“Save More, Spend Less: 10 Genius Money-Saving Hacks for This Year!”

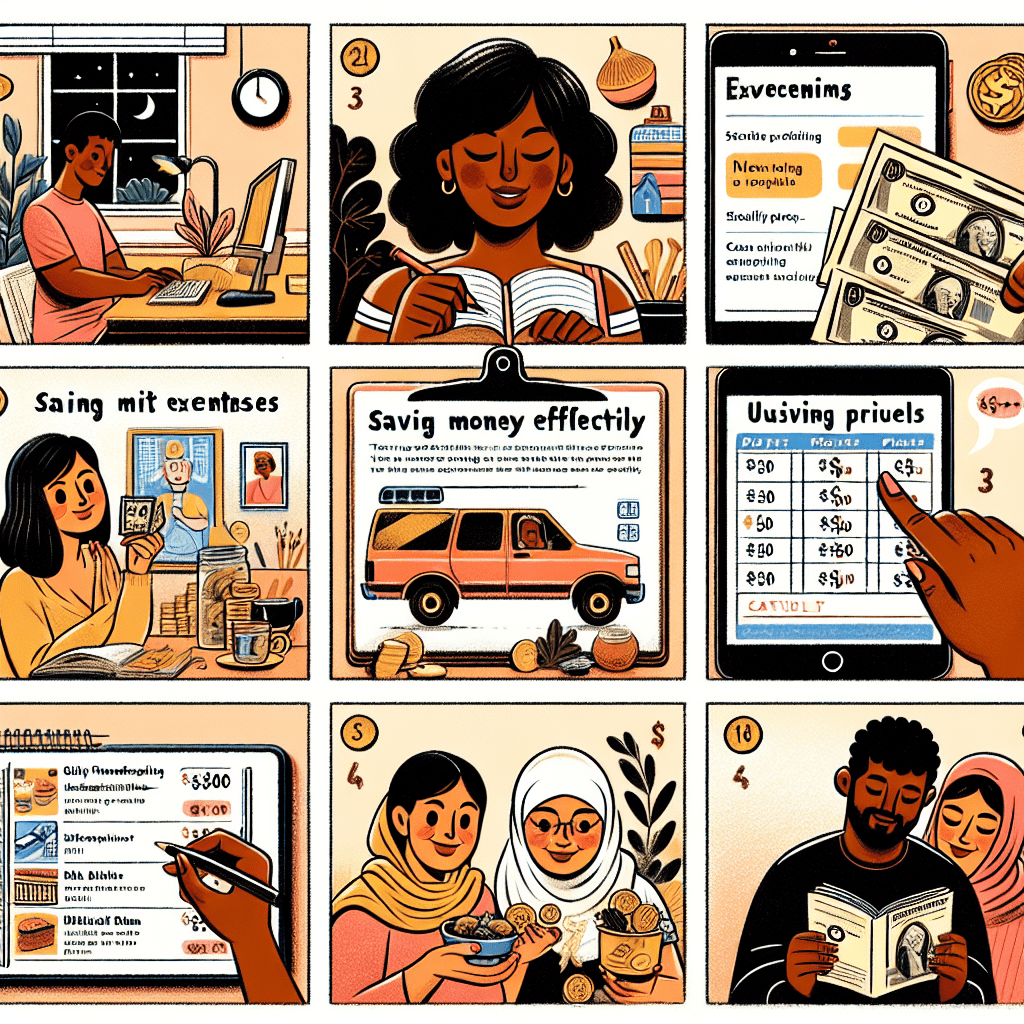

Smart Budgeting: How to Track and Cut Expenses Effectively

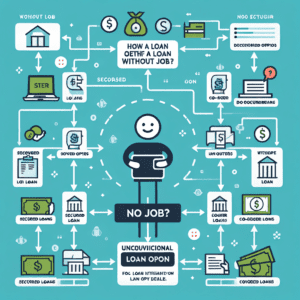

Tracking and cutting expenses effectively is a crucial step toward achieving financial stability. By understanding where your money goes and identifying areas where you can save, you can create a budget that aligns with your financial goals. The first step in smart budgeting is to track your expenses consistently. This can be done using budgeting apps, spreadsheets, or even a simple notebook. By recording every purchase, you gain a clear picture of your spending habits, making it easier to identify unnecessary expenses. Additionally, categorizing your expenses—such as housing, groceries, transportation, and entertainment—allows you to see which areas consume the largest portion of your income.

Once you have a clear understanding of your spending patterns, the next step is to set realistic budget limits for each category. A common approach is the 50/30/20 rule, which allocates 50% of your income to necessities, 30% to discretionary spending, and 20% to savings or debt repayment. However, this framework can be adjusted based on individual financial situations. To ensure that you stay within your budget, consider using cash envelopes for discretionary spending or setting up automatic transfers to savings accounts. These strategies help prevent overspending and encourage disciplined financial habits.

Cutting expenses effectively requires identifying areas where you can reduce costs without compromising your quality of life. One of the most effective ways to do this is by reviewing recurring expenses such as subscriptions, memberships, and utility bills. Many people unknowingly pay for services they no longer use or need. Canceling unused subscriptions or switching to more affordable alternatives can result in significant savings over time. Similarly, negotiating bills—such as internet, cable, or insurance—can lead to lower monthly payments. Many service providers offer discounts or promotions to retain customers, so it is always worth inquiring about potential savings.

Another practical way to reduce expenses is by adopting cost-effective shopping habits. Planning meals in advance and creating a grocery list can prevent impulse purchases and reduce food waste. Additionally, using cashback apps, coupons, and loyalty programs can help lower grocery costs. When shopping for non-essential items, waiting for sales or purchasing second-hand goods can also lead to substantial savings. Furthermore, considering generic or store-brand products instead of name-brand items can make a noticeable difference in your overall spending.

Transportation costs can also be a significant expense, but there are ways to minimize them. Carpooling, using public transportation, or biking instead of driving can reduce fuel and maintenance costs. If owning a car is necessary, regular maintenance and fuel-efficient driving habits can help lower expenses in the long run. Additionally, shopping around for better auto insurance rates can result in further savings.

Finally, adopting a mindful approach to spending can have a lasting impact on your financial well-being. Before making a purchase, consider whether it is a necessity or a want. Delaying non-essential purchases for a few days can help determine if they are truly needed. By implementing these smart budgeting strategies, you can take control of your finances, reduce unnecessary expenses, and work toward achieving your financial goals.

Frugal Shopping: Tips to Save Big on Groceries and Essentials

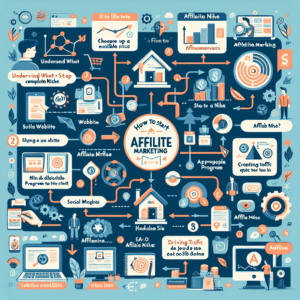

One of the most effective ways to manage your finances wisely is by adopting smart shopping habits, particularly when it comes to groceries and everyday essentials. With the rising cost of living, finding ways to cut expenses without compromising on quality has become increasingly important. Fortunately, there are several strategies that can help you save money while still ensuring that your household needs are met. By implementing a few simple yet effective techniques, you can significantly reduce your grocery bills and make the most of your budget.

A great starting point is to plan your meals in advance. Meal planning allows you to create a structured shopping list based on what you actually need, preventing unnecessary purchases and reducing food waste. When you have a clear idea of what you will be cooking for the week, you are less likely to buy items on impulse. Additionally, shopping with a list helps you stay focused and avoid distractions that could lead to overspending.

Another essential strategy is to take advantage of sales and discounts. Many grocery stores offer weekly promotions, loyalty programs, and digital coupons that can lead to substantial savings. Keeping an eye on store flyers and using cashback apps can help you identify the best deals available. However, it is important to be mindful of marketing tactics that encourage bulk purchases of items you may not actually need. Buying in bulk can be cost-effective for non-perishable goods, but for perishable items, it is best to purchase only what you can realistically consume before they expire.

In addition to looking for discounts, consider switching to store-brand products. Many generic or private-label brands offer the same quality as name-brand items but at a significantly lower price. In most cases, the difference in taste or effectiveness is minimal, making it a practical choice for budget-conscious shoppers. Conducting a price comparison between different brands can help you determine which products offer the best value for your money.

Shopping at the right time can also make a difference in how much you spend. Grocery stores often mark down perishable items such as meat, dairy, and baked goods toward the end of the day or just before their expiration date. Taking advantage of these markdowns can help you save money while still enjoying fresh and high-quality products. Additionally, shopping during off-peak hours can provide a more relaxed experience, allowing you to make thoughtful purchasing decisions without feeling rushed.

Another effective way to cut costs is by reducing your reliance on convenience foods. Pre-packaged meals, snacks, and individually portioned items tend to be more expensive than their bulk counterparts. Preparing meals from scratch not only saves money but also allows you to have greater control over the ingredients you use. Cooking in larger batches and freezing portions for later use can further enhance savings while ensuring that you always have a home-cooked meal readily available.

Finally, adopting a mindful approach to grocery shopping can lead to long-term financial benefits. By being intentional with your purchases, taking advantage of discounts, and making small adjustments to your shopping habits, you can significantly reduce your expenses without sacrificing quality. With careful planning and strategic decision-making, saving money on groceries and essentials becomes an achievable goal that contributes to overall financial well-being.

Energy Efficiency: Simple Ways to Lower Your Utility Bills

Reducing utility bills is a priority for many households, and improving energy efficiency is one of the most effective ways to achieve this goal. By making small but meaningful changes to daily habits and home maintenance routines, it is possible to lower energy consumption without sacrificing comfort. One of the simplest ways to start is by adjusting thermostat settings. Lowering the temperature in winter and raising it in summer by just a few degrees can lead to significant savings over time. Additionally, using a programmable or smart thermostat allows for automatic adjustments based on occupancy, ensuring that energy is not wasted when no one is home.

Another effective strategy is upgrading to energy-efficient appliances. Older models of refrigerators, washing machines, and dishwashers tend to consume more electricity than newer, energy-efficient alternatives. When purchasing new appliances, looking for the ENERGY STAR label can help ensure that the product meets high efficiency standards. While the initial investment may seem costly, the long-term savings on utility bills often outweigh the upfront expense. Similarly, replacing traditional incandescent bulbs with LED lighting can significantly reduce electricity usage. LEDs use up to 75% less energy and last much longer, making them a cost-effective choice for any household.

In addition to upgrading appliances and lighting, improving home insulation is another key factor in reducing energy costs. Proper insulation helps maintain indoor temperatures, reducing the need for excessive heating or cooling. Sealing gaps around windows and doors with weatherstripping or caulking prevents drafts and keeps conditioned air from escaping. Adding insulation to attics, walls, and floors can further enhance energy efficiency, leading to lower heating and cooling expenses throughout the year.

Another simple yet effective way to cut down on energy consumption is by being mindful of water usage. Heating water accounts for a significant portion of energy bills, so reducing hot water consumption can lead to noticeable savings. Installing low-flow showerheads and faucet aerators helps decrease water usage without compromising water pressure. Additionally, washing clothes in cold water instead of hot and only running the dishwasher with a full load can further reduce energy costs.

Unplugging electronic devices when they are not in use is another often-overlooked method of saving energy. Many appliances and gadgets continue to draw power even when turned off, a phenomenon known as phantom energy consumption. Using power strips to easily disconnect multiple devices at once can help eliminate this unnecessary energy drain. Smart power strips, which automatically cut power to devices that are not in use, offer an even more convenient solution.

Finally, taking advantage of natural light and ventilation can help reduce reliance on artificial lighting and air conditioning. Opening curtains and blinds during the day allows sunlight to illuminate indoor spaces, reducing the need for electric lighting. Similarly, using fans and opening windows for cross-ventilation can help maintain a comfortable indoor temperature without relying solely on air conditioning.

By implementing these simple yet effective energy-saving strategies, households can significantly lower their utility bills while also reducing their environmental impact. Making small adjustments to daily habits and investing in energy-efficient upgrades can lead to long-term financial savings and a more sustainable lifestyle.