“New Laws in 2025: Shaping Your Future, One Policy at a Time.”

Changes in Tax Regulations: How the 2025 Tax Laws Will Impact Your Finances

The tax landscape is set to undergo significant changes in 2025, bringing new regulations that will impact individuals and businesses alike. As policymakers aim to address economic challenges and streamline the tax system, these adjustments will influence how taxpayers manage their finances, file returns, and plan for the future. Understanding these changes is essential for ensuring compliance and making informed financial decisions.

One of the most notable changes involves adjustments to income tax brackets. In an effort to account for inflation and shifts in economic conditions, the government has revised tax thresholds, which may alter the amount of tax owed by individuals across different income levels. For some taxpayers, these modifications could result in lower tax liabilities, while others may find themselves in a higher bracket, leading to increased obligations. Additionally, modifications to standard deductions and personal exemptions will play a role in determining taxable income, potentially affecting take-home pay and overall financial planning.

Beyond individual income taxes, corporate tax policies are also undergoing revisions. Lawmakers have introduced new measures aimed at encouraging business investment and economic growth, including adjustments to corporate tax rates and deductions for business expenses. Small businesses, in particular, may benefit from expanded tax credits and incentives designed to support entrepreneurship and job creation. However, certain deductions and loopholes that previously allowed businesses to minimize tax burdens may be reduced or eliminated, requiring companies to reassess their financial strategies.

Another key aspect of the 2025 tax laws involves changes to tax credits and deductions that directly impact families and homeowners. The child tax credit, for instance, has been revised to provide additional relief for qualifying families, potentially increasing the amount of financial support available to parents. Similarly, modifications to mortgage interest deductions and property tax benefits may influence homeownership costs, affecting both current homeowners and prospective buyers. These adjustments highlight the government’s focus on making housing and family-related expenses more manageable for taxpayers.

Retirement savings and investment taxation are also areas experiencing notable shifts. Contribution limits for retirement accounts such as 401(k) plans and IRAs have been adjusted, allowing individuals to set aside more funds for their future. Additionally, changes to capital gains tax rates may impact investors, particularly those with significant holdings in stocks, real estate, or other assets. Understanding these revisions is crucial for individuals looking to optimize their investment strategies and minimize tax liabilities on long-term gains.

Furthermore, compliance and reporting requirements are becoming more stringent, with new regulations aimed at increasing transparency and reducing tax evasion. Enhanced reporting obligations for digital transactions, cryptocurrency holdings, and foreign assets mean that taxpayers must be more diligent in documenting their financial activities. Failure to comply with these new requirements could result in penalties, making it essential for individuals and businesses to stay informed and seek professional guidance if necessary.

As these tax law changes take effect, taxpayers should take proactive steps to assess their financial situations and adjust their strategies accordingly. Consulting with tax professionals, reviewing financial plans, and staying updated on regulatory developments will be key to navigating the evolving tax landscape. By understanding how these new policies impact income, investments, and deductions, individuals and businesses can make informed decisions that align with their financial goals while ensuring compliance with the latest regulations.

New Labor Laws: What Employees and Employers Need to Know in 2025

As 2025 approaches, significant changes in labor laws are set to reshape the workplace for both employees and employers. These new regulations aim to address evolving workforce dynamics, improve job security, and enhance workplace conditions. Understanding these changes is essential for businesses to remain compliant and for workers to be aware of their rights and responsibilities.

One of the most notable updates involves wage regulations. Many jurisdictions are implementing higher minimum wages to keep pace with inflation and the rising cost of living. This adjustment is expected to benefit low-income workers by increasing their earning potential, but it also presents challenges for businesses, particularly small enterprises that may struggle to absorb the additional labor costs. Employers will need to reassess their budgets and potentially adjust pricing structures or workforce strategies to accommodate these changes.

In addition to wage increases, new laws are expanding protections for gig and contract workers. With the rise of the gig economy, many workers have operated without traditional employment benefits such as health insurance, paid leave, or retirement contributions. The 2025 labor laws introduce stricter guidelines for classifying workers as independent contractors, ensuring that those who perform consistent work for a company receive appropriate benefits and protections. While this change enhances job security for many workers, businesses that rely heavily on freelance labor may need to reconsider their employment models to comply with the new regulations.

Another significant development is the introduction of enhanced workplace safety standards. In response to growing concerns about employee well-being, new policies require businesses to implement stricter health and safety measures. This includes updated protocols for workplace ergonomics, mental health support, and emergency preparedness. Employers must invest in training programs and infrastructure improvements to meet these requirements, while employees can expect safer and more supportive work environments.

Furthermore, work-life balance is receiving greater attention in the latest labor laws. Many regions are enacting policies that limit excessive overtime, mandate paid family leave, and encourage flexible work arrangements. These measures aim to reduce employee burnout and improve overall productivity. For businesses, adapting to these changes may require restructuring work schedules and adopting remote or hybrid work models where feasible. Employees, on the other hand, will benefit from increased flexibility, allowing them to better manage personal and professional responsibilities.

Another key aspect of the 2025 labor laws is the emphasis on workplace diversity and inclusion. Companies are now required to implement stronger anti-discrimination policies and provide equal opportunities for all employees, regardless of gender, race, or background. This includes mandatory diversity training and transparent hiring practices to ensure fair treatment in the workplace. While these regulations promote a more inclusive work environment, businesses must take proactive steps to foster a culture of equality and compliance.

As these new labor laws take effect, both employers and employees must stay informed and prepared for the changes ahead. Businesses should review their policies, seek legal guidance if necessary, and ensure compliance to avoid potential penalties. Employees, in turn, should familiarize themselves with their rights and take advantage of the protections and benefits these laws provide. By understanding and adapting to these new regulations, workplaces can create a more equitable and sustainable future for all.

Environmental Policies: How 2025 Regulations Will Affect Your Daily Habits

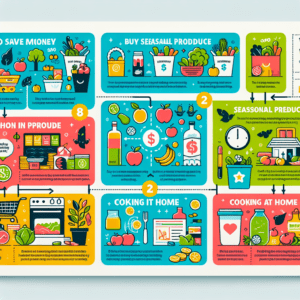

As 2025 approaches, a series of new environmental policies are set to take effect, bringing significant changes to daily routines and consumer habits. These regulations, designed to combat climate change and reduce pollution, will influence everything from household energy consumption to waste disposal practices. While some of these changes may require adjustments, they also present opportunities for individuals to contribute to a more sustainable future.

One of the most notable policy shifts involves stricter energy efficiency standards for household appliances. Governments worldwide are implementing regulations that require manufacturers to produce more energy-efficient refrigerators, washing machines, and air conditioning units. As a result, consumers purchasing new appliances in 2025 will likely notice improved energy ratings, leading to lower electricity bills over time. However, these changes may also mean higher upfront costs for new appliances, as manufacturers invest in advanced technology to meet the new standards.

In addition to energy efficiency, waste management policies are undergoing significant revisions. Many jurisdictions are introducing stricter regulations on single-use plastics, with some governments banning plastic bags, cutlery, and packaging altogether. Consumers will need to adapt by using reusable alternatives, such as cloth bags and biodegradable containers. While this shift may initially seem inconvenient, it is expected to reduce plastic waste in landfills and oceans, ultimately benefiting the environment. Businesses, too, will need to adjust by offering sustainable packaging options and encouraging customers to bring their own reusable items.

Another key area of focus in 2025 is air quality improvement. Several cities are implementing low-emission zones, restricting access for high-polluting vehicles in urban areas. This means that individuals who own older gasoline or diesel-powered cars may face additional fees or be required to transition to electric or hybrid vehicles. While this policy aims to reduce air pollution and improve public health, it may also pose financial challenges for those who rely on older vehicles for daily transportation. To ease the transition, some governments are offering incentives such as tax credits and subsidies for electric vehicle purchases, making it more affordable for consumers to switch to cleaner transportation options.

Water conservation is another priority in the upcoming regulations. In response to increasing concerns about water scarcity, new policies are being introduced to encourage more efficient water use in households and businesses. These measures include restrictions on excessive water consumption, incentives for installing water-saving fixtures, and penalties for wasteful practices. Homeowners may need to invest in low-flow showerheads, water-efficient toilets, and smart irrigation systems to comply with these regulations. While these changes may require an initial investment, they can lead to long-term savings on water bills and contribute to the preservation of vital water resources.

As these environmental policies take effect, individuals will need to adapt their daily habits to align with new regulations. While some changes may require financial investment or behavioral adjustments, they ultimately aim to create a more sustainable and environmentally responsible society. By embracing these policies, consumers can play an active role in reducing their ecological footprint while also benefiting from long-term cost savings and improved public health. As 2025 unfolds, staying informed about these regulations will be essential for ensuring a smooth transition to a more sustainable way of life.