“Interest-Only Mortgages: Weighing the Risks and Rewards for Your Financial Future.”

Understanding Interest-Only Mortgages: How They Work and Who They Benefit

An interest-only mortgage is a type of home loan where the borrower is required to pay only the interest for a specified period, typically between five and ten years. During this time, the principal balance remains unchanged, meaning that monthly payments are lower compared to a traditional mortgage. Once the interest-only period ends, the loan transitions into a fully amortizing structure, requiring the borrower to start repaying both principal and interest, often resulting in significantly higher monthly payments. This type of mortgage can be appealing to certain borrowers, particularly those who seek lower initial payments or anticipate an increase in income over time. However, it is essential to understand how these loans work and who may benefit from them before making a decision.

One of the primary advantages of an interest-only mortgage is the reduced initial payment, which can provide financial flexibility. Borrowers who have irregular income, such as self-employed individuals or commission-based professionals, may find this structure beneficial as it allows them to manage cash flow more effectively. Additionally, those who expect their earnings to rise in the future may take advantage of the lower payments in the early years while preparing for higher payments later. Investors in real estate may also find interest-only mortgages attractive, as they can minimize their monthly expenses while maximizing cash flow from rental properties. This strategy can be particularly useful in markets where property values are expected to appreciate, allowing investors to sell at a profit before the principal payments begin.

Despite these benefits, interest-only mortgages come with significant risks that borrowers must carefully consider. One of the most notable concerns is the potential for payment shock once the interest-only period ends. Since the loan transitions into a fully amortizing structure, monthly payments can increase substantially, which may create financial strain for those unprepared for the adjustment. If a borrower’s income does not rise as expected or if economic conditions change, meeting the higher payments could become challenging. Additionally, because the principal balance remains unchanged during the interest-only period, borrowers do not build equity in their homes unless property values increase. This lack of equity can be problematic if home prices decline, potentially leaving borrowers in a situation where they owe more than their home is worth.

Another risk associated with interest-only mortgages is the potential difficulty in refinancing. If home values decrease or if a borrower’s financial situation changes, securing a new loan with favorable terms may not be possible. This could leave borrowers with limited options, forcing them to either sell their property or face financial hardship. Furthermore, interest-only loans often come with higher interest rates compared to traditional fixed-rate mortgages, particularly after the initial period ends. This can further increase the overall cost of borrowing, making it essential for borrowers to carefully evaluate whether the initial savings outweigh the long-term financial implications.

Ultimately, an interest-only mortgage can be a useful financial tool for certain borrowers, but it is not suitable for everyone. Those considering this type of loan should assess their financial stability, future income prospects, and risk tolerance before proceeding. By understanding both the benefits and potential drawbacks, borrowers can make an informed decision that aligns with their long-term financial goals.

The Pros and Cons of Interest-Only Mortgages: Weighing the Risks and Rewards

Interest-only mortgages can be an attractive option for certain borrowers, offering lower initial payments and increased financial flexibility. However, they also come with significant risks that must be carefully considered. Understanding both the advantages and potential drawbacks of this type of loan is essential for making an informed decision.

One of the primary benefits of an interest-only mortgage is the lower monthly payment during the initial period. Because borrowers are only required to pay the interest on the loan, rather than both principal and interest, their monthly financial obligation is significantly reduced. This can be particularly beneficial for individuals with irregular income, such as self-employed professionals or commission-based workers, who may prefer the flexibility of lower payments during certain periods. Additionally, lower initial payments can free up cash flow for other investments, such as funding a business, investing in the stock market, or purchasing additional real estate.

Another advantage is the potential for increased affordability in high-cost housing markets. In areas where home prices are steep, an interest-only mortgage may allow buyers to afford a more expensive property than they would with a traditional loan. This can be particularly appealing for those who anticipate an increase in income over time, as they may be able to manage higher payments once the interest-only period ends. Furthermore, for investors, this type of mortgage can be a strategic tool to maximize leverage while minimizing short-term costs, potentially leading to greater returns on investment properties.

Despite these benefits, interest-only mortgages also carry significant risks. One of the most notable concerns is the eventual increase in monthly payments. Once the interest-only period ends—typically after five, seven, or ten years—borrowers must begin repaying both principal and interest, often resulting in a substantial jump in their monthly payment. If a borrower has not adequately prepared for this transition, they may struggle to meet their financial obligations, leading to potential financial distress or even foreclosure.

Another risk is the possibility of negative equity. Because borrowers are not paying down the principal during the interest-only period, they do not build equity in their home unless property values appreciate. If housing prices decline, homeowners may find themselves owing more on their mortgage than their home is worth. This situation can be particularly problematic for those who need to sell their property or refinance their loan, as they may be unable to do so without incurring a financial loss.

Additionally, interest-only mortgages often come with higher long-term costs. While the initial payments are lower, the total amount paid over the life of the loan may be greater than that of a traditional mortgage. This is because delaying principal repayment results in more interest accruing over time. Borrowers who do not make additional payments toward the principal during the interest-only period may end up paying significantly more in interest over the course of the loan.

Given these factors, an interest-only mortgage may be a suitable option for certain borrowers, particularly those with strong financial discipline and a clear strategy for managing future payments. However, for individuals who may struggle with higher payments in the future or who are relying on uncertain property appreciation, the risks may outweigh the benefits. Careful consideration of one’s financial situation, long-term goals, and market conditions is essential before committing to this type of loan.

Is an Interest-Only Mortgage Right for You? Key Factors to Consider

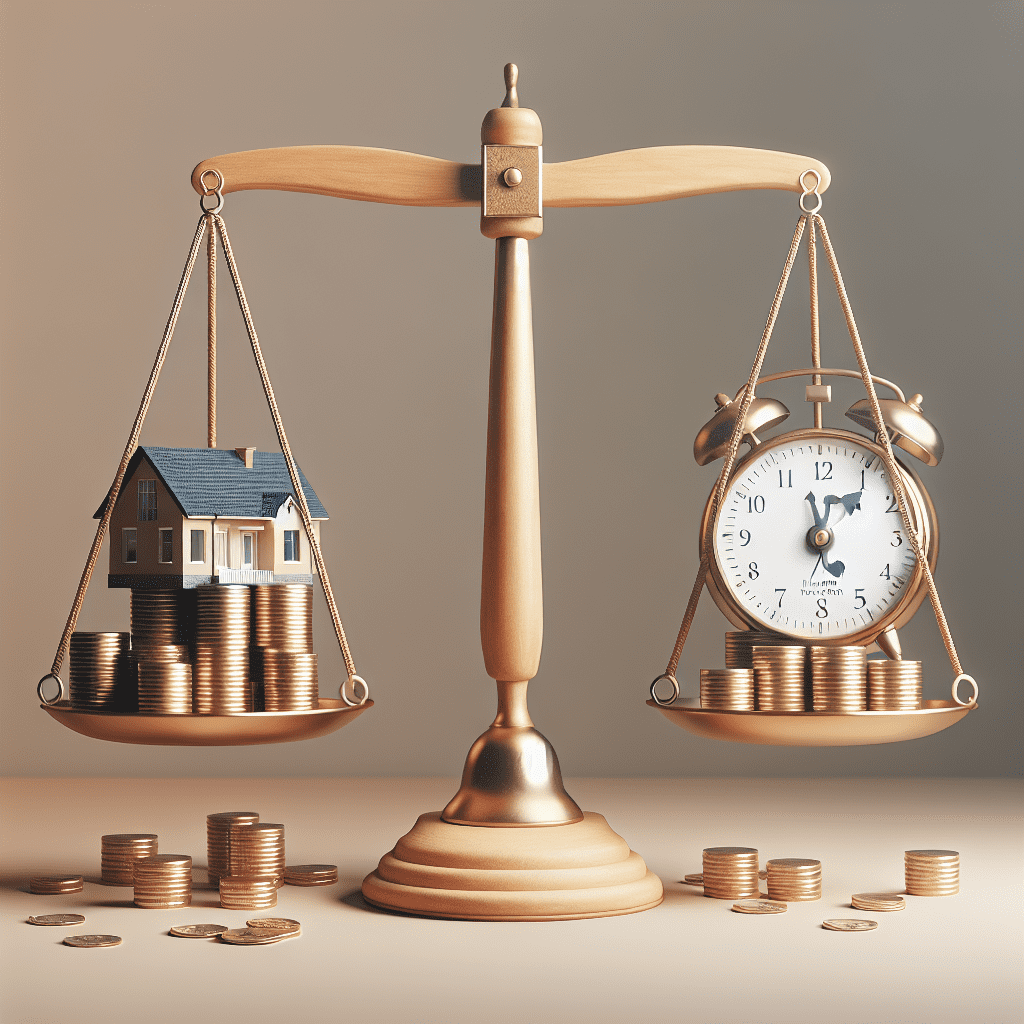

When considering an interest-only mortgage, it is essential to evaluate several key factors to determine whether this type of loan aligns with your financial goals and circumstances. Unlike traditional mortgages, which require payments toward both principal and interest, an interest-only mortgage allows borrowers to pay only the interest for a specified period, typically five to ten years. While this structure can provide short-term financial flexibility, it also comes with potential risks that must be carefully weighed.

One of the primary advantages of an interest-only mortgage is the lower initial monthly payment. By paying only the interest, borrowers can free up cash flow for other financial priorities, such as investing, saving for retirement, or covering other expenses. This can be particularly beneficial for individuals with irregular income, such as self-employed professionals or commission-based earners, who may prefer the flexibility of lower payments during certain periods. Additionally, those who anticipate a significant increase in income in the future may find this option appealing, as it allows them to manage lower payments in the short term while preparing for higher payments once the principal repayment period begins.

However, while the lower initial payments may seem attractive, it is crucial to consider the long-term implications. Once the interest-only period ends, borrowers must begin repaying the principal, which can lead to a substantial increase in monthly payments. If a borrower has not adequately prepared for this transition, they may face financial strain or even risk defaulting on the loan. Furthermore, because no principal is paid down during the interest-only period, homeowners do not build equity unless property values appreciate. This can be a significant drawback, particularly in a declining or stagnant housing market, where borrowers may find themselves owing more than their home is worth.

Another important factor to consider is the potential for rising interest rates. Many interest-only mortgages are structured as adjustable-rate loans, meaning that after the initial fixed period, the interest rate may fluctuate based on market conditions. If interest rates increase, borrowers could see their monthly payments rise significantly, making it more challenging to manage their mortgage obligations. This uncertainty can be a considerable risk, especially for those who do not have a financial cushion to absorb higher payments.

Additionally, qualifying for an interest-only mortgage may be more challenging than obtaining a traditional loan. Lenders often impose stricter requirements, including higher credit scores, lower debt-to-income ratios, and larger down payments. These criteria are designed to mitigate the lender’s risk, as interest-only loans carry a higher likelihood of default if borrowers are unable to manage the payment increase once the principal repayment period begins.

Ultimately, deciding whether an interest-only mortgage is the right choice depends on individual financial circumstances and long-term plans. For those with a clear strategy to manage future payments, stable income growth, or investment opportunities that justify the lower initial payments, this type of loan can be a useful financial tool. However, for borrowers who may struggle with higher payments in the future or who are relying on uncertain property appreciation, the risks may outweigh the benefits. Careful financial planning and a thorough understanding of the loan terms are essential to making an informed decision.