“Stay Ahead of the 2025 Tax Law Changes – Key Updates to Maximize Your Return!”

Key Tax Law Changes in 2025: How They Impact Your Filing

As taxpayers prepare for the 2025 filing season, it is essential to understand the key tax law changes that may impact their returns. With new regulations and adjustments taking effect, individuals and businesses must stay informed to ensure compliance and optimize their tax positions. Several modifications to tax brackets, deductions, and credits could influence the amount owed or refunded, making it crucial to review these changes before filing.

One of the most significant updates involves adjustments to federal income tax brackets. As in previous years, tax brackets have been modified to account for inflation, which may slightly alter the tax rates applicable to different income levels. While these adjustments are designed to prevent bracket creep, where inflation pushes taxpayers into higher tax brackets without an actual increase in real income, they can still affect overall tax liability. Taxpayers should review the updated brackets to determine how their income will be taxed in 2025.

In addition to bracket adjustments, changes to standard deductions will also impact many filers. The standard deduction has been increased to reflect inflation, providing some relief to taxpayers who do not itemize deductions. This increase may reduce taxable income for many individuals and families, potentially lowering their overall tax burden. However, those who typically itemize deductions should carefully evaluate whether the new standard deduction amount makes itemizing less beneficial.

Another notable change involves modifications to certain tax credits, including the Child Tax Credit and the Earned Income Tax Credit. The Child Tax Credit has been adjusted to provide additional benefits to qualifying families, with potential increases in the refundable portion of the credit. Similarly, the Earned Income Tax Credit has been revised to offer greater support to low- and moderate-income workers. These changes could result in larger refunds for eligible taxpayers, making it important to review the updated eligibility requirements and credit amounts.

For business owners and self-employed individuals, adjustments to deductions and tax treatment of certain expenses may also have a significant impact. The qualified business income deduction, which allows eligible pass-through entities to deduct a portion of their income, has been updated to reflect new income thresholds. Additionally, changes to depreciation rules and business expense deductions could influence tax planning strategies. Business owners should consult with tax professionals to ensure they are maximizing available deductions while remaining compliant with the latest regulations.

Retirement savings and investment-related tax provisions have also been revised for 2025. Contribution limits for retirement accounts, such as 401(k) plans and IRAs, have been increased, allowing individuals to save more on a tax-advantaged basis. Additionally, changes to required minimum distributions (RMDs) may affect retirees who must withdraw funds from their retirement accounts. Understanding these updates can help taxpayers make informed decisions about their retirement savings strategies.

As these tax law changes take effect, it is essential for taxpayers to stay informed and plan accordingly. Reviewing the latest updates, consulting with tax professionals, and utilizing available resources can help individuals and businesses navigate the complexities of the tax code. By understanding how these modifications impact their filing, taxpayers can take proactive steps to minimize liabilities and maximize potential refunds. With careful preparation, the 2025 tax season can be approached with confidence and clarity.

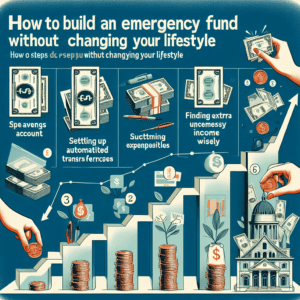

New Deductions and Credits for 2025: Maximizing Your Tax Savings

As taxpayers prepare for the 2025 filing season, understanding the new deductions and credits available can help maximize tax savings and ensure compliance with updated regulations. With recent legislative changes, individuals and businesses alike have new opportunities to reduce their taxable income and potentially increase their refunds. By taking advantage of these provisions, taxpayers can optimize their financial planning and avoid missing out on valuable benefits.

One of the most significant updates for 2025 is the expansion of the standard deduction. Lawmakers have adjusted the deduction amounts to account for inflation, providing additional relief for taxpayers who do not itemize. This increase means that more individuals may find it beneficial to take the standard deduction rather than itemizing expenses, simplifying the filing process while still reducing taxable income. However, for those who do itemize, new deductions related to medical expenses, mortgage interest, and charitable contributions may offer further opportunities for savings.

In addition to changes in deductions, several new tax credits have been introduced to support families, workers, and businesses. The Child Tax Credit has been expanded, offering higher benefits for eligible families and increasing the income thresholds for qualification. This adjustment ensures that more households can claim the credit, reducing their overall tax liability. Similarly, the Earned Income Tax Credit has been modified to provide greater assistance to low- and moderate-income workers, particularly those without dependents. These enhancements aim to make the tax system more equitable while providing financial relief to those who need it most.

For taxpayers pursuing higher education or job training, the updated Lifetime Learning Credit offers increased benefits. The income limits for eligibility have been raised, allowing more individuals to claim this credit for tuition and related expenses. Additionally, new incentives for student loan borrowers provide tax relief for those repaying educational debt, making it easier to manage financial obligations while investing in career advancement. These changes reflect a broader effort to support education and workforce development through the tax code.

Homeowners and energy-conscious consumers will also find new opportunities for tax savings in 2025. The Residential Energy Efficiency Credit has been expanded to encourage investments in renewable energy and energy-efficient home improvements. Taxpayers who install solar panels, energy-efficient windows, or other qualifying upgrades may be eligible for increased credits, reducing the overall cost of these improvements. Similarly, the Electric Vehicle Tax Credit has been revised to include a broader range of qualifying vehicles, making it more accessible to consumers looking to transition to sustainable transportation.

Small business owners and self-employed individuals can also benefit from new deductions and credits designed to support entrepreneurship and economic growth. The Qualified Business Income Deduction has been adjusted to provide greater relief for small businesses, while new incentives for hiring and workforce development encourage job creation. Additionally, expanded deductions for business expenses, including technology and infrastructure investments, allow companies to reinvest in their operations while reducing taxable income.

As these changes take effect, taxpayers should review their financial situations carefully and consider consulting a tax professional to ensure they maximize available benefits. By staying informed about new deductions and credits, individuals and businesses can make strategic decisions that enhance their financial well-being while remaining compliant with evolving tax laws. With careful planning and awareness of these updates, taxpayers can navigate the 2025 filing season with confidence and take full advantage of the opportunities available to them.

Common Mistakes to Avoid Under the 2025 Tax Law Updates

One of the most important aspects of preparing for tax season is understanding the latest changes to tax laws and ensuring compliance with new regulations. With the 2025 tax law updates introducing several modifications, taxpayers must be aware of common mistakes that could lead to filing errors, penalties, or missed deductions. By staying informed and taking a proactive approach, individuals and businesses can avoid costly missteps and ensure a smooth filing process.

A frequent mistake taxpayers make under new tax laws is failing to account for updated income tax brackets and standard deduction amounts. The 2025 updates include adjustments to these figures, which may impact the amount of taxable income and overall tax liability. Some individuals may unknowingly underpay or overpay their taxes if they do not review the revised brackets before filing. To prevent this, taxpayers should verify the latest figures and use updated tax tables when calculating their obligations.

Another common error involves overlooking changes to tax credits and deductions. The 2025 tax law updates have modified eligibility requirements for several credits, including the Child Tax Credit and Earned Income Tax Credit. Taxpayers who previously qualified for these benefits may find that their eligibility has changed due to income thresholds or other revised criteria. Failing to check these updates could result in missed opportunities for tax savings or, conversely, incorrect claims that may trigger audits or penalties. To avoid this mistake, individuals should carefully review the latest guidelines and consult a tax professional if necessary.

In addition to tax credits, deductions for certain expenses have also been adjusted under the new law. For example, changes to deductions for mortgage interest, medical expenses, and state and local taxes may affect the total amount taxpayers can claim. Some deductions that were previously available may have been reduced or eliminated, while others may have expanded eligibility. Taxpayers who assume that prior-year deductions remain unchanged risk making errors that could lead to an inaccurate return. To ensure compliance, it is essential to review the latest deduction rules and maintain proper documentation to support any claims.

Another area where taxpayers often make mistakes is in reporting income from multiple sources. With the rise of freelance work, gig economy jobs, and investment income, many individuals receive earnings from various sources beyond traditional employment. The 2025 tax law updates include new reporting requirements for certain types of income, such as digital transactions and third-party payment platforms. Failing to report all taxable income accurately can result in penalties or audits. To prevent this, taxpayers should gather all necessary tax documents, including 1099 forms, and ensure that all income is properly reported on their return.

Additionally, errors in tax withholding and estimated payments can lead to unexpected tax liabilities. The 2025 updates have introduced changes to withholding calculations, which may affect the amount deducted from paychecks throughout the year. Taxpayers who do not adjust their withholding accordingly may find themselves owing more than anticipated when filing their return. Similarly, self-employed individuals and those with significant non-wage income must ensure that their estimated tax payments align with the new regulations to avoid underpayment penalties. Reviewing withholding allowances and making necessary adjustments can help prevent these issues.

Finally, missing filing deadlines or failing to submit required forms can result in unnecessary penalties and interest charges. The 2025 tax law updates have not altered the standard filing deadline, but taxpayers should remain vigilant about any extensions or special provisions that may apply to their situation. Filing electronically and double-checking all required forms can help reduce the risk of errors and ensure timely submission.

By understanding these common mistakes and taking proactive steps to address them, taxpayers can navigate the 2025 tax law updates with confidence. Staying informed, reviewing changes carefully, and seeking professional guidance when needed will help ensure compliance and maximize potential tax benefits.