“Unlock Homeownership: Qualify for a VA Loan and Buy with Zero Down!”

Understanding VA Loan Eligibility: Who Qualifies and How to Apply

The VA loan program is a valuable benefit designed to help eligible service members, veterans, and certain military spouses achieve homeownership with favorable terms, including the ability to purchase a home with no down payment. Understanding the eligibility requirements and application process is essential for those who wish to take advantage of this opportunity. By meeting the necessary criteria and following the appropriate steps, qualified individuals can secure a VA loan and move forward with purchasing a home.

To begin with, eligibility for a VA loan is primarily determined by military service history. Active-duty service members, veterans, members of the National Guard and Reserves, and certain surviving spouses may qualify. The length and nature of service play a crucial role in determining eligibility. Generally, veterans must have served a minimum period, which varies depending on the era in which they served. For example, those who served during wartime typically need at least 90 consecutive days of active duty, while peacetime service members may need 181 days. National Guard and Reserve members usually qualify after six years of service unless they were called to active duty, in which case they may be eligible sooner. Additionally, surviving spouses of service members who died in the line of duty or as a result of a service-related disability may also qualify.

Once eligibility is established, the next step is obtaining a Certificate of Eligibility (COE), which serves as official proof of qualification for a VA loan. This document can be obtained through the Department of Veterans Affairs, either online via the VA’s eBenefits portal, through a VA-approved lender, or by submitting a paper application. The COE confirms to lenders that the applicant meets the service requirements necessary to access VA loan benefits. While obtaining the COE is an important step, it does not guarantee loan approval, as borrowers must still meet the lender’s financial requirements.

In addition to service eligibility, borrowers must demonstrate financial stability to qualify for a VA loan. Lenders will evaluate credit history, income, and debt-to-income ratio to determine the applicant’s ability to repay the loan. While the VA does not set a minimum credit score requirement, most lenders prefer a score of at least 620. However, some lenders may be willing to work with borrowers who have lower scores, depending on other financial factors. Additionally, applicants must have a stable income and a reasonable debt-to-income ratio, typically not exceeding 41%, though exceptions may be made for borrowers with strong compensating factors.

After obtaining the COE and meeting financial requirements, the next step is selecting a VA-approved lender and beginning the loan application process. Borrowers will need to provide documentation such as proof of income, tax returns, and bank statements. The lender will then assess the application, order a VA appraisal of the property, and ensure that the home meets the VA’s minimum property requirements. Once the loan is approved, the borrower can proceed to closing, where final paperwork is signed, and ownership of the home is officially transferred.

By understanding the eligibility requirements and following the necessary steps, qualified individuals can take full advantage of the VA loan program. With no down payment required and favorable loan terms, this benefit provides a valuable opportunity for service members, veterans, and their families to achieve homeownership.

Step-by-Step Guide to Buying a Home with a VA Loan and Zero Down Payment

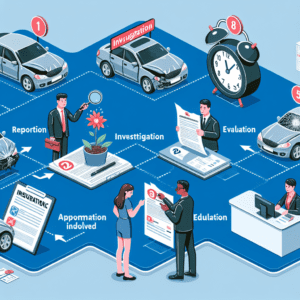

Qualifying for a VA loan and purchasing a home with zero down payment is an excellent opportunity for eligible service members, veterans, and surviving spouses. The process involves several steps, each of which is essential to ensuring a smooth homebuying experience. Understanding these steps can help prospective buyers navigate the process with confidence and take full advantage of the benefits offered by the VA loan program.

The first step in securing a VA loan is determining eligibility. The Department of Veterans Affairs sets specific service requirements that applicants must meet. Generally, active-duty service members, veterans, and certain members of the National Guard and Reserves may qualify. Additionally, surviving spouses of service members who died in the line of duty or as a result of a service-related disability may also be eligible. To confirm eligibility, applicants must obtain a Certificate of Eligibility (COE), which serves as official proof of their qualification for the loan. This document can be requested online through the VA’s eBenefits portal, through a VA-approved lender, or by submitting a paper application directly to the VA.

Once eligibility is established, the next step is to assess financial readiness. While VA loans do not require a down payment, lenders will evaluate an applicant’s credit score, income, and debt-to-income ratio to determine their ability to repay the loan. Although the VA does not set a minimum credit score requirement, most lenders prefer a score of at least 620. Additionally, maintaining a stable income and a manageable level of debt can improve the chances of loan approval. Prospective buyers should review their credit reports, address any outstanding debts, and ensure they have a reliable source of income before applying for a loan.

After financial readiness is confirmed, the next step is to get pre-approved for a VA loan. Pre-approval involves submitting financial documents, such as tax returns, pay stubs, and bank statements, to a VA-approved lender. The lender will review these documents and issue a pre-approval letter, which indicates the maximum loan amount the borrower qualifies for. Having a pre-approval letter not only helps buyers understand their budget but also strengthens their position when making an offer on a home.

With pre-approval in hand, the home search can begin. Working with a real estate agent who has experience with VA loans can be beneficial, as they can help identify properties that meet VA loan requirements. The VA has specific property standards to ensure homes are safe, sanitary, and structurally sound. Once a suitable home is found, the buyer can make an offer, and if accepted, the loan process moves forward.

The next step is the VA appraisal and underwriting process. The VA requires an appraisal to determine the home’s fair market value and ensure it meets minimum property requirements. Additionally, the lender will conduct underwriting to verify the borrower’s financial information and assess the overall risk of the loan. If everything meets the necessary criteria, the loan is approved, and the closing process begins.

Finally, closing on the home involves signing the necessary paperwork and paying any applicable closing costs. While VA loans limit certain fees, buyers may still be responsible for costs such as the VA funding fee, which can be rolled into the loan. Once all documents are signed and funds are disbursed, the buyer officially becomes a homeowner. By following these steps, eligible individuals can successfully purchase a home with a VA loan and enjoy the benefits of homeownership with zero down payment.

Common VA Loan Mistakes to Avoid for a Smooth Home Buying Process

One of the most significant benefits available to eligible service members, veterans, and certain military spouses is the VA home loan program, which allows qualified borrowers to purchase a home with no down payment. However, while the VA loan process is designed to be more accessible than conventional financing, there are several common mistakes that can create unnecessary obstacles. Understanding these potential pitfalls and taking proactive steps to avoid them can help ensure a smooth home buying experience.

A frequent mistake that many borrowers make is failing to check their eligibility early in the process. While VA loans offer numerous advantages, not all service members automatically qualify. Eligibility is based on factors such as length and type of service, and obtaining a Certificate of Eligibility (COE) is a crucial first step. Some borrowers assume they qualify without verifying their status, only to encounter delays later. By securing the COE early, applicants can confirm their eligibility and move forward with confidence.

Another common misstep is not fully understanding the VA loan entitlement. The VA guarantees a portion of the loan, but borrowers have a specific entitlement amount that determines how much they can borrow without a down payment. Some buyers, particularly those who have used a VA loan before, may not realize that their remaining entitlement affects their purchasing power. Consulting with a knowledgeable lender can help clarify entitlement limits and ensure that buyers are making informed decisions.

Additionally, many borrowers overlook the importance of their credit score and financial readiness. While VA loans have more flexible credit requirements than conventional loans, lenders still evaluate credit history and debt-to-income (DTI) ratio. Some applicants assume that because VA loans do not require a down payment, they do not need to focus on their financial profile. However, a low credit score or high DTI ratio can lead to higher interest rates or even loan denial. To avoid this, prospective buyers should review their credit reports, pay down outstanding debts, and ensure they have a stable financial foundation before applying.

Another mistake that can complicate the home buying process is failing to work with a lender experienced in VA loans. Not all mortgage lenders specialize in VA financing, and working with one who lacks expertise can lead to delays and misunderstandings. A lender familiar with VA loan requirements can guide borrowers through the process efficiently, ensuring that all necessary documentation is in place and that the loan is structured correctly.

Furthermore, some buyers neglect to budget for closing costs and other expenses. While VA loans eliminate the need for a down payment, they do not cover all costs associated with purchasing a home. Borrowers may still be responsible for appraisal fees, inspections, and other closing costs. Additionally, while the VA limits certain fees that lenders can charge, there are still expenses that buyers must plan for. Understanding these costs in advance can prevent last-minute financial surprises.

Finally, skipping the home inspection is a mistake that can lead to costly issues down the road. While the VA requires a home appraisal to assess the property’s value and ensure it meets minimum property requirements, this is not the same as a thorough home inspection. An inspection provides a detailed evaluation of the home’s condition, helping buyers identify potential problems before finalizing the purchase. Investing in a professional inspection can provide peace of mind and prevent unexpected repair costs after moving in.

By being aware of these common mistakes and taking proactive steps to avoid them, borrowers can navigate the VA loan process with greater ease. Ensuring eligibility, understanding entitlement, maintaining financial readiness, working with an experienced lender, budgeting for costs, and prioritizing a home inspection are all essential components of a successful home purchase. With careful planning and informed decision-making, eligible buyers can take full advantage of the VA loan program and achieve homeownership with zero down.