“Safeguard Your Home, Secure Your Future – Affordable Coverage Awaits!”

Importance Of Home Insurance: Safeguarding Your Biggest Investment

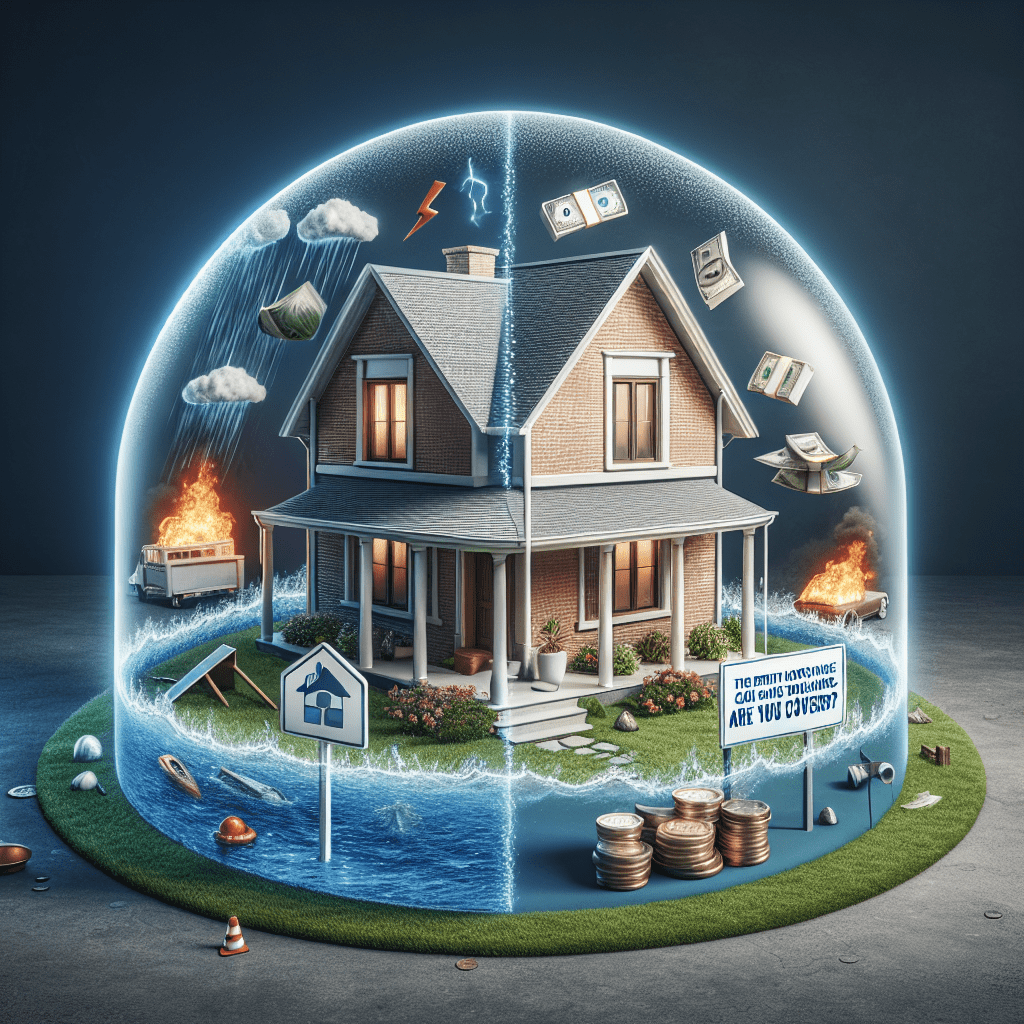

Your home is more than just a place to live; it is one of the most significant financial investments you will ever make. Protecting this investment should be a top priority, as unforeseen events such as natural disasters, theft, or accidents can lead to substantial financial losses. Home insurance provides a crucial safety net, ensuring that you are not left to bear the burden of unexpected damages or liabilities on your own. By securing an affordable home insurance policy, you can safeguard your property, belongings, and financial stability, giving you peace of mind in the face of uncertainty.

One of the primary reasons home insurance is essential is that it offers financial protection against a wide range of risks. Natural disasters such as hurricanes, floods, and wildfires can cause extensive damage to a home, often requiring costly repairs or even complete reconstruction. Without insurance, homeowners may struggle to cover these expenses, potentially leading to financial hardship. Additionally, home insurance typically covers damages caused by theft, vandalism, and other unforeseen incidents, ensuring that homeowners are not left to deal with the financial consequences alone.

Beyond protecting the physical structure of a home, insurance also covers personal belongings inside the property. Furniture, electronics, appliances, and valuable possessions can be expensive to replace if they are damaged or stolen. A comprehensive home insurance policy helps cover these losses, allowing homeowners to recover financially without significant out-of-pocket expenses. This coverage is particularly important in cases of burglary or fire, where personal belongings may be lost or destroyed.

Another critical aspect of home insurance is liability coverage, which protects homeowners from legal and financial consequences if someone is injured on their property. Accidents can happen at any time, and if a guest or visitor sustains an injury while on your premises, you could be held responsible for medical expenses and legal fees. Liability coverage ensures that you are protected from these potential costs, preventing a single incident from causing severe financial strain.

Furthermore, many mortgage lenders require homeowners to carry insurance as a condition of their loan agreement. Lenders want to ensure that their investment is protected in case of damage or loss, making home insurance a necessary requirement for most homeowners. Even if a mortgage is fully paid off, maintaining insurance coverage remains a wise decision, as it provides continued protection against unexpected events that could otherwise lead to financial instability.

While some homeowners may be concerned about the cost of insurance, there are many affordable options available. By comparing policies from different providers, homeowners can find coverage that meets their needs without exceeding their budget. Additionally, many insurance companies offer discounts for bundling policies, installing security systems, or maintaining a claims-free history. Taking advantage of these opportunities can help reduce premiums while ensuring comprehensive protection.

Ultimately, home insurance is an essential safeguard that protects not only the physical structure of a home but also the financial well-being of its owner. The potential risks associated with homeownership make it crucial to have a reliable insurance policy in place. By securing affordable home insurance today, homeowners can protect their biggest investment and enjoy peace of mind knowing that they are prepared for whatever the future may bring.

How To Find Affordable Home Insurance Without Compromising Coverage

Protecting your home is one of the most important financial decisions you can make. As one of your largest investments, your home provides security, comfort, and stability for you and your family. However, unexpected events such as natural disasters, theft, or accidents can lead to significant financial losses. This is why having home insurance is essential. While many homeowners recognize the importance of insurance, finding an affordable policy without sacrificing coverage can be challenging. Fortunately, with careful research and strategic planning, you can secure a policy that meets your needs while staying within your budget.

To begin with, comparing multiple insurance providers is one of the most effective ways to find an affordable policy. Insurance rates can vary significantly between companies, so obtaining quotes from different providers allows you to identify the best deal. Many insurers offer online tools that make it easy to compare coverage options and pricing. Additionally, speaking with an independent insurance agent can provide valuable insights, as they have access to multiple carriers and can help you find a policy that balances cost and coverage.

Another key strategy is to assess your coverage needs carefully. While it may be tempting to opt for the lowest premium available, inadequate coverage can leave you vulnerable to financial hardship in the event of a claim. Instead, evaluate the value of your home, personal belongings, and potential liability risks to determine the appropriate level of coverage. Standard policies typically include dwelling coverage, personal property protection, liability insurance, and additional living expenses. Ensuring that these components align with your specific needs can prevent costly gaps in coverage.

Raising your deductible is another effective way to lower your premium without compromising essential protection. The deductible is the amount you pay out of pocket before your insurance coverage takes effect. By choosing a higher deductible, you assume more financial responsibility in the event of a claim, which often results in lower monthly or annual premiums. However, it is important to select a deductible that you can comfortably afford in case of an emergency.

Bundling your home insurance with other policies, such as auto or life insurance, can also lead to significant savings. Many insurance companies offer discounts to customers who purchase multiple policies from them. This not only simplifies the management of your insurance needs but also reduces overall costs. Before committing to a bundled policy, compare the total cost with individual policies to ensure that you are receiving the best value.

Additionally, improving home security can help lower insurance premiums. Installing security systems, smoke detectors, deadbolt locks, and other safety features reduces the risk of damage or theft, making your home less of a liability for insurers. Many providers offer discounts for homes equipped with these protective measures. Regular maintenance, such as updating electrical systems and reinforcing the roof, can also contribute to lower premiums by reducing the likelihood of claims.

Finally, taking advantage of available discounts can further reduce costs. Many insurers offer discounts for factors such as having a good credit score, being a non-smoker, or maintaining a claims-free history. Reviewing your policy annually and discussing potential discounts with your provider ensures that you are not overpaying for coverage.

By following these strategies, you can find affordable home insurance without compromising the protection your home deserves. Taking the time to research, compare options, and implement cost-saving measures will provide peace of mind while safeguarding your most valuable investment.

Top Factors To Consider When Choosing The Right Home Insurance Policy

Protecting your home with the right insurance policy is one of the most important financial decisions you can make. As a homeowner, your property is likely your most valuable asset, and ensuring that it is adequately covered can provide peace of mind in the face of unexpected events. However, with so many options available, selecting the right home insurance policy can be a complex process. To make an informed decision, it is essential to consider several key factors that can impact the level of protection you receive and the overall cost of your policy.

One of the first aspects to evaluate is the type of coverage offered. Home insurance policies typically include different levels of protection, such as dwelling coverage, personal property coverage, liability protection, and additional living expenses. Dwelling coverage protects the structure of your home, including walls, roof, and built-in appliances, against damage from covered perils like fire, storms, or vandalism. Personal property coverage extends to belongings inside your home, such as furniture, electronics, and clothing. Liability protection is crucial in case someone is injured on your property and decides to file a lawsuit. Additionally, coverage for additional living expenses can help pay for temporary housing if your home becomes uninhabitable due to a covered event. Understanding these components will help you determine the level of protection that best suits your needs.

Another critical factor to consider is the policy’s coverage limits and deductibles. Coverage limits refer to the maximum amount your insurance provider will pay for a covered loss. It is important to ensure that these limits are sufficient to rebuild your home and replace your belongings in the event of a total loss. On the other hand, the deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you will have to cover more expenses in the event of a claim. Striking the right balance between affordability and adequate coverage is essential when selecting a policy.

Equally important is understanding what is excluded from your policy. While standard home insurance covers many common risks, certain perils, such as floods and earthquakes, are typically not included. If you live in an area prone to these natural disasters, you may need to purchase additional coverage or a separate policy to ensure full protection. Reviewing the exclusions in your policy can help you avoid unexpected gaps in coverage and allow you to make necessary adjustments based on your location and risk factors.

In addition to coverage details, the reputation and financial stability of the insurance provider should not be overlooked. A reliable insurer with a strong financial standing will be able to process claims efficiently and provide the necessary support when you need it most. Researching customer reviews, checking ratings from independent agencies, and seeking recommendations from friends or family can help you assess the credibility of an insurance company before making a commitment.

Finally, comparing quotes from multiple providers is a crucial step in finding an affordable policy that meets your needs. Insurance premiums can vary significantly based on factors such as location, home value, and coverage options. By obtaining quotes from different insurers and evaluating the benefits they offer, you can make a well-informed decision that provides both financial security and peace of mind.