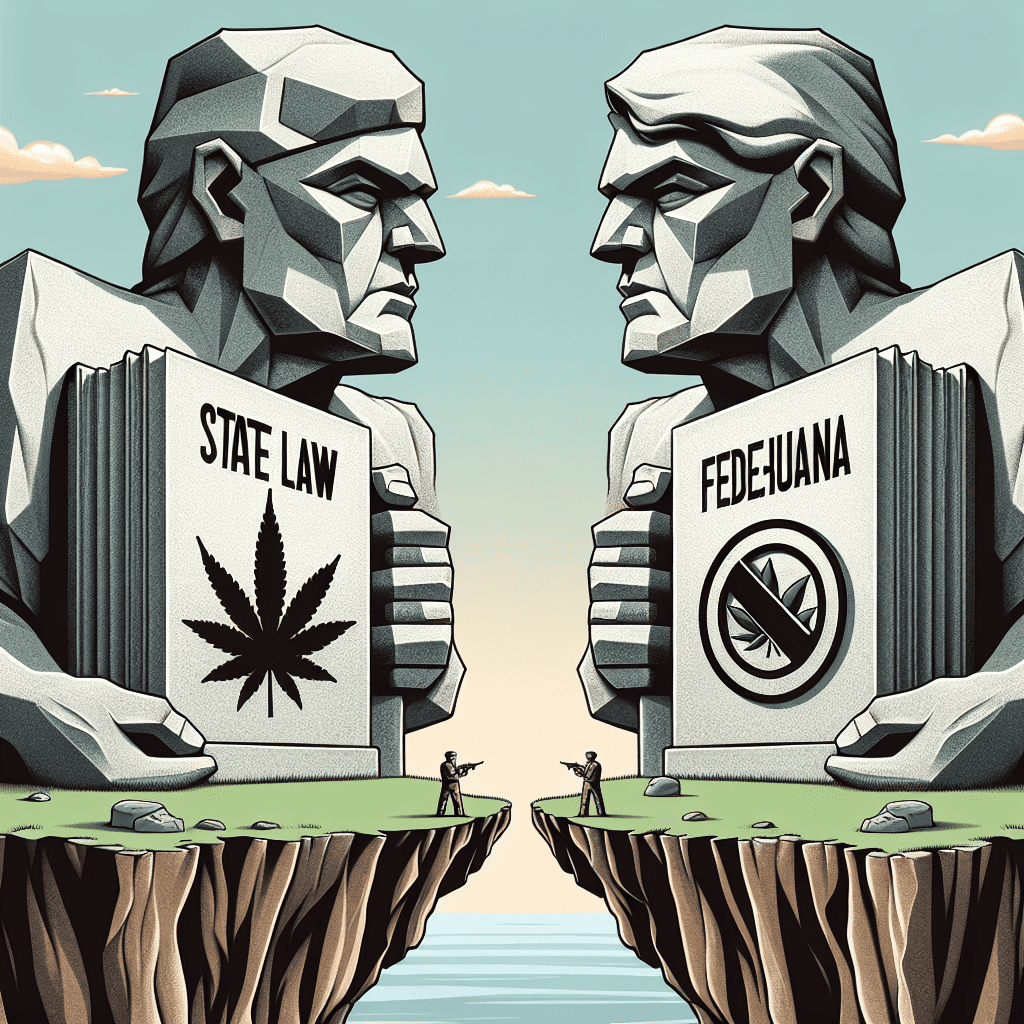

“State vs. Federal Laws: A Tug-of-War Over Marijuana Legalization.”

Conflict Between State and Federal Laws on Marijuana Legalization

The conflict between state and federal laws on marijuana legalization has been a persistent issue in the United States, creating legal uncertainty for individuals, businesses, and law enforcement agencies. While an increasing number of states have moved to legalize marijuana for medical and recreational use, federal law continues to classify it as a Schedule I controlled substance under the Controlled Substances Act (CSA). This fundamental contradiction has led to a complex legal landscape in which state-licensed marijuana businesses operate in direct violation of federal law, raising significant legal and regulatory challenges.

One of the primary sources of conflict stems from the Supremacy Clause of the U.S. Constitution, which establishes that federal law takes precedence over state law when the two are in direct conflict. Under this principle, the federal government has the authority to enforce its prohibition on marijuana, even in states that have legalized its use. However, in practice, federal enforcement has been inconsistent, with different administrations adopting varying approaches to marijuana policy. For example, during the Obama administration, the Department of Justice issued the Cole Memorandum, which advised federal prosecutors to deprioritize enforcement against state-legal marijuana businesses as long as they complied with state regulations. This policy provided a degree of protection for the industry, but it was later rescinded under the Trump administration, creating renewed uncertainty.

Despite federal prohibition, states have continued to expand marijuana legalization, citing economic benefits, criminal justice reform, and public health considerations. Legal cannabis markets generate significant tax revenue, create jobs, and reduce the burden on law enforcement by eliminating the need to prosecute low-level marijuana offenses. Additionally, many states argue that legalization allows for better regulation and quality control, reducing the risks associated with the illicit market. However, the ongoing federal prohibition presents numerous challenges for businesses operating in the cannabis industry. For instance, because marijuana remains illegal under federal law, cannabis businesses are often unable to access traditional banking services, forcing them to operate primarily in cash. This not only creates security risks but also complicates tax compliance and financial management.

Another major issue arising from the conflict between state and federal laws is the impact on individuals who use marijuana legally under state law but may still face federal consequences. For example, federal employees and military personnel are subject to federal drug policies, meaning they can be penalized or even terminated for using marijuana, even if they reside in a state where it is legal. Similarly, individuals applying for federal benefits, such as housing assistance or immigration status, may face disqualification if they admit to marijuana use. These inconsistencies highlight the broader implications of the legal divide and the challenges of navigating a system where state and federal laws are at odds.

As the debate over marijuana legalization continues, there have been increasing calls for federal reform to resolve these conflicts. Some lawmakers have proposed legislation to remove marijuana from the list of controlled substances or to allow states greater autonomy in setting their own policies without federal interference. While progress has been made in terms of public opinion and legislative efforts, the issue remains unresolved, leaving businesses, consumers, and law enforcement in a state of legal uncertainty. Until federal and state laws are aligned, the tension between the two will persist, shaping the future of marijuana policy in the United States.

The Impact of Federal Prohibition on State-Regulated Cannabis Markets

The ongoing conflict between state and federal laws regarding marijuana legalization has created a complex legal landscape, particularly for state-regulated cannabis markets. While an increasing number of states have moved to legalize marijuana for medical and recreational use, federal law continues to classify cannabis as a Schedule I controlled substance under the Controlled Substances Act. This fundamental contradiction has led to significant challenges for businesses, consumers, and policymakers attempting to navigate the regulatory environment.

One of the most immediate consequences of federal prohibition is the difficulty state-licensed cannabis businesses face in accessing financial services. Because banks and financial institutions operate under federal regulations, many are reluctant to provide services to cannabis-related businesses for fear of violating federal anti-money laundering laws. As a result, many dispensaries and other cannabis businesses are forced to operate primarily in cash, increasing security risks and making financial management more complicated. Although some financial institutions have cautiously entered the market, the lack of comprehensive federal protections continues to create uncertainty.

In addition to financial barriers, federal prohibition also affects interstate commerce. Since cannabis remains illegal at the federal level, businesses operating in legal states cannot transport marijuana across state lines, even if both states have legalized its use. This restriction limits the ability of businesses to expand and creates inefficiencies in supply chains, as each state must develop its own cultivation and distribution networks. Furthermore, the inability to engage in interstate commerce prevents states from capitalizing on economies of scale, leading to higher prices for consumers and additional regulatory burdens for businesses.

Another significant impact of federal prohibition is the ongoing risk of federal enforcement actions. While the federal government has largely taken a hands-off approach in states that have legalized marijuana, there is no guarantee that this policy will remain in place. Changes in federal leadership or shifts in enforcement priorities could result in crackdowns on state-legal cannabis businesses, creating uncertainty for investors and entrepreneurs. Additionally, individuals working in the cannabis industry may face legal consequences, including restrictions on federal benefits, housing, and employment opportunities.

The conflict between state and federal laws also has implications for criminal justice and social equity. While many states have moved to decriminalize or legalize marijuana, federal law still imposes severe penalties for cannabis-related offenses. This discrepancy disproportionately affects individuals in states where marijuana remains illegal, as they may face harsher consequences than those in states with more lenient policies. Moreover, the lack of federal legalization complicates efforts to address past injustices related to cannabis prohibition, such as expunging criminal records or providing economic opportunities for communities disproportionately impacted by the war on drugs.

Despite these challenges, there have been efforts to bridge the gap between state and federal policies. Legislative proposals such as the SAFE Banking Act aim to provide financial protections for cannabis businesses, while broader legalization efforts continue to gain traction at the federal level. However, until federal law aligns with state policies, the cannabis industry will continue to face significant legal and regulatory hurdles. As more states move toward legalization, the pressure on federal lawmakers to resolve these conflicts will likely intensify, shaping the future of cannabis policy in the United States.

Legal Challenges Faced by Businesses Operating in Legalized Marijuana States

Operating a business in the legalized marijuana industry presents a unique set of legal challenges, particularly due to the ongoing conflict between state and federal laws. While many states have moved to legalize marijuana for medical and recreational use, the federal government continues to classify it as a Schedule I controlled substance under the Controlled Substances Act. This fundamental legal discrepancy creates significant obstacles for businesses attempting to navigate the industry, as they must comply with state regulations while also considering the potential risks associated with federal enforcement.

One of the most pressing challenges faced by marijuana businesses is access to banking services. Because federal law still prohibits marijuana, financial institutions that operate under federal regulations are often unwilling to provide services to cannabis-related businesses. Banks fear potential legal repercussions, including money laundering charges, if they engage with businesses that handle a substance deemed illegal at the federal level. As a result, many marijuana businesses are forced to operate on a cash-only basis, which not only increases security risks but also complicates tax compliance and financial management. Without access to traditional banking services, businesses struggle to process payroll, secure loans, and conduct routine transactions, placing them at a significant disadvantage compared to other industries.

In addition to banking restrictions, marijuana businesses also face challenges related to taxation. Under Section 280E of the Internal Revenue Code, businesses that engage in the sale of controlled substances prohibited by federal law are not allowed to deduct ordinary business expenses, such as rent, employee salaries, and marketing costs. This means that marijuana businesses often face a much higher effective tax rate than other legal enterprises, making profitability more difficult to achieve. While some states have implemented tax policies to mitigate these financial burdens, the inability to claim standard deductions at the federal level remains a major obstacle for businesses in the industry.

Another significant legal challenge arises in the realm of interstate commerce. Because marijuana remains illegal under federal law, businesses are prohibited from transporting cannabis products across state lines, even between two states where marijuana is legal. This restriction limits the ability of businesses to expand their operations and creates inefficiencies in supply chains. For example, a company that cultivates marijuana in one state cannot legally distribute its products to another state, even if both states have legalized cannabis. This forces businesses to establish separate operations in each state where they wish to operate, increasing costs and complicating regulatory compliance.

Employment law also presents a complex issue for marijuana businesses. While state laws may permit the use of marijuana, federal employment regulations still allow employers to enforce drug-free workplace policies. This creates uncertainty for both employers and employees, particularly in industries where drug testing is common. Additionally, businesses that receive federal contracts or funding must comply with federal drug-free workplace requirements, which can further complicate hiring and employment practices in states where marijuana is legal.

Despite these challenges, the marijuana industry continues to grow, and many businesses are finding ways to adapt to the complex legal landscape. However, until federal and state laws are reconciled, businesses operating in legalized marijuana states will continue to face significant legal and financial hurdles. The ongoing conflict between state and federal regulations underscores the need for comprehensive legal reform to provide clarity and stability for businesses in this rapidly evolving industry.