“Term vs. Whole Life Insurance: Find the Best Fit for Young Adults’ Future Security!”

**Understanding the Differences: Term vs. Whole Life Insurance for Young Adults**

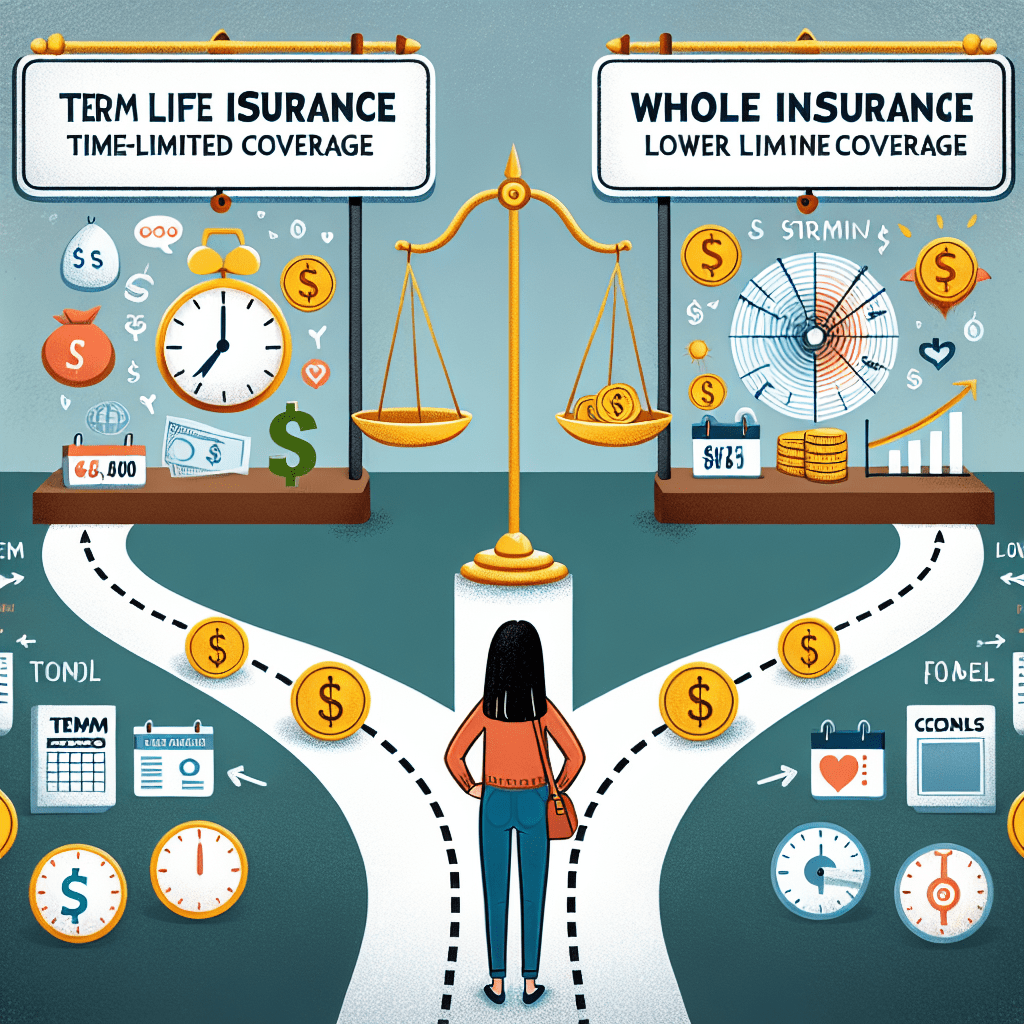

When considering life insurance options, young adults often find themselves choosing between term and whole life insurance. Understanding the differences between these two types of policies is essential for making an informed decision that aligns with financial goals and long-term security. While both provide financial protection, they serve distinct purposes and come with unique benefits and drawbacks.

Term life insurance is often the more affordable option, making it an attractive choice for young adults who may be just starting their careers or managing other financial responsibilities such as student loans or rent. This type of policy provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiaries receive a death benefit. However, if the term expires and the policyholder is still alive, the coverage ends unless it is renewed or converted into a permanent policy. Because term life insurance does not accumulate cash value, its premiums are generally lower than those of whole life insurance, allowing policyholders to allocate their savings toward other financial priorities such as investments or emergency funds.

On the other hand, whole life insurance offers lifelong coverage and includes a cash value component that grows over time. This feature makes it a more comprehensive financial tool, as policyholders can borrow against the accumulated cash value or even withdraw funds if needed. Additionally, whole life insurance premiums remain fixed throughout the policyholder’s lifetime, providing stability and predictability. However, these benefits come at a higher cost, as whole life insurance premiums are significantly more expensive than those of term policies. For young adults with limited financial resources, committing to higher premiums may not always be feasible, especially when other financial goals, such as homeownership or retirement savings, require attention.

When deciding between term and whole life insurance, young adults should consider their financial situation, long-term goals, and the specific purpose of the coverage. For those seeking affordable protection to cover temporary financial obligations—such as a mortgage, student loans, or dependents’ needs—term life insurance may be the most practical choice. It provides substantial coverage at a lower cost, ensuring that loved ones are financially protected in the event of an untimely death. Furthermore, since many young adults may not yet have significant financial dependents, a term policy allows them to secure coverage without committing to high premiums.

Conversely, young adults who prioritize long-term financial planning and wealth accumulation may find whole life insurance more appealing. The cash value component can serve as a financial asset, offering liquidity and potential tax advantages. Additionally, those with lifelong dependents or specific estate planning needs may benefit from the permanent coverage that whole life insurance provides. However, it is crucial to assess whether the higher premiums align with current and future financial capabilities.

Ultimately, the best choice depends on individual circumstances and financial objectives. While term life insurance offers affordability and flexibility, whole life insurance provides lifelong security and investment potential. Young adults should carefully evaluate their needs, consult with financial professionals if necessary, and select a policy that best supports their financial well-being both now and in the future.

**Cost Comparison: Why Term Life Insurance May Be the Better Choice for Young Adults**

When considering life insurance options, young adults often face the decision between term and whole life insurance. While both types provide financial protection, the cost difference between them is a crucial factor that can significantly influence the choice. For many young individuals who are just beginning their careers, managing student loans, or saving for major life expenses, affordability plays a key role in determining the most suitable policy. In this regard, term life insurance often emerges as the more practical and cost-effective option.

One of the primary reasons term life insurance is more affordable is its structure. Unlike whole life insurance, which provides lifelong coverage and includes a cash value component, term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. Because it is designed solely to provide a death benefit without an investment component, the premiums are significantly lower. This makes it an attractive choice for young adults who need financial protection but may not have the budget for higher monthly payments.

In contrast, whole life insurance comes with substantially higher premiums due to its permanent coverage and cash value accumulation. While this cash value can be borrowed against or withdrawn, it takes years to build up a meaningful amount. For young adults who are still in the early stages of financial planning, the higher cost of whole life insurance may not be justifiable, especially when other financial priorities, such as paying off debt or saving for a home, take precedence. The difference in premiums can be substantial, with whole life insurance often costing five to ten times more than a comparable term policy.

Another important consideration is the actual need for life insurance at a young age. Many young adults purchase life insurance to provide financial security for dependents or to cover outstanding debts in the event of an untimely passing. Since these financial responsibilities are often temporary, a term policy can provide adequate coverage during the years when it is most needed. For example, a 20- or 30-year term policy can ensure that a mortgage, student loans, or other financial obligations are covered, without requiring a lifelong financial commitment.

Additionally, the money saved by choosing term life insurance can be allocated toward other financial goals. Instead of paying high premiums for whole life insurance, young adults can invest the difference in retirement accounts, emergency savings, or other investment opportunities that may yield higher returns over time. This approach allows for greater financial flexibility and the potential for long-term wealth accumulation.

While whole life insurance does offer benefits such as lifelong coverage and a guaranteed cash value, these advantages may not be as relevant for young adults who are primarily seeking affordable protection. For those who later decide they need permanent coverage, there is always the option to convert a term policy into a whole life policy or purchase a new policy when financial circumstances allow.

Ultimately, the decision between term and whole life insurance depends on individual financial goals and priorities. However, for most young adults, the lower cost and straightforward nature of term life insurance make it the more practical choice. By opting for term coverage, they can secure essential financial protection while maintaining the flexibility to invest in other areas that contribute to their long-term financial well-being.

**Long-Term Benefits: When Whole Life Insurance Makes Sense for Young Adults**

When considering life insurance options, young adults often face the decision between term and whole life insurance. While term life insurance provides coverage for a specific period, whole life insurance offers lifelong protection along with additional financial benefits. Although whole life insurance typically comes with higher premiums, its long-term advantages can make it a valuable choice for young adults who are thinking ahead.

One of the most significant benefits of whole life insurance is the cash value component, which grows over time. Unlike term life insurance, which only provides a death benefit, whole life insurance accumulates cash value that policyholders can access during their lifetime. This feature can serve as a financial safety net, offering liquidity for emergencies, major purchases, or even retirement planning. Since the cash value grows on a tax-deferred basis, young adults who start early can benefit from decades of compounding growth, potentially building a substantial financial asset.

Additionally, whole life insurance provides stability and predictability, which can be particularly advantageous for young adults looking for long-term financial security. Premiums remain fixed throughout the life of the policy, meaning policyholders do not have to worry about increasing costs as they age. In contrast, term life insurance expires after a set period, and renewing it later in life often comes with significantly higher premiums. By locking in a whole life policy at a young age, individuals can secure lower rates and ensure that their coverage remains in place regardless of future health changes.

Another important consideration is the ability to borrow against the policy’s cash value. Unlike traditional loans, which require credit approval and may come with high interest rates, policy loans from a whole life insurance plan offer a flexible borrowing option. Young adults who may need funds for a down payment on a home, starting a business, or covering unexpected expenses can use their policy’s cash value as collateral. This feature provides financial flexibility without the need to liquidate other investments or take on additional debt.

Furthermore, whole life insurance can play a crucial role in estate planning and wealth transfer. While this may not be an immediate concern for young adults, starting early allows them to build a financial foundation that can benefit future generations. The death benefit from a whole life policy is generally tax-free and can provide financial security for beneficiaries. Additionally, some policies offer dividend payments, which can be reinvested to further increase the policy’s value or used as supplemental income.

Despite these advantages, whole life insurance may not be the best choice for everyone. The higher premiums can be a drawback for young adults with limited financial resources, and some may prefer the affordability of term life insurance. However, for those who can manage the cost, the long-term benefits of whole life insurance—such as cash value accumulation, fixed premiums, borrowing options, and estate planning advantages—make it a compelling option. By securing a policy early, young adults can take advantage of lower rates and maximize the financial benefits over time, ensuring both protection and financial growth for the future.