“Maximize Your Rewards: The Best Credit Cards for 2025 Ranked!”

**Top 5 Credit Cards for 2025: Best Rewards and Benefits Compared**

As 2025 approaches, credit card issuers continue to enhance their offerings, providing consumers with more value through rewards, benefits, and exclusive perks. With so many options available, selecting the right credit card can be challenging. To help consumers make an informed decision, we have analyzed the top credit cards for 2025 based on their rewards programs, benefits, and overall value. By comparing these leading options, cardholders can determine which card best aligns with their spending habits and financial goals.

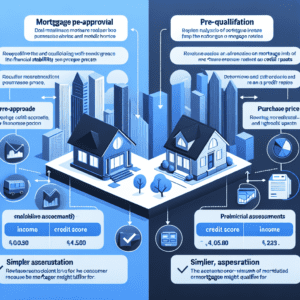

One of the standout choices for 2025 is the Platinum Rewards Card, which remains a top contender for frequent travelers. This card offers generous travel rewards, including five points per dollar spent on airfare and three points per dollar on dining and hotels. Additionally, cardholders receive complimentary airport lounge access, travel insurance, and no foreign transaction fees. The welcome bonus is particularly attractive, providing a substantial number of points after meeting the initial spending requirement. For those who prioritize travel perks and luxury benefits, this card continues to be a strong option.

Another excellent choice is the Cash Back Plus Card, which is ideal for individuals who prefer straightforward rewards. This card offers an impressive 5% cash back on rotating categories such as groceries, gas, and online shopping, along with an unlimited 2% cash back on all other purchases. Unlike some competitors, the Cash Back Plus Card does not impose an annual fee, making it a cost-effective option for those who want to maximize their everyday spending. Additionally, the card provides purchase protection and extended warranty coverage, adding further value for consumers.

For those who frequently dine out or order takeout, the Dining Rewards Card is a compelling option. This card offers an industry-leading 4% cash back on dining and food delivery services, making it an excellent choice for food enthusiasts. In addition to dining rewards, the card provides 2% cash back on groceries and entertainment purchases, ensuring that cardholders earn valuable rewards on their most common expenses. The card also includes exclusive access to dining events, concierge services, and discounts at select restaurants, further enhancing its appeal.

Meanwhile, the Business Elite Card is designed for entrepreneurs and business owners who want to maximize their spending power. This card offers 3% cash back on business-related expenses such as office supplies, advertising, and travel, along with 1.5% cash back on all other purchases. Additionally, cardholders benefit from expense management tools, employee card options, and travel protections tailored to business needs. With a generous sign-up bonus and no foreign transaction fees, this card is an excellent choice for business professionals looking to optimize their financial strategy.

Finally, the Premium Travel Card is a top-tier option for luxury travelers who seek exclusive benefits. This card provides unlimited access to airport lounges worldwide, annual travel credits, and elite status with select hotel and airline partners. Cardholders earn five points per dollar on travel purchases and three points per dollar on dining, making it one of the most rewarding options for frequent travelers. While the annual fee is higher than most other cards, the extensive benefits and rewards easily justify the cost for those who travel frequently.

With a variety of credit cards available in 2025, consumers have numerous options to choose from based on their spending habits and financial priorities. Whether prioritizing travel perks, cash back rewards, or business benefits, selecting the right card can lead to significant savings and enhanced financial flexibility. By carefully evaluating the rewards and benefits of each option, cardholders can maximize their spending power and enjoy the advantages that come with the best credit cards of the year.

**Maximizing Your Rewards: The Best Credit Cards for Travel, Cashback, and Points in 2025**

As credit card rewards programs continue to evolve, selecting the right card in 2025 requires a careful evaluation of benefits, earning potential, and redemption flexibility. Whether you prioritize travel perks, cashback incentives, or points-based rewards, the best credit cards offer a combination of value and convenience tailored to different spending habits. Understanding the nuances of each category can help maximize your rewards and ensure that every purchase contributes to long-term financial benefits.

For frequent travelers, premium travel credit cards provide exceptional value through airline miles, hotel benefits, and exclusive lounge access. The top travel cards in 2025 not only offer generous sign-up bonuses but also include perks such as annual travel credits, priority boarding, and no foreign transaction fees. Some of the most competitive options feature partnerships with major airlines and hotel chains, allowing cardholders to transfer points seamlessly for maximum redemption value. Additionally, many travel cards provide comprehensive travel insurance, covering trip cancellations, lost luggage, and emergency medical expenses, making them an essential companion for those who frequently fly.

On the other hand, cashback credit cards remain a popular choice for individuals who prefer straightforward rewards without the complexities of points transfers. The best cashback cards in 2025 offer high earning rates on everyday purchases such as groceries, dining, and gas, with some providing rotating bonus categories that enhance earning potential throughout the year. Many issuers have also introduced flexible redemption options, allowing cardholders to apply cashback directly to their statement balance, deposit it into a linked bank account, or use it for gift cards and travel purchases. Furthermore, some premium cashback cards include additional benefits such as extended warranties, purchase protection, and complimentary subscription services, adding even more value beyond the rewards structure.

For those who enjoy the flexibility of points-based rewards, several credit cards in 2025 stand out for their ability to accumulate points quickly and redeem them across multiple categories. These cards often feature elevated earning rates on travel, dining, and entertainment, making them ideal for individuals who spend heavily in these areas. Many of the best points-based cards also provide access to exclusive experiences, such as concert tickets, VIP events, and luxury hotel upgrades, enhancing the overall value of membership. Additionally, some issuers allow cardholders to transfer points to airline and hotel loyalty programs at favorable conversion rates, increasing the potential for high-value redemptions.

Beyond rewards, the best credit cards in 2025 also prioritize security and convenience. Many now include advanced fraud protection, virtual card numbers for online purchases, and biometric authentication for added security. Contactless payment technology has become standard, allowing for faster and more secure transactions at retail locations worldwide. Moreover, several issuers have introduced artificial intelligence-driven spending insights, helping cardholders track expenses and optimize their rewards strategy.

Ultimately, choosing the best credit card depends on individual spending habits and financial goals. Whether maximizing travel benefits, earning cashback on everyday purchases, or accumulating flexible points, the right card can provide significant value when used strategically. By carefully comparing rewards structures, fees, and additional perks, consumers can ensure they select a credit card that aligns with their lifestyle and maximizes their financial potential in 2025.

**2025’s Best Credit Cards Ranked: Which One Offers the Most Value?**

As 2025 approaches, selecting the right credit card has become more important than ever, with issuers offering increasingly competitive rewards and benefits. Consumers now have access to a wide range of options tailored to different spending habits, whether they prioritize travel perks, cashback rewards, or low interest rates. Understanding which credit cards provide the most value requires a careful comparison of their features, including reward structures, annual fees, and additional benefits. By evaluating these factors, cardholders can maximize their financial advantages while ensuring their chosen card aligns with their lifestyle and spending patterns.

Among the top contenders for 2025, premium travel credit cards continue to dominate the market, offering generous rewards for frequent travelers. These cards often provide high earning rates on travel-related purchases, such as flights, hotels, and dining, while also including valuable perks like airport lounge access, travel insurance, and statement credits for travel expenses. Some of the best options in this category include those that offer flexible redemption options, allowing cardholders to transfer points to airline and hotel loyalty programs for maximum value. While these cards typically come with higher annual fees, the benefits they provide can easily outweigh the costs for those who travel frequently.

For individuals who prefer straightforward rewards without the complexities of travel redemptions, cashback credit cards remain a popular choice. These cards offer a percentage of spending back in cash, often with bonus categories that provide higher rewards for specific purchases such as groceries, gas, or dining. Some of the best cashback cards for 2025 feature rotating bonus categories, allowing users to earn elevated rewards on different types of spending throughout the year. Others provide a flat cashback rate on all purchases, making them ideal for those who want a simple and predictable rewards structure. With no need to worry about points devaluation or blackout dates, cashback cards offer a practical way to earn rewards on everyday expenses.

In addition to rewards-focused credit cards, low-interest and balance transfer cards continue to be valuable options for those looking to manage debt efficiently. These cards often come with introductory 0% APR offers on purchases and balance transfers, allowing cardholders to pay down existing balances without accruing additional interest. For individuals carrying high-interest debt, choosing a card with an extended 0% APR period can provide significant savings and a clear path toward financial stability. While these cards may not offer the same level of rewards as premium travel or cashback cards, their ability to reduce interest costs makes them an essential tool for responsible financial management.

Beyond rewards and interest rates, many of the best credit cards for 2025 also include valuable additional benefits that enhance their overall appeal. Features such as purchase protection, extended warranties, and complimentary subscription credits can add significant value to a cardholder’s experience. Some issuers also provide exclusive access to events, concierge services, and personalized offers based on spending habits. As competition among credit card companies continues to grow, these extra perks can make a substantial difference in determining which card offers the most value.

Ultimately, the best credit card for 2025 depends on an individual’s financial goals and spending habits. Whether prioritizing travel rewards, cashback earnings, or low interest rates, selecting a card that aligns with personal needs ensures maximum benefits. By carefully evaluating the available options and considering both rewards and additional perks, consumers can make informed decisions that enhance their financial well-being in the year ahead.