Zero-interest loans are an attractive financing option, often advertised as a way to borrow money without paying extra. But are they really as good as they seem? While these loans can be beneficial in certain situations, they often come with hidden risks and conditions that borrowers should be aware of. In this article, we’ll explore how zero-interest loans work, their advantages and disadvantages, and whether they are truly a smart financial choice.

What Are Zero-Interest Loans?

A zero-interest loan is a type of financing where the borrower does not have to pay any interest on the principal amount for a specified period. These loans are commonly offered by retailers, car dealerships, and credit card companies as promotional deals to attract customers.

Some common examples of zero-interest loans include:

- Retail Financing: Many electronics and furniture stores offer “0% APR for 12 months” deals to encourage purchases.

- Auto Loans: Car manufacturers sometimes provide interest-free financing to boost sales.

- Credit Card Promotions: Some credit cards offer 0% interest on purchases or balance transfers for an introductory period.

The Benefits of Zero-Interest Loans

Zero-interest loans can be a great financial tool when used wisely. Here are some of the key benefits:

- Cost Savings: Since you’re not paying interest, you can save a significant amount compared to traditional loans.

- Affordable Payments: These loans allow you to spread out payments over time without additional costs.

- Access to Expensive Items: Consumers can purchase high-ticket items like appliances or cars without paying interest.

- Credit Score Improvement: If managed properly, making on-time payments can help build or improve your credit score.

The Hidden Risks of Zero-Interest Loans

Despite their appeal, zero-interest loans often come with hidden risks that can turn them into costly mistakes. Here are some potential pitfalls:

1. Deferred Interest Clauses

Many zero-interest loans include a deferred interest clause, meaning that if you fail to pay off the full balance by the end of the promotional period, you’ll be charged retroactive interest on the entire original amount. This can result in a hefty financial burden.

2. High Late Fees and Penalties

Missing a payment or paying late can void the zero-interest offer, leading to high interest rates and penalties. Some lenders impose interest rates as high as 25% or more once the promotional period ends.

3. Short Repayment Periods

Many zero-interest loans have short repayment terms, requiring large monthly payments. If you’re unable to pay off the balance in time, you may face financial strain.

4. Impact on Credit Score

Applying for multiple zero-interest loans can lead to hard inquiries on your credit report, potentially lowering your credit score. Additionally, high credit utilization from these loans can negatively impact your financial standing.

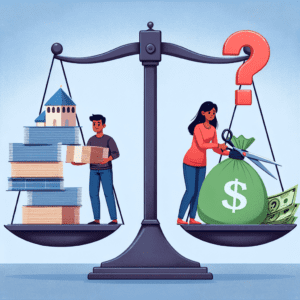

Are Zero-Interest Loans Right for You?

Before taking out a zero-interest loan, consider the following questions:

- Can you afford to pay off the loan within the promotional period?

- Are there any hidden fees or deferred interest clauses?

- Will this loan impact your credit score or financial stability?

- Are there better financing options available?

If you’re confident that you can meet the repayment terms and avoid penalties, a zero-interest loan can be a smart way to finance a purchase. However, if there’s any uncertainty about your ability to pay on time, it may be best to explore other options.

Final Thoughts

Zero-interest loans can be a valuable financial tool when used responsibly, but they are not always as risk-free as they appear. Understanding the terms, avoiding hidden fees, and ensuring timely payments are crucial to making the most of these offers. Before committing, always read the fine print and assess whether the loan aligns with your financial goals.

Have you ever taken out a zero-interest loan? Share your experiences in the comments below!