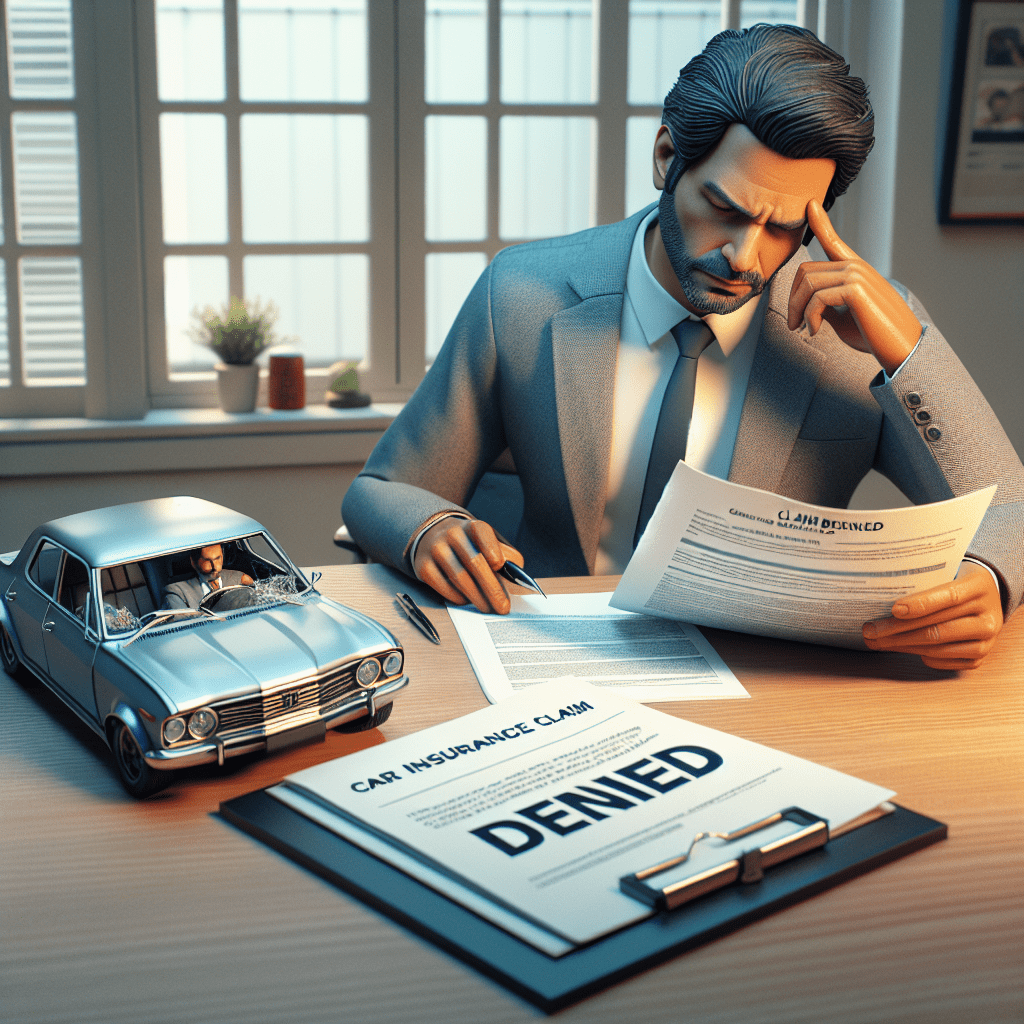

“Denied Claim? Fight Back and Get the Coverage You Deserve!”

Understanding Why Your Car Insurance Claim Was Denied

When dealing with a denied car insurance claim, the first step is to understand the reasons behind the decision. Insurance companies provide specific explanations for claim denials, and reviewing these details carefully can help determine the next course of action. Typically, the denial letter will outline the insurer’s reasoning, citing policy terms, exclusions, or insufficient evidence. By thoroughly examining this document, policyholders can gain clarity on whether the denial was justified or if further action is necessary.

One of the most common reasons for a denied claim is a lapse in coverage. If the policyholder failed to make timely premium payments, the insurance policy may have been canceled or suspended, leaving the claim ineligible for coverage. Additionally, if the accident occurred outside the policy’s effective period, the insurer may reject the claim on the grounds that coverage was not active at the time of the incident. Ensuring that payments are up to date and that the policy remains in force is essential to avoiding such issues.

Another frequent reason for denial is that the claim falls under an exclusion listed in the policy. Insurance policies contain specific exclusions that outline situations in which coverage does not apply. For example, if the driver was using the vehicle for commercial purposes without the appropriate coverage, the insurer may deny the claim. Similarly, damages resulting from intentional acts, racing, or driving under the influence are often excluded from coverage. Reviewing the policy’s terms and conditions can help determine whether the denial is based on a legitimate exclusion.

In some cases, the insurer may argue that the policyholder failed to provide sufficient evidence to support the claim. Insurance companies require documentation such as police reports, photographs, witness statements, and repair estimates to assess the validity of a claim. If the provided information is incomplete or inconsistent, the insurer may reject the claim due to a lack of supporting evidence. To prevent this, policyholders should ensure that all necessary documentation is submitted promptly and accurately.

Additionally, an insurance company may deny a claim if it believes that the policyholder was at fault for the accident in a way that is not covered by the policy. For instance, if the driver was engaging in reckless behavior or violating traffic laws, the insurer may determine that the damages were caused by negligence and refuse to provide coverage. Understanding how fault is determined and whether the policy includes coverage for such situations is crucial in evaluating the validity of a denial.

If a claim is denied due to suspected fraud or misrepresentation, the insurer may argue that the policyholder provided false or misleading information when purchasing the policy or filing the claim. Any discrepancies in the details provided, such as inaccurate statements about the vehicle’s condition or the circumstances of the accident, can lead to a denial. To avoid this, policyholders should always provide truthful and accurate information when dealing with their insurer.

By carefully reviewing the denial letter and understanding the specific reasons for the decision, policyholders can determine whether to accept the denial or challenge it. If there is reason to believe that the claim was wrongfully denied, gathering additional evidence, seeking clarification from the insurer, or consulting a legal professional may be necessary to pursue a resolution.

Steps to Take After a Car Insurance Claim Denial

Receiving a denial for a car insurance claim can be frustrating and stressful, especially when you rely on your policy to cover damages or medical expenses. However, a denial does not necessarily mean the end of the road. There are several steps you can take to address the situation and potentially overturn the decision. Understanding the reasons behind the denial and knowing how to proceed can significantly improve your chances of a successful resolution.

The first step after receiving a denial is to carefully review the denial letter from your insurance company. This document should outline the specific reasons for the rejection, whether it is due to policy exclusions, insufficient evidence, or missed deadlines. By understanding the insurer’s rationale, you can determine the best course of action to challenge the decision. If the explanation is unclear, contacting your insurance provider for further clarification is essential. Speaking with a representative can help you gain insight into the denial and identify any possible misunderstandings or missing information.

Once you have a clear understanding of why your claim was denied, gathering all relevant documentation is crucial. This includes the original claim form, accident reports, photographs, witness statements, medical records, and any correspondence with the insurance company. Having a well-organized file of supporting evidence can strengthen your case if you decide to appeal the decision. Additionally, reviewing your insurance policy in detail is important to ensure that the denial aligns with the terms and conditions outlined in your coverage. If you believe the insurer has misinterpreted your policy, you may have grounds to dispute the decision.

If you find discrepancies or believe the denial was unjustified, filing an appeal is the next logical step. Most insurance companies have an appeals process that allows policyholders to request a reconsideration of their claim. When submitting an appeal, it is important to provide a well-structured letter explaining why you believe the denial was incorrect. Including additional evidence, such as repair estimates, medical bills, or expert opinions, can further support your case. Ensuring that your appeal is submitted within the insurer’s specified timeframe is also critical, as missing deadlines could result in losing the opportunity to challenge the decision.

In some cases, seeking assistance from a third party may be necessary. If your appeal is unsuccessful or if you encounter difficulties communicating with your insurer, consulting a legal professional or a public adjuster can be beneficial. An attorney specializing in insurance claims can help you understand your rights and determine whether legal action is warranted. Similarly, a public adjuster can provide an independent assessment of your claim and negotiate with the insurance company on your behalf. These professionals can offer valuable guidance and increase the likelihood of a favorable outcome.

If all else fails, filing a complaint with your state’s insurance department may be an option. Insurance regulators oversee the industry and ensure that companies adhere to fair practices. Submitting a formal complaint can prompt an investigation into your claim and potentially lead to a resolution. Additionally, exploring alternative dispute resolution methods, such as mediation or arbitration, may provide another avenue for settling the matter without resorting to litigation.

Ultimately, while a car insurance claim denial can be discouraging, taking proactive steps can improve your chances of obtaining the coverage you deserve. By thoroughly reviewing the denial, gathering supporting evidence, filing an appeal, and seeking professional assistance if necessary, you can navigate the process effectively and work toward a satisfactory resolution.

How to Appeal a Denied Car Insurance Claim Successfully

Receiving a denial for a car insurance claim can be frustrating and stressful, especially when you believe the claim is valid. However, a denial does not necessarily mean the end of the process. There are steps you can take to appeal the decision and potentially have it overturned. Understanding the reasons behind the denial, gathering the necessary documentation, and following the appropriate appeal procedures can significantly improve your chances of success.

The first step in appealing a denied car insurance claim is to carefully review the denial letter provided by your insurance company. This letter should outline the specific reasons for the denial, whether it is due to policy exclusions, insufficient evidence, or missed deadlines. By understanding the insurer’s reasoning, you can determine the best course of action for your appeal. If the explanation is unclear, contacting your insurance provider for further clarification can help you gain a better understanding of the situation.

Once you have identified the reason for the denial, gathering supporting evidence is crucial. This may include photographs of the accident scene, witness statements, police reports, medical records, or repair estimates. The more documentation you can provide to support your claim, the stronger your appeal will be. Additionally, reviewing your insurance policy in detail can help you determine whether the denial was justified or if the insurer may have misinterpreted the terms of your coverage.

After collecting the necessary evidence, the next step is to draft a formal appeal letter. This letter should be concise, professional, and well-organized. Begin by stating your policy number, the date of the claim, and the reason for your appeal. Clearly explain why you believe the denial was incorrect and provide any supporting documentation to strengthen your case. It is also helpful to reference specific policy provisions that support your claim. Addressing the appeal to the appropriate department within the insurance company ensures that it reaches the right individuals for review.

In addition to submitting an appeal letter, maintaining open communication with your insurance company is essential. Following up regularly to check on the status of your appeal can demonstrate your commitment to resolving the issue. If necessary, request a meeting or phone call with a claims adjuster or supervisor to discuss your case in more detail. Being persistent and professional throughout the process can increase the likelihood of a favorable outcome.

If your appeal is unsuccessful, there are still other options available. You may consider seeking assistance from a third party, such as a state insurance department or an independent mediator. Many states have regulatory agencies that oversee insurance companies and can help resolve disputes between policyholders and insurers. Additionally, consulting with an attorney who specializes in insurance claims can provide valuable legal guidance and representation if needed.

Ultimately, appealing a denied car insurance claim requires patience, organization, and persistence. By understanding the reasons for the denial, gathering strong supporting evidence, and following the appropriate appeal procedures, you can improve your chances of having the decision overturned. While the process may take time, staying proactive and informed can help ensure that you receive the coverage you are entitled to under your policy.