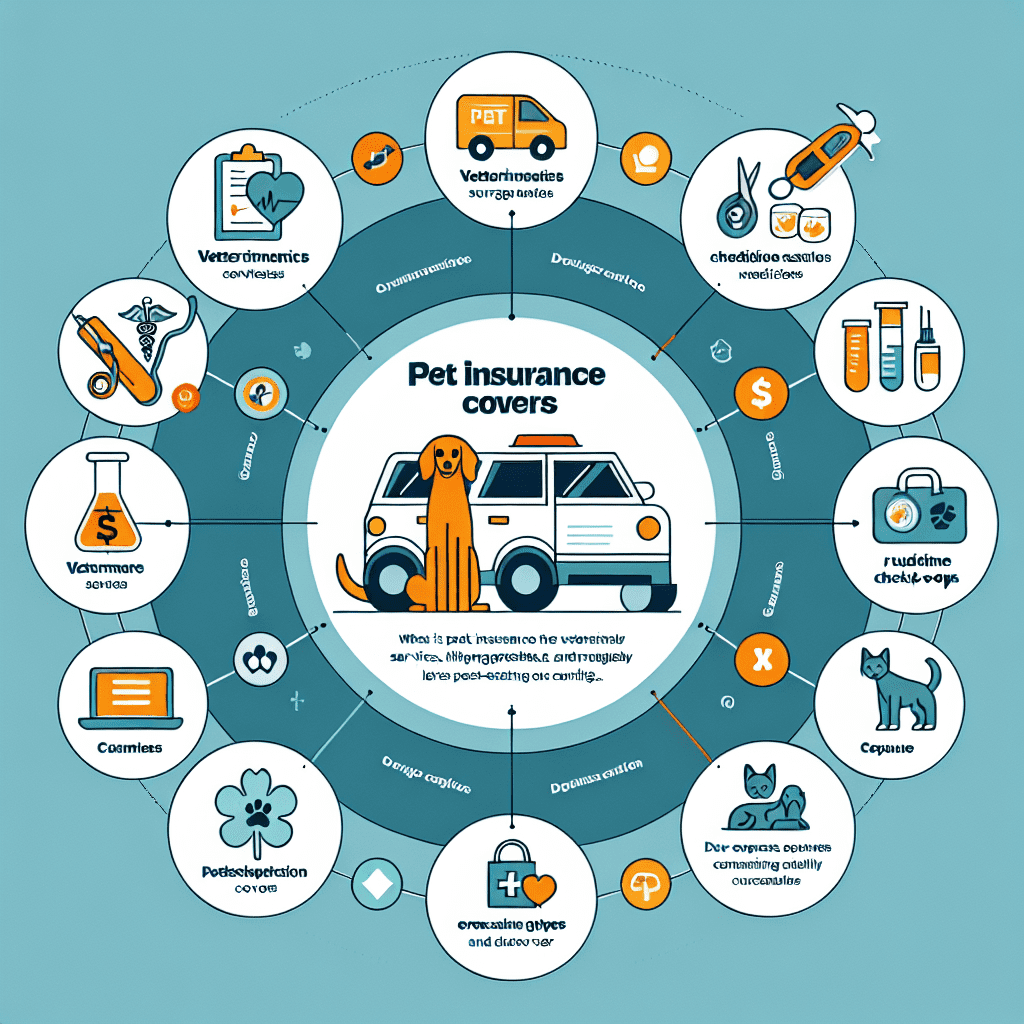

“Pet Insurance Uncovered: What’s Protected, What’s Not!”

Understanding Pet Insurance: What’s Covered and What’s Not

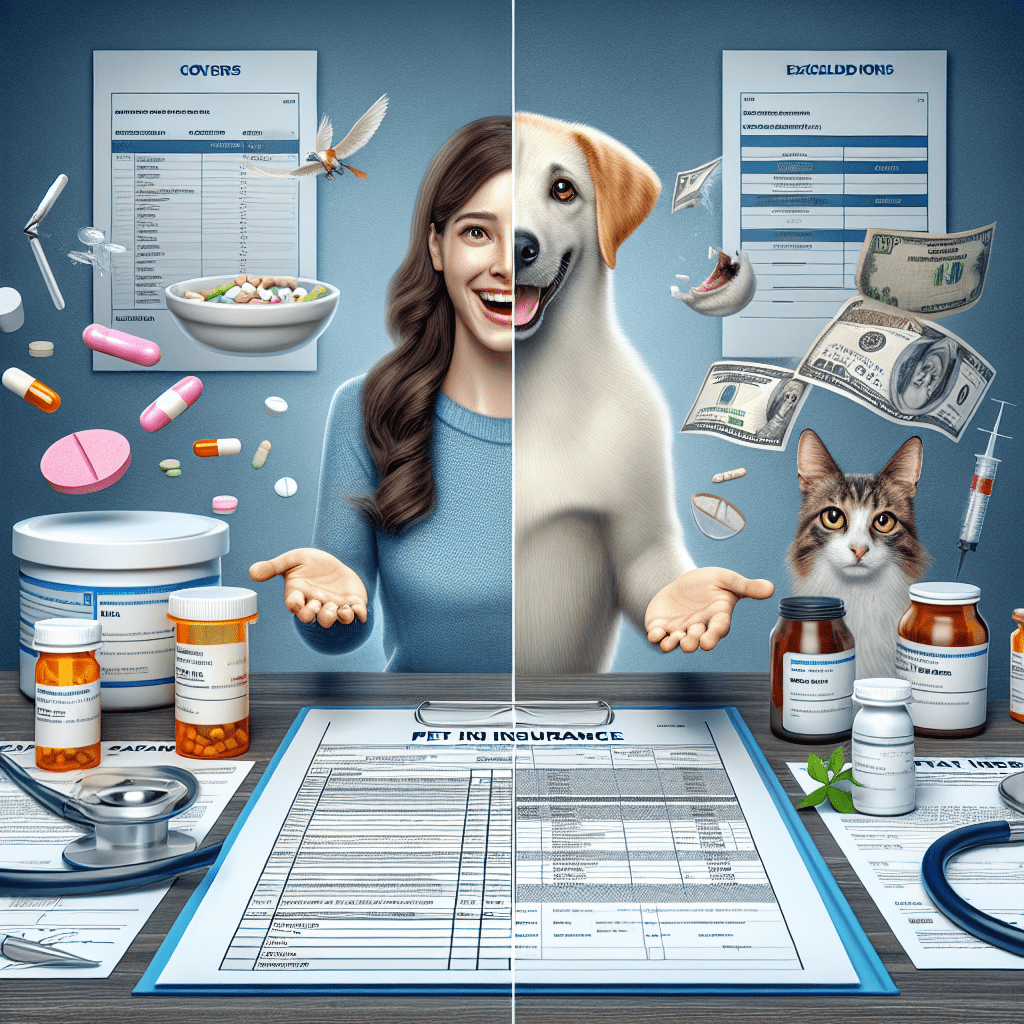

Pet insurance provides financial protection for pet owners by covering a portion of veterinary expenses, ensuring that pets receive necessary medical care without placing an overwhelming financial burden on their owners. However, understanding what pet insurance actually covers—and what it does not—is essential for making informed decisions about a policy. Coverage varies depending on the provider and plan, but most policies include certain fundamental benefits while excluding specific conditions and treatments.

Typically, pet insurance covers accidents and illnesses, which form the core of most policies. Accident coverage includes injuries resulting from unforeseen events such as broken bones, lacerations, or ingestion of foreign objects. Illness coverage, on the other hand, applies to conditions such as infections, digestive issues, and chronic diseases like diabetes or arthritis. Many policies also cover diagnostic tests, hospitalizations, surgeries, and prescription medications necessary for treating covered conditions. Some comprehensive plans extend coverage to hereditary and congenital conditions, which can be particularly beneficial for breeds prone to genetic disorders.

In addition to standard medical expenses, some pet insurance policies offer optional wellness or preventive care coverage. This typically includes routine veterinary visits, vaccinations, flea and tick prevention, dental cleanings, and spaying or neutering procedures. While these services are not included in basic accident and illness plans, adding wellness coverage can help pet owners manage routine healthcare costs more effectively.

Despite the broad range of covered expenses, pet insurance does not cover everything. One of the most significant exclusions is pre-existing conditions, which are any illnesses or injuries that a pet has before the policy takes effect. Even if a condition is undiagnosed at the time of enrollment, insurers may still classify it as pre-existing if symptoms were present before coverage began. Some providers may offer coverage for curable pre-existing conditions after a waiting period, but chronic or recurring conditions are generally excluded.

Another common exclusion is elective procedures, which include cosmetic surgeries such as ear cropping, tail docking, and declawing. These procedures are not considered medically necessary and are therefore not covered by insurance. Similarly, breeding-related expenses, including fertility treatments, pregnancy complications, and cesarean sections, are typically excluded from coverage.

Behavioral treatments and training are also frequently omitted from standard pet insurance policies. While some insurers offer coverage for behavioral therapy if it is prescribed by a veterinarian, many do not include expenses related to training or addressing behavioral issues such as aggression or anxiety. Additionally, alternative therapies, such as acupuncture, chiropractic care, and hydrotherapy, may not be covered unless specifically included in a policy’s terms.

It is also important to note that most pet insurance policies have waiting periods before coverage takes effect. This means that any illnesses or injuries that occur during this period will not be covered. Furthermore, policies often have annual or per-condition limits, meaning that once a certain amount has been reimbursed, the owner is responsible for any additional costs.

Understanding the specifics of pet insurance coverage is crucial for selecting the right policy. By carefully reviewing the terms and exclusions, pet owners can ensure they choose a plan that provides the necessary financial protection while being aware of any out-of-pocket expenses they may still need to cover.

Common Exclusions in Pet Insurance Policies You Should Know

Pet insurance can be a valuable tool for managing the cost of veterinary care, but it is essential to understand that not all expenses are covered. While policies vary by provider, there are common exclusions that pet owners should be aware of before purchasing a plan. Knowing these exclusions can help prevent unexpected financial burdens and ensure that pet owners make informed decisions about their pet’s healthcare.

One of the most common exclusions in pet insurance policies is pre-existing conditions. These are medical issues that a pet has been diagnosed with or has shown symptoms of before the policy’s start date. Insurance providers typically do not cover these conditions, as they are considered known risks. Some companies may differentiate between curable and incurable pre-existing conditions, offering coverage for conditions that have been resolved for a certain period. However, chronic illnesses such as diabetes, cancer, or heart disease that were diagnosed before enrollment are generally not covered.

In addition to pre-existing conditions, hereditary and congenital disorders may also be excluded, depending on the policy. Certain breeds are predisposed to specific health issues, such as hip dysplasia in large dogs or respiratory problems in flat-faced breeds. Some insurers offer coverage for these conditions, but others may exclude them entirely or impose restrictions, such as waiting periods or additional costs. It is crucial for pet owners to review their policy carefully to determine whether breed-specific conditions are covered.

Routine and preventive care, including vaccinations, dental cleanings, and annual check-ups, are often not included in standard pet insurance plans. While these services are essential for maintaining a pet’s health, they are typically considered predictable expenses that pet owners should budget for separately. Some insurers offer wellness plans as an add-on, which can help cover these costs, but they are not included in basic accident and illness policies.

Another common exclusion is elective procedures, which include treatments that are not medically necessary. Cosmetic surgeries such as tail docking, ear cropping, and declawing are generally not covered unless they are required for medical reasons. Similarly, breeding-related expenses, including fertility treatments, pregnancy complications, and cesarean sections, are often excluded from coverage. Pet owners who plan to breed their animals should be aware that most standard policies do not provide financial assistance for these costs.

Behavioral issues and training expenses are also frequently excluded from pet insurance coverage. While some policies may cover treatment for behavioral disorders if they are diagnosed by a veterinarian, general obedience training, aggression management, and anxiety treatments are usually not included. This can be an important consideration for pet owners dealing with behavioral challenges, as professional training and therapy can be costly.

Additionally, alternative and experimental treatments may not be covered under standard policies. While some insurers have started to include coverage for therapies such as acupuncture, chiropractic care, and hydrotherapy, others still consider these treatments elective. Experimental treatments, including clinical trials and investigational drugs, are also typically excluded, as they have not been widely accepted as standard veterinary care.

Understanding these common exclusions can help pet owners set realistic expectations about what their insurance policy will cover. By carefully reviewing the terms and conditions of a policy before purchasing, pet owners can avoid surprises and ensure they choose a plan that best meets their pet’s needs.

Essential Coverage in Pet Insurance: Protecting Your Pet and Your Wallet

Pet insurance provides financial protection for pet owners by covering unexpected veterinary expenses, ensuring that pets receive the necessary medical care without placing a significant financial burden on their owners. Understanding what pet insurance actually covers and what it does not is essential for making an informed decision when selecting a policy. While coverage varies depending on the provider and plan, most policies include essential medical treatments, but they also come with exclusions that pet owners should be aware of before purchasing a plan.

One of the primary components of pet insurance is accident coverage, which typically includes injuries resulting from incidents such as broken bones, bite wounds, or ingestion of foreign objects. These situations often require immediate medical attention, diagnostic tests, and sometimes surgery, all of which can be costly. By covering these expenses, pet insurance helps ensure that pets receive prompt and necessary treatment without financial constraints delaying their care. Additionally, many policies include coverage for illnesses, ranging from minor infections to more serious conditions such as cancer, diabetes, or kidney disease. This aspect of coverage is particularly valuable, as chronic illnesses often require ongoing treatment, medication, and regular veterinary visits, which can accumulate significant costs over time.

Beyond accidents and illnesses, some pet insurance plans offer coverage for hereditary and congenital conditions, which are medical issues that pets may inherit or be born with. These conditions, such as hip dysplasia in certain dog breeds or heart defects in cats, can lead to long-term health complications and require specialized treatment. However, not all policies automatically include this coverage, and some may impose restrictions based on the pet’s breed or age. Therefore, it is crucial for pet owners to carefully review policy details to ensure that hereditary conditions are covered if their pet is at risk.

Another important aspect of pet insurance is coverage for diagnostic tests, hospitalization, and surgery. Veterinary care has advanced significantly, and diagnostic tools such as X-rays, MRIs, and blood tests are often necessary to accurately diagnose and treat medical conditions. Hospitalization and surgical procedures can be particularly expensive, making insurance coverage for these services highly beneficial. Some policies also include prescription medications, which are often required for treating infections, pain management, or chronic conditions.

While pet insurance provides extensive coverage for many medical expenses, there are notable exclusions that pet owners should consider. Pre-existing conditions, which refer to any illness or injury that a pet has before the policy takes effect, are generally not covered. This means that if a pet has been diagnosed with a condition before obtaining insurance, any related treatments will not be reimbursed. Additionally, routine and preventive care, such as vaccinations, dental cleanings, and annual check-ups, are typically not included in standard policies unless the owner opts for an additional wellness plan.

Furthermore, elective procedures, such as cosmetic surgeries or tail docking, are not covered by pet insurance. Behavioral treatments, including training for aggression or anxiety, are also commonly excluded. Understanding these limitations is essential for pet owners to avoid unexpected out-of-pocket expenses. By carefully reviewing policy details and selecting a plan that aligns with their pet’s needs, owners can ensure they have the right coverage to protect both their pet’s health and their financial well-being.