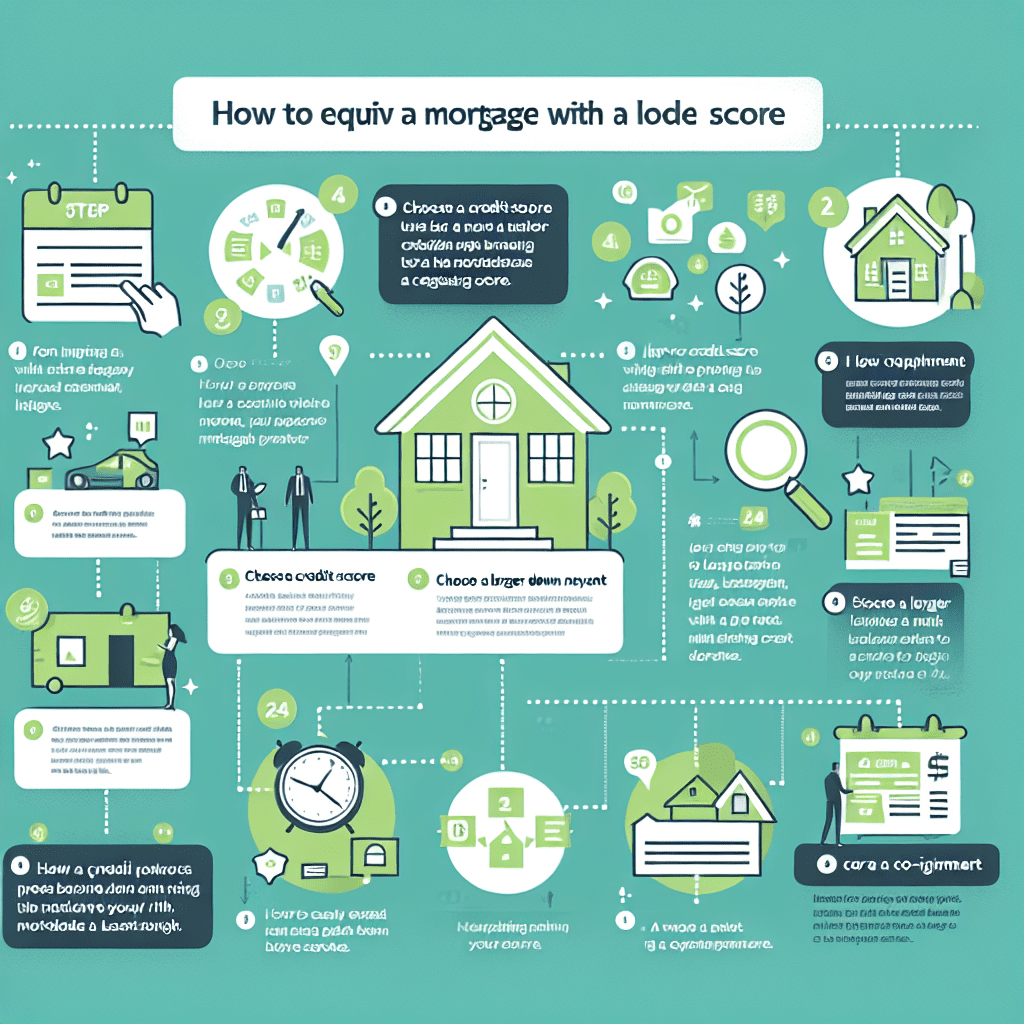

“Smart Strategies to Secure a Mortgage with a Low Credit Score!”

**Understanding Your Credit Score and Its Impact on Mortgage Approval**

Your credit score plays a crucial role in determining your eligibility for a mortgage, as lenders use it to assess your financial responsibility and ability to repay a loan. A low credit score can make the mortgage approval process more challenging, but it does not necessarily mean that homeownership is out of reach. By understanding how your credit score affects mortgage approval and taking strategic steps to improve your financial profile, you can increase your chances of securing a loan with favorable terms.

Lenders evaluate credit scores to gauge the level of risk associated with lending money to a borrower. Generally, credit scores range from 300 to 850, with higher scores indicating a stronger credit history. A score below 620 is often considered low by most lenders, which may result in higher interest rates, stricter loan terms, or even loan denial. This is because a lower score suggests a history of missed payments, high debt levels, or other financial difficulties that could make repayment less certain. However, while a low credit score presents challenges, there are still viable options for obtaining a mortgage.

One of the most effective ways to improve your chances of mortgage approval is to review your credit report for errors. Inaccurate information, such as incorrect late payments or accounts that do not belong to you, can negatively impact your score. By obtaining a copy of your credit report from major credit bureaus and disputing any inaccuracies, you may be able to raise your score and present a more favorable financial profile to lenders. Additionally, making consistent, on-time payments on existing debts can gradually improve your creditworthiness over time.

Another strategy to enhance your mortgage eligibility is to reduce your debt-to-income ratio. Lenders assess this ratio to determine how much of your monthly income is allocated to debt payments. A high debt-to-income ratio can signal financial strain, making lenders hesitant to approve a mortgage. Paying down outstanding debts, such as credit card balances or personal loans, can lower this ratio and demonstrate financial stability. Furthermore, avoiding new debt in the months leading up to a mortgage application can prevent further negative impacts on your credit score.

For borrowers with low credit scores, exploring government-backed loan programs can provide a viable path to homeownership. Programs such as FHA loans, VA loans, and USDA loans are designed to assist individuals with less-than-perfect credit. FHA loans, for example, allow borrowers with credit scores as low as 500 to qualify with a higher down payment, while those with scores of 580 or higher may be eligible with a lower down payment. VA loans, available to eligible military service members and veterans, often have more lenient credit requirements and do not require a down payment. Similarly, USDA loans, intended for rural homebuyers, offer flexible credit guidelines and low-interest rates.

In addition to exploring loan options, working with a mortgage broker can be beneficial. Brokers have access to multiple lenders and can help identify those willing to work with borrowers who have lower credit scores. They can also provide guidance on improving financial standing and securing the best possible loan terms. By taking proactive steps to address credit challenges and exploring alternative mortgage options, individuals with low credit scores can still achieve their goal of homeownership.

**Proven Strategies to Secure a Mortgage with a Low Credit Score**

Securing a mortgage with a low credit score can be challenging, but it is not impossible. Many prospective homebuyers assume that a poor credit history automatically disqualifies them from obtaining a home loan. However, lenders consider multiple factors when evaluating mortgage applications, and there are several strategies that can improve the chances of approval. By understanding the available options and taking proactive steps, individuals with low credit scores can still achieve homeownership.

One of the most effective ways to secure a mortgage with a low credit score is to explore government-backed loan programs. Loans insured by the Federal Housing Administration (FHA), the U.S. Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) often have more lenient credit requirements than conventional loans. FHA loans, for example, allow borrowers with credit scores as low as 500 to qualify, provided they can make a 10% down payment. Those with scores of 580 or higher may qualify with as little as 3.5% down. Similarly, VA loans, which are available to eligible military service members and veterans, do not have a minimum credit score requirement set by the VA, though individual lenders may impose their own standards. USDA loans, designed for rural homebuyers, also offer flexible credit requirements and may not require a down payment.

In addition to considering government-backed loans, potential borrowers can improve their chances of approval by offering a larger down payment. A substantial down payment reduces the lender’s risk and demonstrates financial responsibility. While conventional loans typically require a minimum of 3% to 5% down, individuals with lower credit scores may need to provide at least 10% to 20% to reassure lenders. A higher down payment not only increases the likelihood of approval but may also result in better loan terms, such as lower interest rates and reduced private mortgage insurance (PMI) costs.

Another important strategy is to work on improving credit before applying for a mortgage. Even small improvements in a credit score can make a significant difference in loan eligibility and interest rates. Paying down outstanding debts, making timely payments, and avoiding new credit inquiries can help boost a credit score over time. Additionally, reviewing credit reports for errors and disputing any inaccuracies can lead to a higher score. Many lenders also offer credit counseling services that can provide guidance on improving financial health before applying for a mortgage.

For those struggling to qualify on their own, having a co-signer or applying for a joint mortgage with a financially stable partner can be beneficial. A co-signer with a strong credit history can help offset the risk associated with a low credit score, making lenders more willing to approve the loan. However, it is important to understand that the co-signer assumes responsibility for the loan if the primary borrower fails to make payments.

Finally, working with specialized lenders who cater to borrowers with low credit scores can increase the chances of securing a mortgage. Some lenders focus on providing loans to individuals with less-than-perfect credit and may offer alternative qualification criteria. While these loans may come with higher interest rates, they can serve as a stepping stone toward homeownership. By carefully considering all available options and taking proactive steps to strengthen financial standing, individuals with low credit scores can successfully navigate the mortgage process and achieve their goal of owning a home.

**Best Loan Options for Homebuyers with Less-Than-Perfect Credit**

For homebuyers with less-than-perfect credit, securing a mortgage may seem like a daunting challenge. However, several loan options are specifically designed to accommodate borrowers with lower credit scores, making homeownership more accessible. Understanding these options and their requirements can help prospective buyers make informed decisions and improve their chances of approval.

One of the most popular choices for borrowers with lower credit scores is an FHA loan. Backed by the Federal Housing Administration, FHA loans are designed to assist individuals who may not qualify for conventional financing. These loans typically require a minimum credit score of 580 to qualify for a low down payment of 3.5%. However, applicants with scores as low as 500 may still be eligible if they can provide a 10% down payment. Additionally, FHA loans have more lenient debt-to-income ratio requirements, making them an attractive option for those with financial challenges.

Another viable option is a VA loan, available exclusively to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. VA loans, backed by the Department of Veterans Affairs, do not have a strict minimum credit score requirement, though most lenders prefer a score of at least 580 to 620. These loans offer significant benefits, including no down payment, competitive interest rates, and no private mortgage insurance (PMI), making them an excellent choice for qualified borrowers with lower credit scores.

For those purchasing homes in rural or suburban areas, a USDA loan may be a suitable alternative. Guaranteed by the U.S. Department of Agriculture, USDA loans are designed to assist low- to moderate-income borrowers in eligible locations. While there is no official minimum credit score requirement, most lenders look for a score of at least 640 to qualify for streamlined processing. These loans offer 100% financing, meaning no down payment is required, and they also feature lower mortgage insurance costs compared to FHA loans.

In addition to government-backed loans, some lenders offer non-conventional loan programs tailored to individuals with lower credit scores. Subprime mortgages, for example, are designed for borrowers who do not meet traditional lending criteria. While these loans often come with higher interest rates and fees, they can provide a pathway to homeownership for those who may not qualify for other options. Similarly, some credit unions and community banks offer portfolio loans, which are not sold to secondary markets and allow for more flexible underwriting standards.

For borrowers who may not qualify for any of these options, considering a co-signer or making a larger down payment can improve the likelihood of approval. A co-signer with strong credit can help reassure lenders of the borrower’s ability to repay the loan, while a larger down payment reduces the lender’s risk and may result in more favorable loan terms.

Ultimately, while a low credit score can present challenges in securing a mortgage, various loan options exist to help homebuyers achieve their goals. By exploring these alternatives, improving financial habits, and working with knowledgeable lenders, individuals with less-than-perfect credit can take meaningful steps toward homeownership.