“Debt Relief Programs Explained: Find the Right Path to Financial Freedom!”

Understanding Debt Relief Programs: A Comprehensive Guide

Debt relief programs offer individuals struggling with financial burdens a structured way to manage and reduce their outstanding obligations. These programs are designed to provide relief by either lowering the total amount owed, restructuring repayment terms, or offering a path to financial stability. Understanding the different types of debt relief programs is essential for determining which option best suits an individual’s financial situation. Since each program has its own benefits and potential drawbacks, careful consideration is necessary before making a decision.

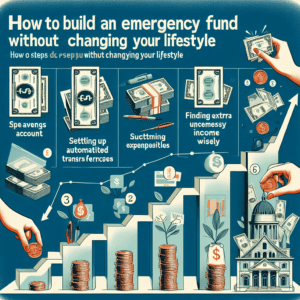

One of the most common forms of debt relief is debt consolidation, which involves combining multiple debts into a single loan with a lower interest rate. This approach simplifies repayment by reducing the number of monthly payments and can potentially lower overall costs. Debt consolidation is particularly beneficial for individuals with high-interest credit card debt, as it allows them to pay off their balances more efficiently. However, it requires a good credit score to qualify for favorable loan terms, and without disciplined financial management, there is a risk of accumulating new debt.

Another widely used option is debt settlement, which involves negotiating with creditors to reduce the total amount owed. This process is typically facilitated by a debt settlement company that works on behalf of the debtor to reach an agreement with creditors. While this method can significantly lower outstanding balances, it may also negatively impact credit scores and result in tax liabilities on the forgiven debt. Additionally, creditors are not obligated to accept settlement offers, and the process can take several months or even years to complete.

For individuals facing extreme financial hardship, bankruptcy may be a last resort. There are two primary types of personal bankruptcy: Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves liquidating non-exempt assets to pay off creditors, after which most remaining debts are discharged. This option provides a fresh financial start but has long-term consequences, including a significant impact on credit scores and the potential loss of valuable assets. Chapter 13 bankruptcy, on the other hand, allows individuals to restructure their debts into a manageable repayment plan over three to five years. While this option enables debtors to retain their assets, it requires strict adherence to court-approved payment schedules.

Credit counseling is another alternative for those seeking professional guidance in managing their debt. Nonprofit credit counseling agencies offer financial education, budgeting assistance, and debt management plans (DMPs) to help individuals regain control of their finances. A DMP consolidates unsecured debts into a single monthly payment, often with reduced interest rates and waived fees. While this approach does not reduce the principal balance, it provides a structured repayment plan that can lead to financial stability over time. However, participation in a DMP requires consistent payments and may temporarily impact credit availability.

Choosing the right debt relief program depends on various factors, including the amount of debt, financial stability, and long-term financial goals. It is crucial to assess all available options, consider potential consequences, and seek professional advice if necessary. By carefully evaluating each program’s advantages and limitations, individuals can make informed decisions that align with their financial needs and pave the way toward a more secure financial future.

Comparing Debt Relief Options: Which One Suits Your Financial Situation?

Debt relief programs offer individuals struggling with financial burdens a way to regain control over their finances. However, with multiple options available, choosing the right one requires a careful evaluation of personal circumstances, financial goals, and long-term implications. Understanding the differences between these programs can help determine which solution best aligns with an individual’s needs.

One of the most common debt relief options is debt consolidation, which involves combining multiple debts into a single loan with a lower interest rate. This approach simplifies repayment by reducing the number of monthly payments and can potentially lower overall costs. Debt consolidation is particularly beneficial for individuals with a steady income who can afford fixed monthly payments. However, it requires a good credit score to secure favorable loan terms, and without disciplined financial management, there is a risk of accumulating new debt while repaying the consolidated loan.

Another widely used option is debt settlement, which allows individuals to negotiate with creditors to reduce the total amount owed. This process typically involves working with a debt settlement company that negotiates on behalf of the debtor. While this method can significantly lower outstanding balances, it also comes with risks. Creditors are not obligated to accept settlement offers, and missed payments during negotiations can negatively impact credit scores. Additionally, forgiven debt may be considered taxable income, which could create an unexpected financial burden. Despite these drawbacks, debt settlement may be a viable option for those facing severe financial hardship and unable to meet their current obligations.

For individuals struggling with overwhelming debt and unable to find relief through other means, credit counseling provides an alternative solution. Credit counseling agencies offer financial education, budgeting assistance, and debt management plans (DMPs). A DMP allows individuals to make a single monthly payment to the agency, which then distributes funds to creditors. This approach often results in reduced interest rates and waived fees, making repayment more manageable. However, enrolling in a DMP requires closing existing credit accounts, which can temporarily impact credit scores. While this option does not reduce the principal balance, it provides a structured repayment plan that can help individuals regain financial stability over time.

In more extreme cases, bankruptcy may be the only viable solution. There are two primary types of personal bankruptcy: Chapter 7 and Chapter 13. Chapter 7 bankruptcy involves liquidating non-exempt assets to discharge most unsecured debts, providing a fresh financial start. However, it has strict eligibility requirements and remains on credit reports for up to ten years. Chapter 13 bankruptcy, on the other hand, allows individuals to restructure their debts into a court-approved repayment plan over three to five years. While this option enables individuals to retain assets such as homes and vehicles, it requires a stable income to meet repayment obligations. Bankruptcy should be considered a last resort due to its long-term impact on credit and financial opportunities.

Ultimately, selecting the right debt relief program depends on an individual’s financial situation, income stability, and long-term goals. While debt consolidation and credit counseling offer structured repayment plans, debt settlement and bankruptcy provide relief for those facing severe financial distress. Carefully weighing the benefits and drawbacks of each option can help individuals make informed decisions and work toward financial recovery.

Pros and Cons of Debt Relief Programs: Making the Right Choice

Debt relief programs offer individuals struggling with financial burdens a way to regain control over their finances. However, choosing the right program requires careful consideration of the advantages and disadvantages associated with each option. Understanding the pros and cons of debt relief programs can help individuals make informed decisions that align with their financial goals and circumstances.

One of the primary benefits of debt relief programs is the potential for reduced debt obligations. Many programs, such as debt settlement, allow individuals to negotiate with creditors to lower the total amount owed. This can provide significant financial relief, especially for those facing overwhelming debt. Additionally, debt consolidation programs simplify repayment by combining multiple debts into a single monthly payment, often with a lower interest rate. This can make managing finances more straightforward and reduce the risk of missed payments.

Another advantage is the potential for faster debt resolution. Unlike traditional repayment methods, which may take years to complete, debt relief programs can shorten the repayment period. For example, debt settlement programs typically resolve debts within two to four years, allowing individuals to move forward financially in a shorter time frame. Similarly, credit counseling programs provide structured repayment plans that help individuals pay off their debts more efficiently.

Furthermore, debt relief programs can provide psychological and emotional relief. The stress of overwhelming debt can take a toll on mental well-being, leading to anxiety and financial insecurity. By enrolling in a structured program, individuals can gain a sense of control over their financial situation, reducing stress and improving overall quality of life.

Despite these benefits, debt relief programs also come with potential drawbacks that must be carefully considered. One significant disadvantage is the impact on credit scores. Programs such as debt settlement and bankruptcy can negatively affect credit ratings, making it more difficult to obtain loans or credit in the future. Missed payments during the negotiation process can further damage creditworthiness, potentially leading to long-term financial consequences.

Additionally, some debt relief programs involve fees that can add to the overall cost of repayment. Debt settlement companies, for instance, often charge a percentage of the settled debt as a service fee. While this may still result in overall savings, individuals should carefully evaluate the costs associated with each program before making a decision. Similarly, debt consolidation loans may require collateral or come with higher interest rates if credit scores are already low.

Another potential drawback is the risk of scams and fraudulent companies. The debt relief industry has seen cases of unethical practices, where companies charge high fees without delivering promised results. It is essential for individuals to research and choose reputable organizations with a proven track record of success. Consulting with financial advisors or nonprofit credit counseling agencies can help ensure that the chosen program is legitimate and beneficial.

Ultimately, selecting the right debt relief program depends on individual financial situations and long-term goals. While these programs can provide much-needed relief, they also require careful consideration of potential risks. By weighing the pros and cons, individuals can make informed decisions that lead to financial stability and a path toward a debt-free future.