“Debt relief companies can help, but beware of scams—know the risks before you commit!”

Understanding Debt Relief Companies: Are They Legit or a Scam?

Debt relief companies offer services designed to help individuals manage or reduce their outstanding debts, often by negotiating with creditors on their behalf. While some of these companies operate legitimately and provide valuable assistance, others engage in deceptive practices that can leave consumers in a worse financial position. Understanding how these companies work and recognizing potential warning signs can help individuals make informed decisions about whether to seek their services.

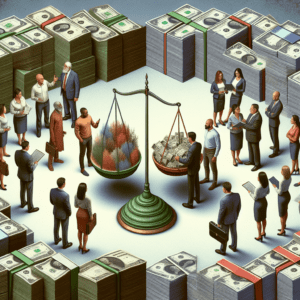

Legitimate debt relief companies typically offer solutions such as debt settlement, debt consolidation, or credit counseling. Debt settlement involves negotiating with creditors to reduce the total amount owed, while debt consolidation combines multiple debts into a single payment, often with a lower interest rate. Credit counseling, on the other hand, provides financial education and structured repayment plans to help individuals regain control of their finances. Reputable companies are transparent about their services, fees, and potential risks, ensuring that clients fully understand their options before committing to a program.

However, not all debt relief companies operate with integrity. Some engage in fraudulent practices, making unrealistic promises or charging excessive fees without delivering meaningful results. One common red flag is a company that guarantees debt elimination or promises to settle debts for pennies on the dollar. While debt settlement can sometimes result in reduced balances, no company can guarantee specific outcomes, as creditors are not obligated to accept settlement offers. Additionally, companies that demand large upfront fees before providing any services should be approached with caution. Legitimate debt relief providers typically charge fees based on the amount of debt settled rather than requiring payment in advance.

Another warning sign is a lack of clear communication or transparency. Reputable companies provide detailed information about their services, including potential risks such as the impact on credit scores and the possibility of legal action from creditors. In contrast, fraudulent companies may withhold critical details or pressure clients into signing agreements without fully explaining the terms. Consumers should be wary of high-pressure sales tactics or companies that discourage them from researching alternative options.

Furthermore, some debt relief companies advise clients to stop making payments to creditors while negotiations are in progress. While this strategy may sometimes be necessary for debt settlement, it can also lead to late fees, increased interest rates, and damage to credit scores. In some cases, creditors may even pursue legal action, resulting in wage garnishments or lawsuits. A reputable company will clearly outline these risks and help clients weigh the potential benefits and drawbacks before proceeding.

To determine whether a debt relief company is legitimate, consumers should conduct thorough research. Checking for accreditation from organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) can provide reassurance that a company adheres to ethical standards. Additionally, reviewing customer feedback, complaints filed with the Better Business Bureau (BBB), and any regulatory actions taken by the Consumer Financial Protection Bureau (CFPB) can help identify potential concerns.

Ultimately, while some debt relief companies provide valuable assistance, others engage in deceptive practices that can worsen financial difficulties. By understanding how these companies operate and recognizing warning signs, consumers can make informed decisions and protect themselves from scams. Seeking guidance from nonprofit credit counseling agencies or financial professionals can also provide additional support in managing debt effectively.

Red Flags to Watch Out for When Choosing a Debt Relief Company

When considering a debt relief company, it is crucial to be aware of potential red flags that may indicate fraudulent or unethical practices. While many legitimate companies offer valuable services to help individuals manage their debt, others may take advantage of vulnerable consumers by making false promises or charging excessive fees. Understanding the warning signs can help you make an informed decision and avoid falling victim to a scam.

One of the most significant red flags is a company that guarantees debt elimination or promises results that seem too good to be true. No legitimate debt relief company can guarantee that all of your debt will be forgiven or that creditors will agree to specific terms. Debt relief is a complex process that depends on various factors, including the willingness of creditors to negotiate. Companies that make bold claims without assessing your financial situation may be more interested in collecting fees than actually helping you resolve your debt.

Another warning sign is a company that demands upfront fees before providing any services. While some legitimate companies charge fees for their work, reputable organizations typically do not require payment before delivering results. The Federal Trade Commission (FTC) has regulations in place that prohibit debt relief companies from charging fees before they have successfully settled or reduced a consumer’s debt. If a company insists on payment before taking any action, it may be a sign that they are more focused on profiting from your financial distress rather than assisting you in achieving relief.

Additionally, a lack of transparency regarding fees and services should raise concerns. A trustworthy debt relief company will clearly outline the costs associated with their services and provide a detailed explanation of how the process works. If a company is vague about its pricing structure or avoids answering questions about potential costs, it may be attempting to hide excessive fees or misleading terms. Always request a written agreement that specifies the services provided and the associated costs before committing to any program.

High-pressure sales tactics are another red flag to watch for when evaluating a debt relief company. Some companies use aggressive marketing strategies to persuade consumers to sign up for their services without fully understanding the implications. If a representative pressures you to make an immediate decision or discourages you from exploring other options, it is a sign that they may not have your best interests in mind. A reputable company will allow you the time to review your options and make an informed choice based on your financial situation.

Furthermore, it is essential to research a company’s reputation before enrolling in any debt relief program. Checking online reviews, consumer complaints, and ratings from organizations such as the Better Business Bureau (BBB) can provide valuable insight into a company’s track record. If a company has numerous complaints about deceptive practices, unfulfilled promises, or poor customer service, it is best to proceed with caution. Additionally, verifying whether the company is accredited by reputable industry organizations can help ensure that they adhere to ethical standards.

By being aware of these red flags, you can protect yourself from potential scams and make a more informed decision when seeking debt relief assistance. Taking the time to research and evaluate a company’s legitimacy can help you avoid financial pitfalls and find a trustworthy organization that genuinely aims to help you regain control of your finances.

How to Verify the Legitimacy of a Debt Relief Company Before Signing Up

When considering a debt relief company, it is crucial to verify its legitimacy before committing to any program. With numerous companies offering debt settlement, consolidation, and management services, distinguishing between reputable organizations and potential scams can be challenging. However, by conducting thorough research and evaluating key factors, consumers can make informed decisions and avoid financial pitfalls.

One of the first steps in verifying a debt relief company’s legitimacy is checking its accreditation and industry affiliations. Reputable companies are often members of recognized organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). These organizations establish ethical standards and best practices that their members must follow. Additionally, legitimate debt relief companies may be accredited by the Better Business Bureau (BBB), which provides ratings and customer reviews that can offer insight into a company’s reputation. A high BBB rating and positive customer feedback indicate a history of reliable service, while numerous complaints or unresolved disputes may be a red flag.

Beyond accreditation, it is essential to research the company’s track record and customer experiences. Reading online reviews from multiple sources, such as consumer protection websites and financial forums, can help identify patterns of customer satisfaction or dissatisfaction. While no company is immune to negative reviews, a consistent history of complaints regarding hidden fees, unfulfilled promises, or poor communication should raise concerns. Additionally, checking with the Consumer Financial Protection Bureau (CFPB) for any regulatory actions or complaints against the company can provide further insight into its business practices.

Another critical factor to consider is transparency in pricing and services. Legitimate debt relief companies provide clear and detailed explanations of their fees, terms, and potential risks. They should offer a written contract outlining all costs and obligations before requiring any payments. Be wary of companies that demand upfront fees before delivering any services, as this practice is prohibited under the Federal Trade Commission’s (FTC) Telemarketing Sales Rule for debt relief services. A trustworthy company will also provide a realistic assessment of your financial situation and avoid making guarantees about debt reduction or credit score improvement.

In addition to transparency, evaluating the company’s communication and customer service is essential. A reputable debt relief provider will take the time to explain its programs, answer questions, and provide realistic expectations. If a company pressures you into making quick decisions, refuses to provide written documentation, or avoids answering specific questions, these may be signs of a scam. Furthermore, legitimate companies will not discourage you from researching other options or consulting with a financial advisor before enrolling in their program.

Finally, verifying a company’s compliance with state and federal regulations is a necessary step in ensuring its legitimacy. Debt relief companies must adhere to laws governing their industry, including licensing requirements in certain states. Checking with your state’s attorney general’s office or financial regulatory agency can confirm whether a company is authorized to operate in your area. Additionally, reviewing the company’s website for disclosures about its legal standing and compliance with consumer protection laws can provide further reassurance.

By taking these precautions, consumers can protect themselves from fraudulent debt relief schemes and choose a reputable company that aligns with their financial needs. Conducting thorough research, verifying credentials, and ensuring transparency in services will help individuals make informed decisions and work toward financial stability with confidence.