“Find the Perfect Loan: Smart Choices for a Secure Financial Future.”

Understanding Different Types of Loans and Their Benefits

When considering a loan, it is essential to understand the different types available and how they align with your financial needs. Loans come in various forms, each designed to serve a specific purpose, and selecting the right one requires careful evaluation of your financial situation, repayment ability, and long-term goals. By familiarizing yourself with the benefits and characteristics of different loan types, you can make an informed decision that supports your financial well-being.

One of the most common types of loans is a personal loan, which offers flexibility in terms of usage. Personal loans are typically unsecured, meaning they do not require collateral, and they can be used for a variety of purposes, such as consolidating debt, covering medical expenses, or financing a major purchase. These loans often come with fixed interest rates and structured repayment terms, making them a predictable option for borrowers. However, because they are unsecured, interest rates may be higher compared to secured loans, especially for individuals with lower credit scores.

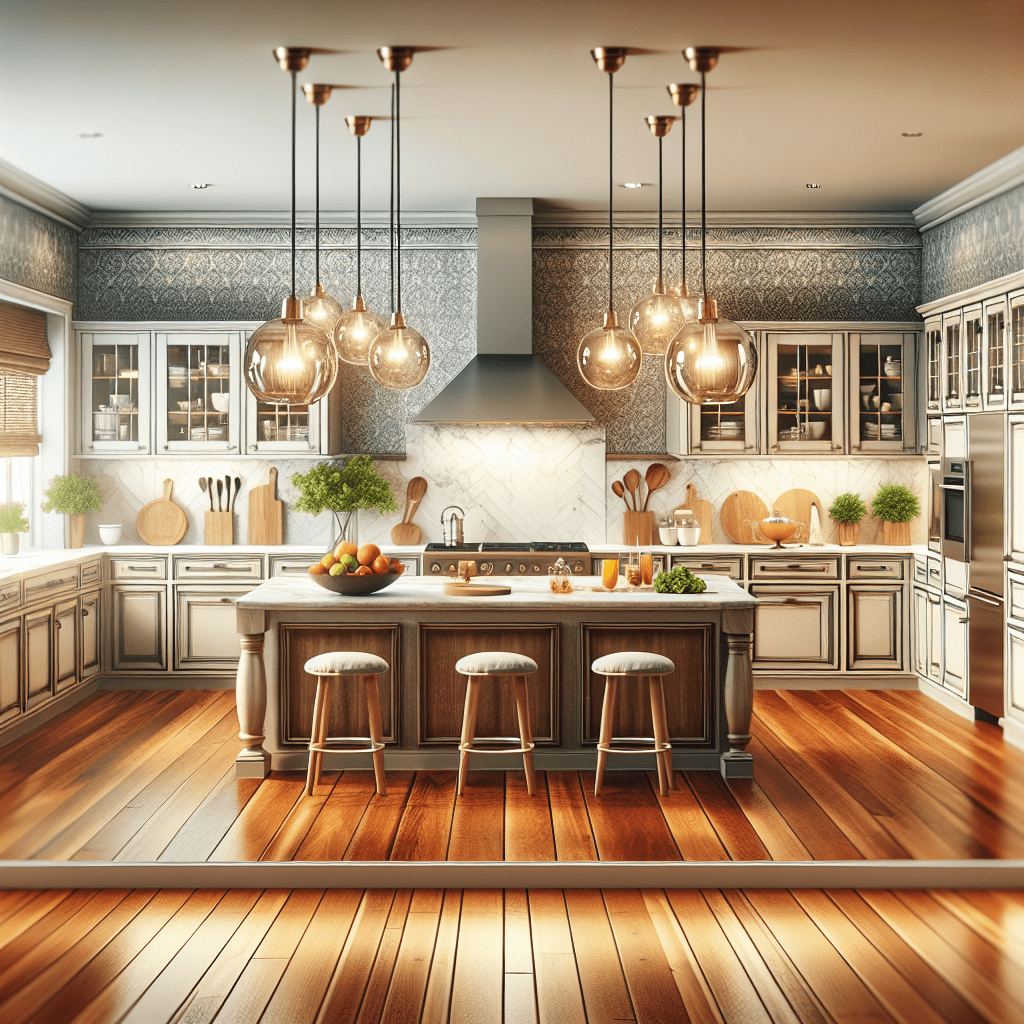

In contrast, secured loans require collateral, such as a home or vehicle, which serves as security for the lender. Mortgage loans and auto loans fall into this category, offering lower interest rates due to the reduced risk for lenders. A mortgage loan is specifically designed for purchasing real estate, with repayment terms that can extend over several decades. The advantage of a mortgage is that it allows individuals to become homeowners without needing to pay the full purchase price upfront. Similarly, auto loans enable borrowers to finance a vehicle purchase while spreading payments over a set period. While secured loans generally offer better interest rates, the risk of losing the collateral in case of default is an important factor to consider.

For those looking to fund higher education, student loans provide a specialized solution. These loans are designed to cover tuition, books, and living expenses, often featuring lower interest rates and flexible repayment options. Federal student loans, in particular, offer benefits such as income-driven repayment plans and deferment options, making them a more manageable choice for students who may not have immediate income. Private student loans, on the other hand, may have higher interest rates and fewer borrower protections, so it is crucial to compare options before committing to a loan.

Another type of loan that can be beneficial in certain situations is a business loan. Entrepreneurs and small business owners often rely on these loans to finance startup costs, expand operations, or manage cash flow. Business loans can be secured or unsecured, with terms and interest rates varying based on the lender and the borrower’s financial profile. Some business loans, such as Small Business Administration (SBA) loans, offer favorable terms and government-backed guarantees, making them an attractive option for qualifying businesses.

Understanding the different types of loans and their benefits is a crucial step in choosing the right one for your financial situation. By evaluating factors such as interest rates, repayment terms, and potential risks, you can select a loan that aligns with your needs while minimizing financial strain. Taking the time to research and compare options ensures that you make a well-informed decision that supports your long-term financial stability.

Key Factors to Consider When Selecting the Right Loan

When selecting the right loan for your financial situation, it is essential to consider several key factors to ensure that you make an informed decision. With numerous loan options available, understanding the terms, interest rates, repayment structures, and overall costs can help you choose the most suitable financing solution. By carefully evaluating these aspects, you can avoid unnecessary financial strain and secure a loan that aligns with your needs and long-term financial goals.

One of the most critical factors to consider is the purpose of the loan. Different types of loans are designed for specific financial needs, such as personal loans for general expenses, auto loans for vehicle purchases, and mortgage loans for home financing. Identifying the primary reason for borrowing will help narrow down the options and ensure that you select a loan that offers the most favorable terms for your situation. Additionally, some loans, such as business loans or student loans, may come with unique benefits, including tax advantages or lower interest rates, making them more suitable for particular circumstances.

Another important consideration is the interest rate, which directly impacts the total cost of borrowing. Interest rates can be fixed or variable, with each option having its advantages and disadvantages. A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments and financial stability. In contrast, a variable interest rate fluctuates based on market conditions, which may result in lower initial payments but could increase over time. Comparing interest rates from different lenders and understanding how they affect your repayment obligations can help you choose the most cost-effective loan.

In addition to interest rates, loan terms and repayment periods play a significant role in determining affordability. Shorter loan terms typically come with higher monthly payments but lower overall interest costs, while longer terms may offer lower monthly payments but result in higher total interest expenses. Evaluating your financial capacity and long-term budget can help you decide on a repayment period that balances affordability with minimizing interest costs. Furthermore, some loans may offer flexible repayment options, such as the ability to make extra payments without penalties, which can be beneficial if you plan to pay off the loan early.

Your credit score is another crucial factor that influences loan eligibility and interest rates. Lenders use credit scores to assess the risk of lending, with higher scores generally leading to better loan terms and lower interest rates. Before applying for a loan, it is advisable to review your credit report, correct any errors, and take steps to improve your credit score if necessary. This may include paying down existing debt, making timely payments, and reducing credit utilization. A strong credit profile can increase your chances of securing a loan with favorable terms and lower borrowing costs.

Finally, it is essential to compare loan offers from multiple lenders to find the best deal. Financial institutions, including banks, credit unions, and online lenders, may offer varying terms, fees, and benefits. Carefully reviewing loan agreements, understanding any associated fees, and considering customer service quality can help you make a well-informed decision. By taking the time to evaluate these key factors, you can select a loan that best suits your financial situation and supports your long-term financial well-being.

Common Mistakes to Avoid When Choosing a Loan

One of the most important financial decisions an individual can make is selecting the right loan. However, many borrowers make common mistakes that can lead to financial strain, higher costs, or unfavorable terms. Understanding these pitfalls and how to avoid them is essential for making an informed decision that aligns with your financial situation.

A frequent mistake is failing to assess one’s financial needs and borrowing more than necessary. While it may be tempting to take out a larger loan to cover additional expenses, doing so can lead to higher interest payments and longer repayment periods. Instead, borrowers should carefully evaluate their financial situation, determine the exact amount required, and avoid unnecessary debt. By borrowing only what is needed, individuals can minimize their financial burden and ensure manageable repayment terms.

Another common error is neglecting to compare loan options from different lenders. Many borrowers accept the first loan offer they receive without researching alternative options, which can result in higher interest rates or unfavorable terms. To avoid this, it is crucial to shop around, compare interest rates, fees, and repayment terms, and choose the loan that best suits one’s financial circumstances. Additionally, understanding the difference between fixed and variable interest rates can help borrowers make an informed decision. Fixed rates provide stability with consistent monthly payments, while variable rates may fluctuate, potentially leading to higher costs over time.

Ignoring the total cost of the loan is another mistake that can have long-term financial consequences. Many borrowers focus solely on the monthly payment amount without considering the overall cost, including interest and fees. While a lower monthly payment may seem attractive, it often results in a longer repayment period and higher total interest costs. To make a well-informed decision, borrowers should calculate the total repayment amount and assess whether the loan is financially sustainable in the long run.

Additionally, failing to review the loan terms and conditions in detail can lead to unexpected financial challenges. Some loans come with hidden fees, prepayment penalties, or other clauses that may not be immediately apparent. Before signing any agreement, borrowers should carefully read the terms, ask questions about any unclear provisions, and ensure they fully understand their obligations. This step is crucial in avoiding unexpected costs and ensuring that the loan aligns with one’s financial goals.

Another critical mistake is overlooking one’s credit score and its impact on loan eligibility and interest rates. A lower credit score can result in higher interest rates or even loan denial. Before applying for a loan, individuals should check their credit reports, address any inaccuracies, and take steps to improve their credit score if necessary. Paying off existing debts, making timely payments, and reducing credit utilization can help improve creditworthiness and increase the chances of securing a loan with favorable terms.

Finally, some borrowers fail to consider their ability to repay the loan comfortably. Taking on a loan without a clear repayment plan can lead to financial stress and potential default. It is essential to evaluate one’s income, expenses, and financial stability before committing to a loan. Creating a budget and ensuring that loan payments fit within one’s financial capacity can help prevent future difficulties.

By avoiding these common mistakes, borrowers can make informed decisions that support their financial well-being. Careful planning, thorough research, and a clear understanding of loan terms can help individuals secure the right loan for their needs while minimizing financial risks.