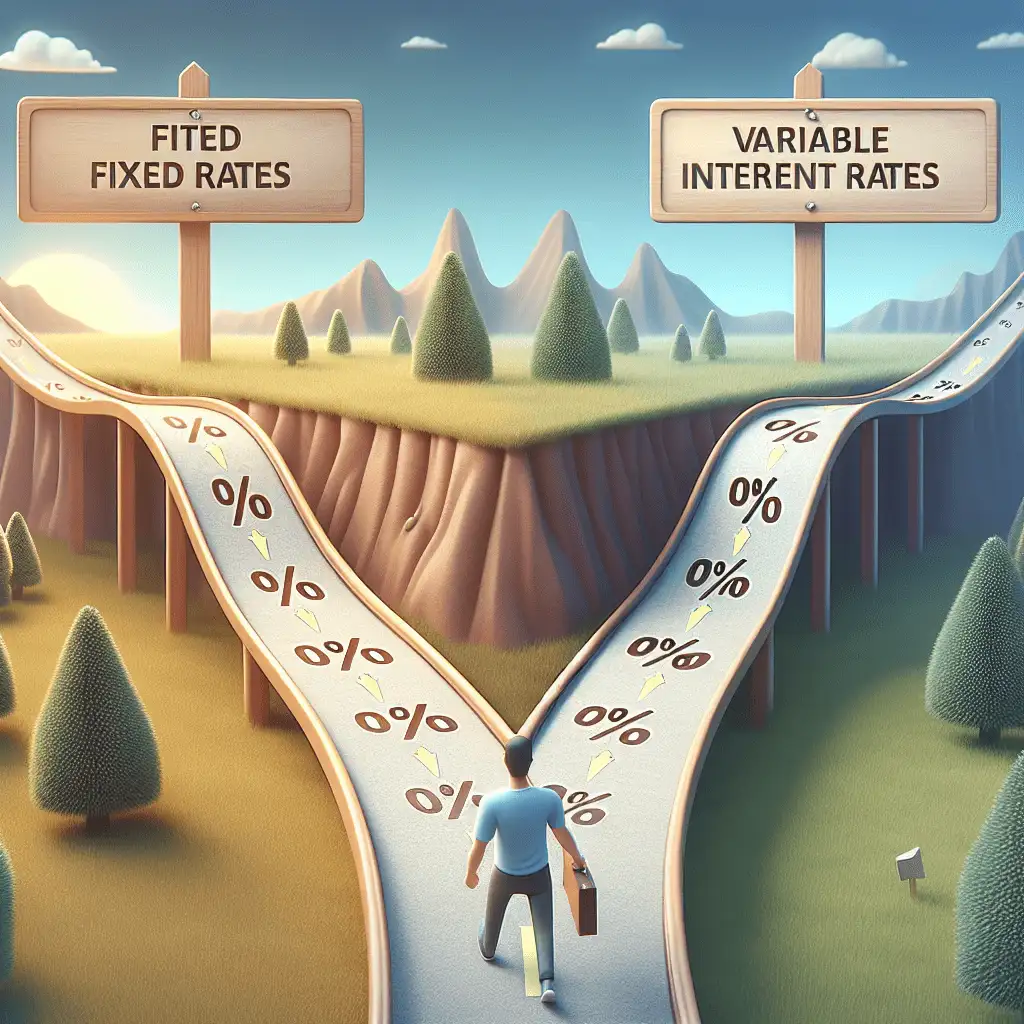

“Fixed vs. Variable Interest Rates: Find the Loan That Fits Your Financial Future!”

Pros And Cons Of Fixed Vs. Variable Interest Rates

When deciding between a fixed or variable interest rate for a loan, it is essential to understand the advantages and disadvantages of each option. Both types of interest rates have unique characteristics that can impact the overall cost of borrowing, making it crucial to evaluate their benefits and drawbacks before making a decision.

A fixed interest rate remains constant throughout the loan term, providing borrowers with predictable monthly payments. One of the primary advantages of this type of loan is stability. Since the interest rate does not fluctuate, borrowers can accurately budget their expenses without worrying about market changes. This predictability is particularly beneficial for individuals who prefer financial certainty or have a fixed income. Additionally, fixed-rate loans protect borrowers from potential interest rate increases, ensuring that their payments remain manageable even if market rates rise.

However, fixed interest rates also have some disadvantages. Typically, they start higher than variable rates, meaning borrowers may initially pay more in interest. Furthermore, if market interest rates decrease, those with fixed-rate loans will not benefit from lower payments unless they refinance, which can involve additional costs and administrative processes. This rigidity may make fixed-rate loans less attractive to borrowers who anticipate a decline in interest rates or plan to repay their loan quickly.

On the other hand, variable interest rates fluctuate based on market conditions, which means that monthly payments can change over time. One of the most significant advantages of variable-rate loans is that they often start with lower interest rates compared to fixed-rate loans. This initial lower rate can result in reduced borrowing costs, making variable-rate loans appealing to those looking to save money in the short term. Additionally, if market interest rates decrease, borrowers with variable-rate loans will benefit from lower payments without needing to refinance.

Despite these benefits, variable interest rates come with inherent risks. Since they are tied to market fluctuations, borrowers may experience increased payments if interest rates rise. This unpredictability can make budgeting more challenging, particularly for individuals with limited financial flexibility. In extreme cases, significant rate increases can lead to financial strain, making it difficult for borrowers to meet their repayment obligations. Furthermore, while some variable-rate loans have interest rate caps to limit increases, these caps may still allow for substantial payment fluctuations over time.

When choosing between a fixed and variable interest rate, borrowers should consider their financial situation, risk tolerance, and market conditions. Those who prioritize stability and long-term predictability may find fixed-rate loans more suitable, as they provide consistent payments and protection against rising interest rates. Conversely, borrowers who are comfortable with some level of risk and anticipate lower interest rates in the future may prefer variable-rate loans, as they offer the potential for cost savings.

Ultimately, the decision between fixed and variable interest rates depends on individual financial goals and circumstances. By carefully weighing the pros and cons of each option, borrowers can make an informed choice that aligns with their needs and ensures manageable loan repayments over time.

How Market Conditions Impact Fixed And Variable Interest Rates

Fixed and variable interest rates respond differently to market conditions, making it essential for borrowers to understand how economic factors influence each option. Interest rates are primarily affected by central bank policies, inflation, and overall economic performance. When evaluating whether a fixed or variable interest rate is the better choice, it is crucial to consider how these external factors shape borrowing costs over time.

Fixed interest rates remain constant throughout the loan term, providing stability and predictability for borrowers. These rates are typically determined at the time of loan origination and are influenced by broader economic conditions, including government bond yields and central bank policies. When market interest rates are low, borrowers who secure a fixed-rate loan can benefit from locking in a favorable rate, protecting themselves from potential future increases. However, if market rates decline after the loan is issued, fixed-rate borrowers may miss out on the opportunity to take advantage of lower borrowing costs unless they refinance.

In contrast, variable interest rates fluctuate based on market conditions, often tied to a benchmark rate such as the prime rate or the London Interbank Offered Rate (LIBOR). As central banks adjust monetary policy in response to inflation, employment levels, and economic growth, variable rates can rise or fall accordingly. During periods of economic expansion, central banks may increase interest rates to control inflation, leading to higher borrowing costs for those with variable-rate loans. Conversely, during economic downturns, central banks often lower interest rates to stimulate borrowing and investment, which can result in reduced payments for borrowers with variable-rate loans.

The choice between fixed and variable interest rates depends largely on a borrower’s risk tolerance and expectations regarding future market conditions. If interest rates are expected to rise, a fixed-rate loan may be the safer option, as it shields borrowers from potential increases in monthly payments. On the other hand, if rates are projected to decline or remain stable, a variable-rate loan could offer initial cost savings, as these loans often start with lower interest rates compared to fixed-rate alternatives.

Another important consideration is the length of the loan term. Short-term loans may benefit more from variable rates, as the likelihood of significant rate fluctuations over a shorter period is lower. However, for long-term loans, such as mortgages, the uncertainty associated with variable rates can pose a greater financial risk. Borrowers who prefer stability and want to avoid potential payment increases may find fixed rates more suitable, while those comfortable with some level of risk may opt for variable rates in hopes of benefiting from lower costs over time.

Ultimately, market conditions play a crucial role in determining the advantages and disadvantages of fixed and variable interest rates. Borrowers should carefully assess economic trends, central bank policies, and their own financial situation before making a decision. Consulting with financial professionals and staying informed about market developments can help individuals choose the loan option that best aligns with their financial goals and risk tolerance. By understanding how interest rates respond to economic changes, borrowers can make more informed decisions and manage their debt effectively in varying market conditions.

Choosing The Right Loan: Fixed Vs. Variable Interest Rates Explained

When deciding on a loan, one of the most important considerations is whether to choose a fixed or variable interest rate. Each option has distinct advantages and potential drawbacks, making it essential to understand how they work and which one aligns best with your financial situation. By carefully evaluating the differences between these two types of interest rates, borrowers can make an informed decision that suits their long-term financial goals.

A fixed interest rate remains constant throughout the life of the loan, meaning that monthly payments remain predictable and unchanged. This stability can be particularly beneficial for individuals who prefer consistency in their budgeting and want to avoid fluctuations in their repayment amounts. Fixed-rate loans are often favored by borrowers who plan to keep their loan for an extended period, as they provide protection against potential interest rate increases in the future. Additionally, during periods of rising interest rates, having a fixed rate ensures that borrowers do not experience higher monthly payments, which can be a significant advantage in maintaining financial stability.

On the other hand, a variable interest rate fluctuates based on changes in a benchmark interest rate, such as the prime rate or the London Interbank Offered Rate (LIBOR). As a result, monthly payments may increase or decrease over time, depending on market conditions. One of the primary benefits of a variable-rate loan is that it often starts with a lower interest rate compared to a fixed-rate loan. This initial lower rate can lead to reduced monthly payments in the short term, making it an attractive option for borrowers who anticipate paying off their loan quickly or who are comfortable with potential rate adjustments.

However, the unpredictability of variable interest rates can pose a risk, particularly if interest rates rise significantly. Borrowers who choose this option must be prepared for the possibility of higher payments in the future, which could impact their financial stability. While some variable-rate loans have interest rate caps that limit how much the rate can increase within a specific period, there is still an inherent level of uncertainty that borrowers must consider.

When determining which loan option is better, it is essential to assess individual financial circumstances and risk tolerance. For those who prioritize stability and long-term planning, a fixed-rate loan may be the better choice, as it provides certainty in repayment amounts and protection against market fluctuations. Conversely, borrowers who are comfortable with some level of risk and are looking for potential cost savings in the short term may find a variable-rate loan more appealing.

Additionally, economic conditions play a crucial role in this decision. In a low-interest-rate environment, locking in a fixed rate can be advantageous, as it ensures that borrowers benefit from favorable rates over the life of the loan. However, if interest rates are expected to decline, a variable-rate loan may offer greater savings over time.

Ultimately, the choice between a fixed and variable interest rate depends on personal financial goals, market conditions, and risk tolerance. By carefully weighing the advantages and potential risks of each option, borrowers can select the loan structure that best aligns with their needs and ensures financial stability in the long run.