“Secure Car Insurance Without a Credit Check – Explore Your Best Options Today!”

Understanding No-Credit-Check Car Insurance: What You Need to Know

Car insurance is a necessity for drivers, providing financial protection in the event of an accident, theft, or other unforeseen circumstances. However, for individuals with poor credit or no credit history, obtaining coverage can be challenging. Many insurance companies use credit scores as a factor in determining premiums, as they believe there is a correlation between creditworthiness and the likelihood of filing claims. This practice can make it difficult for some drivers to secure affordable coverage. Fortunately, there are options available for those seeking car insurance without undergoing a credit check. Understanding these alternatives can help drivers find the right policy without being penalized for their credit history.

One of the most effective ways to obtain car insurance without a credit check is to seek out insurers that do not use credit scores as part of their underwriting process. While many major insurance companies rely on credit-based insurance scores, some providers focus on other factors, such as driving history, vehicle type, and location. These insurers assess risk based on tangible driving-related factors rather than financial history, making them a viable option for individuals with low or no credit. Researching and comparing such companies can help drivers find a policy that meets their needs without the added burden of a credit check.

Another alternative is to opt for a pay-as-you-go or usage-based insurance policy. These policies determine premiums based on driving behavior rather than credit scores. By using telematics devices or mobile apps, insurers track factors such as speed, braking habits, and mileage to assess risk. Safe drivers can benefit from lower premiums, regardless of their credit history. This type of insurance is particularly beneficial for individuals who drive infrequently or maintain safe driving habits, as their premiums are directly influenced by their on-road behavior rather than financial standing.

For those who struggle to find traditional insurance options, state-sponsored programs may provide a solution. Some states offer government-backed insurance programs designed for high-risk drivers, including those with poor credit. These programs ensure that all drivers have access to the necessary coverage, even if they have been denied by private insurers. While premiums for these policies may be higher than standard insurance rates, they provide an essential safety net for individuals who might otherwise be unable to obtain coverage. Checking with the state’s department of insurance can help determine eligibility and available options.

Additionally, making a larger upfront payment can sometimes help bypass credit checks. Some insurers allow policyholders to pay their premiums in full rather than in monthly installments. Since installment plans often involve a credit check to assess payment reliability, paying in full eliminates the need for this evaluation. While this option requires a larger initial financial commitment, it can be a practical solution for those who want to avoid credit-based pricing.

Ultimately, while credit scores play a significant role in the insurance industry, they are not the sole determining factor in obtaining coverage. By exploring insurers that do not rely on credit checks, considering usage-based policies, researching state-sponsored programs, or opting for full premium payments, drivers can find suitable car insurance options. Taking the time to compare different providers and policies ensures that individuals can secure the necessary coverage without being unfairly impacted by their credit history.

Best Alternatives to Traditional Car Insurance for Drivers Without Credit Checks

For drivers who prefer to avoid credit checks when obtaining car insurance, several alternatives to traditional policies exist. While many insurance companies use credit scores to assess risk and determine premiums, some providers offer options that do not require a credit check. These alternatives can be beneficial for individuals with limited or poor credit histories, ensuring they can still obtain the necessary coverage without financial barriers. Understanding these options and how they work can help drivers make informed decisions about their insurance needs.

One viable alternative is usage-based insurance, which determines premiums based on driving behavior rather than credit history. These policies rely on telematics devices or mobile apps to track factors such as speed, braking patterns, and mileage. By focusing on actual driving habits, insurers can offer personalized rates that reflect a driver’s level of risk. This approach benefits individuals who maintain safe driving practices, as they may receive lower premiums compared to traditional policies that factor in credit scores. Additionally, usage-based insurance provides an opportunity for drivers to improve their rates over time by demonstrating responsible driving behavior.

Another option is non-standard auto insurance, which caters to high-risk drivers, including those with poor credit or a history of accidents. While these policies may come with higher premiums, they do not typically require a credit check. Non-standard insurers specialize in providing coverage to individuals who may struggle to obtain insurance through conventional providers. Although the cost may be higher, this type of insurance ensures that drivers can meet legal requirements and remain protected on the road. To find the best rates, it is advisable to compare multiple non-standard insurance providers and explore any available discounts.

For those seeking a more flexible approach, pay-per-mile insurance offers an alternative that bases premiums on the number of miles driven. This type of policy is particularly beneficial for individuals who drive infrequently, as they only pay for the miles they use. Since pay-per-mile insurance focuses on driving habits rather than credit scores, it provides an accessible option for those looking to avoid credit checks. By monitoring mileage through a tracking device, insurers can offer lower rates to drivers who use their vehicles sparingly. This alternative is especially useful for retirees, remote workers, or individuals who rely on public transportation for most of their travel needs.

In addition to these specialized policies, some insurance companies offer no-credit-check policies as part of their standard coverage options. These insurers assess risk based on other factors, such as driving history, vehicle type, and location, rather than relying on credit scores. While these policies may not be as widely available as traditional insurance, they provide a valuable solution for individuals who prefer to keep their credit history separate from their insurance rates. Researching and comparing different providers can help drivers identify companies that offer this type of coverage.

Ultimately, finding car insurance without a credit check requires exploring alternative options and understanding how different policies operate. Whether through usage-based insurance, non-standard coverage, pay-per-mile policies, or insurers that do not consider credit scores, drivers have several choices to secure the protection they need. By carefully evaluating these alternatives and comparing rates, individuals can find a policy that meets their needs without the added concern of a credit check.

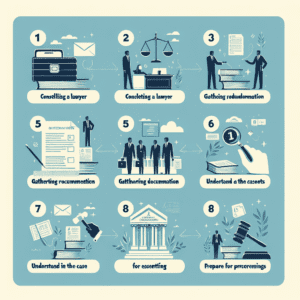

How to Get Car Insurance Without a Credit Check: Tips and Strategies

When searching for car insurance, many providers consider credit history as a factor in determining premiums. However, for individuals with poor or no credit, this can make obtaining affordable coverage challenging. Fortunately, there are ways to secure car insurance without undergoing a credit check. By exploring alternative options and implementing strategic approaches, drivers can find suitable coverage that meets their needs without being penalized for their credit history.

One of the most effective ways to obtain car insurance without a credit check is to seek out insurance companies that do not use credit scores as part of their underwriting process. Some insurers, particularly those specializing in high-risk drivers or non-standard policies, focus on other factors such as driving history, location, and vehicle type rather than credit history. Researching and comparing these providers can help drivers find a policy that does not require a credit check while still offering competitive rates.

Another viable option is to consider state-sponsored insurance programs. Some states offer government-backed insurance plans for drivers who may have difficulty obtaining coverage through traditional means. These programs are designed to ensure that all drivers have access to the necessary insurance, regardless of their financial background. While these policies may have specific eligibility requirements, they can be a valuable resource for individuals looking to avoid credit checks.

Additionally, opting for a usage-based insurance policy can be an alternative solution. Many insurers now offer telematics-based programs that determine premiums based on driving behavior rather than credit history. By installing a device in the vehicle or using a mobile app, drivers can demonstrate safe driving habits, which may result in lower premiums. This approach not only eliminates the need for a credit check but also provides an opportunity for responsible drivers to save money on their insurance.

For those who prefer a more straightforward approach, paying for insurance in full rather than in monthly installments can sometimes bypass the need for a credit check. Many insurers conduct credit checks primarily when setting up payment plans, as they assess the risk of missed payments. By paying the entire premium upfront, drivers may be able to avoid this process altogether. While this requires a larger initial payment, it can be a practical solution for those who have the financial means to do so.

Another strategy is to work with an independent insurance agent who specializes in finding policies for individuals with unique circumstances. These professionals have access to a wide range of insurance providers and can help identify companies that do not rely on credit scores. By leveraging their expertise, drivers can find policies that align with their needs while avoiding unnecessary credit inquiries.

Finally, improving other aspects of insurability, such as maintaining a clean driving record and choosing a vehicle with lower insurance costs, can help offset the impact of not having a credit check. Insurance companies prioritize risk assessment, and demonstrating responsible driving behavior can lead to more favorable rates. By focusing on these factors, drivers can increase their chances of securing affordable coverage without relying on credit history.

In conclusion, while many insurers use credit scores to determine premiums, there are several ways to obtain car insurance without undergoing a credit check. By exploring alternative providers, considering state-sponsored programs, opting for usage-based insurance, paying in full, working with independent agents, and improving overall insurability, drivers can find suitable coverage that meets their needs. Taking the time to research and compare options can lead to a policy that provides financial protection without the burden of a credit check.