“Save More, Skip PMI: Smart Strategies for a Bigger Down Payment!”

**Increase Your Down Payment to 20%**

One of the most effective ways to avoid private mortgage insurance (PMI) and save money in the long run is by making a down payment of at least 20% when purchasing a home. PMI is typically required by lenders when borrowers put down less than this amount, as it serves to protect the lender in case of default. However, for homeowners, PMI represents an additional monthly expense that does not contribute to building equity. By increasing the down payment to 20%, buyers can eliminate this cost and reduce their overall mortgage expenses.

A larger down payment not only helps in avoiding PMI but also results in a lower loan amount, which can lead to more favorable loan terms. Since lenders view borrowers with substantial down payments as lower risk, they may offer better interest rates, ultimately reducing the total cost of the mortgage. Additionally, a smaller loan balance means lower monthly payments, making homeownership more affordable in the long term. This financial advantage allows homeowners to allocate funds toward other expenses, savings, or investments rather than paying for insurance that solely benefits the lender.

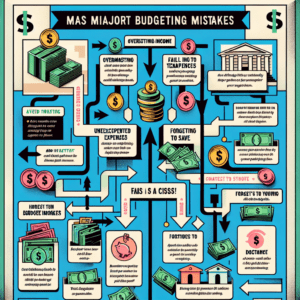

For many prospective buyers, saving for a 20% down payment may seem like a daunting task, but with careful planning and disciplined financial habits, it is achievable. One effective strategy is to establish a dedicated savings account specifically for the down payment and contribute to it consistently. Setting a realistic savings goal and timeline can help maintain focus and motivation. Additionally, cutting unnecessary expenses, reducing discretionary spending, and prioritizing savings can accelerate progress toward reaching the required amount.

Another approach to increasing the down payment is exploring alternative sources of funding. Some buyers may be able to use gifts from family members, as many lenders allow gifted funds to be applied toward the down payment. However, it is essential to ensure that any financial assistance complies with lender requirements, which may include providing documentation to verify that the funds are a gift rather than a loan. Additionally, certain employer programs, grants, or state and local assistance programs may offer financial support to help homebuyers reach their down payment goals.

For those who already have savings but fall short of the 20% threshold, delaying the home purchase to continue saving may be a prudent decision. While waiting may require patience, it can ultimately result in significant long-term savings by eliminating PMI and securing better loan terms. In some cases, buyers may also consider purchasing a more affordable home that requires a lower down payment while still meeting their needs. This approach allows them to reach the 20% mark more easily and avoid unnecessary costs.

Ultimately, increasing the down payment to 20% is a strategic financial decision that can provide substantial benefits. By eliminating PMI, securing better loan terms, and reducing monthly mortgage payments, homebuyers can achieve greater financial stability and long-term savings. While it may require careful planning and disciplined saving, the effort is well worth it for those looking to maximize their investment and minimize unnecessary expenses.

**Explore Lender-Paid Mortgage Insurance (LPMI) Options**

Lender-Paid Mortgage Insurance (LPMI) is an alternative to traditional private mortgage insurance (PMI) that can help borrowers reduce their monthly mortgage payments. Unlike borrower-paid mortgage insurance (BPMI), which requires homeowners to make separate monthly payments for PMI, LPMI is built into the loan itself. This means that instead of paying a separate insurance premium, the lender covers the cost of the insurance in exchange for a slightly higher interest rate on the loan. While this option can be beneficial for some borrowers, it is important to carefully evaluate its long-term financial implications before making a decision.

One of the primary advantages of LPMI is that it eliminates the need for an additional monthly PMI payment, which can make homeownership more affordable in the short term. By rolling the cost of mortgage insurance into the loan, borrowers can benefit from lower monthly payments compared to a loan with BPMI. This can be particularly helpful for individuals who want to maximize their purchasing power or who prefer a more predictable monthly payment structure. Additionally, because LPMI is included in the loan itself, borrowers may be able to qualify for a larger loan amount than they would with BPMI, potentially allowing them to purchase a more desirable home.

However, while LPMI offers immediate savings on monthly payments, it is essential to consider the long-term costs associated with this option. Since LPMI results in a higher interest rate, borrowers may end up paying more over the life of the loan compared to a loan with BPMI. Unlike BPMI, which can be canceled once the borrower reaches 20% equity in the home, LPMI remains in place for the duration of the loan. This means that even after a homeowner has built sufficient equity, they will continue paying the higher interest rate unless they refinance. Refinancing, however, comes with its own costs and may not always be a viable option, particularly if interest rates have risen since the original loan was obtained.

Another important factor to consider is how long the borrower plans to stay in the home. For those who intend to sell or refinance within a few years, LPMI may be a cost-effective choice, as the higher interest rate may not have a significant impact over a short period. On the other hand, for borrowers who plan to stay in their home for the long term, the cumulative cost of the higher interest rate could outweigh the initial savings on monthly payments. Therefore, it is crucial to carefully analyze the total cost of the loan over time and compare it to other available options.

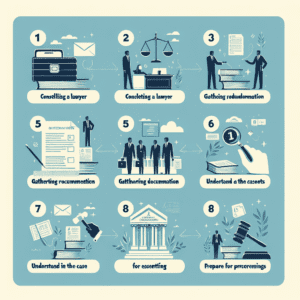

To determine whether LPMI is the right choice, borrowers should work closely with their lender to evaluate different loan scenarios. By comparing the total cost of a loan with LPMI versus one with BPMI, borrowers can make an informed decision based on their financial goals and homeownership plans. Additionally, exploring other strategies to avoid PMI, such as making a larger down payment or considering a piggyback loan, may provide alternative ways to save money. Ultimately, understanding the benefits and drawbacks of LPMI can help borrowers choose the most cost-effective mortgage option for their needs.

**Use a Piggyback Loan to Bypass PMI**

A piggyback loan is a financing strategy that allows homebuyers to avoid private mortgage insurance (PMI) by using a second loan to cover part of the down payment. Typically, PMI is required when a borrower puts down less than 20% of a home’s purchase price. However, by structuring the financing with a piggyback loan, buyers can reduce their primary mortgage balance and eliminate the need for PMI, ultimately saving money over time.

This approach generally involves two loans: a primary mortgage covering 80% of the home’s value and a secondary loan, often referred to as a home equity loan or home equity line of credit (HELOC), covering an additional portion—usually 10% or 15%—of the purchase price. The borrower then contributes the remaining 10% or 5% as a down payment. This structure is commonly known as an 80-10-10 or 80-15-5 loan, depending on the percentage breakdown. By keeping the primary mortgage at or below 80% of the home’s value, the borrower avoids PMI, which can result in significant monthly savings.

One of the key advantages of using a piggyback loan is the potential for lower overall costs. PMI premiums can add hundreds of dollars to a monthly mortgage payment, and unlike interest payments, PMI is not tax-deductible in most cases. By eliminating PMI, borrowers can allocate those funds toward paying down their mortgage principal or other financial goals. Additionally, the interest on the second loan may be tax-deductible, depending on the borrower’s financial situation and current tax laws.

However, while a piggyback loan can be an effective way to bypass PMI, it is important to consider the potential drawbacks. The second loan often carries a higher interest rate than the primary mortgage, which can increase the overall cost of borrowing. Additionally, some lenders may impose stricter qualification requirements for the second loan, including higher credit score thresholds and lower debt-to-income ratios. Borrowers should carefully evaluate whether the combined cost of both loans is more favorable than paying PMI.

Another factor to consider is the repayment structure of the second loan. If it is a HELOC, the interest rate may be variable, meaning it could increase over time. This could lead to higher monthly payments in the future, making it essential for borrowers to assess their long-term financial stability before committing to this strategy. Fixed-rate second loans provide more predictability but may come with higher initial interest rates. Understanding these differences can help borrowers make an informed decision based on their financial goals and risk tolerance.

To determine whether a piggyback loan is the right choice, prospective homebuyers should compare the total costs of both options, including PMI premiums, interest rates, and loan terms. Consulting with a mortgage professional can provide valuable insights into the best financing strategy based on individual circumstances. Additionally, borrowers should review their credit score and financial standing to ensure they qualify for favorable loan terms.

Ultimately, using a piggyback loan to bypass PMI can be a smart financial move for those who qualify and can manage the repayment terms effectively. By carefully weighing the benefits and potential risks, homebuyers can make an informed decision that aligns with their long-term financial objectives while minimizing unnecessary costs.