“Reverse Mortgages Explained: Unlocking Financial Freedom for Retirees!”

Understanding Reverse Mortgages: How They Work and Who Benefits

A reverse mortgage is a financial product designed to help retirees access the equity in their homes without the burden of monthly loan payments. Unlike a traditional mortgage, where the borrower makes payments to the lender, a reverse mortgage allows homeowners to receive payments from the lender, effectively converting their home equity into cash. This option can be particularly beneficial for retirees who need additional income to cover living expenses, medical costs, or other financial obligations. However, understanding how reverse mortgages work and who stands to benefit the most is essential before making a decision.

To qualify for a reverse mortgage, homeowners must be at least 62 years old and live in the home as their primary residence. The amount that can be borrowed depends on several factors, including the home’s value, the borrower’s age, and current interest rates. Generally, the older the borrower and the more valuable the home, the higher the loan amount available. The loan is typically repaid when the homeowner sells the property, moves out permanently, or passes away. At that point, the proceeds from the home’s sale are used to pay off the loan balance, with any remaining equity going to the homeowner or their heirs.

One of the key advantages of a reverse mortgage is that it provides retirees with a steady source of income without requiring them to sell their home. This can be particularly useful for those who have significant home equity but limited liquid assets. Additionally, because reverse mortgage payments are considered loan proceeds rather than income, they are generally not subject to taxation. This can make them an attractive option for retirees looking to supplement their Social Security benefits or other retirement income.

Despite these benefits, reverse mortgages are not suitable for everyone. One important consideration is the cost associated with obtaining the loan. Reverse mortgages often come with higher fees and interest rates compared to traditional home loans. These costs can include origination fees, mortgage insurance premiums, and servicing fees, which can add up over time and reduce the amount of equity available to the homeowner or their heirs. Furthermore, while borrowers are not required to make monthly payments, they must continue to pay property taxes, homeowners insurance, and maintenance costs. Failure to meet these obligations could result in foreclosure.

Another potential drawback is the impact on a homeowner’s estate. Because the loan balance increases over time as interest accrues, there may be little to no equity left for heirs when the home is eventually sold. This can be a significant concern for those who wish to leave their home as an inheritance. However, most reverse mortgages are structured as non-recourse loans, meaning that borrowers or their heirs will never owe more than the home’s value at the time of sale. This feature provides some level of financial protection, ensuring that heirs are not left with additional debt.

Ultimately, whether a reverse mortgage is a smart move for retirees depends on individual financial circumstances and long-term goals. For those who need additional income and plan to remain in their home for the foreseeable future, a reverse mortgage can provide financial stability. However, for those who anticipate moving or wish to preserve home equity for their heirs, other options such as downsizing or a home equity line of credit may be more suitable. Consulting with a financial advisor can help retirees weigh the pros and cons and determine the best course of action for their specific needs.

Pros and Cons of Reverse Mortgages: Is It the Right Choice for Your Retirement?

Reverse mortgages have become an increasingly popular financial tool for retirees seeking to supplement their income. By allowing homeowners aged 62 and older to convert a portion of their home equity into cash, these loans provide a potential solution for those looking to enhance their financial stability in retirement. However, while reverse mortgages offer several advantages, they also come with potential drawbacks that must be carefully considered before making a decision. Understanding both the benefits and risks can help retirees determine whether this financial option aligns with their long-term goals.

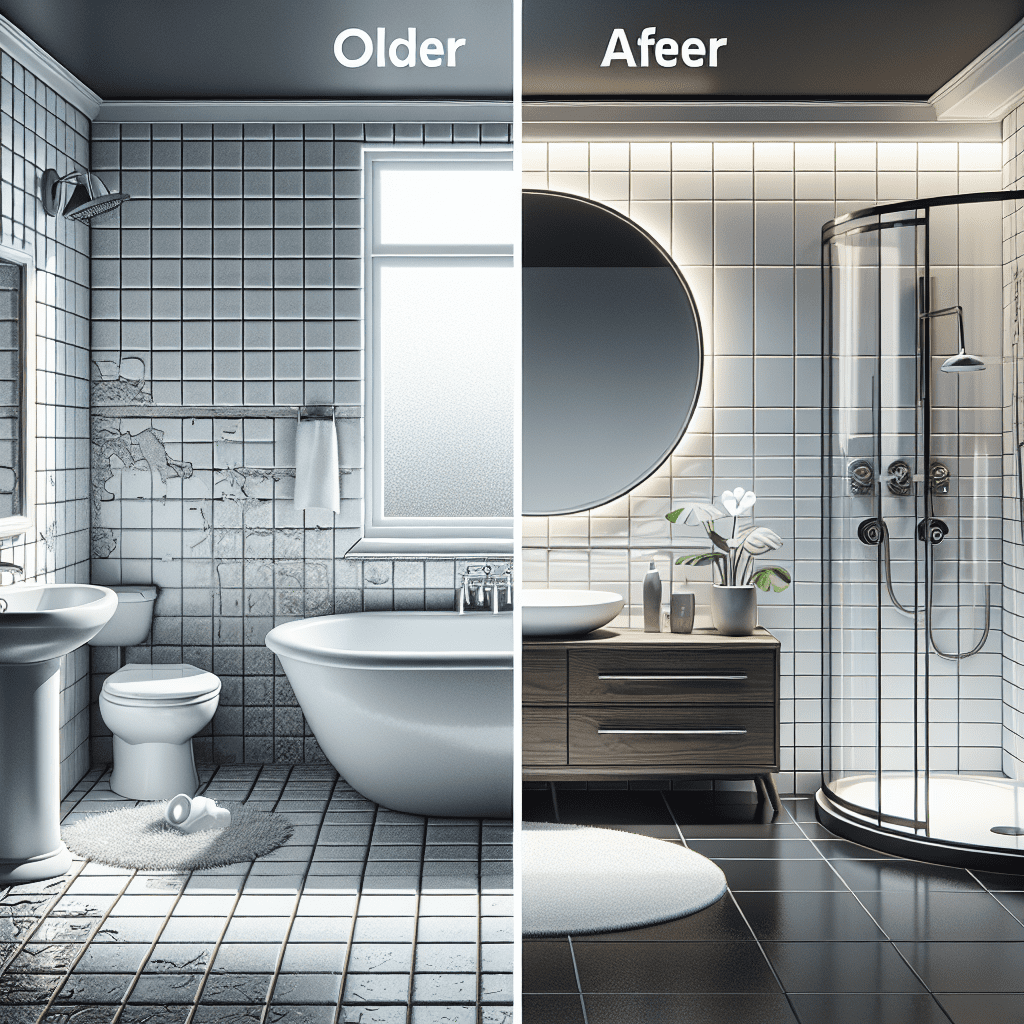

One of the most significant advantages of a reverse mortgage is the ability to access additional funds without the burden of monthly loan payments. Unlike traditional home loans, repayment is deferred until the homeowner sells the property, moves out permanently, or passes away. This feature can be particularly beneficial for retirees who may have limited income but substantial home equity. By converting this equity into cash, they can cover essential expenses, medical bills, or even home improvements, thereby improving their quality of life without the immediate financial strain of loan repayments.

Additionally, reverse mortgages provide flexibility in how funds are received. Borrowers can choose to receive a lump sum, monthly payments, a line of credit, or a combination of these options. This flexibility allows retirees to tailor the loan to their specific financial needs, whether they require a steady income stream or occasional access to funds for unexpected expenses. Furthermore, because reverse mortgage proceeds are considered loan advances rather than income, they are generally not subject to federal income tax, which can be an added financial advantage.

Another key benefit is that homeowners retain ownership of their property as long as they meet the loan requirements, such as maintaining the home and staying current on property taxes and insurance. This means that retirees can continue living in their homes while benefiting from the additional financial resources provided by the loan. For those who wish to age in place rather than downsize or relocate, a reverse mortgage can be an effective way to achieve that goal.

Despite these advantages, there are also potential downsides that must be carefully weighed. One of the primary concerns is the accumulation of interest over time. Since borrowers are not required to make monthly payments, interest on the loan balance continues to accrue, which can significantly reduce the amount of equity available to heirs. This means that when the home is eventually sold, there may be little to no remaining equity left for beneficiaries.

Moreover, reverse mortgages come with various fees and closing costs, which can be higher than those associated with traditional home loans. These costs may include origination fees, mortgage insurance premiums, and servicing fees, all of which can reduce the overall financial benefit of the loan. Additionally, failure to meet loan obligations, such as paying property taxes and homeowners insurance, can result in foreclosure, putting the borrower’s home at risk.

Given these considerations, retirees should carefully evaluate their financial situation and long-term plans before deciding on a reverse mortgage. Consulting with a financial advisor or housing counselor can provide valuable insights into whether this option aligns with their retirement goals. While a reverse mortgage can offer financial relief and flexibility, it is essential to fully understand the potential risks and costs involved to make an informed decision.

Financial Planning for Retirees: When a Reverse Mortgage Makes Sense

A reverse mortgage can be a valuable financial tool for retirees seeking to supplement their income, but it is essential to understand when it makes sense to pursue this option. Unlike a traditional mortgage, where the borrower makes monthly payments to a lender, a reverse mortgage allows homeowners aged 62 and older to convert a portion of their home equity into cash without the obligation of monthly payments. Instead, the loan balance grows over time and is repaid when the homeowner sells the home, moves out permanently, or passes away. While this financial product can provide much-needed liquidity, it is not suitable for everyone, and careful consideration is necessary before making a decision.

One of the primary reasons retirees consider a reverse mortgage is to enhance their financial stability during retirement. Many individuals find that their savings, Social Security benefits, and pensions may not be sufficient to cover their living expenses, particularly as healthcare costs continue to rise. A reverse mortgage can provide a steady stream of income, allowing retirees to maintain their standard of living without depleting other assets too quickly. This can be especially beneficial for those who have significant home equity but limited cash flow. By tapping into their home’s value, retirees can access funds to cover daily expenses, medical bills, or even home modifications that allow them to age in place comfortably.

However, while a reverse mortgage can offer financial relief, it is not the right choice for everyone. One important factor to consider is the long-term impact on estate planning. Since the loan balance increases over time due to accrued interest and fees, the amount left to heirs may be significantly reduced. For retirees who wish to leave their home as an inheritance, this could be a major drawback. Additionally, if the homeowner moves out of the property for more than 12 consecutive months—such as relocating to a long-term care facility—the loan becomes due, which may force the sale of the home sooner than anticipated.

Another key consideration is the cost associated with a reverse mortgage. While borrowers are not required to make monthly payments, they are still responsible for property taxes, homeowners insurance, and maintenance costs. Failure to meet these obligations could result in foreclosure. Furthermore, reverse mortgages come with upfront fees, including origination fees, mortgage insurance premiums, and closing costs, which can be substantial. Retirees should carefully evaluate whether the benefits outweigh these expenses and explore alternative options, such as downsizing or utilizing other retirement savings, before committing to a reverse mortgage.

Despite these potential drawbacks, there are situations where a reverse mortgage makes sense. For retirees who plan to stay in their home for the foreseeable future and need additional income to support their lifestyle, this financial tool can provide much-needed flexibility. It can also serve as a strategic component of a broader retirement plan, allowing individuals to delay claiming Social Security benefits or preserve other investments for future growth. Consulting with a financial advisor can help retirees determine whether a reverse mortgage aligns with their long-term goals and financial needs.

Ultimately, deciding whether to pursue a reverse mortgage requires careful analysis of one’s financial situation, future plans, and personal priorities. While it can be a useful solution for some retirees, it is not a one-size-fits-all approach. By weighing the benefits and potential risks, individuals can make an informed decision that best supports their financial well-being in retirement.