“Debt Consolidation vs. Debt Settlement: Find the Best Path to Financial Freedom!”

Understanding the Key Differences Between Debt Consolidation and Debt Settlement

Debt consolidation and debt settlement are two distinct financial strategies designed to help individuals manage overwhelming debt. While both approaches aim to provide relief, they differ significantly in their methods, potential benefits, and long-term financial implications. Understanding these key differences is essential for making an informed decision about which option best suits your financial situation.

Debt consolidation involves combining multiple debts into a single loan, typically with a lower interest rate and a structured repayment plan. This approach simplifies debt management by reducing the number of monthly payments and potentially lowering overall interest costs. Individuals who choose debt consolidation often take out a personal loan, a home equity loan, or a balance transfer credit card to pay off existing debts. By consolidating debt, borrowers can streamline their financial obligations and make repayment more manageable. Additionally, this method does not negatively impact credit scores as long as payments are made on time. In fact, consistent payments on a consolidated loan can improve credit over time. However, debt consolidation requires financial discipline, as it does not reduce the total amount owed. Borrowers must ensure they do not accumulate additional debt while repaying the consolidated loan.

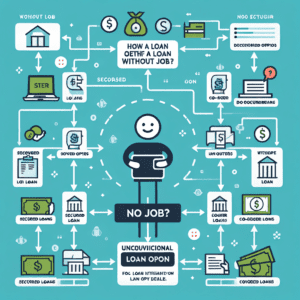

In contrast, debt settlement focuses on negotiating with creditors to reduce the total amount of debt owed. This process typically involves working with a debt settlement company that negotiates on behalf of the debtor to reach a lower payoff amount. Debt settlement can be an attractive option for individuals facing severe financial hardship who are unable to meet their current debt obligations. By settling debts for less than the full balance, borrowers may achieve significant savings. However, this approach comes with notable risks and drawbacks. Creditors are not obligated to accept settlement offers, and the process can take several months or even years to complete. Additionally, debt settlement often requires individuals to stop making payments on their debts, which can lead to late fees, increased interest rates, and a significant drop in credit scores. The impact on credit can be long-lasting, making it more difficult to obtain loans or credit in the future. Furthermore, forgiven debt may be considered taxable income, potentially leading to additional financial burdens.

When deciding between debt consolidation and debt settlement, it is crucial to assess personal financial circumstances, goals, and the ability to manage repayment. Debt consolidation is generally a better option for individuals with a steady income who can afford to make regular payments and want to simplify their financial obligations without damaging their credit. On the other hand, debt settlement may be more suitable for those experiencing financial distress who are unable to meet their current debt obligations and are willing to accept the potential negative consequences in exchange for reducing their overall debt burden.

Ultimately, both strategies have their advantages and disadvantages, and the right choice depends on individual financial needs. Seeking professional financial advice can provide valuable insights into the best course of action. By carefully evaluating the key differences between debt consolidation and debt settlement, individuals can make informed decisions that align with their long-term financial well-being.

Pros and Cons of Debt Consolidation vs. Debt Settlement

Debt consolidation and debt settlement are two common strategies for managing overwhelming financial obligations, each with its own advantages and drawbacks. Understanding the pros and cons of these approaches is essential for making an informed decision about which option best suits your financial situation. While both methods aim to provide relief from debt, they operate in fundamentally different ways and have distinct implications for credit scores, financial stability, and long-term financial health.

Debt consolidation involves combining multiple debts into a single loan, typically with a lower interest rate and a fixed repayment schedule. One of the primary benefits of this approach is the simplification of debt management. Instead of keeping track of multiple payments with varying due dates and interest rates, borrowers make a single monthly payment, reducing the risk of missed or late payments. Additionally, debt consolidation can lower the overall interest rate, which may result in reduced monthly payments and long-term savings. This method is particularly beneficial for individuals with high-interest credit card debt, as consolidating into a lower-rate loan can make repayment more manageable.

However, debt consolidation is not without its drawbacks. To qualify for a favorable consolidation loan, borrowers typically need a good credit score. Those with poor credit may struggle to secure a loan with a lower interest rate, which could negate the benefits of consolidation. Furthermore, while this approach simplifies repayment, it does not reduce the total amount owed. Borrowers must remain disciplined in their financial habits to avoid accumulating new debt while repaying the consolidated loan. Additionally, some consolidation options, such as home equity loans, require collateral, which puts assets at risk if the borrower is unable to meet repayment obligations.

On the other hand, debt settlement offers a different approach by negotiating with creditors to reduce the total amount owed. This method can be particularly appealing to individuals facing significant financial hardship, as it has the potential to lower overall debt burdens substantially. By working with a debt settlement company or negotiating directly with creditors, borrowers may be able to settle their debts for a fraction of the original balance. This can provide much-needed financial relief and a faster path to becoming debt-free compared to traditional repayment methods.

Despite its potential benefits, debt settlement also comes with significant risks and consequences. One major drawback is the negative impact on credit scores. Because the process often involves ceasing payments to creditors while negotiations take place, accounts may become delinquent, leading to late fees, collection efforts, and a decline in creditworthiness. Additionally, there is no guarantee that creditors will agree to settle, and even if they do, forgiven debt may be considered taxable income by the IRS. Furthermore, debt settlement companies often charge high fees, which can reduce the overall savings achieved through the process.

When deciding between debt consolidation and debt settlement, individuals must carefully assess their financial circumstances, credit standing, and long-term goals. Those with stable income and good credit may find debt consolidation to be a more structured and less damaging solution, while those facing severe financial distress may consider debt settlement as a last resort. Ultimately, understanding the advantages and disadvantages of each approach is crucial in selecting the most effective strategy for achieving financial stability.

How to Choose Between Debt Consolidation and Debt Settlement for Your Financial Situation

When faced with overwhelming debt, individuals often seek solutions that can help them regain financial stability. Two common options are debt consolidation and debt settlement, each offering distinct advantages and potential drawbacks. Choosing the right approach depends on various factors, including the total amount of debt, financial goals, and the ability to make consistent payments. Understanding the differences between these two strategies is essential in determining which one aligns best with your financial situation.

Debt consolidation involves combining multiple debts into a single loan, typically with a lower interest rate and a structured repayment plan. This method simplifies debt management by reducing the number of payments and potentially lowering monthly obligations. It is particularly beneficial for individuals with high-interest credit card debt, as consolidating balances into a lower-rate loan can lead to significant savings over time. Additionally, debt consolidation can improve credit scores if payments are made consistently, as it reduces the risk of missed or late payments. However, this approach requires a stable income and a good credit score to qualify for favorable loan terms. Without these, borrowers may struggle to secure a consolidation loan with a lower interest rate than their existing debts, limiting the effectiveness of this strategy.

On the other hand, debt settlement focuses on negotiating with creditors to reduce the total amount owed. This process typically involves working with a debt settlement company that communicates with creditors on behalf of the debtor. The goal is to reach an agreement where the creditor accepts a lump-sum payment that is less than the original balance. While this method can significantly reduce overall debt, it comes with certain risks. Debt settlement often requires individuals to stop making payments on their accounts, which can lead to late fees, increased interest, and a negative impact on credit scores. Additionally, there is no guarantee that creditors will agree to a settlement, and any forgiven debt may be considered taxable income. Despite these challenges, debt settlement can be a viable option for those who are struggling with financial hardship and cannot afford to repay their debts in full.

When deciding between debt consolidation and debt settlement, it is important to assess your financial situation carefully. If you have a steady income and a good credit score, debt consolidation may be the better choice, as it allows for structured repayment without damaging your credit. This option is ideal for individuals who can commit to making regular payments and want to simplify their financial obligations. Conversely, if you are experiencing financial distress and cannot keep up with your current payments, debt settlement may provide relief by reducing the total amount owed. However, it is crucial to consider the potential impact on your credit score and the possibility of tax consequences before proceeding with this option.

Ultimately, the right choice depends on your specific financial circumstances and long-term goals. Consulting with a financial advisor or credit counselor can provide valuable insights and help you determine the most effective strategy for managing your debt. By carefully weighing the benefits and risks of each approach, you can make an informed decision that supports your financial well-being and sets you on the path toward a more stable future.