“Secure Your Future: The Best Life Insurance Options for Over 50s”

Understanding the Best Life Insurance Policies for People Over 50

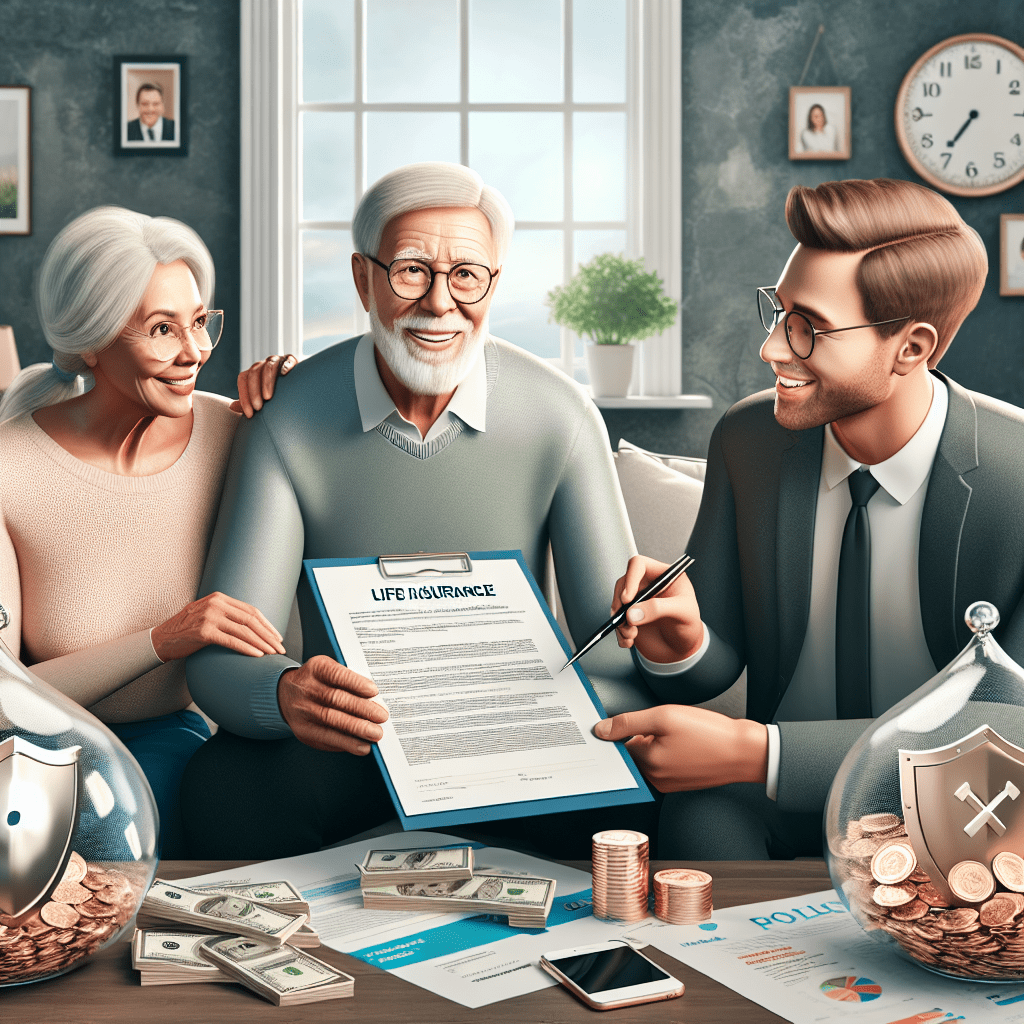

As individuals reach their 50s, financial priorities often shift, making life insurance an essential consideration for securing their loved ones’ future. At this stage, people may be looking for policies that provide financial protection for their families, cover outstanding debts, or assist with final expenses. Understanding the best life insurance options available can help individuals make informed decisions that align with their needs and long-term goals.

One of the most common choices for people over 50 is term life insurance. This type of policy provides coverage for a specific period, typically ranging from 10 to 30 years. It is often more affordable than permanent life insurance, making it an attractive option for those who need coverage for a set period, such as until a mortgage is paid off or children become financially independent. However, term life insurance does not accumulate cash value, and once the term expires, policyholders may need to renew at a higher premium or seek alternative coverage.

For those looking for lifelong protection, whole life insurance may be a more suitable option. Unlike term life insurance, whole life policies provide coverage for the insured’s entire lifetime, as long as premiums are paid. Additionally, these policies build cash value over time, which can be borrowed against or used for other financial needs. While whole life insurance tends to have higher premiums than term policies, it offers the benefit of guaranteed coverage and a financial asset that can be utilized during the policyholder’s lifetime.

Another viable option is universal life insurance, which combines the benefits of lifelong coverage with flexible premium payments and a cash value component. This type of policy allows policyholders to adjust their premiums and death benefits as their financial situation changes. The cash value grows based on interest rates set by the insurer, providing an opportunity for additional financial growth. However, it is important to monitor the policy’s performance, as fluctuations in interest rates can impact the cash value and overall affordability of the policy.

For individuals who may have health concerns or difficulty qualifying for traditional life insurance, guaranteed issue life insurance can be an alternative worth considering. This type of policy does not require a medical exam or health questionnaire, making it accessible to those with pre-existing conditions. However, guaranteed issue policies typically have lower coverage amounts and higher premiums compared to other types of life insurance. Additionally, they often include a graded death benefit, meaning that full benefits may not be paid out if the policyholder passes away within the first few years of coverage.

Final expense insurance, also known as burial insurance, is another option specifically designed to cover end-of-life costs such as funeral expenses, medical bills, and outstanding debts. These policies generally offer lower coverage amounts but can provide peace of mind by ensuring that loved ones are not burdened with financial responsibilities after the policyholder’s passing. Since final expense insurance is typically easier to qualify for, it can be a practical choice for those seeking a straightforward and affordable solution.

Ultimately, selecting the best life insurance policy for individuals over 50 depends on their financial goals, health status, and coverage needs. By carefully evaluating the available options and considering factors such as premium costs, coverage duration, and cash value benefits, individuals can choose a policy that provides financial security and peace of mind for themselves and their loved ones.

Top Life Insurance Companies Offering Plans for Seniors Over 50

When searching for the best life insurance options for individuals over 50, it is essential to consider companies that specialize in policies tailored to the needs of older adults. Many insurers offer plans designed to provide financial security, ensuring that loved ones are protected from unexpected expenses. As people age, factors such as health conditions, coverage amounts, and premium costs become increasingly important. Fortunately, several top-rated life insurance companies provide policies that cater specifically to seniors, offering flexible terms and competitive rates.

One of the most well-regarded insurers for individuals over 50 is Mutual of Omaha. This company is known for its simplified underwriting process, making it easier for seniors to obtain coverage without undergoing a medical exam. Their whole life insurance policies offer guaranteed premiums and lifelong protection, ensuring that beneficiaries receive a payout regardless of when the policyholder passes away. Additionally, their term life insurance options provide affordable coverage for those who need financial protection for a specific period, such as until retirement or until a mortgage is paid off.

Another excellent choice is AARP, which partners with New York Life to offer life insurance policies specifically designed for older adults. AARP’s policies are particularly appealing because they do not require a medical exam, making them accessible to individuals with pre-existing health conditions. Their guaranteed acceptance life insurance ensures that applicants cannot be denied coverage based on health status, providing peace of mind for those who may have difficulty qualifying for traditional policies. While premiums may be higher than those of medically underwritten policies, the convenience and accessibility make AARP a strong option for seniors seeking reliable coverage.

For those looking for a highly customizable policy, Prudential is a top contender. Prudential offers a range of term and permanent life insurance options, allowing policyholders to choose coverage that aligns with their financial goals. Their term life policies provide affordable premiums with the option to convert to permanent coverage if needed. Additionally, Prudential’s universal life insurance policies offer flexibility in premium payments and death benefits, making them an attractive choice for individuals who want to adjust their coverage as their financial situation changes.

State Farm is another reputable insurer that provides excellent life insurance options for individuals over 50. Known for its strong customer service and financial stability, State Farm offers both term and permanent life insurance policies. Their term life insurance plans are particularly appealing for those who need coverage for a specific period, while their whole life policies provide lifelong protection with a guaranteed death benefit. Additionally, State Farm’s policies often include options for policyholders to add riders, such as long-term care benefits, which can be valuable for seniors concerned about future healthcare costs.

For individuals seeking a no-exam policy with competitive rates, Colonial Penn is a well-known provider. Their guaranteed acceptance life insurance is designed for seniors who may have difficulty qualifying for traditional policies due to health concerns. While these policies typically have a graded death benefit, meaning full benefits are not available in the first few years, they provide an accessible option for those who need coverage without the hassle of medical underwriting.

Ultimately, choosing the right life insurance company depends on individual needs, budget, and health status. By considering factors such as coverage options, premium costs, and policy flexibility, individuals over 50 can find a plan that provides financial security and peace of mind for their loved ones.

Term vs. Whole Life Insurance: Choosing the Right Option After 50

When considering life insurance options after the age of 50, it is essential to understand the differences between term and whole life insurance. Each type of policy offers distinct benefits, and the right choice depends on individual financial goals, health status, and long-term needs. As people approach retirement, their insurance priorities often shift, making it crucial to evaluate which option provides the most security and value.

Term life insurance is often an attractive choice for individuals over 50 due to its affordability and straightforward structure. This type of policy provides coverage for a specific period, typically ranging from 10 to 30 years. If the policyholder passes away during the term, their beneficiaries receive a death benefit. However, if the term expires and the policyholder is still alive, coverage ends unless the policy is renewed or converted into a permanent policy. One of the primary advantages of term life insurance is its lower premiums compared to whole life insurance, making it a cost-effective solution for those who need coverage for a limited time. This can be particularly beneficial for individuals who still have financial obligations, such as a mortgage or dependents who rely on their income.

On the other hand, whole life insurance provides lifelong coverage and includes a cash value component that grows over time. Unlike term life insurance, which only offers a death benefit, whole life insurance accumulates cash value that policyholders can borrow against or withdraw if needed. This feature makes whole life insurance an appealing option for those who want to build financial security while ensuring their loved ones receive a guaranteed payout. Additionally, whole life insurance premiums remain fixed, which can be advantageous for individuals who prefer predictable costs. However, the higher premiums associated with whole life insurance may be a drawback for some, especially those on a fixed income.

When deciding between term and whole life insurance after 50, it is important to consider personal financial circumstances and long-term objectives. For individuals who primarily seek coverage to replace lost income or pay off outstanding debts, term life insurance may be the most practical option. Since premiums are lower, policyholders can obtain higher coverage amounts at a more affordable rate. Furthermore, many term policies offer the option to convert to a permanent policy later, providing flexibility if financial needs change.

Conversely, whole life insurance may be more suitable for those who want to leave a financial legacy or cover final expenses without worrying about policy expiration. The cash value component can also serve as an additional financial resource during retirement, offering policyholders the ability to access funds if necessary. This can be particularly beneficial for individuals who have maxed out other retirement savings options and want to supplement their financial portfolio.

Ultimately, the choice between term and whole life insurance depends on individual priorities and financial goals. While term life insurance offers affordability and flexibility, whole life insurance provides lifelong security and additional financial benefits. Carefully assessing current and future financial needs can help individuals over 50 make an informed decision that best supports their loved ones and long-term financial well-being.