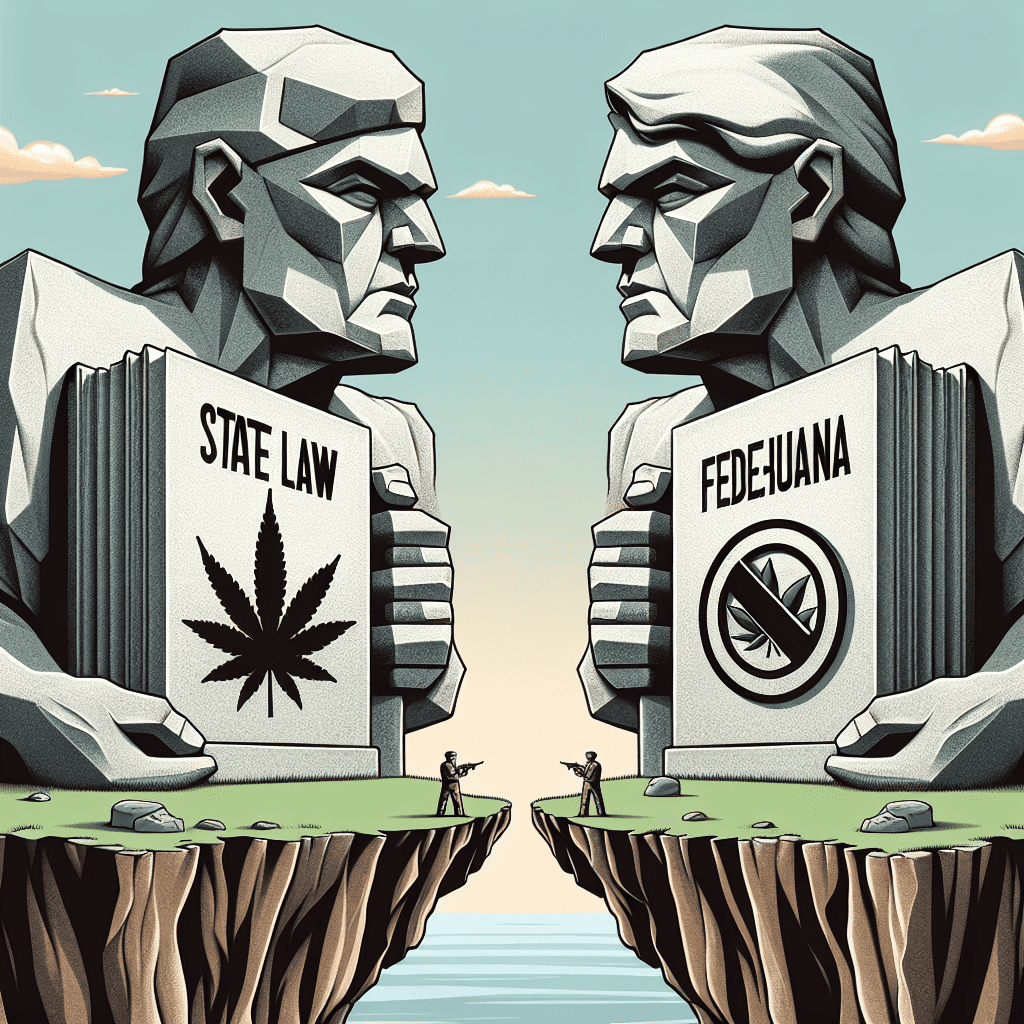

“State vs. Federal Laws: A Tug-of-War Over Marijuana Legalization.”

Conflict Between State and Federal Laws on Marijuana Legalization

The conflict between state and federal laws on marijuana legalization has been a persistent issue in the United States, creating legal uncertainty for individuals, businesses, and law enforcement agencies. While an increasing number of states have moved to legalize marijuana for medical and recreational use, federal law continues to classify it as a Schedule I controlled substance under the Controlled Substances Act (CSA). This classification places marijuana in the same category as heroin and LSD, indicating that the federal government considers it to have a high potential for abuse and no accepted medical use. As a result, the divergence between state and federal policies has led to a complex legal landscape that affects various aspects of governance, commerce, and criminal justice.

One of the most significant consequences of this legal conflict is the uncertainty it creates for businesses operating in the cannabis industry. In states where marijuana is legal, dispensaries and growers must navigate a challenging regulatory environment in which they are permitted to operate under state law but remain in violation of federal law. This contradiction has far-reaching implications, particularly in areas such as banking and taxation. Because federal law prohibits financial institutions from handling proceeds related to illegal drug sales, many banks refuse to provide services to cannabis businesses, forcing them to operate primarily in cash. This not only increases security risks but also complicates tax compliance and financial management. Additionally, under Section 280E of the Internal Revenue Code, businesses that engage in the sale of controlled substances prohibited by federal law are unable to deduct ordinary business expenses, leading to significantly higher tax burdens for cannabis companies compared to other legal businesses.

Beyond the economic challenges, the legal conflict also affects law enforcement and the criminal justice system. While state and local authorities generally follow their own laws regarding marijuana enforcement, federal agencies retain the power to intervene. Although federal enforcement has been inconsistent, with some administrations adopting a more lenient approach and others taking a stricter stance, the potential for federal prosecution remains a concern. This uncertainty can create difficulties for individuals who use marijuana legally under state law but may still face consequences in certain situations, such as federal employment, immigration proceedings, or firearm ownership. Furthermore, the disparity between state and federal laws has led to legal disputes over issues such as interstate commerce, as businesses seek to transport cannabis products across state lines, which remains illegal under federal law.

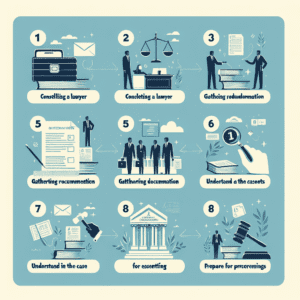

The conflict between state and federal marijuana laws also raises broader constitutional and policy questions. Under the U.S. Constitution’s Supremacy Clause, federal law generally takes precedence over state law when the two are in direct conflict. However, the federal government has largely allowed states to implement their own marijuana policies without direct intervention, leading to a de facto system of state-level legalization despite federal prohibition. This situation has prompted ongoing debates about the appropriate balance of power between state and federal governments, as well as discussions about potential legislative solutions. Some lawmakers have proposed reforms such as the SAFE Banking Act, which would provide financial protections for cannabis businesses, or the MORE Act, which seeks to remove marijuana from the list of controlled substances entirely. Until comprehensive federal reform is enacted, however, the legal uncertainty surrounding marijuana legalization is likely to persist, continuing to create challenges for businesses, law enforcement, and policymakers alike.

The Impact of Federal Prohibition on State-Regulated Cannabis Markets

The ongoing conflict between state and federal laws regarding marijuana legalization has created significant challenges for state-regulated cannabis markets. While many states have moved forward with legalizing marijuana for medical and recreational use, federal law continues to classify cannabis as a Schedule I controlled substance under the Controlled Substances Act. This fundamental contradiction has led to a complex legal landscape in which state-licensed businesses operate in a gray area, facing numerous regulatory and financial obstacles despite being fully compliant with state laws.

One of the most significant consequences of federal prohibition is the difficulty cannabis businesses face in accessing banking services. Because financial institutions are federally regulated, banks and credit unions risk legal repercussions if they provide services to marijuana-related businesses. As a result, many cannabis businesses are forced to operate on a cash-only basis, which not only creates security risks but also complicates tax compliance and financial management. Although some financial institutions have cautiously begun working with cannabis businesses in states where marijuana is legal, the lack of clear federal guidance continues to deter most banks from offering their services.

In addition to banking restrictions, federal prohibition also affects taxation policies for cannabis businesses. Under Section 280E of the Internal Revenue Code, businesses that engage in the sale of controlled substances prohibited under federal law are not allowed to deduct ordinary business expenses, such as rent, payroll, and marketing costs. This results in an unusually high tax burden for state-licensed cannabis businesses, making it difficult for them to remain profitable. While some states have implemented tax policies to offset this financial strain, the inability to claim standard deductions remains a significant disadvantage for the industry.

Furthermore, the conflict between state and federal laws has implications for interstate commerce. Because marijuana remains illegal at the federal level, transporting cannabis across state lines is prohibited, even between two states where it is legal. This restriction prevents businesses from taking advantage of economies of scale and creates inefficiencies in supply chains. For example, states with surplus cannabis production cannot legally export their products to states with high demand, leading to market imbalances and price fluctuations. The inability to engage in interstate commerce also limits opportunities for industry growth and innovation, as businesses are confined to operating within state borders.

Another major challenge posed by federal prohibition is the uncertainty surrounding law enforcement and regulatory oversight. While the federal government has largely taken a hands-off approach in states that have legalized marijuana, there is always the risk that federal agencies could choose to enforce prohibition more aggressively. This uncertainty makes it difficult for businesses and investors to plan for the future, as changes in federal policy could have significant consequences for the industry. Additionally, the lack of federal regulation means that each state must develop its own rules and standards for cannabis production, testing, and distribution, leading to inconsistencies across the country.

Despite these challenges, the growing number of states legalizing marijuana suggests that federal reform may eventually be necessary to resolve these conflicts. Until then, state-regulated cannabis markets will continue to navigate the complexities of operating within a legal framework that remains at odds with federal law.

Legal Challenges Faced by Businesses Operating in Legalized Marijuana States

Operating a business in the legalized marijuana industry presents a unique set of legal challenges, particularly due to the ongoing conflict between state and federal laws. While many states have moved to legalize marijuana for medical and recreational use, the federal government continues to classify it as a Schedule I controlled substance under the Controlled Substances Act. This fundamental legal discrepancy creates significant obstacles for businesses attempting to navigate the industry, as they must comply with state regulations while also considering the potential risks associated with federal enforcement. As a result, businesses in this sector face uncertainty in areas such as banking, taxation, and interstate commerce, all of which are critical to their long-term viability.

One of the most pressing challenges stems from the inability of marijuana-related businesses to access traditional banking services. Because federal law still prohibits marijuana, financial institutions that provide services to cannabis businesses risk being charged with money laundering or other federal offenses. Consequently, many banks refuse to work with these businesses, forcing them to operate primarily in cash. This not only creates logistical difficulties in managing payroll, taxes, and expenses but also increases security risks, making businesses more vulnerable to theft and fraud. Although some financial institutions have begun offering limited services under strict compliance guidelines, the lack of comprehensive banking solutions remains a significant hurdle for the industry.

In addition to banking restrictions, marijuana businesses also face unique tax burdens due to federal law. Under Section 280E of the Internal Revenue Code, businesses that are involved in the trafficking of controlled substances, including marijuana, are prohibited from deducting ordinary business expenses. This means that while other businesses can deduct costs such as rent, employee salaries, and marketing expenses, cannabis businesses are unable to do so, resulting in significantly higher tax liabilities. This financial strain makes it difficult for small and medium-sized businesses to remain profitable, further complicating their ability to compete in an already challenging market.

Beyond financial concerns, the conflict between state and federal laws also affects the ability of marijuana businesses to engage in interstate commerce. Since federal law prohibits the transportation of marijuana across state lines, businesses are restricted to operating within the boundaries of the state in which they are licensed. This limitation prevents companies from expanding into new markets or taking advantage of economies of scale, which are essential for growth in other industries. Additionally, it creates supply chain inefficiencies, as businesses must source all materials and products from within their own state, often at higher costs.

Moreover, the legal uncertainty surrounding marijuana at the federal level leaves businesses vulnerable to potential enforcement actions. While federal agencies have largely taken a hands-off approach in states where marijuana is legal, there is no guarantee that this policy will remain in place. Changes in federal administration or shifts in enforcement priorities could result in crackdowns on businesses that are otherwise operating legally under state law. This unpredictability makes long-term planning difficult and discourages investment in the industry, as businesses and investors remain wary of potential legal repercussions.

Despite these challenges, the marijuana industry continues to grow, with increasing public support for legalization and ongoing efforts to reform federal laws. Some legislative proposals, such as the SAFE Banking Act, aim to provide financial protections for cannabis businesses, while others seek to remove marijuana from the list of controlled substances altogether. Until comprehensive federal reform is achieved, however, businesses operating in legalized marijuana states must continue to navigate the complex and often contradictory legal landscape, balancing compliance with state regulations while mitigating the risks posed by federal prohibition.