“Shield Yourself from Crippling Medical Bills – Choose the Right Health Plan Today!”

Understanding Health Insurance: Choosing the Right Plan to Avoid Crippling Medical Bills

Medical expenses can be overwhelming, and without the right health insurance plan, they have the potential to create significant financial hardship. Understanding how to choose the right health insurance plan is essential to ensuring that you are adequately protected from unexpected medical costs. With numerous options available, selecting the most suitable plan requires careful consideration of various factors, including coverage, premiums, deductibles, and out-of-pocket expenses. By taking the time to evaluate these elements, individuals can make informed decisions that safeguard their financial well-being while ensuring access to necessary medical care.

One of the most important aspects to consider when selecting a health insurance plan is the type of coverage it provides. Different plans offer varying levels of benefits, and it is crucial to assess whether a plan covers essential services such as doctor visits, hospital stays, prescription medications, and preventive care. Some plans may also include additional benefits, such as mental health services, maternity care, or specialist visits, which can be particularly important depending on an individual’s healthcare needs. Ensuring that a plan aligns with both current and potential future medical requirements can prevent unexpected expenses and gaps in coverage.

In addition to coverage, the cost of the plan plays a significant role in the decision-making process. Health insurance plans typically involve a combination of premiums, deductibles, copayments, and coinsurance. The premium is the amount paid monthly for coverage, while the deductible is the amount an individual must pay out of pocket before the insurance begins to cover expenses. Copayments and coinsurance represent the portion of medical costs that the insured person is responsible for after meeting the deductible. Balancing these costs is essential, as a lower premium may result in higher out-of-pocket expenses when medical care is needed, whereas a higher premium may provide more comprehensive coverage with lower costs at the time of service.

Another critical factor to evaluate is the network of healthcare providers associated with a particular plan. Many insurance plans have a network of doctors, hospitals, and specialists that they work with, and receiving care from providers within this network typically results in lower costs. Out-of-network care, on the other hand, can be significantly more expensive or may not be covered at all. Therefore, individuals should verify whether their preferred healthcare providers are included in the plan’s network to avoid unexpected expenses and ensure continuity of care.

Furthermore, it is essential to consider the potential for unforeseen medical emergencies. While no one anticipates experiencing a serious illness or injury, having a plan that provides adequate coverage for emergency care and hospitalizations can prevent financial devastation. Reviewing the plan’s policy on emergency services, ambulance transportation, and hospital stays can help individuals prepare for unexpected medical situations without facing excessive financial burdens.

Ultimately, selecting the right health insurance plan requires a thorough assessment of personal healthcare needs, financial considerations, and provider networks. By carefully comparing available options and understanding the details of each plan, individuals can make informed choices that protect them from crippling medical bills. Taking the time to research and select a suitable health insurance plan is an investment in both financial security and overall well-being, ensuring access to necessary medical care without the risk of overwhelming expenses.

Hidden Costs in Medical Bills: How the Right Health Plan Can Save You Thousands

Medical expenses can be overwhelming, and for many individuals and families, unexpected medical bills can lead to significant financial strain. While most people anticipate costs such as doctor’s visits, hospital stays, and prescription medications, there are often hidden charges that can dramatically increase the total amount owed. These unexpected expenses may include out-of-network fees, laboratory tests, medical equipment, and administrative costs that are not always clearly outlined in advance. Without the right health plan, these hidden costs can add up quickly, leaving patients with substantial financial burdens that could have been mitigated with proper coverage.

One of the most common sources of hidden medical costs is out-of-network care. Even with insurance, patients may unknowingly receive treatment from providers who are not covered under their plan’s network, resulting in significantly higher charges. This can happen in emergency situations where patients do not have the opportunity to choose their provider or when a hospital contracts with specialists who bill separately from the facility. In such cases, patients may receive surprise medical bills that they were not prepared for. A well-structured health plan with comprehensive network coverage can help prevent these unexpected expenses by ensuring access to in-network providers and offering protections against excessive out-of-network charges.

Additionally, diagnostic tests and medical procedures often come with hidden fees that are not always disclosed upfront. While a doctor may order a routine blood test or imaging scan, the associated costs can vary widely depending on the facility and the specific tests performed. Some insurance plans cover only a portion of these expenses, leaving patients responsible for the remaining balance. Choosing a health plan that provides clear coverage for diagnostic services and preventive care can help reduce out-of-pocket costs and prevent financial surprises.

Another factor that contributes to hidden medical expenses is the cost of prescription medications. Many patients assume that their insurance will cover the full cost of their prescriptions, only to find out that certain medications require high copayments or are not included in their plan’s formulary. In some cases, patients may need to switch to a more expensive brand-name drug if a generic alternative is not covered. A well-designed health plan should offer comprehensive prescription drug coverage, including access to affordable generic medications and a transparent pricing structure that allows patients to anticipate their costs.

Beyond direct medical expenses, administrative fees and billing errors can also contribute to unexpected costs. Hospitals and healthcare providers may charge for services such as medical record requests, late payment fees, or billing adjustments that are not always clearly communicated to patients. Additionally, errors in medical billing, such as duplicate charges or incorrect coding, can lead to inflated costs that patients may not immediately recognize. Reviewing medical bills carefully and selecting a health plan that provides clear billing policies and customer support can help individuals avoid unnecessary expenses.

Ultimately, having the right health plan is essential for protecting against the financial impact of hidden medical costs. By carefully reviewing plan options, understanding coverage details, and selecting a policy that aligns with individual healthcare needs, patients can avoid unexpected expenses and ensure they receive the care they need without undue financial hardship. Investing time in choosing the right health insurance can lead to significant long-term savings and provide peace of mind in the face of medical uncertainties.

Emergency Medical Expenses: Protecting Your Finances with Comprehensive Health Coverage

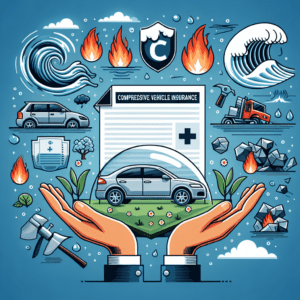

Medical emergencies can arise without warning, leaving individuals and families facing not only health crises but also significant financial burdens. The cost of emergency medical care can be overwhelming, with expenses for hospital stays, surgeries, medications, and specialized treatments quickly adding up. Without adequate health coverage, these unexpected costs can lead to financial instability, forcing individuals to deplete their savings, take on debt, or even delay necessary medical care. To safeguard against these risks, it is essential to have a comprehensive health plan that provides sufficient coverage for emergency medical expenses.

One of the primary benefits of a well-structured health insurance plan is its ability to cover a substantial portion of emergency medical costs. Many plans include coverage for ambulance services, emergency room visits, diagnostic tests, and surgical procedures, ensuring that policyholders receive the necessary care without the added stress of exorbitant out-of-pocket expenses. Additionally, some plans offer direct billing arrangements with hospitals, allowing patients to receive treatment without having to pay upfront and seek reimbursement later. This not only eases the financial burden but also ensures that medical attention is not delayed due to concerns about cost.

Beyond covering immediate emergency expenses, a comprehensive health plan also provides access to a network of healthcare providers, ensuring that policyholders receive quality care at negotiated rates. Insurance companies often have agreements with hospitals and medical professionals, which can significantly reduce the overall cost of treatment. Without insurance, individuals may be charged higher rates for the same services, further exacerbating financial strain. By choosing a plan with a broad network of providers, policyholders can benefit from cost savings while receiving timely and effective medical care.

Another critical aspect of protecting oneself from emergency medical expenses is understanding the terms and conditions of a health insurance policy. Many plans have deductibles, copayments, and coinsurance requirements that determine how much a policyholder must pay out of pocket before insurance coverage takes effect. Being aware of these costs in advance can help individuals plan for potential medical expenses and avoid unexpected financial surprises. Additionally, some policies have annual out-of-pocket maximums, which limit the total amount a policyholder must pay in a given year. Once this limit is reached, the insurance company covers all additional eligible expenses, providing further financial protection.

It is also important to consider the inclusion of critical benefits such as coverage for pre-existing conditions, prescription medications, and post-hospitalization care. Some emergencies require ongoing treatment, rehabilitation, or long-term medication, all of which can be costly without adequate insurance coverage. A well-rounded health plan should address these needs, ensuring that individuals receive the necessary follow-up care without facing financial hardship.

Ultimately, investing in a comprehensive health insurance plan is a proactive step toward financial security and peace of mind. Medical emergencies are unpredictable, but their financial impact can be mitigated with the right coverage. By carefully evaluating different health plans, understanding policy terms, and selecting a plan that offers extensive emergency coverage, individuals can protect themselves and their families from the potentially crippling costs of medical care. In doing so, they can focus on recovery and well-being rather than the stress of mounting medical bills.