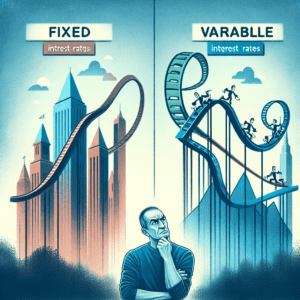

“Fixed vs. Adjustable-Rate Mortgages: Stability or Flexibility—Which Fits Your Future?”

Pros and Cons of Fixed-Rate vs. Adjustable-Rate Mortgages

When deciding between a fixed-rate mortgage and an adjustable-rate mortgage (ARM), it is essential to weigh the advantages and disadvantages of each option. Both types of loans offer unique benefits and potential drawbacks, making it crucial to consider factors such as financial stability, long-term goals, and market conditions before making a decision. Understanding the pros and cons of each mortgage type can help borrowers determine which option best suits their needs.

A fixed-rate mortgage provides stability and predictability, making it an attractive choice for many homebuyers. One of the primary advantages of this type of loan is that the interest rate remains constant throughout the life of the loan, ensuring that monthly payments remain unchanged. This consistency allows borrowers to plan their finances with confidence, as they do not have to worry about fluctuations in interest rates affecting their mortgage payments. Additionally, fixed-rate mortgages are particularly beneficial in a rising interest rate environment, as borrowers are protected from potential increases that could make their payments more expensive over time.

However, fixed-rate mortgages also have some drawbacks. One of the most notable disadvantages is that they typically come with higher initial interest rates compared to adjustable-rate mortgages. This means that borrowers may pay more in interest during the early years of the loan. Additionally, if market interest rates decline, those with fixed-rate mortgages may not benefit from lower rates unless they refinance, which can involve additional costs and paperwork.

On the other hand, adjustable-rate mortgages offer lower initial interest rates, making them an appealing option for borrowers who want to take advantage of lower monthly payments in the short term. These loans typically start with a fixed interest rate for an initial period, after which the rate adjusts periodically based on market conditions. This structure can be advantageous for individuals who plan to sell or refinance their home before the adjustable period begins, as they can benefit from lower payments without being affected by future rate increases.

Despite these benefits, adjustable-rate mortgages also come with risks. One of the most significant concerns is the potential for interest rate increases, which can lead to higher monthly payments. If market rates rise significantly, borrowers may find themselves facing unaffordable payments, which could lead to financial strain. Additionally, the uncertainty associated with ARMs can make long-term financial planning more challenging, as borrowers cannot predict exactly how much they will owe in the future.

When choosing between a fixed-rate mortgage and an adjustable-rate mortgage, it is important to consider individual financial circumstances and risk tolerance. Those who prioritize stability and long-term predictability may find that a fixed-rate mortgage is the better option, as it provides consistent payments and protection against rising interest rates. Conversely, borrowers who are comfortable with some level of risk and plan to move or refinance within a few years may benefit from the lower initial rates offered by an ARM.

Ultimately, the decision between a fixed-rate and an adjustable-rate mortgage depends on a variety of factors, including financial goals, market conditions, and personal preferences. By carefully evaluating the pros and cons of each option, borrowers can make an informed choice that aligns with their long-term financial well-being.

How to Choose Between a Fixed and Adjustable-Rate Mortgage

When deciding between a fixed-rate mortgage and an adjustable-rate mortgage (ARM), it is essential to consider several factors that can influence your financial stability and long-term goals. Each type of mortgage has distinct advantages and potential drawbacks, making it crucial to assess your personal circumstances before making a decision. Understanding how these mortgage options work and how they align with your financial situation can help you make an informed choice.

A fixed-rate mortgage offers stability and predictability, making it an attractive option for many homebuyers. With this type of loan, the interest rate remains constant throughout the life of the mortgage, ensuring that monthly principal and interest payments do not change. This consistency allows homeowners to budget more effectively, as they do not have to worry about fluctuations in their mortgage payments due to interest rate changes. Fixed-rate mortgages are particularly beneficial for individuals who plan to stay in their homes for an extended period, as they provide long-term financial security. Additionally, they protect borrowers from potential interest rate increases, which can be a significant advantage in a rising-rate environment.

On the other hand, an adjustable-rate mortgage typically starts with a lower initial interest rate compared to a fixed-rate mortgage. This lower rate can result in lower monthly payments during the initial period, which may last anywhere from a few months to several years, depending on the loan terms. However, once this introductory period ends, the interest rate adjusts periodically based on market conditions. While this can lead to lower payments if interest rates decrease, it also introduces the risk of higher payments if rates rise. As a result, ARMs are often more suitable for borrowers who plan to sell or refinance their homes before the adjustable period begins. They can also be advantageous for individuals who anticipate an increase in their income, as they may be better equipped to handle potential payment increases in the future.

When choosing between these two mortgage options, it is important to evaluate your financial stability, future plans, and risk tolerance. If you prefer the security of knowing exactly what your mortgage payments will be each month and want to avoid the uncertainty of interest rate fluctuations, a fixed-rate mortgage may be the better choice. This option is particularly beneficial for those who intend to stay in their homes for many years and do not want to worry about potential payment increases.

Conversely, if you are comfortable with some level of risk and are confident that you will either sell or refinance before the adjustable period begins, an ARM could be a more cost-effective option. The lower initial interest rate can provide short-term savings, which may be beneficial if you have other financial priorities, such as paying off debt or investing in other opportunities. However, it is crucial to consider the potential for rising interest rates and ensure that you have a financial plan in place to manage any future payment increases.

Ultimately, the decision between a fixed-rate and an adjustable-rate mortgage depends on your individual financial situation and long-term goals. Carefully assessing your needs and considering how each option aligns with your circumstances can help you choose the mortgage that best supports your financial well-being.

Financial Scenarios Where Fixed or Adjustable-Rate Mortgages Make Sense

When deciding between a fixed-rate mortgage and an adjustable-rate mortgage (ARM), it is essential to consider your financial situation, long-term goals, and risk tolerance. Each type of mortgage has distinct advantages and is suited to different financial scenarios. Understanding when a fixed or adjustable-rate mortgage makes sense can help you make an informed decision that aligns with your needs.

A fixed-rate mortgage is often the preferred choice for borrowers who value stability and predictability. This type of loan locks in an interest rate for the entire term, ensuring that monthly principal and interest payments remain consistent. For individuals with a steady income and long-term homeownership plans, a fixed-rate mortgage provides financial security. Homebuyers who intend to stay in their home for many years benefit from the protection against interest rate fluctuations, making it easier to budget for housing costs. Additionally, in a low-interest-rate environment, locking in a fixed rate can be advantageous, as it prevents future increases in borrowing costs.

On the other hand, an adjustable-rate mortgage may be a suitable option for borrowers who anticipate changes in their financial situation or do not plan to stay in their home for an extended period. ARMs typically offer lower initial interest rates compared to fixed-rate mortgages, which can result in lower monthly payments during the introductory period. This feature makes ARMs attractive to homebuyers who expect their income to increase in the future or those who plan to sell or refinance before the rate adjusts. For example, if a borrower intends to relocate within five to seven years, an ARM with a fixed introductory rate for that period can provide cost savings without the long-term commitment of a fixed-rate loan.

However, it is important to consider the potential risks associated with adjustable-rate mortgages. Once the initial fixed-rate period ends, the interest rate adjusts periodically based on market conditions. If interest rates rise significantly, monthly payments can increase, potentially straining a borrower’s budget. Therefore, ARMs are best suited for individuals who can tolerate some level of financial uncertainty or have the flexibility to refinance if necessary.

Another financial scenario where a fixed-rate mortgage may be the better choice is for borrowers who prioritize long-term financial planning. Families looking to establish roots in a community, retirees on a fixed income, or individuals who prefer a predictable payment structure may find the stability of a fixed-rate mortgage more appealing. Since the interest rate remains unchanged, homeowners are protected from market volatility, allowing them to plan their finances with confidence.

Conversely, an adjustable-rate mortgage may be beneficial for borrowers who expect to pay off their loan quickly. Real estate investors, for instance, may opt for an ARM if they plan to sell the property before the rate adjusts. Similarly, individuals who receive large bonuses or commissions may use an ARM to take advantage of lower initial payments while making extra principal payments to reduce the loan balance before adjustments occur.

Ultimately, the decision between a fixed and adjustable-rate mortgage depends on individual financial circumstances and future plans. By carefully evaluating factors such as income stability, length of homeownership, and risk tolerance, borrowers can choose the mortgage option that best aligns with their financial goals.