“Breaking Big Tech: Can Antitrust Laws Tame the Titans or Fall Short?”

The Power Struggle: How Anti-Trust Laws Could Dismantle Big Tech Giants

The increasing dominance of major technology companies has sparked intense debate over whether existing anti-trust laws are sufficient to regulate their influence. Governments and regulatory bodies worldwide have scrutinized the market power of companies such as Amazon, Google, Apple, and Meta, raising concerns about monopolistic practices, data privacy, and market competition. As these corporations continue to expand their reach across multiple industries, the question remains whether anti-trust laws can effectively dismantle their dominance or if legal and structural challenges will prevent meaningful action.

Historically, anti-trust laws have been used to break up monopolies that stifled competition and harmed consumers. The Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of the same year were designed to prevent anti-competitive behavior and promote fair market conditions. These laws have been successfully applied in cases such as the breakup of Standard Oil in 1911 and AT&T in 1982. However, applying these principles to modern technology companies presents unique challenges, as their business models differ significantly from traditional monopolies.

One of the primary difficulties in regulating Big Tech lies in defining the nature of their monopolistic power. Unlike past monopolies that controlled tangible goods, technology giants dominate through data collection, digital ecosystems, and network effects. For instance, Google’s search engine commands an overwhelming market share, not because of direct consumer payments but due to its ability to collect vast amounts of user data and leverage it for targeted advertising. Similarly, Amazon’s dominance in e-commerce is reinforced by its control over logistics, cloud computing, and third-party seller data. These factors make it difficult to apply traditional anti-trust frameworks, which often focus on pricing and direct consumer harm.

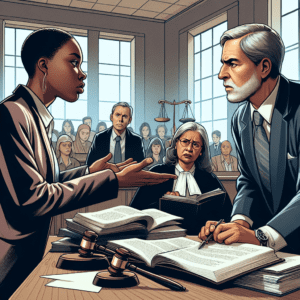

Despite these challenges, regulators have taken steps to curb the power of Big Tech. The European Union has been at the forefront of imposing fines and regulations, such as the General Data Protection Regulation (GDPR) and the Digital Markets Act, aimed at increasing competition and limiting data exploitation. In the United States, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) have launched investigations and lawsuits against major tech firms, accusing them of anti-competitive behavior. For example, the DOJ’s lawsuit against Google alleges that the company has unlawfully maintained its search engine monopoly through exclusive agreements with device manufacturers and browsers. Similarly, the FTC has pursued legal action against Meta, arguing that its acquisitions of Instagram and WhatsApp were designed to eliminate competition.

However, breaking up these companies is easier said than done. Legal battles can take years, and technology firms have vast financial resources to challenge regulatory actions. Additionally, the complexity of their business structures makes it difficult to determine how a breakup would be implemented without unintended consequences. Critics argue that even if a company like Meta were forced to divest Instagram and WhatsApp, the core issue of data dominance would remain unresolved. Furthermore, some experts warn that excessive regulation could stifle innovation and harm consumers by disrupting services they rely on daily.

Ultimately, while anti-trust laws provide a framework for addressing monopolistic behavior, their effectiveness in dismantling Big Tech remains uncertain. The evolving nature of digital markets requires a reassessment of regulatory approaches to ensure fair competition without hindering technological progress. Whether these efforts succeed or fail will depend on the ability of lawmakers and regulators to adapt to the complexities of the modern digital economy.

Legal Loopholes: Why Anti-Trust Efforts Might Fail Against Big Tech

Anti-trust laws have long been a tool for governments to regulate market competition and prevent monopolistic practices. In recent years, as technology giants have grown in influence and market dominance, regulators have increasingly scrutinized their business practices. Companies such as Google, Amazon, Apple, and Meta have faced legal challenges aimed at curbing their power, with some policymakers advocating for their breakup. However, despite these efforts, significant legal and structural obstacles may prevent anti-trust laws from effectively dismantling these corporations.

One of the primary challenges in applying anti-trust laws to Big Tech lies in the interpretation of market dominance. Traditional anti-trust cases have focused on price manipulation and consumer harm, but many technology companies offer free services, making it difficult to prove direct financial harm to consumers. Courts often require clear evidence that a company’s actions have led to reduced competition or consumer choice, yet the digital economy operates under different principles than traditional markets. For instance, network effects—where a platform becomes more valuable as more users join—can create natural monopolies that are not easily addressed by existing legal frameworks.

Moreover, Big Tech firms have developed complex corporate structures that make regulatory intervention challenging. Many of these companies operate through a web of subsidiaries, acquisitions, and partnerships that blur the lines of market control. When regulators attempt to break up these firms, they must first establish which specific business practices constitute anti-competitive behavior. However, technology companies often argue that their acquisitions and integrations benefit consumers by improving efficiency and innovation. This argument has historically been persuasive in court, making it difficult for regulators to justify forced divestitures.

Another significant hurdle is the slow pace of legal proceedings compared to the rapid evolution of technology markets. Anti-trust cases can take years, if not decades, to resolve, by which time the market landscape may have shifted dramatically. For example, by the time a court rules on a case against a dominant platform, new competitors or technologies may have already emerged, rendering the original complaint less relevant. This lag in enforcement allows Big Tech firms to continue expanding their influence while legal battles remain unresolved.

Additionally, lobbying efforts and political influence play a crucial role in shaping anti-trust enforcement. Technology companies invest heavily in lobbying and legal defense, often securing favorable regulatory outcomes. Policymakers may also be reluctant to take aggressive action against these firms due to their economic contributions, including job creation and technological advancements. As a result, even when anti-trust cases are pursued, they may lead to settlements or minor regulatory adjustments rather than structural breakups.

Despite these challenges, some regulators remain committed to curbing Big Tech’s power through legislative reforms. Proposals such as stricter merger guidelines, increased transparency requirements, and enhanced enforcement mechanisms aim to close existing legal loopholes. However, the effectiveness of these measures remains uncertain, as companies continue to adapt their business models to navigate regulatory constraints.

Ultimately, while anti-trust laws provide a framework for addressing monopolistic behavior, their application to Big Tech remains fraught with legal, structural, and political complexities. Unless significant reforms are implemented, efforts to break up these corporations may face continued resistance, raising questions about the future of competition in the digital economy.

Breaking Up or Breaking Down? The Uncertain Future of Big Tech Under Anti-Trust Scrutiny

The growing dominance of major technology companies has sparked intense debate over whether existing anti-trust laws are sufficient to regulate their influence. Governments and regulatory bodies worldwide have scrutinized companies such as Amazon, Google, Apple, and Meta, arguing that their market power stifles competition, limits consumer choice, and undermines innovation. In response, lawmakers have proposed using anti-trust laws to break up these corporations or impose stricter regulations to curb their influence. However, the effectiveness of such measures remains uncertain, as legal, economic, and political challenges complicate efforts to rein in Big Tech.

One of the primary arguments in favor of breaking up large technology firms is that their dominance creates monopolistic conditions that harm both consumers and smaller competitors. Critics argue that these companies engage in anti-competitive practices, such as self-preferencing their own products, acquiring potential rivals before they can become threats, and leveraging vast amounts of user data to maintain their market position. By dismantling these firms into smaller, independent entities, regulators hope to restore competition and create a more level playing field. Proponents of this approach point to historical precedents, such as the breakup of Standard Oil in 1911 and AT&T in 1984, as evidence that anti-trust action can successfully dismantle monopolies and foster a more competitive market.

However, applying traditional anti-trust principles to modern technology companies presents significant challenges. Unlike past monopolies that controlled tangible goods or infrastructure, Big Tech firms operate in digital markets where network effects play a crucial role. The more users a platform attracts, the more valuable it becomes, making it difficult for new entrants to compete. Additionally, many of these companies offer services that are free to consumers, complicating the argument that their dominance leads to higher prices or direct financial harm. Courts and regulators must therefore adapt existing legal frameworks to address the unique characteristics of digital markets, a task that has proven to be both complex and contentious.

Moreover, even if regulators succeed in breaking up these companies, there is no guarantee that doing so will achieve the desired outcomes. Some experts argue that splitting up large firms could lead to unintended consequences, such as reduced efficiency, weakened global competitiveness, and fragmented services that ultimately harm consumers. For instance, separating Google’s search engine from its advertising business might disrupt the company’s ability to provide free services while failing to create viable competitors. Similarly, breaking up Amazon’s retail and cloud computing divisions could weaken its logistical capabilities without necessarily benefiting smaller retailers. These concerns raise questions about whether structural remedies are the best approach or if alternative regulatory measures, such as stricter oversight and targeted restrictions, would be more effective.

Political and legal obstacles further complicate efforts to regulate Big Tech. In the United States, anti-trust cases often take years to litigate, and companies have the resources to mount extensive legal defenses. Additionally, political divisions influence the direction of regulatory efforts, with some policymakers advocating for aggressive action while others warn against government overreach. Meanwhile, in Europe, regulators have taken a more proactive stance, imposing hefty fines and introducing new legislation aimed at curbing Big Tech’s power. However, enforcement remains a challenge, as companies continue to find ways to adapt and maintain their dominance.

Ultimately, the future of Big Tech under anti-trust scrutiny remains uncertain. While there is growing momentum for regulatory action, the complexities of digital markets, legal hurdles, and potential unintended consequences make it unclear whether breaking up these companies will achieve the intended goals. As governments and regulators continue to grapple with these challenges, the debate over how best to address Big Tech’s influence is likely to persist, shaping the future of the digital economy for years to come.