“Protect Your Home Before the Unexpected Strikes – Get Covered Today!”

Importance Of Home Insurance: Protecting Your Home And Finances

Don’t Wait for the Unexpected – Get Home Insurance That Has Your Back

A home is more than just a place to live; it is a significant financial investment and a source of security for you and your family. However, unforeseen events such as natural disasters, theft, or accidents can threaten the safety and stability of your home. Without proper protection, these incidents can lead to substantial financial burdens, making it difficult to recover from the damage. This is where home insurance plays a crucial role, offering a safety net that ensures you are not left facing overwhelming expenses in the wake of an unexpected event.

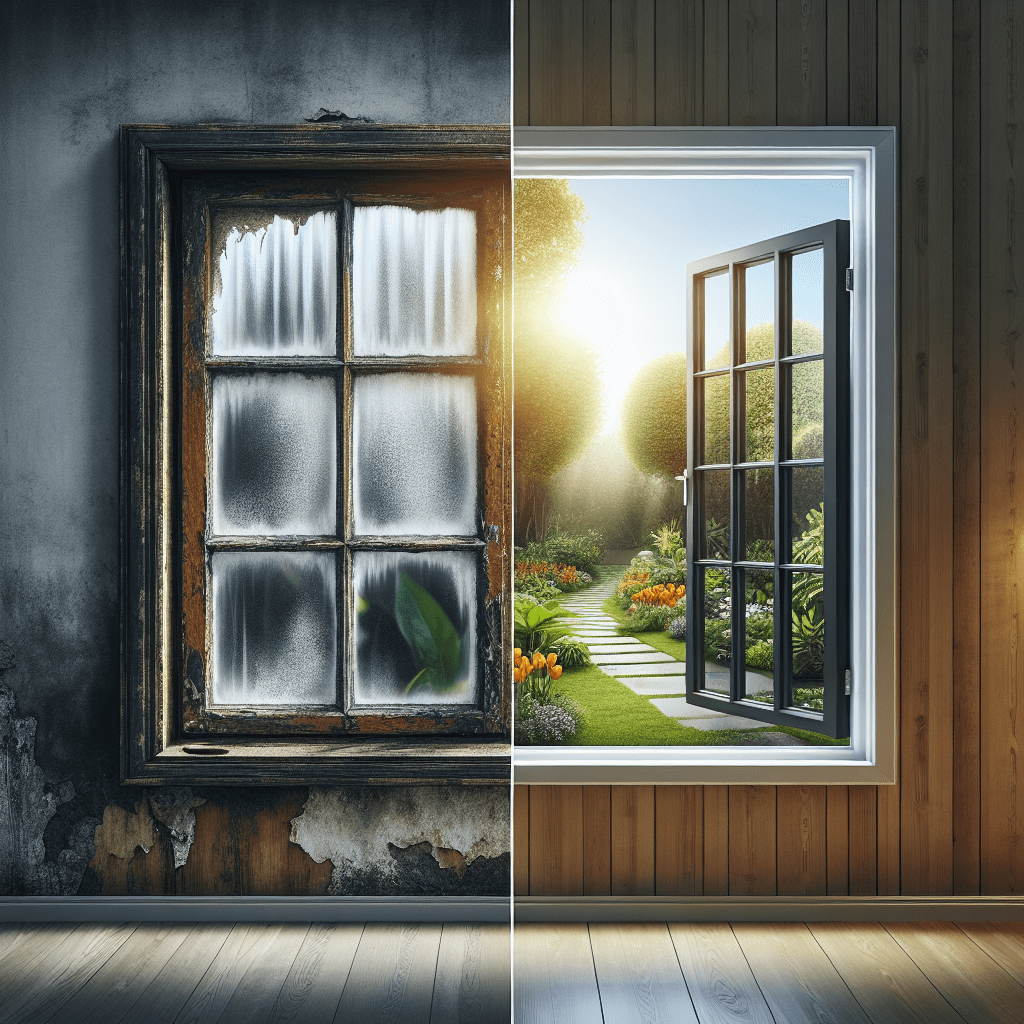

One of the primary reasons home insurance is essential is that it provides financial protection against a wide range of risks. Whether it is damage caused by fire, storms, or vandalism, a comprehensive home insurance policy can help cover the cost of repairs or even a complete rebuild if necessary. Without insurance, homeowners may find themselves struggling to afford the expenses associated with restoring their property, potentially leading to long-term financial hardship. By securing a policy that aligns with your needs, you can have peace of mind knowing that your home is safeguarded against potential threats.

In addition to covering structural damage, home insurance also extends protection to personal belongings. Many policies include coverage for furniture, electronics, clothing, and other valuables in the event of theft, fire, or other covered perils. Replacing these items out of pocket can be costly, but with the right insurance policy, homeowners can receive compensation to help replace lost or damaged possessions. This aspect of home insurance is particularly important, as it ensures that not only the structure of the home but also the contents within it are protected.

Beyond property and belongings, home insurance also provides liability coverage, which is an often-overlooked but essential component. If someone is injured on your property, whether due to a slip-and-fall accident or another unforeseen incident, you could be held legally responsible for medical expenses and other damages. Liability coverage helps protect homeowners from the financial consequences of such claims, covering legal fees and settlement costs if necessary. Without this protection, a single accident could result in significant financial strain, making liability coverage a critical aspect of any home insurance policy.

Moreover, home insurance can offer additional living expenses coverage, which becomes invaluable in situations where a home is temporarily uninhabitable due to covered damage. If a fire or severe storm forces you to relocate while repairs are being made, this coverage can help pay for hotel stays, meals, and other necessary expenses. Without such protection, homeowners may find themselves struggling to afford temporary accommodations, adding further stress to an already challenging situation.

Ultimately, home insurance is not just a precautionary measure; it is a fundamental necessity for protecting both your home and your financial well-being. While no one anticipates disasters or accidents, they can happen at any time, often without warning. By securing a comprehensive home insurance policy, homeowners can ensure they are prepared for the unexpected, minimizing financial risks and providing stability for themselves and their families. Rather than waiting until disaster strikes, taking proactive steps to obtain the right coverage can make all the difference in safeguarding your most valuable asset.

How To Choose The Right Home Insurance Policy For Your Needs

Don’t Wait for the Unexpected – Get Home Insurance That Has Your Back

Selecting the right home insurance policy is a crucial step in protecting your most valuable asset. With so many options available, it can be overwhelming to determine which policy best suits your needs. However, by carefully evaluating your requirements and understanding the key factors that influence coverage, you can make an informed decision that provides financial security and peace of mind.

To begin with, assessing the value of your home and its contents is essential. The cost of rebuilding your home in the event of a disaster should be a primary consideration when choosing coverage. Many homeowners make the mistake of insuring their property based on its market value rather than the actual cost of reconstruction. Since rebuilding expenses can fluctuate due to labor and material costs, it is advisable to obtain an estimate from a professional to ensure that your policy provides adequate coverage. Additionally, taking inventory of your personal belongings and estimating their worth will help you determine the appropriate level of personal property coverage.

Beyond the basic coverage for your home and belongings, it is important to consider additional protections that may be necessary based on your location and lifestyle. For instance, if you live in an area prone to natural disasters such as floods, earthquakes, or hurricanes, standard home insurance may not be sufficient. Many policies exclude coverage for these events, requiring homeowners to purchase separate endorsements or policies. Understanding the specific risks associated with your region will help you determine whether additional coverage is necessary to safeguard your home against potential threats.

Equally important is evaluating the liability protection included in your policy. Liability coverage protects you financially if someone is injured on your property or if you accidentally cause damage to someone else’s property. This aspect of home insurance is often overlooked, yet it can be invaluable in preventing significant financial losses due to legal claims or medical expenses. Ensuring that your policy includes sufficient liability coverage can provide an extra layer of security in case of unforeseen incidents.

While coverage options are a primary concern, the cost of premiums also plays a significant role in selecting the right policy. Insurance providers consider various factors when determining premiums, including the location of your home, its age and condition, security features, and your claims history. To find a policy that offers the best value, it is advisable to obtain quotes from multiple insurers and compare their offerings. Additionally, many insurance companies offer discounts for bundling home and auto insurance, installing security systems, or maintaining a claims-free record. Taking advantage of these discounts can help reduce your overall insurance costs without compromising coverage.

Finally, reviewing the terms and conditions of a policy before making a decision is essential. Understanding the exclusions, deductibles, and claim procedures will prevent any surprises in the event of a loss. Some policies may have limitations on high-value items such as jewelry, electronics, or collectibles, requiring additional coverage for full protection. Carefully reading the fine print and asking questions about any unclear terms will ensure that you select a policy that aligns with your needs.

By taking the time to evaluate your coverage requirements, compare policy options, and understand the details of your insurance plan, you can confidently choose a home insurance policy that provides comprehensive protection. Investing in the right coverage today will ensure that you are prepared for the unexpected, giving you peace of mind knowing that your home and belongings are secure.

Common Home Insurance Myths Debunked: What You Need To Know

Don’t Wait for the Unexpected – Get Home Insurance That Has Your Back

Many homeowners believe they understand the ins and outs of home insurance, but misconceptions about coverage, costs, and claims can lead to costly mistakes. These misunderstandings often result in homeowners being underinsured or assuming they have protection when they do not. To make informed decisions, it is essential to separate fact from fiction and debunk some of the most common home insurance myths.

One widespread misconception is that home insurance covers all types of damage. While policies provide broad protection, they do not cover every possible scenario. Standard policies typically exclude damage caused by floods, earthquakes, and routine wear and tear. Homeowners who assume they are covered for these events may face significant financial burdens when disaster strikes. To ensure adequate protection, it is crucial to review policy details and consider additional coverage for specific risks based on location and individual needs.

Another common myth is that home insurance automatically covers all personal belongings at their full value. While policies do include personal property coverage, there are often limits on high-value items such as jewelry, artwork, and electronics. Homeowners who own expensive possessions should verify their policy’s coverage limits and consider purchasing additional endorsements or riders to fully protect their valuables. Conducting a home inventory and documenting valuable items can also help streamline the claims process in the event of loss or damage.

Many people also believe that home insurance only benefits homeowners, but renters should not overlook the importance of coverage. A landlord’s insurance policy typically covers the structure of the building but does not protect a tenant’s personal belongings. Renters insurance provides coverage for personal property, liability, and additional living expenses if a rental unit becomes uninhabitable due to a covered event. Given its affordability, renters insurance is a wise investment for anyone leasing a home or apartment.

Another frequently misunderstood aspect of home insurance is liability coverage. Some homeowners assume that liability protection only applies to incidents that occur within their home, but in reality, it extends beyond the property. If a homeowner or a family member accidentally causes injury or property damage to someone else, liability coverage can help cover legal fees and medical expenses. This protection is particularly valuable in situations such as dog bites, accidental damage to a neighbor’s property, or injuries that occur away from home.

Additionally, many homeowners mistakenly believe that filing a claim will always lead to a significant increase in premiums. While it is true that multiple claims within a short period can impact rates, not every claim results in higher costs. Insurance providers consider various factors, including the severity of the claim and the homeowner’s claims history. In some cases, policyholders may qualify for discounts or policy adjustments that help mitigate premium increases. Before filing a claim, it is advisable to assess the situation and determine whether the cost of repairs exceeds the deductible.

Understanding the realities of home insurance is essential for making informed decisions and ensuring adequate protection. By debunking these common myths, homeowners and renters can take proactive steps to secure the right coverage for their needs. Reviewing policy details, considering additional coverage options, and staying informed about insurance terms can help prevent costly surprises in the future.