“Fire, Storms, Theft – Protect Your Home Before Disaster Strikes!”

Fire: Essential Home Insurance Coverage to Protect Against Devastating Losses

Fire is one of the most destructive forces that can impact a home, often leading to devastating financial and emotional consequences. While no homeowner wants to imagine the possibility of losing their property to flames, the reality is that fires can occur unexpectedly due to electrical malfunctions, cooking accidents, or even natural disasters. Given the potential for significant damage, having the right home insurance coverage is essential to ensuring financial protection and peace of mind. Without adequate coverage, homeowners may find themselves facing overwhelming repair costs or, in the worst cases, the complete loss of their property without the means to rebuild.

A standard homeowners insurance policy typically includes coverage for fire damage, but it is crucial to understand the specifics of what is protected. Most policies cover not only the structure of the home but also personal belongings, detached structures such as garages or sheds, and additional living expenses if the home becomes uninhabitable. This means that if a fire renders a home unsafe to live in, insurance can help cover the cost of temporary housing, meals, and other necessary expenses. However, policyholders should carefully review their coverage limits to ensure they have sufficient protection to fully rebuild and replace lost possessions.

In addition to understanding what is covered, homeowners should also be aware of any exclusions or limitations in their policies. While fire damage is generally included, certain circumstances may not be covered, such as fires caused by negligence or intentional acts. Furthermore, if a home is located in an area prone to wildfires, insurers may impose higher premiums or require additional coverage. In such cases, homeowners may need to purchase supplemental policies to ensure they are fully protected. It is always advisable to consult with an insurance provider to clarify any uncertainties and make necessary adjustments to the policy.

Beyond securing the right insurance coverage, homeowners can take proactive steps to minimize fire risks and potentially lower their insurance premiums. Installing smoke detectors, fire extinguishers, and sprinkler systems can not only enhance safety but also demonstrate to insurers that the home is well-protected. Additionally, maintaining electrical systems, using fire-resistant building materials, and creating a defensible space around the property can reduce the likelihood of fire damage. Some insurance companies may even offer discounts for implementing these safety measures, making it a worthwhile investment.

In the unfortunate event that a fire does occur, knowing how to navigate the claims process is essential for a smooth recovery. Homeowners should document all damage by taking photographs and making a detailed inventory of lost or damaged items. Promptly notifying the insurance company and providing necessary documentation can help expedite the claims process. Additionally, keeping records of repair estimates, receipts, and any temporary living expenses will ensure that all eligible costs are reimbursed. Working closely with the insurance provider and, if necessary, seeking assistance from a public adjuster can help maximize the claim payout and facilitate the rebuilding process.

Ultimately, fire insurance coverage is a critical component of any homeowners policy, offering financial security in the face of unexpected disasters. By understanding policy details, taking preventive measures, and being prepared for the claims process, homeowners can protect their property and ensure they have the necessary resources to recover from a fire. While no one can predict when disaster will strike, having comprehensive insurance coverage provides the reassurance that, even in the worst-case scenario, rebuilding and recovery remain possible.

Storms: How to Safeguard Your Home and Ensure Proper Insurance Coverage

Severe storms can cause significant damage to homes, leaving homeowners with costly repairs and financial burdens. High winds, heavy rain, hail, and even lightning strikes can all contribute to structural damage, flooding, and power outages. To minimize the impact of these natural disasters, it is essential to take proactive steps to safeguard your home while also ensuring that your insurance coverage is sufficient to protect against potential losses. By implementing preventive measures and reviewing your policy, you can reduce the risk of damage and avoid unexpected financial strain.

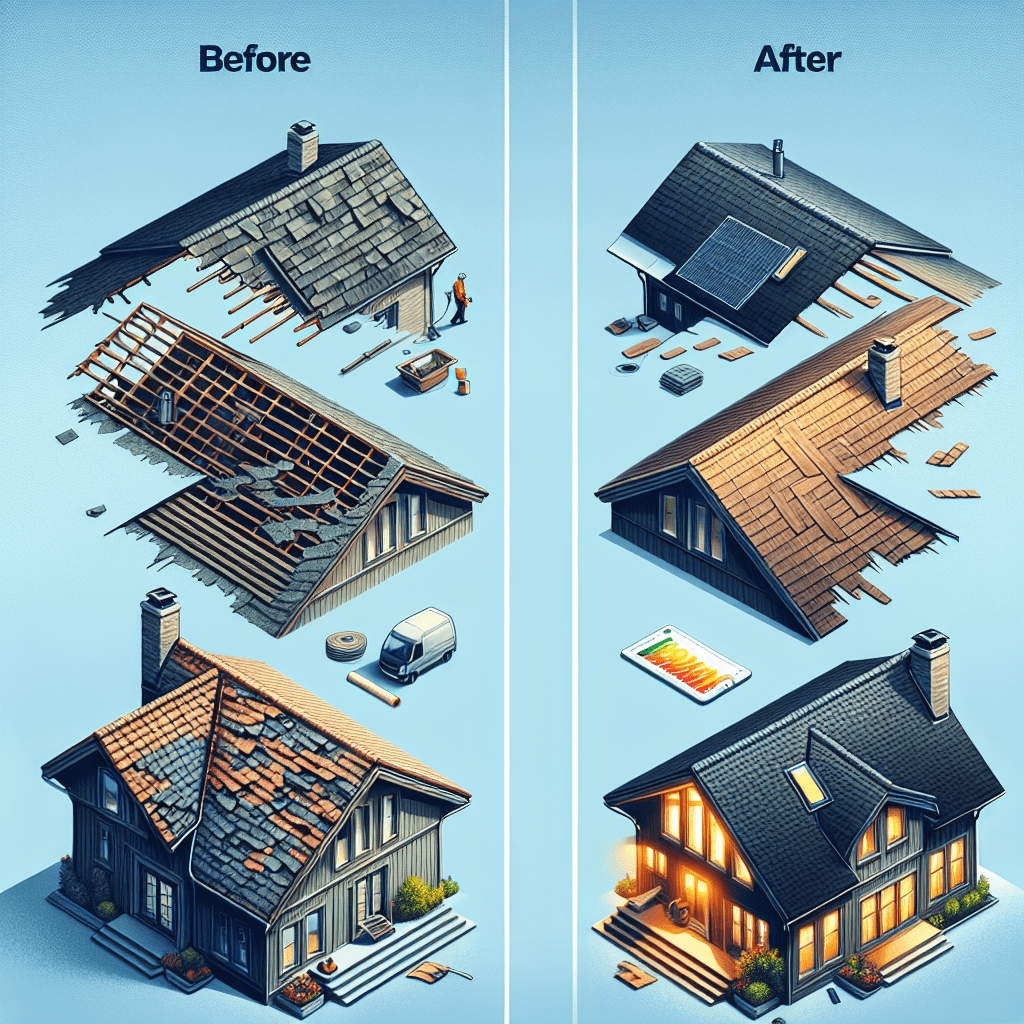

One of the most effective ways to protect your home from storm damage is to reinforce vulnerable areas. Start by inspecting your roof, as it is often the first part of a home to sustain damage during a storm. Loose or missing shingles should be replaced, and flashing should be secured to prevent leaks. Additionally, installing impact-resistant roofing materials can provide extra protection against hail and strong winds. Gutters and downspouts should also be kept clear of debris to ensure proper drainage and prevent water from accumulating around the foundation.

Windows and doors are another critical area to reinforce. High winds can shatter glass, leading to interior damage and potential safety hazards. Installing storm shutters or impact-resistant windows can help prevent breakage, while reinforcing doors with heavy-duty hinges and deadbolts can reduce the risk of wind-driven debris causing structural damage. Garage doors, which are particularly vulnerable to high winds, should be braced or replaced with wind-resistant models to prevent them from collapsing under pressure.

Landscaping also plays a role in storm preparedness. Trees with weak or overhanging branches should be trimmed to prevent them from falling onto the house during a storm. Loose outdoor furniture, garden tools, and other objects should be secured or stored indoors to prevent them from becoming projectiles in high winds. Additionally, ensuring that drainage systems are functioning properly can help prevent water from pooling around the home, reducing the risk of flooding.

While taking these precautions can help minimize damage, it is equally important to have the right insurance coverage in place. Standard homeowners insurance policies typically cover storm-related damage, but it is crucial to review the specifics of your policy to ensure you have adequate protection. Wind and hail damage are generally included, but coverage for flooding may require a separate policy. Since flood damage is not covered under most standard policies, homeowners in flood-prone areas should consider purchasing flood insurance through the National Flood Insurance Program or a private insurer.

In addition to verifying coverage, homeowners should document their property and belongings before a storm occurs. Taking photographs or videos of the home’s interior and exterior, as well as keeping an inventory of valuable possessions, can help streamline the claims process in the event of damage. Storing important documents, such as insurance policies and home deeds, in a secure, waterproof location can also prevent loss and ensure easy access when needed.

By taking proactive steps to safeguard your home and reviewing your insurance coverage, you can better protect yourself from the financial and emotional toll of storm damage. While storms are unpredictable, being prepared can make a significant difference in minimizing losses and ensuring a swift recovery.

Theft: Preventing Break-Ins and Understanding Your Home Insurance Policy

Home security is a crucial aspect of homeownership, and protecting your property from theft requires both preventive measures and a comprehensive understanding of your home insurance policy. While many homeowners focus on fire and storm damage, burglary remains a significant risk that can lead to financial loss and emotional distress. Taking proactive steps to secure your home and ensuring that your insurance policy provides adequate coverage can help mitigate the impact of a break-in.

One of the most effective ways to prevent theft is by reinforcing entry points. Doors and windows are the most common access points for burglars, so installing high-quality locks, deadbolts, and security bars can serve as strong deterrents. Additionally, motion-sensor lighting around the perimeter of your home can discourage potential intruders by eliminating dark areas where they might attempt to hide. Security cameras and alarm systems further enhance protection, as they not only alert homeowners to suspicious activity but also increase the likelihood of identifying and apprehending criminals.

Beyond physical security measures, homeowners should also be mindful of their daily routines and habits. Leaving spare keys outside, posting vacation plans on social media, or failing to collect mail and newspapers while away can signal to burglars that a home is unoccupied. Instead, homeowners should consider using timers for lights and televisions to create the appearance of activity, as well as enlisting a trusted neighbor to check on the property when they are away for an extended period.

Despite taking all necessary precautions, break-ins can still occur, making it essential to have a home insurance policy that provides adequate coverage for theft-related losses. Homeowners should carefully review their policies to understand what is covered and whether additional endorsements or riders are necessary. Standard policies typically cover stolen belongings, but coverage limits may apply to high-value items such as jewelry, electronics, and collectibles. If the value of personal possessions exceeds the policy’s limits, homeowners may need to purchase additional coverage to ensure full reimbursement in the event of a loss.

Equally important is understanding the claims process in the aftermath of a burglary. Homeowners should document their belongings by keeping an updated inventory, including photographs, receipts, and serial numbers. This documentation can expedite the claims process and provide proof of ownership, which is often required by insurance providers. In the event of a break-in, filing a police report immediately is crucial, as insurers typically require official documentation before processing a claim.

Furthermore, homeowners should be aware of their policy’s deductible, which is the amount they must pay out of pocket before insurance coverage applies. Choosing a deductible that balances affordability with adequate protection is essential, as a higher deductible may lower monthly premiums but could result in greater financial strain if a claim is necessary.

Ultimately, preventing theft and ensuring proper insurance coverage go hand in hand. By implementing security measures, maintaining awareness of potential risks, and thoroughly understanding their home insurance policy, homeowners can protect their property and minimize financial losses in the event of a break-in. Taking these steps not only enhances home security but also provides peace of mind, knowing that both preventive and financial safeguards are in place.