“Shield Your Wealth Before Trouble Strikes – Legal Strategies to Protect Your Assets.”

Establishing Trusts to Safeguard Your Assets

One of the most effective ways to protect your assets before facing a lawsuit is by establishing trusts. A trust is a legal arrangement in which a trustee holds and manages assets on behalf of beneficiaries, offering a layer of protection against potential creditors and legal claims. By transferring ownership of assets into a trust, individuals can reduce their personal liability while ensuring that their wealth is preserved for future generations. However, not all trusts provide the same level of protection, and understanding the different types is essential for making informed decisions.

A revocable trust, for instance, allows the grantor to retain control over the assets and make changes as needed. While this type of trust is useful for estate planning and avoiding probate, it does not offer significant protection against lawsuits. Since the grantor maintains control, courts may determine that the assets remain part of the individual’s estate and are therefore subject to legal claims. In contrast, an irrevocable trust provides a stronger shield against potential lawsuits. Once assets are placed in an irrevocable trust, the grantor relinquishes control, meaning creditors and litigants may find it more difficult to access those assets. Because the trust is a separate legal entity, assets held within it are generally protected from personal liability.

In addition to choosing the right type of trust, selecting a reliable trustee is crucial. The trustee is responsible for managing the assets according to the terms of the trust, ensuring that they are distributed appropriately and in compliance with legal requirements. Many individuals opt for a professional trustee, such as a financial institution or attorney, to ensure impartiality and proper administration. This decision can help prevent conflicts of interest and ensure that the trust operates as intended.

Another important consideration is the timing of trust establishment. Courts may scrutinize asset transfers if they occur after a lawsuit has been filed or when legal action is imminent. If a court determines that assets were transferred with the intent to defraud creditors, it may invalidate the trust and allow claimants to access those assets. Therefore, proactive planning is essential. Establishing a trust well in advance of any legal threats demonstrates that the transfer was made for legitimate estate planning or asset protection purposes rather than to evade potential liabilities.

Furthermore, trusts can be structured to provide additional layers of protection. For example, a spendthrift trust restricts beneficiaries from accessing trust assets directly, preventing creditors from seizing those assets to satisfy debts. Similarly, a domestic asset protection trust (DAPT) is specifically designed to shield assets from future creditors while allowing the grantor to remain a beneficiary under certain conditions. These specialized trusts can be particularly useful for individuals in high-risk professions, such as business owners, physicians, and real estate investors, who may face a greater likelihood of litigation.

Ultimately, establishing a trust as part of a comprehensive asset protection strategy requires careful planning and legal guidance. Consulting with an experienced attorney can help ensure that the trust is structured correctly and complies with applicable laws. By taking proactive steps to safeguard assets through trusts, individuals can reduce their exposure to legal risks while preserving their financial security for the future.

Utilizing Business Entities for Liability Protection

One of the most effective ways to protect your assets before facing a lawsuit is by utilizing business entities for liability protection. By structuring your business properly, you can create a legal separation between your personal and business assets, reducing the risk of personal financial loss in the event of litigation. Understanding the different types of business entities and how they function is essential for implementing a strong asset protection strategy.

A sole proprietorship, while the simplest business structure, offers no liability protection. In this arrangement, the business and the owner are legally the same entity, meaning that personal assets such as bank accounts, real estate, and investments are vulnerable to business-related lawsuits. To mitigate this risk, many business owners choose to form a limited liability company (LLC) or a corporation, both of which provide a legal distinction between personal and business assets.

An LLC is a popular choice for small business owners due to its flexibility and liability protection. When properly maintained, an LLC shields personal assets from business debts and legal claims. However, simply forming an LLC is not enough; it must be operated correctly to maintain its protective benefits. This includes keeping business and personal finances separate, maintaining accurate records, and adhering to state regulations. Failure to do so can result in a court disregarding the LLC’s liability protection, a situation known as “piercing the corporate veil.”

Similarly, corporations offer strong liability protection, particularly when structured as a C corporation or an S corporation. A corporation is a separate legal entity, meaning that shareholders are generally not personally responsible for business debts or legal judgments. However, corporations require more formalities than LLCs, such as holding regular board meetings, maintaining corporate minutes, and following strict record-keeping procedures. While these requirements may seem burdensome, they are crucial for preserving the corporation’s legal protections.

In addition to choosing the right business entity, business owners should consider using multiple entities to further safeguard their assets. For example, separating high-risk activities from valuable assets by placing them in different entities can limit exposure to liability. A common strategy is to hold real estate in one LLC while operating the business in another. This way, if the operating business is sued, the real estate remains protected from potential claims.

Another important aspect of liability protection is ensuring that contracts and agreements are executed in the name of the business entity rather than in an individual’s name. Signing contracts as an individual can expose personal assets to liability, whereas signing on behalf of the business entity helps maintain the legal separation between personal and business obligations. Additionally, obtaining appropriate business insurance can provide an extra layer of protection, covering legal costs and potential damages in the event of a lawsuit.

Ultimately, utilizing business entities for liability protection is a proactive approach to safeguarding personal assets. By selecting the appropriate entity, maintaining proper corporate formalities, and implementing strategic asset separation, business owners can significantly reduce their exposure to financial risk. Taking these steps before facing legal challenges ensures that assets remain protected, allowing business owners to focus on growth and success with greater peace of mind.

Implementing Insurance Strategies to Minimize Risk

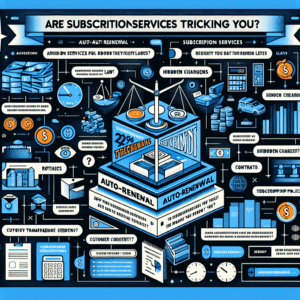

One of the most effective ways to protect your assets before facing a lawsuit is by implementing comprehensive insurance strategies. Insurance serves as a financial safeguard, ensuring that unexpected legal claims do not result in significant personal or business losses. By carefully selecting and maintaining appropriate coverage, individuals and business owners can mitigate risks and shield their wealth from potential liabilities. Understanding the various types of insurance available and how they function is essential in creating a robust asset protection plan.

Liability insurance is a fundamental component of risk management, as it provides coverage for claims arising from injuries, property damage, or negligence. For individuals, personal liability insurance—often included in homeowners or renters policies—can offer protection against lawsuits stemming from accidents that occur on their property. However, for those with substantial assets, an umbrella insurance policy may be necessary to extend coverage beyond standard liability limits. This type of policy acts as an additional layer of protection, covering legal expenses and damages that exceed the limits of primary insurance policies.

For business owners, general liability insurance is crucial in safeguarding against claims related to bodily injury, property damage, or advertising harm. Additionally, professional liability insurance, also known as errors and omissions insurance, is essential for individuals in professions where mistakes or negligence could lead to legal action. Doctors, lawyers, financial advisors, and other professionals often face lawsuits related to their services, making this coverage indispensable. Without adequate insurance, defending against such claims can be financially devastating, potentially leading to the loss of personal and business assets.

Beyond liability coverage, property insurance plays a vital role in asset protection. Whether for a personal residence or a business facility, property insurance ensures that damages caused by fire, theft, natural disasters, or other unforeseen events do not result in financial ruin. Business owners should also consider business interruption insurance, which provides compensation for lost income and operating expenses in the event of a temporary shutdown due to covered damages. This type of coverage can be particularly beneficial in maintaining financial stability during unexpected disruptions.

In addition to these standard policies, specialized insurance options can further enhance asset protection. Directors and officers (D&O) insurance, for example, is designed to protect executives and board members from personal liability in lawsuits related to their corporate decisions. Similarly, cyber liability insurance has become increasingly important in an era where data breaches and cyberattacks pose significant financial risks. By assessing specific vulnerabilities and obtaining appropriate coverage, individuals and businesses can proactively address potential threats before they escalate into costly legal battles.

While securing the right insurance policies is essential, regularly reviewing and updating coverage is equally important. As financial situations evolve, asset values increase, and business operations expand, insurance needs may change. Conducting periodic assessments with an insurance professional ensures that coverage remains adequate and aligned with current risks. Additionally, understanding policy exclusions and limitations is critical to avoiding gaps in protection. Some policies may not cover certain types of claims, making it necessary to explore supplemental coverage options.

Ultimately, implementing a well-structured insurance strategy is a proactive approach to minimizing financial exposure and protecting assets from potential lawsuits. By carefully selecting appropriate policies, maintaining adequate coverage limits, and staying informed about evolving risks, individuals and business owners can create a strong defense against legal claims. In combination with other asset protection strategies, such as legal structures and estate planning, insurance serves as a crucial tool in preserving financial security and ensuring long-term stability.