Dreaming of a home makeover but worried about the costs? Home renovation loans can help you transform your space without straining your finances. Whether you’re planning a kitchen remodel, bathroom upgrade, or a full-scale renovation, the right financing can make your vision a reality.

What Are Home Renovation Loans?

Home renovation loans are financial products designed to help homeowners fund improvements, repairs, or upgrades. These loans provide the necessary capital to enhance your living space while spreading the cost over time.

Types of Home Renovation Loans

There are several financing options available for home renovations. Understanding the differences can help you choose the best one for your needs.

- Home Equity Loan: A lump-sum loan that allows you to borrow against your home’s equity. It typically has a fixed interest rate and repayment term.

- Home Equity Line of Credit (HELOC): A flexible credit line that lets you borrow as needed, similar to a credit card, using your home as collateral.

- FHA 203(k) Loan: A government-backed loan that combines home purchase and renovation costs into a single mortgage.

- Personal Loan: An unsecured loan that doesn’t require home equity, making it a good option for smaller projects.

- Cash-Out Refinance: A refinancing option where you replace your existing mortgage with a larger one and use the difference for renovations.

Benefits of Home Renovation Loans

Investing in home improvements can enhance your property’s value and comfort. Here are some key benefits of using a renovation loan:

- Increased Home Value: Renovations can boost your property’s market value, offering a strong return on investment.

- Flexible Financing: Various loan options allow you to choose a plan that fits your budget and needs.

- Improved Living Conditions: Upgrades can enhance comfort, energy efficiency, and functionality.

- Tax Benefits: Some home improvement loans may offer tax deductions on interest payments.

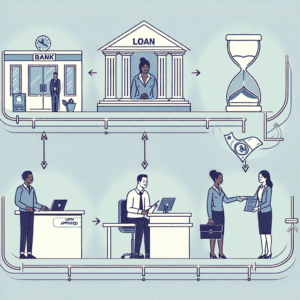

How to Qualify for a Home Renovation Loan

Qualifying for a renovation loan depends on several factors, including your credit score, income, and home equity. Here are some key steps to improve your chances:

- Check Your Credit Score: A higher credit score can help you secure better interest rates.

- Assess Your Home Equity: If using a home equity loan or HELOC, ensure you have sufficient equity.

- Compare Lenders: Shop around for the best loan terms and interest rates.

- Prepare Documentation: Gather necessary documents, such as income statements, tax returns, and renovation plans.

Tips for Using a Home Renovation Loan Wisely

To make the most of your renovation loan, follow these smart financial strategies:

- Set a Realistic Budget: Outline your renovation costs and stick to a budget to avoid overspending.

- Prioritize High-Value Upgrades: Focus on renovations that offer the best return on investment, such as kitchen and bathroom remodels.

- Work with Reputable Contractors: Hire licensed professionals to ensure quality work and avoid costly mistakes.

- Monitor Loan Repayments: Keep track of your loan payments to maintain financial stability.

Final Thoughts

Home renovation loans provide a practical way to upgrade your space without depleting your savings. By choosing the right financing option and managing your budget wisely, you can enhance your home’s value and comfort while keeping costs under control.

Ready to start your renovation journey? Explore your loan options today and take the first step toward transforming your home!