“Bankrupt Business? Know Your Refund Rights Before It’s Too Late!”

Understanding Bankruptcy: What Happens to Customer Refunds?

When a business goes bankrupt, customers who have made purchases but have not yet received their products or services may find themselves in a difficult situation. Bankruptcy is a legal process that allows businesses to either restructure their debts or liquidate their assets to pay creditors. However, when a company enters bankruptcy, customers seeking refunds may face challenges in recovering their money. Understanding how bankruptcy affects customer refunds can help individuals navigate this complex situation and determine their options.

When a company files for bankruptcy, it typically does so under either Chapter 7 or Chapter 11 of the U.S. Bankruptcy Code. Chapter 7 bankruptcy involves the liquidation of the company’s assets, meaning the business ceases operations, and its assets are sold to pay off creditors. In contrast, Chapter 11 bankruptcy allows a company to restructure its debts and continue operating while working on a repayment plan. The type of bankruptcy filed can significantly impact whether customers receive refunds.

In a Chapter 7 bankruptcy, the company’s assets are distributed according to a specific order of priority. Secured creditors, such as banks or lenders with collateral, are paid first. Next in line are unsecured creditors, including suppliers, employees, and government agencies owed taxes. Customers who are owed refunds are generally considered unsecured creditors, placing them lower in priority. As a result, they may only receive a portion of their refund, if anything at all, depending on the remaining assets after higher-priority creditors have been paid.

On the other hand, if a company files for Chapter 11 bankruptcy, it may continue operating while restructuring its debts. In this case, customers may still have a chance to receive their refunds if the company remains solvent and includes customer claims in its repayment plan. However, the process can take time, and there is no guarantee that all refunds will be honored. Customers may need to file a claim with the bankruptcy court to be considered for repayment.

For those who have paid for goods or services with a credit card, there may be an alternative way to recover their money. Many credit card companies offer chargeback protections, allowing customers to dispute a charge if they do not receive the product or service they paid for. If a business declares bankruptcy before fulfilling an order, customers can contact their credit card issuer to request a chargeback. This process can be more effective than waiting for bankruptcy proceedings to conclude, as it provides a direct path to reimbursement.

Similarly, customers who have made purchases through third-party payment services, such as PayPal, may have buyer protection policies that allow them to request a refund. These policies vary by provider, so it is important to review the terms and conditions to determine eligibility. Additionally, if a customer has purchased an item from a retailer that later goes bankrupt, they may be able to seek a refund through the manufacturer or another authorized seller.

In cases where a business has declared bankruptcy and customers are unable to recover their money through other means, they may need to file a claim with the bankruptcy court. This involves submitting a proof of claim form, detailing the amount owed and the reason for the claim. While this does not guarantee repayment, it ensures that the customer’s claim is officially recorded in the bankruptcy proceedings. However, given the priority structure of bankruptcy payments, customers should be prepared for the possibility that they may not receive a full refund.

Ultimately, when a business goes bankrupt, customers seeking refunds may face significant challenges. The type of bankruptcy filed, the company’s remaining assets, and the priority of creditors all play a role in determining whether refunds will be issued. While credit card chargebacks and third-party payment protections can provide alternative avenues for reimbursement, customers should act quickly to explore their options. Understanding the bankruptcy process and knowing the available remedies can help individuals make informed decisions and improve their chances of recovering their money.

Steps to Take If a Business Declares Bankruptcy and Owes You a Refund

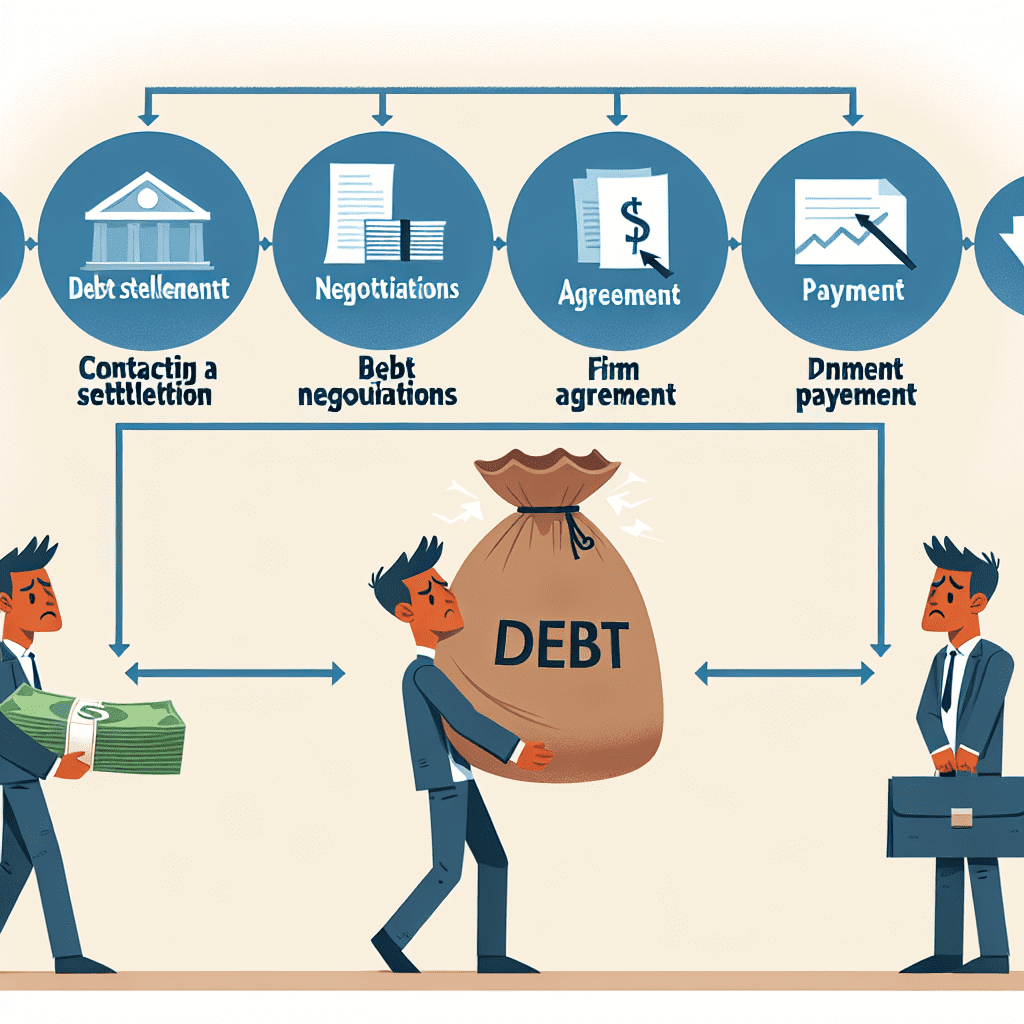

When a business declares bankruptcy and owes you a refund, it can be a frustrating and uncertain situation. However, understanding the steps you can take to recover your money can help you navigate the process more effectively. The first step is to determine the type of bankruptcy the business has filed. In the United States, businesses typically file for either Chapter 7 or Chapter 11 bankruptcy. Chapter 7 involves liquidation, meaning the company ceases operations and its assets are sold to pay creditors. Chapter 11, on the other hand, allows the business to restructure and continue operating while repaying debts over time. The type of bankruptcy will influence your chances of receiving a refund.

Once you confirm the bankruptcy filing, you should check whether you are listed as a creditor. In many cases, customers who are owed refunds are considered unsecured creditors, meaning they are lower in priority compared to secured creditors, such as banks or lenders with collateral. To verify your status, you can review the bankruptcy filing, which is typically available through the U.S. Bankruptcy Court system. If you are not listed, you may need to file a proof of claim with the court to formally request repayment. This document provides details about the amount you are owed and the reason for the claim.

After filing a proof of claim, it is important to understand that refunds are not guaranteed. In a Chapter 7 bankruptcy, the company’s assets are distributed based on a legal priority system, with secured creditors and administrative expenses being paid first. If any funds remain after these obligations are met, unsecured creditors, including customers, may receive a portion of what they are owed. However, in many cases, there are insufficient funds to cover all claims, meaning customers may receive only partial refunds or nothing at all. In a Chapter 11 bankruptcy, the business may continue operating and could eventually issue refunds as part of its reorganization plan, but this process can take months or even years.

While waiting for the bankruptcy proceedings to unfold, you may want to explore alternative options for recovering your money. If you paid for the purchase using a credit card, you can contact your credit card issuer to request a chargeback. Many credit card companies offer consumer protection policies that allow you to dispute charges for goods or services that were not delivered. Similarly, if you used a payment service such as PayPal, you may be able to file a dispute through their resolution process. These options can sometimes provide a quicker resolution than waiting for the bankruptcy court’s decision.

Additionally, if the business was part of a larger corporation or had a parent company, you may want to investigate whether another entity is responsible for honoring refunds. Some businesses have subsidiaries that file for bankruptcy while the parent company remains solvent. In such cases, reaching out to the parent company’s customer service or legal department may yield better results.

Finally, staying informed about the bankruptcy proceedings is crucial. Courts often provide updates on the status of claims, and creditors may receive notices regarding hearings or settlement distributions. Monitoring these updates can help you understand your chances of receiving a refund and whether any further action is required on your part. While the process can be complex and time-consuming, taking these steps can improve your chances of recovering your money.

Legal Rights and Options for Consumers Seeking Refunds from Bankrupt Businesses

When a business declares bankruptcy, consumers who have paid for goods or services but have not yet received them may find themselves in a difficult position. Understanding the legal rights and options available in such situations is essential for those seeking refunds. Bankruptcy proceedings are complex, and the ability to recover funds depends on several factors, including the type of bankruptcy filed, the status of the consumer’s claim, and the availability of assets to repay creditors.

Businesses typically file for bankruptcy under either Chapter 7 or Chapter 11 of the U.S. Bankruptcy Code. Chapter 7 involves liquidation, where the company ceases operations, and its assets are sold to pay creditors. In contrast, Chapter 11 allows a business to restructure its debts while continuing to operate. The type of bankruptcy significantly impacts consumers’ chances of obtaining a refund. In a Chapter 7 case, once the company’s assets are liquidated, secured creditors—such as banks and lenders with collateral—are paid first. Unsecured creditors, including customers with outstanding refunds, are often last in line and may receive only a fraction of what they are owed, if anything. In a Chapter 11 case, the business may continue fulfilling orders or issuing refunds as part of its reorganization plan, but this is not guaranteed.

Consumers seeking refunds must take specific steps to assert their claims. When a company files for bankruptcy, the court appoints a trustee to oversee the process. The trustee notifies creditors, including customers, about the bankruptcy filing and provides instructions on how to submit a claim. Consumers must file a proof of claim with the bankruptcy court by the deadline specified in the notice. This document outlines the amount owed and the reason for the claim. However, even if a claim is filed, there is no certainty that the consumer will receive a refund, as payments depend on the availability of funds after higher-priority creditors are paid.

In some cases, consumers may have alternative options for recovering their money. If a purchase was made using a credit card, the card issuer may offer chargeback protections. Many credit card companies allow customers to dispute charges for goods or services not received, potentially resulting in a refund. Similarly, if the purchase was made through a third-party payment service, such as PayPal, the service’s buyer protection policies may provide recourse. Consumers should contact their payment provider as soon as they become aware of the bankruptcy to determine whether a chargeback or dispute is possible.

Another potential avenue for recovery is through warranties or insurance policies. If the product or service was covered by a third-party warranty or insurance, consumers may be able to file a claim under those terms. Additionally, state consumer protection laws may offer some remedies, particularly if the business engaged in deceptive practices before filing for bankruptcy. Consumers can check with their state attorney general’s office or consumer protection agency to explore any available legal options.

While bankruptcy can complicate the refund process, staying informed and taking prompt action can improve the chances of recovering funds. By understanding their rights, filing claims on time, and exploring alternative refund options, consumers can navigate the challenges posed by a business’s financial collapse more effectively.