Moving to a new home can be an exciting yet expensive endeavor. From hiring movers to security deposits and travel expenses, the costs can quickly add up. If you’re struggling to cover these expenses, a relocation loan might be the solution. In this guide, we’ll explore the best loan options to help you finance your move without breaking the bank.

Understanding the Costs of Moving

Before diving into loan options, it’s essential to understand the various expenses associated with moving. These costs can vary depending on distance, household size, and additional services required.

- Moving Company Fees: Professional movers can charge anywhere from $800 to $5,000, depending on the distance and size of your move.

- Security Deposits & Rent: If you’re renting, expect to pay a security deposit and first month’s rent upfront.

- Utility Setup Fees: Transferring or setting up utilities like electricity, water, and internet can cost between $100 and $300.

- Travel Expenses: If you’re moving long-distance, factor in gas, flights, or hotel stays.

- Storage Costs: Temporary storage units can range from $50 to $300 per month.

Best Loan Options to Cover Moving Expenses

If you don’t have enough savings to cover your move, several financing options can help. Here are the best loans and financial solutions to consider:

1. Personal Loans for Moving

Personal loans are a popular choice for covering moving expenses. These loans are unsecured, meaning you don’t need collateral, and they offer fixed interest rates and predictable monthly payments.

Pros:

- Fixed interest rates and repayment terms

- Quick approval and funding (often within a few days)

- No collateral required

Cons:

- Interest rates can be high for those with poor credit

- May require a good credit score for favorable terms

Best for: Individuals with good credit who need a lump sum to cover moving costs.

2. Credit Cards with 0% APR Introductory Offers

If your moving expenses are relatively low, a credit card with a 0% APR introductory offer can be a smart way to finance your move without paying interest—provided you pay off the balance before the promotional period ends.

Pros:

- Interest-free financing during the introductory period

- Convenient and flexible payment options

Cons:

- High-interest rates after the promotional period

- Potential impact on credit utilization and credit score

Best for: Those with good credit who can pay off the balance within the 0% APR period.

3. Employer Relocation Assistance

Some companies offer relocation assistance as part of their benefits package. This can include reimbursement for moving expenses, temporary housing, or even a lump sum to cover costs.

Pros:

- May cover a significant portion of moving expenses

- No repayment required

Cons:

- Not all employers offer relocation assistance

- May have restrictions on how funds can be used

Best for: Employees relocating for a new job or company transfer.

4. Home Equity Loans or HELOCs

If you own a home and have built up equity, a home equity loan or home equity line of credit (HELOC) can provide funds for your move at a lower interest rate than personal loans or credit cards.

Pros:

- Lower interest rates compared to personal loans

- Potential tax benefits

Cons:

- Requires home equity as collateral

- Risk of foreclosure if you fail to repay

Best for: Homeowners with significant equity who need a low-interest financing option.

5. Moving Company Financing

Some moving companies offer financing plans that allow you to pay for their services over time. These plans may come with interest or fees, so it’s essential to compare costs before committing.

Pros:

- Convenient financing directly through the moving company

- May offer promotional 0% interest plans

Cons:

- Interest rates may be higher than personal loans

- Limited to covering moving company expenses only

Best for: Those using professional movers who offer financing options.

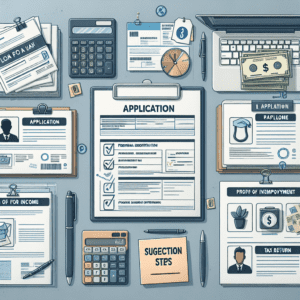

How to Choose the Right Loan for Your Move

When selecting a loan or financing option for your move, consider the following factors:

- Interest Rates: Compare rates to find the most affordable option.

- Repayment Terms: Choose a loan with manageable monthly payments.

- Approval Requirements: Check credit score and income requirements before applying.

- Loan Amount: Ensure the loan covers all necessary moving expenses.

Final Thoughts

Moving can be costly, but the right financing option can help ease the burden. Whether you opt for a personal loan, credit card, or employer assistance, it’s essential to choose a solution that fits your financial