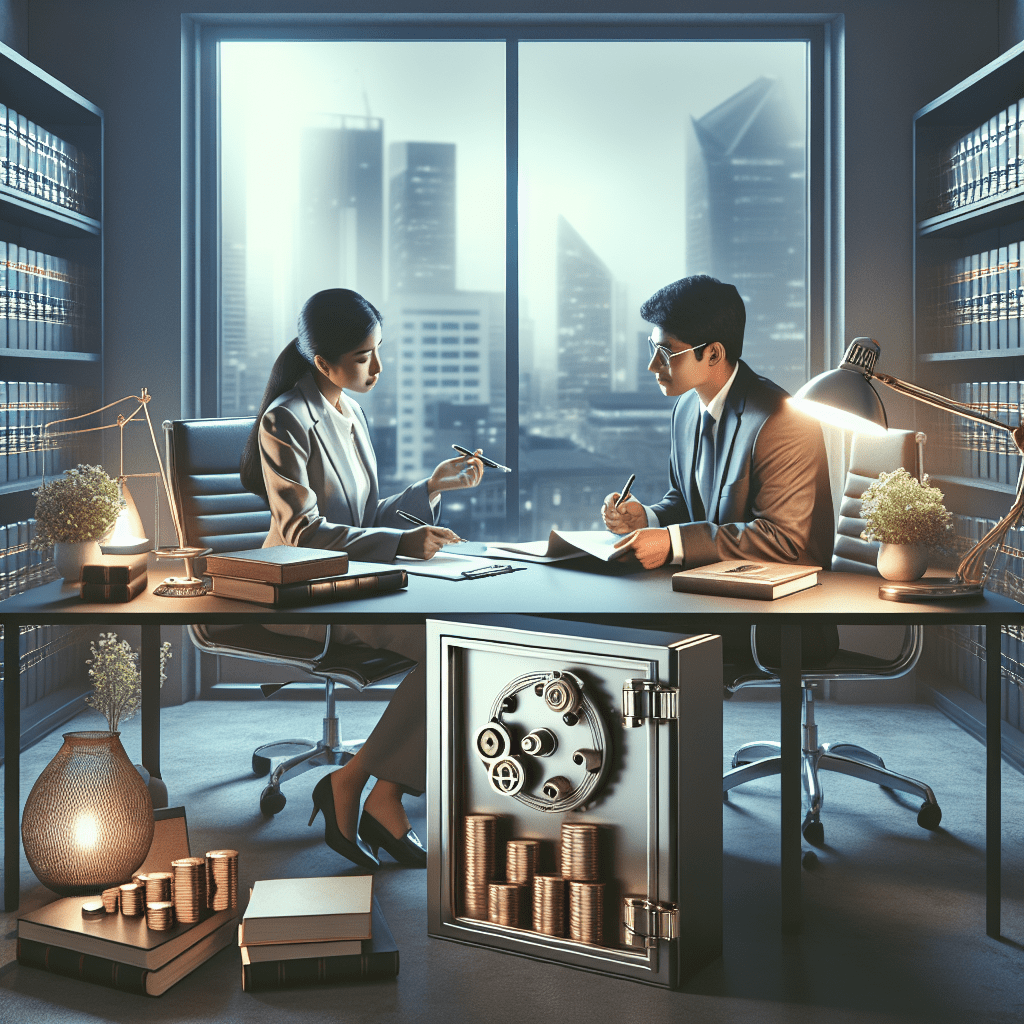

“Shield Your Wealth Before Trouble Strikes – Legal Strategies to Protect Your Assets.”

Understanding Trusts: How to Shield Your Assets from Lawsuits

One of the most effective ways to protect your assets from potential lawsuits is by utilizing legal structures such as trusts. A trust is a legal arrangement in which a trustee holds and manages assets on behalf of beneficiaries, offering a layer of protection against creditors and legal claims. By transferring ownership of assets into a trust, individuals can reduce their personal liability while maintaining control over their wealth. However, not all trusts provide the same level of protection, and understanding the differences between them is crucial for ensuring that your assets remain secure.

A revocable living trust, for instance, is commonly used for estate planning purposes but does not offer significant protection against lawsuits. Since the grantor retains control over the assets, they are still considered part of the grantor’s estate and can be subject to legal claims. In contrast, an irrevocable trust provides a much stronger shield against lawsuits because the grantor relinquishes ownership and control over the assets. Once assets are placed in an irrevocable trust, they are no longer considered part of the grantor’s personal estate, making it more difficult for creditors or litigants to access them.

Another important consideration is the type of irrevocable trust used for asset protection. A domestic asset protection trust (DAPT) is a trust established under the laws of certain U.S. states that allow individuals to protect their assets from future creditors while still benefiting from them. These trusts can be highly effective, but their enforceability depends on the jurisdiction in which they are created. Some states have stronger asset protection laws than others, making it essential to choose the right location for establishing the trust.

For those seeking even greater protection, an offshore asset protection trust (OAPT) may be a viable option. These trusts are established in foreign jurisdictions with favorable asset protection laws, making it more challenging for creditors to pursue claims against the trust’s assets. Offshore trusts can provide a significant legal barrier against lawsuits, but they require careful planning and compliance with tax and reporting regulations. Additionally, they may be subject to scrutiny by courts if they are perceived as being used solely to evade legal obligations.

While trusts can be a powerful tool for shielding assets from lawsuits, they must be established before any legal claims arise. Courts may view last-minute transfers of assets into a trust as fraudulent conveyances, which can result in the trust being disregarded and the assets being made available to creditors. Therefore, proactive planning is essential to ensure that asset protection strategies are legally sound and effective.

In addition to trusts, individuals can further safeguard their assets by combining multiple legal strategies, such as forming limited liability companies (LLCs) or family limited partnerships (FLPs). These entities can provide additional layers of protection by separating personal and business assets, reducing exposure to liability. Consulting with an experienced asset protection attorney is crucial to developing a comprehensive strategy tailored to individual circumstances.

Ultimately, protecting assets from lawsuits requires careful planning and a thorough understanding of legal structures. By utilizing trusts and other asset protection tools in advance, individuals can safeguard their wealth and minimize the risk of financial loss in the event of legal disputes.

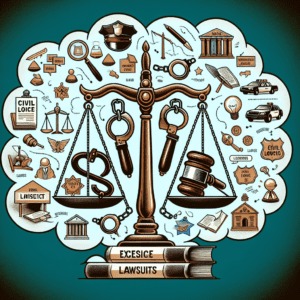

The Power of LLCs: Structuring Your Business for Maximum Legal Protection

One of the most effective ways to protect your assets before facing a lawsuit is by structuring your business as a Limited Liability Company (LLC). This legal entity provides a crucial layer of protection by separating personal and business assets, ensuring that your personal wealth is not at risk in the event of legal action against your company. By understanding how an LLC functions and implementing best practices in its management, business owners can significantly reduce their exposure to financial liability.

An LLC offers limited liability protection, meaning that the owners, known as members, are not personally responsible for the company’s debts or legal obligations. This separation is essential because, without it, creditors or litigants could pursue personal assets such as homes, bank accounts, and investments to satisfy business-related claims. By forming an LLC, business owners create a legal distinction between themselves and their company, which serves as a protective barrier against potential lawsuits.

Beyond liability protection, an LLC provides flexibility in management and taxation. Unlike corporations, which require a rigid structure with a board of directors and formal meetings, LLCs allow owners to manage the business directly or appoint managers to oversee operations. This flexibility makes it easier to maintain compliance with legal requirements while still benefiting from asset protection. Additionally, LLCs offer various tax advantages, including the ability to choose between pass-through taxation and corporate taxation, depending on what best suits the business’s financial strategy.

However, simply forming an LLC is not enough to ensure full legal protection. Business owners must take additional steps to maintain the integrity of the liability shield. One of the most important practices is keeping personal and business finances separate. Commingling funds by using a personal bank account for business transactions can weaken the legal distinction between the owner and the LLC, potentially exposing personal assets to liability. To prevent this, it is essential to open a dedicated business bank account, maintain accurate financial records, and ensure that all transactions are conducted in the company’s name.

Another critical aspect of maintaining an LLC’s protective benefits is adhering to corporate formalities. While LLCs have fewer formal requirements than corporations, they still need to follow certain legal procedures, such as drafting an operating agreement, holding regular meetings if required by state law, and keeping detailed records of major business decisions. Failure to observe these formalities can lead to a court disregarding the LLC’s liability protection, a legal concept known as “piercing the corporate veil.” If this occurs, business owners may become personally liable for the company’s debts and legal obligations.

In addition to proper structuring and management, business owners should consider supplementing their LLC’s protection with liability insurance. General liability insurance, professional liability insurance, and umbrella policies can provide an extra layer of security by covering legal costs and potential damages in the event of a lawsuit. While an LLC shields personal assets, insurance ensures that the business itself has financial resources to handle legal claims without jeopardizing its operations.

By carefully structuring an LLC, maintaining financial and legal separation, and securing appropriate insurance coverage, business owners can significantly reduce their risk of personal liability. Taking these proactive steps before facing a lawsuit ensures that assets remain protected, allowing entrepreneurs to focus on growing their businesses with confidence.

Essential Estate Planning Strategies to Safeguard Your Wealth

One of the most effective ways to protect your assets before facing a lawsuit is through comprehensive estate planning. By implementing strategic legal measures, individuals can safeguard their wealth from potential creditors, lawsuits, and unforeseen financial challenges. Estate planning is not only about distributing assets after death but also about ensuring financial security during one’s lifetime. Taking proactive steps can help shield personal and business assets from legal claims while maintaining control over wealth.

A fundamental strategy in estate planning is the establishment of a trust. Trusts provide a legal framework for managing and distributing assets while offering protection from creditors and lawsuits. An irrevocable trust, in particular, can be highly effective in safeguarding wealth, as assets transferred into the trust are no longer considered personal property. Since the trust becomes the legal owner of the assets, they are generally protected from legal claims against the individual. However, it is crucial to establish such a trust before any legal action arises, as courts may view last-minute transfers as fraudulent attempts to evade creditors.

In addition to trusts, the use of limited liability entities can provide significant asset protection. Business owners, real estate investors, and professionals in high-risk industries can benefit from structuring their holdings through limited liability companies (LLCs) or family limited partnerships (FLPs). These entities create a legal separation between personal and business assets, reducing personal liability in the event of a lawsuit. By properly maintaining corporate formalities and keeping business and personal finances separate, individuals can strengthen the legal protection these structures offer.

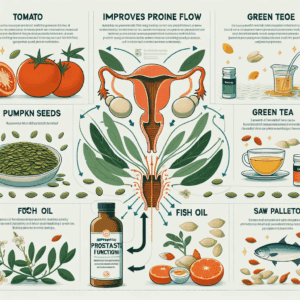

Another essential component of estate planning is the strategic use of insurance. Liability insurance, including umbrella policies, can serve as a financial safeguard against lawsuits. High-net-worth individuals should consider increasing their coverage limits to ensure adequate protection. Additionally, professional liability insurance is crucial for those in fields such as medicine, law, and finance, where malpractice claims are common. While insurance does not prevent lawsuits, it can provide financial resources to cover legal expenses and settlements, thereby preserving personal assets.

Furthermore, proper titling of assets can enhance protection against legal claims. Holding property as tenants by the entirety, where available, can shield real estate from creditors seeking to collect on an individual’s debts. This form of ownership, exclusive to married couples in certain states, ensures that property cannot be seized to satisfy the debts of one spouse alone. Similarly, designating beneficiaries on financial accounts and retirement plans can facilitate the smooth transfer of assets while bypassing probate and potential legal disputes.

Estate planning also involves careful consideration of financial privacy. Maintaining confidentiality in asset ownership can deter potential litigants from pursuing legal action. Using trusts, LLCs, or other legal entities to hold assets can make it more difficult for creditors to identify and target personal wealth. Additionally, avoiding public records by structuring transactions through private agreements can further enhance financial security.

Ultimately, protecting assets before a lawsuit arises requires foresight and careful planning. By utilizing trusts, business entities, insurance, proper asset titling, and financial privacy strategies, individuals can create a robust legal framework to safeguard their wealth. Consulting with an experienced estate planning attorney is essential to ensure compliance with legal requirements and to tailor strategies to individual circumstances. Taking these proactive measures can provide peace of mind and long-term financial security, ensuring that assets remain protected for future generations.