“Automate Your Wealth: Harness AI to Invest Smarter, Faster, and Better.”

The Power of AI in Wealth Management: How Automation is Revolutionizing Investing

Artificial intelligence is transforming the landscape of wealth management, offering investors unprecedented opportunities to optimize their portfolios, mitigate risks, and enhance decision-making. As financial markets become increasingly complex, AI-driven automation is proving to be a game-changer, enabling both institutional and individual investors to navigate the intricacies of investing with greater efficiency and precision. By leveraging machine learning algorithms, predictive analytics, and real-time data processing, AI is reshaping traditional investment strategies and redefining the role of financial advisors.

One of the most significant advantages of AI in wealth management is its ability to analyze vast amounts of data at an unparalleled speed. Traditional investment strategies often rely on historical data and human intuition, which can be prone to biases and limitations. In contrast, AI-powered systems can process real-time market data, identify patterns, and generate insights that would be impossible for a human to discern in the same timeframe. This capability allows investors to make more informed decisions, reducing the likelihood of emotional or impulsive trading. Furthermore, AI-driven models continuously learn and adapt, refining their predictions and strategies based on new information, which enhances their accuracy over time.

Another key benefit of AI in investing is the automation of portfolio management. Robo-advisors, which utilize AI algorithms to create and manage investment portfolios, have gained significant traction in recent years. These digital platforms assess an investor’s risk tolerance, financial goals, and market conditions to construct a diversified portfolio tailored to their needs. By automating asset allocation and rebalancing, robo-advisors eliminate the need for constant manual intervention, ensuring that portfolios remain aligned with an investor’s objectives. Additionally, they offer cost-effective solutions, making professional-grade investment management accessible to a broader audience.

Risk management is another area where AI is making a profound impact. Market volatility and economic uncertainties can pose significant challenges for investors, but AI-driven risk assessment tools can help mitigate potential losses. By analyzing historical market trends, economic indicators, and geopolitical events, AI models can predict potential downturns and suggest proactive measures to safeguard investments. These predictive capabilities enable investors to implement risk-adjusted strategies, such as hedging or diversification, to protect their portfolios from adverse market movements.

Moreover, AI is enhancing the personalization of investment strategies. Traditional financial advisory services often follow a one-size-fits-all approach, but AI enables a more customized experience. By analyzing an investor’s financial behavior, spending patterns, and long-term objectives, AI-driven platforms can recommend tailored investment opportunities that align with individual preferences. This level of personalization not only improves investment outcomes but also enhances the overall client experience, fostering greater trust and engagement.

Despite its numerous advantages, the integration of AI in wealth management is not without challenges. Data privacy concerns, algorithmic biases, and regulatory compliance are critical considerations that must be addressed to ensure ethical and responsible AI deployment. Financial institutions and technology providers must work collaboratively to establish transparent frameworks that prioritize investor protection while harnessing the full potential of AI.

As AI continues to evolve, its role in wealth management will only expand, offering investors more sophisticated tools to navigate the complexities of financial markets. By embracing AI-driven automation, investors can enhance their decision-making processes, optimize portfolio performance, and achieve greater financial security. The future of investing is undoubtedly being shaped by AI, and those who leverage its capabilities stand to gain a significant competitive advantage in the ever-changing world of finance.

AI-Driven Investment Strategies: Maximizing Returns with Machine Learning

Artificial intelligence is transforming the investment landscape, offering sophisticated tools that enable investors to make more informed decisions. AI-driven investment strategies leverage machine learning algorithms to analyze vast amounts of data, identify patterns, and optimize portfolio management. By utilizing these advanced technologies, investors can enhance their ability to predict market trends, mitigate risks, and maximize returns. As financial markets become increasingly complex, AI provides a competitive edge by processing information at a speed and accuracy that far surpasses human capabilities.

One of the most significant advantages of AI-driven investment strategies is their ability to analyze large datasets in real time. Traditional investment approaches often rely on historical data and human intuition, which can be limited by cognitive biases and the inability to process vast amounts of information efficiently. In contrast, machine learning algorithms can sift through extensive financial data, including market trends, economic indicators, and company performance metrics, to identify patterns that may not be immediately apparent to human analysts. This ability to detect subtle correlations allows AI-driven models to make more precise predictions about asset price movements and market fluctuations.

Moreover, AI enhances risk management by continuously monitoring market conditions and adjusting investment strategies accordingly. Machine learning models can assess risk factors by analyzing historical volatility, macroeconomic trends, and geopolitical events. By identifying potential risks before they materialize, AI-driven systems enable investors to make proactive decisions that protect their portfolios from significant losses. Additionally, these models can optimize asset allocation by dynamically adjusting investment portfolios based on changing market conditions, ensuring that capital is allocated to the most promising opportunities.

Another key benefit of AI in investment strategies is its ability to execute trades with precision and efficiency. Algorithmic trading, powered by AI, allows investors to automate trade execution based on predefined criteria. These algorithms can analyze market conditions in real time and execute trades at optimal prices, reducing the impact of market fluctuations and minimizing transaction costs. Furthermore, AI-driven trading systems can react to market changes within milliseconds, a speed that is impossible for human traders to match. This rapid response capability is particularly valuable in volatile markets, where timely decision-making can significantly impact investment outcomes.

Beyond trade execution, AI also plays a crucial role in portfolio optimization. Traditional portfolio management often involves a manual process of selecting assets based on historical performance and diversification principles. However, AI-driven models can enhance this process by continuously analyzing market data and adjusting portfolio allocations to maximize returns while minimizing risk. These models use advanced optimization techniques, such as reinforcement learning and deep learning, to refine investment strategies over time. As a result, investors can benefit from a more adaptive and data-driven approach to portfolio management.

As AI continues to evolve, its impact on investment strategies will only grow stronger. The integration of natural language processing enables AI systems to analyze news articles, earnings reports, and social media sentiment to gauge market sentiment and predict potential price movements. Additionally, advancements in deep learning allow AI models to improve their predictive accuracy by learning from past market behaviors. These innovations are reshaping the investment landscape, making AI an indispensable tool for investors seeking to maximize returns and manage risks effectively.

While AI-driven investment strategies offer numerous advantages, it is essential for investors to remain aware of potential challenges. Machine learning models rely on historical data, which may not always accurately predict future market conditions. Additionally, algorithmic trading systems can be susceptible to unforeseen market anomalies that may lead to unexpected losses. Therefore, investors should complement AI-driven insights with human expertise and sound financial judgment. By combining the power of AI with strategic decision-making, investors can harness the full potential of machine learning to optimize their investment strategies and achieve long-term financial success.

The Future of Financial Planning: How AI is Reshaping Wealth Automation

Artificial intelligence is revolutionizing the financial industry, transforming the way individuals manage their wealth and plan for the future. As technology continues to advance, AI-driven financial tools are becoming more sophisticated, offering investors unprecedented levels of automation, efficiency, and personalization. This shift is not only streamlining traditional financial planning processes but also making wealth management more accessible to a broader range of investors. By leveraging AI, individuals can now optimize their investment strategies, minimize risks, and make data-driven decisions with greater confidence.

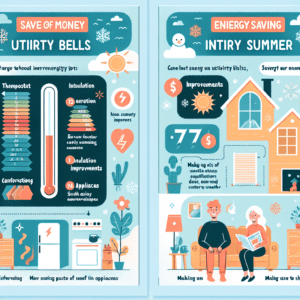

One of the most significant ways AI is reshaping wealth automation is through robo-advisors. These digital platforms use complex algorithms to analyze market trends, assess risk tolerance, and create personalized investment portfolios. Unlike traditional financial advisors, robo-advisors operate with minimal human intervention, allowing for lower fees and greater accessibility. As a result, investors who may have previously been unable to afford professional financial advice can now benefit from sophisticated portfolio management. Furthermore, AI-powered robo-advisors continuously monitor market conditions and automatically rebalance portfolios to ensure alignment with an investor’s financial goals. This level of automation reduces the need for constant manual adjustments, making long-term investing more efficient and less time-consuming.

Beyond portfolio management, AI is also enhancing financial forecasting and risk assessment. By analyzing vast amounts of historical and real-time data, AI can identify patterns and predict market movements with remarkable accuracy. This predictive capability enables investors to make more informed decisions, reducing the likelihood of costly mistakes. Additionally, AI-driven risk assessment tools can evaluate an individual’s financial situation and suggest strategies to mitigate potential losses. Whether it is adjusting asset allocations or identifying emerging investment opportunities, AI provides investors with valuable insights that were once only available to institutional traders.

Another critical aspect of AI-driven wealth automation is its ability to personalize financial planning. Traditional financial advisors often rely on standardized models that may not fully account for an individual’s unique circumstances. In contrast, AI can analyze a person’s spending habits, income patterns, and long-term financial goals to create highly customized investment strategies. This level of personalization ensures that financial plans are tailored to an investor’s specific needs, increasing the likelihood of achieving desired outcomes. Moreover, AI-powered financial assistants can provide real-time recommendations, helping individuals stay on track with their financial objectives.

As AI continues to evolve, its role in financial planning is expected to expand even further. Emerging technologies such as machine learning and natural language processing are enabling AI systems to understand and respond to complex financial queries with greater accuracy. Additionally, advancements in blockchain and decentralized finance (DeFi) are opening new possibilities for AI-driven wealth management, offering investors more secure and transparent financial solutions. While concerns about data privacy and algorithmic biases remain, ongoing regulatory developments aim to ensure that AI-driven financial tools operate ethically and fairly.

Ultimately, the integration of AI into financial planning is transforming the way individuals build and manage their wealth. By automating key processes, enhancing decision-making, and providing personalized insights, AI is making wealth management more efficient and accessible than ever before. As technology continues to advance, investors who embrace AI-driven financial tools will be better positioned to navigate the complexities of the modern financial landscape and achieve long-term financial success.