Driving for Uber or Lyft can be a great way to earn extra income, but ensuring you have the right car insurance is crucial. Standard personal auto insurance policies often don’t cover rideshare activities, leaving drivers vulnerable in case of an accident. In this guide, we’ll explore the best car insurance options for rideshare drivers, explain Uber and Lyft’s insurance requirements, and help you find the right coverage.

Why Rideshare Drivers Need Special Insurance

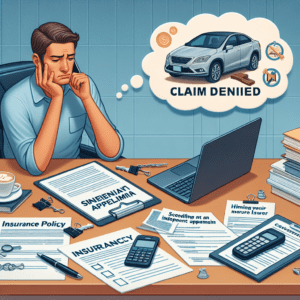

Most personal auto insurance policies exclude coverage when a vehicle is being used for commercial purposes, such as driving for Uber or Lyft. This means that if you get into an accident while waiting for a ride request or transporting a passenger, your personal policy may not cover the damages.

To bridge this gap, rideshare insurance policies are designed to provide coverage during different phases of your driving activity. Without proper coverage, you could face significant financial risks.

Understanding Uber and Lyft Insurance Coverage

Both Uber and Lyft provide some level of insurance coverage for their drivers, but it varies depending on the stage of the ride:

- Period 1: When the driver is online but has not yet accepted a ride request. Limited liability coverage is provided.

- Period 2: When the driver has accepted a ride request and is en route to pick up the passenger. More comprehensive coverage applies.

- Period 3: When the passenger is in the vehicle until the ride is completed. Full coverage, including liability, collision, and comprehensive insurance, is provided.

While Uber and Lyft offer some coverage, there are gaps that could leave drivers exposed, particularly during Period 1. This is where rideshare insurance from private insurers becomes essential.

Best Car Insurance Providers for Rideshare Drivers

Several insurance companies offer rideshare coverage to fill the gaps left by Uber and Lyft’s policies. Here are some of the best options:

1. GEICO Rideshare Insurance

- Offers a hybrid policy that replaces personal auto insurance and includes rideshare coverage.

- Covers all driving periods, eliminating coverage gaps.

- Available in most states.

2. Progressive Rideshare Insurance

- Provides coverage during Period 1 when Uber and Lyft’s insurance is limited.

- Affordable add-on to personal auto policies.

- Available in select states.

3. State Farm Rideshare Insurance

- Extends personal auto policy to cover rideshare driving.

- Seamless transition between personal and rideshare use.

- Available in many states.

4. Allstate Ride for Hire

- Provides additional coverage for rideshare drivers.

- Fills gaps in Uber and Lyft’s insurance policies.

- Available as an affordable add-on.

5. Farmers Rideshare Insurance

- Offers coverage during all rideshare driving periods.

- Affordable and easy to add to an existing policy.

- Available in select states.

How Much Does Rideshare Insurance Cost?

The cost of rideshare insurance varies based on factors such as location, driving history, and the insurance provider. On average, adding rideshare coverage to a personal auto policy costs between and per month. However, hybrid policies that replace personal auto insurance may cost more but provide seamless coverage.

How to Choose the Best Rideshare Insurance

When selecting a rideshare insurance policy, consider the following factors:

- Coverage Gaps: Ensure the policy covers all driving periods, including Period 1.

- Cost: Compare premiums and deductibles to find an affordable option.

- Availability: Not all insurers offer rideshare coverage in every state.

- Customer Service: Choose a provider with a strong reputation for handling claims efficiently.

Final Thoughts

Having the right car insurance as a rideshare driver is essential to protect yourself financially. While Uber and Lyft provide some coverage, it’s often not enough to fully protect drivers. Investing in a rideshare insurance policy from a reputable provider can help fill coverage gaps and provide peace of mind.

Before choosing a policy, compare options from top insurers like GEICO, Progressive, and State Farm to find the best coverage for your needs. By securing the right insurance, you can drive with confidence, knowing you’re fully protected on the road.