“Save Smart, Live Fully: Secure Your Future Without Sacrificing Today.”

Smart Budgeting: Balancing Present Enjoyment with Future Savings

Saving for retirement while still enjoying life today requires a thoughtful approach to budgeting that balances present needs with future financial security. Many people struggle with the idea of setting aside money for the future, fearing that doing so will mean sacrificing the experiences and pleasures that make life enjoyable. However, with smart budgeting strategies, it is possible to achieve both goals without feeling deprived or overwhelmed. By making intentional financial decisions, prioritizing spending, and adopting a disciplined yet flexible approach, individuals can secure their future while still making the most of the present.

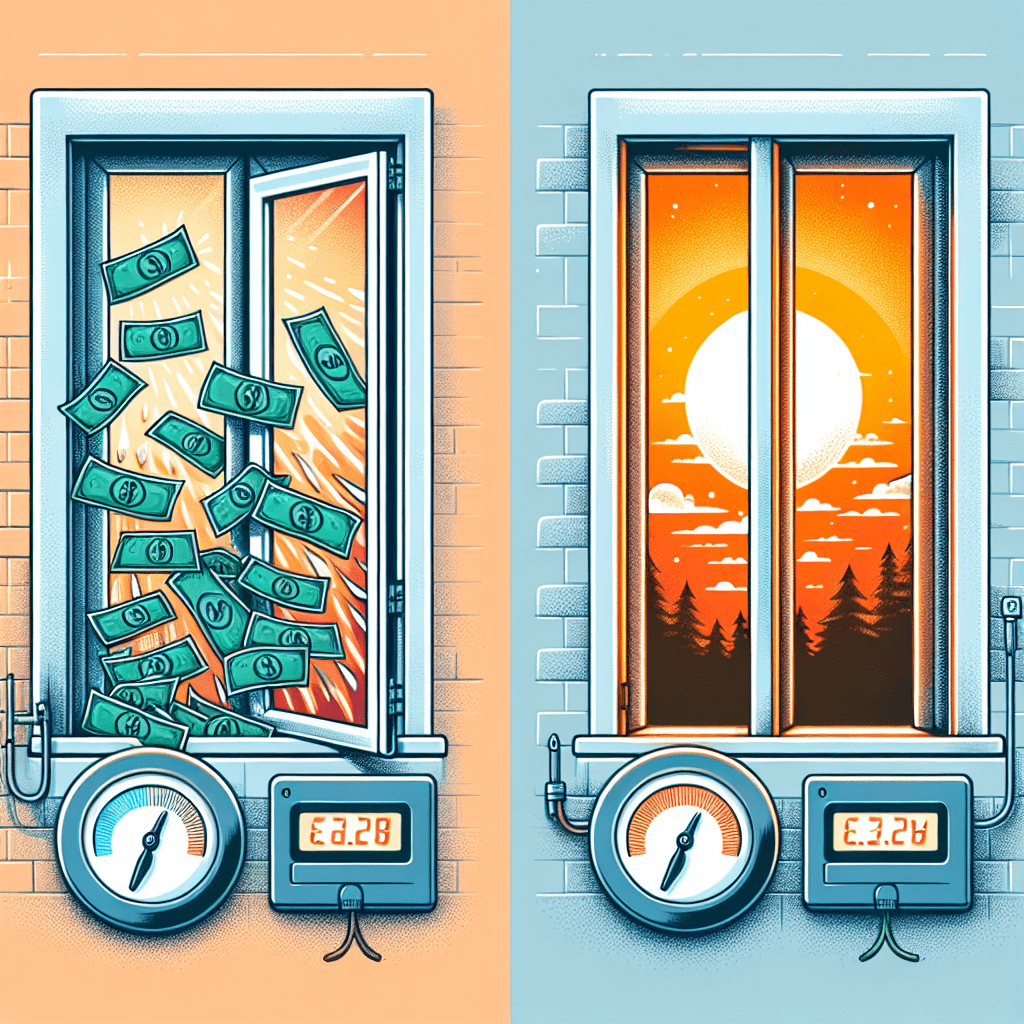

One of the most effective ways to achieve this balance is by creating a detailed budget that accounts for both short-term and long-term financial goals. A well-structured budget provides clarity on income, expenses, and savings, allowing individuals to allocate funds efficiently. To begin, it is essential to track all sources of income and categorize expenses into necessities, discretionary spending, and savings. Necessities include housing, utilities, groceries, and healthcare, while discretionary spending covers entertainment, dining out, and travel. By understanding where money is going, individuals can identify areas where adjustments can be made without significantly impacting their quality of life.

Once a clear budget is established, prioritizing savings becomes a crucial step. A common recommendation is to follow the 50/30/20 rule, which allocates 50% of income to necessities, 30% to discretionary spending, and 20% to savings. This framework ensures that saving for retirement remains a consistent priority while still allowing room for enjoyment. Automating savings contributions can further reinforce this habit, making it easier to set aside money without the temptation to spend it elsewhere. Contributing to employer-sponsored retirement plans, such as a 401(k), or opening an individual retirement account (IRA) can provide long-term benefits, including tax advantages and potential employer matching contributions.

While saving is essential, it does not mean eliminating all discretionary spending. Instead, individuals can focus on mindful spending by distinguishing between what truly brings value and what is merely impulsive or unnecessary. For example, rather than dining out frequently, one might choose to cook at home more often and reserve restaurant visits for special occasions. Similarly, opting for cost-effective entertainment options, such as community events or outdoor activities, can provide enjoyment without excessive costs. By making intentional choices, individuals can still indulge in experiences that bring happiness while maintaining financial discipline.

Another key aspect of smart budgeting is finding ways to increase income or reduce expenses without compromising lifestyle quality. Seeking additional income streams, such as freelance work or passive income opportunities, can provide extra funds for both savings and leisure activities. Additionally, reviewing recurring expenses, such as subscriptions or memberships, can help identify areas where costs can be minimized. Refinancing loans, negotiating bills, or switching to more affordable service providers are practical ways to free up money for both present enjoyment and future savings.

Ultimately, achieving financial security while enjoying life today requires a balanced approach that prioritizes both present experiences and long-term goals. By creating a structured budget, automating savings, practicing mindful spending, and exploring ways to optimize income and expenses, individuals can build a secure financial future without feeling restricted. With careful planning and disciplined financial habits, it is possible to enjoy life today while ensuring a comfortable and stable retirement.

Investing Wisely: Growing Wealth While Living Comfortably

Investing wisely is a crucial component of saving for retirement while still enjoying life today. Striking a balance between financial security and present-day fulfillment requires a strategic approach that allows for both growth and flexibility. By making informed investment decisions, individuals can build wealth over time without sacrificing their current quality of life. This approach involves understanding different investment options, managing risk effectively, and ensuring that financial goals align with personal values and lifestyle choices.

One of the most effective ways to grow wealth while maintaining financial stability is through diversified investments. A well-balanced portfolio that includes a mix of stocks, bonds, and other assets can help mitigate risk while maximizing potential returns. Stocks, for instance, offer the opportunity for long-term growth, while bonds provide stability and predictable income. Additionally, real estate and other alternative investments can further enhance financial security. By diversifying across different asset classes, individuals can reduce the impact of market fluctuations and ensure steady progress toward their retirement goals.

At the same time, it is essential to consider risk tolerance and investment time horizon. Younger investors may have the ability to take on more risk, as they have a longer period to recover from market downturns. In contrast, those closer to retirement may prefer a more conservative approach to protect their accumulated wealth. Regardless of age, maintaining a well-balanced portfolio that aligns with personal financial objectives is key to sustaining both short-term enjoyment and long-term security.

Another important aspect of investing wisely is taking advantage of tax-advantaged retirement accounts. Contributing to employer-sponsored plans such as a 401(k) or individual retirement accounts (IRAs) allows individuals to benefit from tax-deferred or tax-free growth, depending on the type of account. Many employers also offer matching contributions, which can significantly boost retirement savings without requiring additional personal investment. By maximizing contributions to these accounts, individuals can accelerate their wealth-building efforts while still having funds available for present-day expenses.

While long-term investments are essential, maintaining liquidity is equally important for financial flexibility. Having an emergency fund and accessible savings ensures that unexpected expenses do not disrupt investment strategies or lead to unnecessary debt. A well-funded emergency account provides peace of mind, allowing individuals to enjoy their current lifestyle without the constant worry of financial setbacks. This balance between long-term growth and short-term security is crucial for maintaining financial well-being.

Furthermore, adopting a mindful approach to spending can help individuals invest wisely without feeling deprived. Prioritizing meaningful experiences and thoughtful purchases over impulsive spending allows for a fulfilling lifestyle while still making progress toward retirement goals. Budgeting effectively and distinguishing between essential and discretionary expenses can create opportunities to invest without compromising present enjoyment. By aligning financial decisions with personal values, individuals can achieve both financial security and a satisfying lifestyle.

Ultimately, investing wisely requires a combination of strategic planning, disciplined saving, and informed decision-making. By diversifying investments, managing risk appropriately, leveraging tax-advantaged accounts, maintaining liquidity, and practicing mindful spending, individuals can grow their wealth while continuing to enjoy life today. This balanced approach ensures that financial security does not come at the expense of present happiness, allowing for a fulfilling and prosperous future.

Passive Income Strategies: Earning Extra Without Sacrificing Fun

Saving for retirement while still enjoying life today may seem like a difficult balance to achieve. Many people assume that securing their financial future requires significant sacrifices in the present, leading them to cut back on leisure activities and personal enjoyment. However, by incorporating passive income strategies into a financial plan, it is possible to build long-term wealth without compromising on the experiences that make life fulfilling. Passive income allows individuals to generate earnings with minimal ongoing effort, providing a steady stream of funds that can be used for both present enjoyment and future security.

One of the most effective ways to establish passive income is through dividend-paying stocks. Investing in companies that distribute regular dividends enables individuals to earn money without actively working for it. Over time, reinvesting these dividends can lead to substantial growth, creating a reliable source of income that can supplement both current expenses and retirement savings. While stock market investments carry some level of risk, a well-diversified portfolio can help mitigate potential losses and ensure steady returns.

Similarly, real estate investments offer another avenue for generating passive income. Rental properties, for instance, provide a consistent cash flow while also appreciating in value over time. By carefully selecting properties in high-demand areas and outsourcing management tasks to property managers, investors can enjoy the benefits of real estate income without the burden of day-to-day responsibilities. Additionally, real estate investment trusts (REITs) offer an alternative for those who prefer a more hands-off approach, allowing individuals to invest in real estate without directly managing properties.

Beyond traditional investments, creating digital products or online content can serve as a lucrative passive income stream. Writing e-books, developing online courses, or launching a blog with affiliate marketing can generate revenue with minimal ongoing effort. Once these products are created and marketed effectively, they can continue to generate income for years, providing financial support without requiring constant attention. This approach not only contributes to long-term savings but also allows individuals to pursue creative passions and share knowledge with others.

Another effective strategy involves leveraging high-yield savings accounts and certificates of deposit (CDs). While these options may not offer the same high returns as stocks or real estate, they provide a secure and low-risk way to grow savings over time. By strategically allocating funds into interest-bearing accounts, individuals can ensure that their money is working for them while maintaining easy access to cash for immediate needs.

For those seeking a more automated approach, robo-advisors and automated investment platforms can simplify the process of building passive income. These tools use algorithms to manage investments, ensuring that portfolios remain balanced and aligned with financial goals. By utilizing such services, individuals can benefit from professional investment strategies without the need for extensive financial knowledge or active management.

Ultimately, incorporating passive income strategies into a financial plan allows individuals to save for retirement while still enjoying life today. By diversifying income sources and making strategic investments, it is possible to achieve financial security without sacrificing present-day experiences. With careful planning and a commitment to long-term growth, individuals can create a sustainable financial future while continuing to enjoy the activities and experiences that bring them joy.