“Secure Their Future, Protect Your Love – The Best Life Insurance for Parents.”

Choosing the Best Life Insurance Plan to Secure Your Child’s Future

Selecting the best life insurance plan as a parent of young children is a crucial step in ensuring their financial security in the event of an unforeseen tragedy. Life insurance provides peace of mind, knowing that your children will be financially protected if something were to happen to you. However, with numerous options available, choosing the right plan requires careful consideration of your family’s needs, financial situation, and long-term goals. Understanding the different types of life insurance and their benefits can help you make an informed decision that best secures your child’s future.

One of the most common types of life insurance is term life insurance, which provides coverage for a specific period, typically ranging from 10 to 30 years. This type of policy is often the most affordable option, making it an attractive choice for parents who want substantial coverage at a lower cost. Term life insurance ensures that if the policyholder passes away during the term, their beneficiaries receive a death benefit that can be used to cover essential expenses such as mortgage payments, childcare, and education costs. Since young children rely heavily on their parents for financial support, selecting a term length that lasts until they reach adulthood can provide the necessary protection during their most vulnerable years.

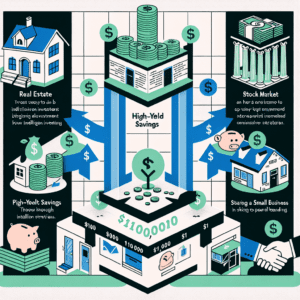

While term life insurance is a practical choice for many families, some parents may prefer the lifelong coverage offered by permanent life insurance. Unlike term policies, permanent life insurance, which includes whole life and universal life insurance, does not expire as long as premiums are paid. These policies also accumulate cash value over time, which can be borrowed against or withdrawn if needed. Although permanent life insurance tends to be more expensive than term life insurance, it can serve as both a financial safety net and a long-term investment. Parents who want to leave a financial legacy for their children or ensure coverage regardless of age may find permanent life insurance to be a suitable option.

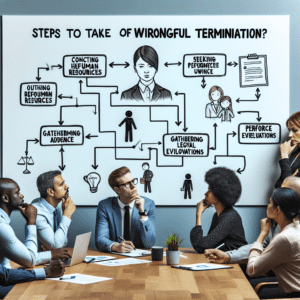

In addition to choosing between term and permanent life insurance, parents should carefully assess the coverage amount needed to secure their child’s future. A general rule of thumb is to select a policy that provides coverage equal to at least 10 times the policyholder’s annual income. This ensures that in the event of an untimely passing, the surviving family members have sufficient funds to maintain their standard of living, pay off debts, and cover future expenses such as college tuition. However, individual circumstances vary, and factors such as existing savings, outstanding debts, and anticipated future costs should be considered when determining the appropriate coverage amount.

Another important aspect to consider is the inclusion of riders that can enhance the policy’s benefits. Many insurance providers offer optional riders, such as a child rider that provides coverage for children or a waiver of premium rider that ensures the policy remains active if the policyholder becomes disabled and unable to work. These additional features can provide extra security and flexibility, making the policy more comprehensive.

Ultimately, selecting the best life insurance plan requires careful evaluation of your family’s financial needs and long-term objectives. By comparing different policies, understanding their benefits, and choosing an appropriate coverage amount, parents can ensure that their children are financially protected no matter what the future holds.

Term vs. Whole Life Insurance: Which Is Better for Parents of Young Children?

When selecting a life insurance plan, parents of young children must carefully consider their options to ensure their family’s financial security. Among the most common choices are term life insurance and whole life insurance, each offering distinct benefits and drawbacks. Understanding the differences between these two types of policies is essential in determining which best suits the needs of parents who want to protect their children’s future.

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. This type of policy is often more affordable than whole life insurance, making it an attractive option for parents who need substantial coverage at a lower cost. Since young children rely heavily on their parents for financial support, term life insurance can offer peace of mind by ensuring that, in the event of an untimely death, the surviving family members will have the necessary funds to cover essential expenses such as mortgage payments, childcare, and education. Additionally, term policies are relatively straightforward, with fixed premiums and a guaranteed death benefit if the policyholder passes away during the coverage period.

On the other hand, whole life insurance provides lifelong coverage and includes a cash value component that grows over time. While this type of policy is significantly more expensive than term life insurance, it offers long-term financial benefits that may appeal to some parents. The cash value accumulates on a tax-deferred basis and can be accessed through loans or withdrawals, providing a potential source of funds for future expenses such as college tuition or emergency costs. Furthermore, whole life insurance guarantees a death benefit regardless of when the policyholder passes away, ensuring that beneficiaries receive financial support at any stage of life.

Despite these advantages, the higher premiums associated with whole life insurance can be a major drawback for parents who are managing household expenses, childcare costs, and savings goals. Many families may find it more practical to allocate their financial resources toward term life insurance, which allows them to secure a larger death benefit at a lower cost. This approach ensures that, during the years when children are most financially dependent, there is sufficient coverage to replace lost income and maintain the family’s standard of living.

Another important consideration is flexibility. Term life insurance policies can often be converted into permanent coverage if needed, providing an option for parents who may later decide they want lifelong protection. Conversely, whole life insurance requires a long-term commitment, and policyholders who struggle to keep up with the higher premiums may risk losing coverage if they are unable to make payments.

Ultimately, the decision between term and whole life insurance depends on a family’s financial situation, long-term goals, and risk tolerance. For most parents of young children, term life insurance offers the most practical and cost-effective solution, ensuring that their family is protected during the critical years of child-rearing. However, those who seek lifelong coverage and the added benefit of cash value accumulation may find whole life insurance to be a worthwhile investment. By carefully evaluating their needs and consulting with a financial professional, parents can make an informed decision that provides security and peace of mind for their loved ones.

Top Life Insurance Providers for Parents: Coverage, Costs, and Benefits

When selecting a life insurance plan as a parent of young children, it is essential to consider coverage, costs, and benefits to ensure financial security for your family. Several top providers offer policies tailored to meet the needs of parents, providing peace of mind that dependents will be financially protected in the event of an untimely passing. By evaluating the best life insurance providers, parents can make informed decisions that align with their financial goals and family needs.

One of the most reputable life insurance providers for parents is Northwestern Mutual. Known for its strong financial stability and customer satisfaction, Northwestern Mutual offers both term and whole life insurance policies. Term life insurance provides coverage for a specific period, making it an affordable option for parents who want protection during their children’s formative years. Whole life insurance, on the other hand, offers lifelong coverage with a cash value component that can be used for future financial needs. While premiums for whole life insurance are higher, the long-term benefits and investment potential make it an attractive option for parents seeking permanent coverage.

Another leading provider is MassMutual, which offers a range of policies designed to accommodate different financial situations. MassMutual’s term life insurance policies are competitively priced, making them an excellent choice for parents who need substantial coverage at an affordable rate. Additionally, the company provides whole and universal life insurance options, allowing policyholders to build cash value over time. With a strong reputation for financial strength and customer service, MassMutual is a reliable choice for parents looking for comprehensive life insurance coverage.

For those seeking affordability without compromising on quality, Haven Life is a top contender. Backed by MassMutual, Haven Life specializes in term life insurance with a streamlined online application process. Parents can obtain coverage quickly, often without the need for a medical exam, depending on eligibility. Haven Life’s policies are designed to be accessible and budget-friendly, making them an ideal option for young families who need immediate protection. The company’s digital-first approach simplifies the purchasing process, allowing parents to secure coverage efficiently.

State Farm is another well-regarded provider that offers both term and permanent life insurance options. With a strong network of agents, State Farm provides personalized service to help parents determine the best policy for their needs. The company’s term life insurance policies are flexible, with options to convert to permanent coverage if needed. Additionally, State Farm’s whole and universal life insurance policies offer cash value accumulation, which can serve as a financial resource for future expenses such as college tuition. The combination of affordability, flexibility, and strong customer support makes State Farm a solid choice for parents.

Finally, Prudential stands out for its diverse policy offerings and customizable coverage options. Parents can choose from term, whole, and universal life insurance policies, with the ability to add riders for additional protection. Prudential’s policies are designed to accommodate various financial situations, making it easier for parents to find coverage that fits their budget. The company’s strong financial ratings and long-standing reputation in the industry provide confidence that beneficiaries will receive the support they need when it matters most.

By carefully evaluating these top life insurance providers, parents can select a policy that offers the right balance of coverage, cost, and benefits. Ensuring financial security for young children is a crucial responsibility, and choosing the right life insurance plan is a significant step toward protecting their future.