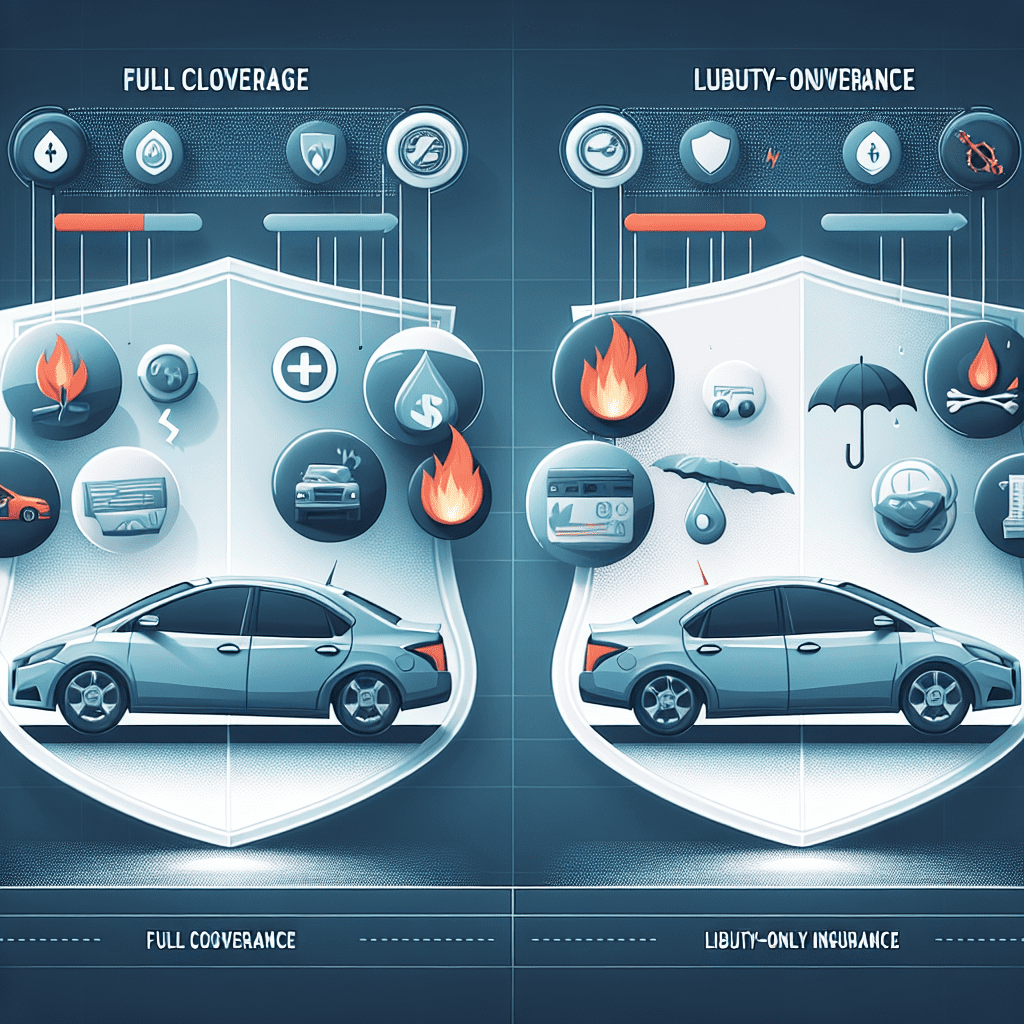

Choosing the right car insurance can be overwhelming, especially when deciding between full coverage and liability-only policies. Each option has its benefits and drawbacks, depending on your financial situation, vehicle value, and risk tolerance. In this guide, we’ll break down the differences to help you make an informed decision.

What Is Liability-Only Car Insurance?

Liability-only insurance is the minimum coverage required by law in most states. It covers damages and injuries you cause to others in an accident but does not cover your own vehicle.

What Does Liability Insurance Cover?

- Bodily Injury Liability: Pays for medical expenses, lost wages, and legal fees if you injure someone in an accident.

- Property Damage Liability: Covers the cost of repairing or replacing another person’s vehicle or property.

For example, if you rear-end another car and cause ,000 in damages, your liability insurance will cover the repair costs for the other driver’s vehicle. However, you’ll have to pay out of pocket for your own car repairs.

Who Should Consider Liability-Only Insurance?

Liability-only insurance is a good option if:

- You drive an older car with a low market value.

- You can afford to pay for repairs or replacement out of pocket.

- You want to keep your insurance premiums as low as possible.

What Is Full Coverage Car Insurance?

Full coverage insurance includes liability coverage plus additional protections for your own vehicle. While not legally required, it is often recommended for newer or financed cars.

What Does Full Coverage Include?

- Collision Coverage: Pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision-related damages, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance.

For instance, if a hailstorm damages your car, comprehensive coverage will pay for the repairs. Without it, you’d have to cover the costs yourself.

Who Should Consider Full Coverage Insurance?

Full coverage is ideal if:

- You have a new or expensive vehicle.

- Your car is financed or leased (lenders often require full coverage).

- You live in an area prone to theft, vandalism, or extreme weather.

- You want peace of mind knowing your vehicle is protected in various situations.

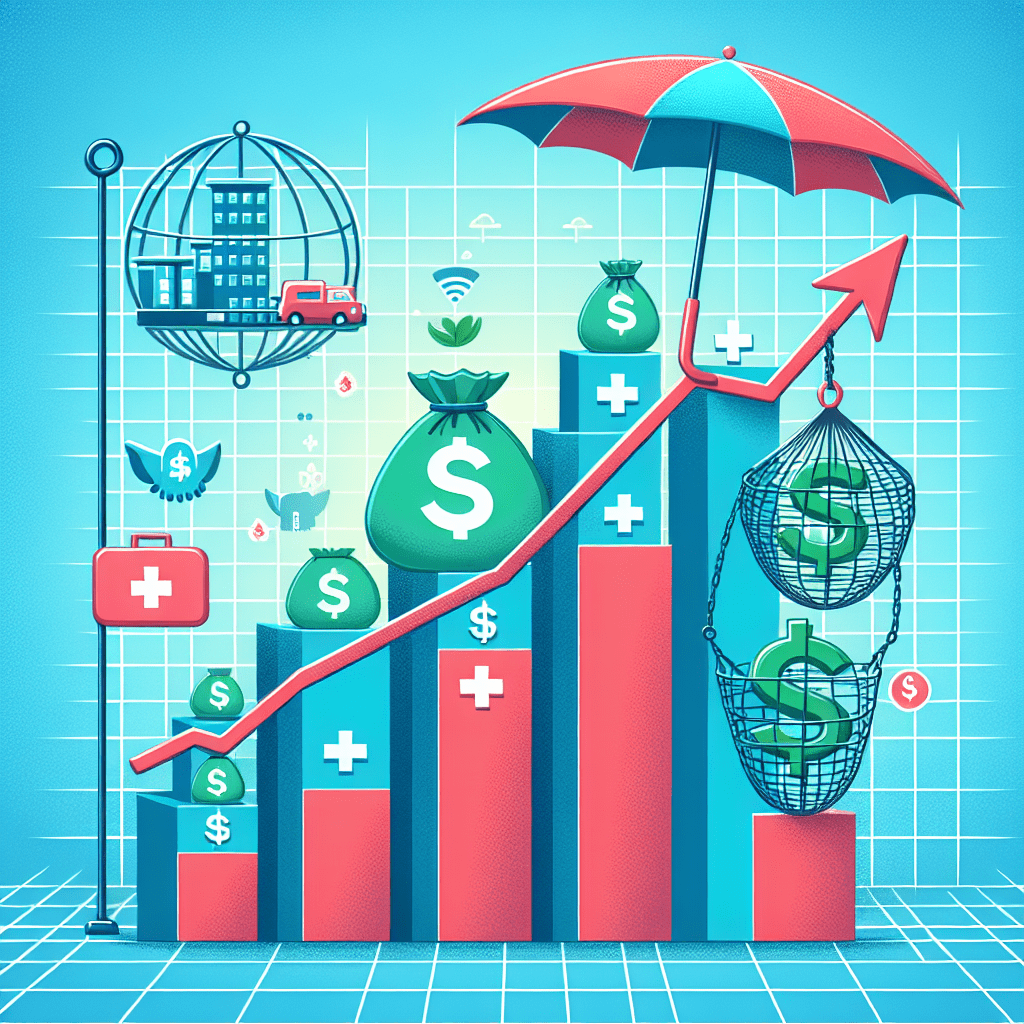

Cost Comparison: Full Coverage vs. Liability-Only

One of the biggest factors in choosing between full coverage and liability-only insurance is cost. On average:

- Liability-only insurance costs around $600 per year.

- Full coverage insurance costs approximately $1,600 per year.

However, these rates vary based on factors such as your driving history, location, and vehicle type. While full coverage is more expensive, it can save you thousands in repair or replacement costs after an accident.

How to Decide Which Coverage Is Right for You

To determine the best option, consider the following:

1. Assess Your Vehicle’s Value

If your car is worth less than $4,000, liability-only insurance may be sufficient. You can check your car’s value using resources like Kelley Blue Book or Edmunds.

2. Evaluate Your Financial Situation

Can you afford to replace or repair your car if it’s damaged? If not, full coverage may be a safer choice.

3. Consider Your Driving Habits

If you drive frequently or in high-risk areas, full coverage provides extra protection against accidents and theft.

4. Check Lender Requirements

If you have a car loan or lease, your lender may require full coverage until the vehicle is paid off.

Final Thoughts: Making the Right Choice

Ultimately, the decision between full coverage and liability-only insurance depends on your personal circumstances. If you own an older car and want to save money, liability-only may be the best option. However, if you have a newer vehicle or want comprehensive protection, full coverage is worth the investment.

Before making a decision, compare quotes from multiple insurance providers to find the best rates and coverage for your needs. A well-informed choice can save you money while ensuring you have the right level of protection on the road.