“Life Insurance for Less – Starting at Just a Few Dollars a Month!”

Affordable Protection: How Life Insurance Can Fit Any Budget

Life insurance is often perceived as an expensive investment, but in reality, it can be surprisingly affordable. Many people assume that securing financial protection for their loved ones requires a significant financial commitment, yet policies are available for just a few dollars a month. By understanding the different types of life insurance and how they can be tailored to fit various budgets, individuals can ensure their families are protected without straining their finances.

One of the most cost-effective options is term life insurance, which provides coverage for a specified period, such as 10, 20, or 30 years. Because it offers protection for a limited time and does not accumulate cash value, term life insurance tends to have lower premiums compared to permanent policies. This makes it an attractive choice for individuals seeking affordable coverage, particularly those with young families, outstanding debts, or financial responsibilities that will decrease over time. By selecting a policy with a coverage amount that meets their needs, policyholders can secure financial stability for their loved ones without exceeding their budget.

For those who prefer lifelong coverage, whole life or universal life insurance may be suitable alternatives. While these policies typically have higher premiums than term life insurance, they also offer additional benefits, such as cash value accumulation. However, even within these categories, there are ways to manage costs effectively. Some insurers provide flexible payment options or allow policyholders to adjust their coverage over time, ensuring that the policy remains affordable while still offering long-term financial security.

Another factor that influences the affordability of life insurance is the applicant’s age and health. Generally, younger and healthier individuals qualify for lower premiums, as they are considered lower risk by insurance providers. This is why purchasing life insurance early can be a financially wise decision. By locking in a lower rate while in good health, policyholders can maintain affordable coverage for years to come. Additionally, many insurers offer simplified underwriting processes, which can make obtaining coverage easier and more accessible for those who may have concerns about medical exams or pre-existing conditions.

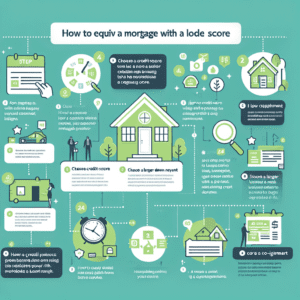

Beyond selecting the right type of policy, there are other strategies to keep life insurance costs manageable. Comparing quotes from multiple providers can help individuals find the most competitive rates, as premiums can vary significantly between insurers. Additionally, choosing a policy with only the necessary coverage amount can prevent overpaying for benefits that may not be needed. Some employers also offer group life insurance as part of their benefits package, which can serve as a cost-effective supplement to an individual policy.

Ultimately, life insurance is an essential financial tool that can fit within almost any budget. With options starting at just a few dollars a month, individuals can find a policy that meets their needs without creating financial strain. By exploring different types of coverage, considering factors such as age and health, and comparing available options, securing life insurance can be both affordable and accessible. Taking the time to invest in this protection ensures that loved ones will have financial security, providing peace of mind for the future.

Peace of Mind for Pennies: The True Cost of Life Insurance

Life insurance is often perceived as an expensive commitment, but in reality, it can be surprisingly affordable. Many people assume that securing financial protection for their loved ones requires a significant investment, yet policies are available for just a few dollars a month. This affordability makes life insurance an accessible option for individuals and families seeking peace of mind without straining their budgets. Understanding the true cost of life insurance and the factors that influence pricing can help dispel common misconceptions and encourage more people to take advantage of this essential financial tool.

One of the primary reasons life insurance remains within reach for many is the variety of policy options available. Term life insurance, for example, is one of the most cost-effective choices, offering coverage for a specified period—typically 10, 20, or 30 years—at a fixed premium. Because it provides protection without accumulating cash value, term life insurance is often significantly more affordable than permanent policies. For young and healthy individuals, premiums can be as low as the cost of a daily cup of coffee, making it an attractive option for those looking to secure their family’s financial future without a substantial financial commitment.

Moreover, several factors influence the cost of life insurance, including age, health, lifestyle, and coverage amount. Generally, younger individuals pay lower premiums because they are considered lower risk. This is why purchasing life insurance early can be a smart financial decision, as it allows policyholders to lock in lower rates for the duration of their coverage. Additionally, maintaining good health by avoiding smoking, managing medical conditions, and leading an active lifestyle can contribute to more favorable premium rates. Insurers assess these factors to determine the level of risk associated with each applicant, which ultimately affects the cost of coverage.

Beyond affordability, life insurance provides invaluable financial security for loved ones. In the event of an untimely passing, a life insurance policy ensures that beneficiaries receive a death benefit that can be used to cover essential expenses such as mortgage payments, outstanding debts, daily living costs, and even future education expenses. This financial support can prevent families from experiencing financial hardship during an already difficult time, offering stability and reassurance when it is needed most.

Additionally, life insurance is not just for those with dependents. Even individuals without children or spouses can benefit from having a policy in place. It can help cover funeral expenses, outstanding debts, or even provide a financial legacy for a charitable cause. By securing coverage early, individuals can take advantage of lower premiums while ensuring that their financial responsibilities are met, regardless of their life stage.

Ultimately, life insurance is a small investment that yields significant benefits. With policies available at just a few dollars a month, it is more affordable than many people realize. By exploring different options, understanding the factors that influence pricing, and securing coverage early, individuals can protect their loved ones without compromising their financial well-being. In doing so, they gain not only financial security but also the peace of mind that comes with knowing their family’s future is safeguarded.

Secure Your Family’s Future: Life Insurance Starting at Just a Few Dollars a Month

Life insurance is often perceived as an expensive commitment, but in reality, it can be surprisingly affordable. Many people assume that securing financial protection for their loved ones requires a significant investment, yet policies are available for just a few dollars a month. This makes life insurance an accessible option for individuals and families looking to safeguard their future without straining their budget. By understanding the benefits of life insurance and the factors that influence its cost, you can make an informed decision that ensures financial security for those who matter most.

One of the primary reasons to consider life insurance is the peace of mind it provides. In the event of an unexpected passing, a life insurance policy can help cover essential expenses such as funeral costs, outstanding debts, and daily living expenses for dependents. Without this financial safety net, loved ones may struggle to maintain their standard of living or face significant financial hardship. By securing a policy now, you can ensure that your family is protected from these potential burdens.

Affordability is a key factor that makes life insurance an attractive option for many individuals. Term life insurance, in particular, offers coverage for a specified period—such as 10, 20, or 30 years—at a lower cost compared to permanent life insurance policies. Because term life insurance is designed to provide coverage during critical financial years, such as while raising children or paying off a mortgage, it is often the most cost-effective choice. Premiums for term policies can start at just a few dollars a month, making it possible for almost anyone to obtain coverage.

Several factors influence the cost of life insurance, including age, health, lifestyle, and the amount of coverage selected. Generally, younger and healthier individuals qualify for lower premiums, as they pose a lower risk to insurers. This is why it is beneficial to purchase life insurance as early as possible. Additionally, maintaining a healthy lifestyle—such as avoiding tobacco use and managing medical conditions—can help keep premiums affordable. By comparing different policies and providers, you can find a plan that fits both your needs and your budget.

Beyond affordability, life insurance offers flexibility in coverage options. Many policies allow policyholders to customize their coverage by adding riders, such as critical illness or disability benefits, which provide additional financial protection in case of unforeseen circumstances. Some policies also offer the option to convert term coverage into permanent life insurance, ensuring lifelong protection if needed. These features make life insurance a versatile tool for financial planning, allowing individuals to adapt their coverage as their needs change over time.

Ultimately, life insurance is an essential component of a comprehensive financial plan. It provides security for loved ones, ensuring that they are not left with financial burdens in difficult times. With policies available at an affordable cost, there is no reason to delay obtaining coverage. By taking action today, you can secure your family’s future and gain the peace of mind that comes with knowing they will be financially protected, no matter what the future holds.